jhm

Well-Known Member

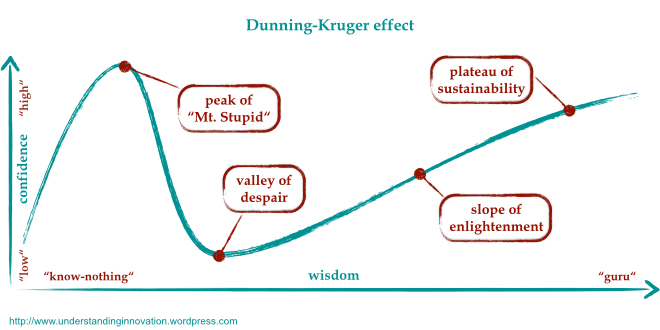

I love the explanation of the negative learning curve. In a nutshell, the more we learn, the more we realize how much more costly it is than we previously imagined. To understand how a learning curve can go negative more generally, it may be helpful to consider the Dunning-Kruger effect.OT:

There is no economic case for it. There just isn't. The fuel is more abundant but fuel rod fabrication costs are higher, which offsets it. The waste rods are more hazardous to handle and reprocess (due to the very thing that resists proliferation, U-232 - and its proliferation resistance can be bypassed, turning a proliferation hindrance into a proliferation benefit). You can run it as a breeder, and create less waste, but you can do the exact same thing (only more effectively) with U-238, and we generally don't do that either. Yes, every new thorium reactor design makes all sorts of "we're super economical and safe" argument, but so does every new uranium reactor, and in general, they're all BS in practice.

(These sorts of claims tend to cause nerdy but non-industry-savvy people to glob onto them as the Next Big Thing - you see the same thing as well with various types of "trendy" uranium reactors, like PBMRs)

The simple problem is the very nature of fission. Whatever method you use. Fission creates every isotope on the table lighter than your fissile material (and indirectly, some heavier ones). Most of these are exceedingly toxic, in vanishingly small quantities. But you're simultaneously creating new byproducts with every chemical property in existence in your fuel rods - solids, liquids, gases, things that readily convert between different states, things that corrode various other things (whatever you make your reactor out of, you're also generating its worst enemy), etc. On top of that you're simultaneously bombarding your reactor (solid structures and working fluids) with an intense neutron flux, which is first off changing what it's made out of, via neutron capture, and secondly altering its crystal structure, which not only can severely harm its material properties, but can also store energy inside of it which can be released suddenly (Wigner energy), depending on the material. And you can't just use whatever materials you want to make it, because you also have to take into account how they're going to affect fission inside the reactor.

The economics problem is far worse than the physics and engineering, however. The lead times on reactor construction and necessary operating lifespans are so long that if you get your demand or price forecasts at all wrong, you're totally screwed. Nuclear power has also undergone something extremely rare in industry: a negative learning curve. That is, the more you deploy the tech, the more expensive it gets. In the case of nuclear, it's due to the process of learning all of the things that you didn't forsee that start to affect your reactor with time, and new hazards or costs that you didn't expect previously. The way to overcome this is with new reactor generations, but then with each new generation, you reset your learning curve and have to start over from scratch. And then we come back to the lead-time problem - you've invested countless billions before you discover what you did wrong.

Nuclear power has always had far more support on K-Street than Wall Street. Many of the most expensive structures on Earth are nuclear reactors. The price is mind-boggling - even with government subsidies (like the US indemnifying reactor operators from catastrophic damage liability - no insurer would ever insure them without that). And it doesn't even pair well with renewable power - response times to increase or decrease generation are usually slow, and they have to run at high capacity factor to get even their already-poor economics, while renewables need to pair with generation sources that throttle up and down.

In general, the "you can't fight climate change without nuclear power" advocates' arguments are almost always "argument via incredulity". Aka, of the form "I can't imagine deploying that much renewables power!". Well, sorry, but that just means that your imagination sucks.The simple fact is, you can build more renewable power capacity - paired with peaking, storage, and HVDC for reliability - for much cheaper and faster than you can with nuclear. One's incredulity doesn't change economic reality.

... and that's all I have to say on the topic.

The global growth of nuclear power generation occurred in the mid-1980s. I would submit that the peak of Mt Stupid was reached around 1980. It was this excess of confidence that emboldened so much growth at the time. But as more was learned, confidence plummeted. And as a consequence the need to build in a lot more safety, redundancy and durability increases the cost faster than what an ordinary learning curve could offset. So the net effect is a negative learning curve as the state of art transitions from the peak of Mt Stupid through the Valley of Despair.

The troublesome thing for combating climate change with nuclear is that the Slope of Enlightenment may be too slow to allow nuclear to compete economically with renewables plus storage which concurrently running their own course down a learning curve. Moreover, there is no certainty that even at the Plateau of Sustainability any nuclear power would be cost competitive. So even if our nuclear engineers were past the Valley of Despair and making steady progress along the Slope of Enlightenment the learning gains may well be too little, too late to have any really impact on climate change. We simply do not have another 70 years to wait for several generations of nuclear engineers to achieve enlightenment.