I keep hearing about $$$ movements, $60 at sp 900 = $20 at sp 300 or $13.33 when sp was $200.Yes. You may not care about 60 dollars a share but others do

Shouldn't we be talking in %'s instead of $'s?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I keep hearing about $$$ movements, $60 at sp 900 = $20 at sp 300 or $13.33 when sp was $200.Yes. You may not care about 60 dollars a share but others do

I started in November. Totally opposite experience by order on magnitude... I'm prolly lucky, not smart.I second this. I also lured into option trading after few days reading.

My first venture .. lost 10k and another 5k loss is in progress.

Luckily, today long gains got me enough to cover the loss.

Well, maybe me just dont know how to do it correctly but my option trading career wont go much further for sure.

bounched back up at frankfurt, was down 10%, now only 5% (800euro or 880 usd)

Thoughts: Account value = shares x price. Up $10k is more meaningful to me than y%. Option values are $ based. Plus, down 5 up 5 only cancels out when using currency.I keep hearing about $$$ movements, $60 at sp 900 = $20 at sp 300 or $13.33 when sp was $200.

Shouldn't we be talking in %'s instead of $'s?

Permit

View attachment 508084

F19-0024 - Installation of new backup power packs at North Paint Building. Equipment anchorage and installation of new concrete pad.

GF Texas, hyper growth.

No cap raise needed.

bounched back up at frankfurt, was down 10%, now only 5% (800euro or 880 usd)

Thanks for posting this.

Given the increasing number of Tesla factories/facilities (alone in the USA we have Fremont, GF1, GF2, Lathrop), I think it could it be helpful to post the actual location along with these permits.

Thanks again.

Asked my Tesla service tech about stock. He was VERY appreciative of the stock arrangement with Tesla.So, I had a thought on the dip near the end. Last week when I was getting my powerwalls installed I overheard one of the workers mention that a trading day was coming up next week (this week) that allows them to sell their stock. They're only allowed to sell on certain days because they're considered "insiders." No idea what all the rules are around what time of day you can trade or if it could come anywhere near the volume to justify the dip...but I'd image the stock price near $1k would be a very nice and much deserved bonus for many employees.

My account is up more than 10X from where it was in June. My family went through extreme hardship 4 months ago, and I am now considering retiring this year or next. The first step is owning my house, so I sold 19% of my shares today at 959 to pay off my mortgage. I plan to keep 66% of my remaining shares another 5-10 years, so I have 33% of the remaining shares that I am looking to sell to pull off the retirement. My price point now is 1200 or higher. Of course, if the stock drops below 800, the retirement plans are off the table (but at least my house is paid). I think S&P 500 this year will guarantee at least 1200, but we will see. I hope I don't regret not selling more shares today because I was being greedy and wanted more money to retire with.....

So, I had a thought on the dip near the end. Last week when I was getting my powerwalls installed I overheard one of the workers mention that a trading day was coming up next week (this week) that allows them to sell their stock. They're only allowed to sell on certain days because they're considered "insiders." No idea what all the rules are around what time of day you can trade or if it could come anywhere near the volume to justify the dip...but I'd image the stock price near $1k would be a very nice and much deserved bonus for many employees.

S&P500 inclusion:

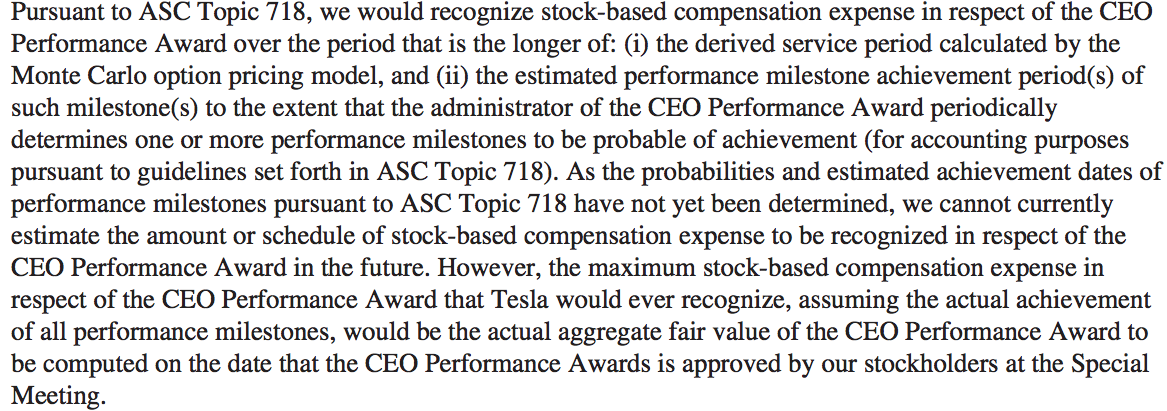

Tesla now have to fork out for Elon's second milestone payment (market cap >$150Bn). This means that Q1 now probably won't be enough. However, given the SP spike, delaying S&P500 inclusion is beneficial - allows me to leverage up slowly as we go.

So Q2 ER will be out ~30th July with inclusion some time in August. Unless of course Elon's 3rd, 4th and 5th payments get triggered?

I knew Elon was gonna get paid a lot but I had no idea what effect they would have.

And for calls?Those whose TSLA holdings have greatly grown as the TSLA share price has been soaring, may want to research the difference in income taxes for short-term and long-term (year or more) holdings. They can be quite substantial. For tax purposes, stock profits are not "realized" until shares are sold. This should be an important consideration in determining when to sell.

If it hits $1,100 tomorrow, I'll get a small Tesla logo tattoo and post it here. I hate tattoos btw

IIRC, traded calls are treated just like stocks for capital gains. Hold a call for a year, it becomes long term capital gains just like a stock held for a year.And for calls?

Executed calls and resulting stocks?

Thanks!

My account is up more than 10X from where it was in June. My family went through extreme hardship 4 months ago, and I am now considering retiring this year or next. The first step is owning my house, so I sold 19% of my shares today at 959 to pay off my mortgage. I plan to keep 66% of my remaining shares another 5-10 years, so I have 33% of the remaining shares that I am looking to sell to pull off the retirement. My price point now is 1200 or higher. Of course, if the stock drops below 800, the retirement plans are off the table (but at least my house is paid). I think S&P 500 this year will guarantee at least 1200, but we will see. I hope I don't regret not selling more shares today because I was being greedy and wanted more money to retire with.....