Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZeApelido

Active Member

I think I cracked the TSLA short seller algorithm:

while(portfolio > 0) {

print "Tesla is a great short at $N"}

N += 100

portfolio -= 100000

Whoa, how dare you mix C and Python together.

Last edited:

G

goinfraftw

Guest

Whoa, how are you mixed C and Python together.

I think you need a few wrapper classes in there to make that happen.

StealthP3D

Well-Known Member

How Elon can be so Elon despite the general disgusting nature of humanity is hard for me to wrap my brain around, especially when he’s been treated so harshly and continues to be. He truly is an amazing alien.

Because Elon knows he'll never make it back home if he's an unlikeable asshole!

erthquake

Active Member

AFAIK nothing else came into the S&P 500 with anywhere NEAR the market cap tesla will have (meaning a lot more of it needs to be bought by index funds) and also that level of short float needing to fight the index funds for covering shares

@Fact Checking does a great job explaining it on Twitter.

Many of the names added to the S&P 500 didn't get a big bump in SP because they were already members of the S&P 400. Their shares were already owned by the index funds and just had to be transferred to the S&P 500 index. Those companies were profitable, but they didn't have the large market cap to qualify for the S&P 500. Tesla is coming from the other direction. It more than qualifies on the market cap, but hasn't met the TTM and most recent quarter GAAP+ criteria.

https://twitter.com/truth_tesla/status/1277321864101138433?s=20

Edit: I did my part too, and ordered replacement wiper blades and a CyberTruck t-shirt this afternoon.

Wuhan looks to be in serious troubleShanghai is a province level municipality and while the Three Gorges Dam currently in distress is a ways away from there, all areas downstream should be concerned if it fails.

China admits to 'flood discharge' fro... | Taiwan News

TrendTrader007

Active Member

007

@TrendTrader007

·

1s

$TSLA did my part by buying FSD upgrades for 2 of my Teslas Third one already had everything

StealthP3D

Well-Known Member

I wonder what Mark Speilgel is doing right now........

Hanging out with other shorts and:

Tesla Facts has calculated that inclusion requires the purchase of 52% of float. Combined with shorts covering on 11% of float makes 63%. Squeezy indeed.

The question we now have to ask is who is gonna to sell and when. The price keeps going up until 63% have sold.

Given that the TMC crowd are your average TSLA float owners, I thought I would set up a poll to find out.

What are you going to sell at once the squeeze happens?

Think Tesla would do another stock offering?

MC3OZ

Active Member

Think Tesla would do another stock offering?

That might depend on what is announced at Battery Day, for example if Tesla is getting into mining, that might require more capital.

Just added Wuhan and Shanghai to my weather app, nothing but rain for the next 8 days after Wednesday. It is the rainy season over there. Jason did also mention that Giga Shanghai construction could slow down due to the rainy conditions. That really sucks for the poor Wuhan-ites. Just a reminder that we are only halfway through 2020!Wuhan looks to be in serious trouble

China admits to 'flood discharge' fro... | Taiwan News

Two sell side updates.

Barclays, with their extremely bullish $300 price target decides to title their report "Shelter in cave order for bears extended". Oh, and they're forecasting $4.20 million net profit for the cherry on top. Production estimate is 91k due to a quick Fremont ramp.

Deliveries are as follows:

JMP's forecast is much more conservative, following the trend of the more bullish analysts having more bearish estimates and vice versa.

Deliveries are as follows:

Barclays, with their extremely bullish $300 price target decides to title their report "Shelter in cave order for bears extended". Oh, and they're forecasting $4.20 million net profit for the cherry on top. Production estimate is 91k due to a quick Fremont ramp.

Deliveries are as follows:

- S/X: 10.8k

- 3/Y: 74.1k

- 29.7k Model 3s from China

- 10.5k Model Ys

- Total: 84.9k

JMP's forecast is much more conservative, following the trend of the more bullish analysts having more bearish estimates and vice versa.

Deliveries are as follows:

- S/X: 10.8k

- 3/Y: 63.0k

- ~25k Model 3s from China

- Only 3k Model Ys

- ~25k Model 3s from China

- Total: 73.8k

Last edited:

If the index funds really will need $63 billion in TSLA shares, surely Tesla could offer, say, $10 billion to help them lock in some shares at a set price.That might depend on what is announced at Battery Day, for example if Tesla is getting into mining, that might require more capital.

I'm not worried. No sign of the "Stay Puft Marshmallow Man" yet. The apocalypse was already supposed to happen in 2012Just added Wuhan and Shanghai to my weather app, nothing but rain for the next 8 days after Wednesday. It is the rainy season over there. Jason did also mention that Giga Shanghai construction could slow down due to the rainy conditions. That really sucks for the poor Wuhan-ites. Just a reminder that we are only halfway through 2020!

erthquake

Active Member

If the index funds really will need $63 billion in TSLA shares, surely Tesla could offer, say, $10 billion to help them lock in some shares at a set price.

Wouldn't it be better to wait until after inclusion has happened (and after Battery Day which should follow a week or so after inclusion)? Waiting for higher SP helps Tesla reduce dilution.

Yup. No reason to doubt he meant profitable on just Model Y production so far (or any other market unnamed). Maybe solar glass.... and by the way, huge Q2 profits. Bazinga!I wonder if Elon's leaked email about maybe breaking even is some kind of trap. Set expectations of a small loss, or break even at best, then announce a profit. Unhappy bears.

Todesbuckler

Member

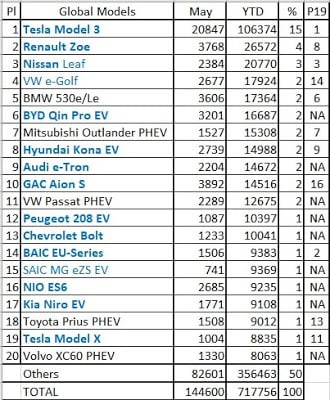

Global Top 20 May 2020

EV Sales: Global Top 20 May 2020

Based on EV sales blog:

April Tesla total: 14,793

April + May Tesla total: 39,400

EV Sales: Global Top 20 May 2020

Based on EV sales blog:

April Tesla total: 14,793

April + May Tesla total: 39,400

AFAIK nothing else came into the S&P 500 with anywhere NEAR the market cap tesla will have (meaning a lot more of it needs to be bought by index funds) and also that level of short float needing to fight the index funds for covering shares

Berkshire had a market cap of $170 billion when joining the S&P 500 in 2010. Making roughly 1% weight in the index. Source: Will Berkshire Pop Friday Upon Joining S&P 500?

TSLA weight would be somewhere around 0.6% if joining today. Source: https://twitter.com/truth_tesla/status/1277324996319338497

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K