Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

Excuse my ignorance, but is a F150-type vehicle typically used for road trips and similar long distance driving?

(I am trying to imagine what kind of range and battery the Tesla version would have).

If you’re hauling horses, a camper, a boat or some such - yes.

PhaseWhite

Member

Also note that Gasparino was on the bankwuptcy $TSLAQ hype train a few short months ago:

Charles Gasparino on Twitter

"SCOOP: Bankers are inundating @Tesla

w refinancing ideas as two major bond repayments near; one idea floated with be to raise about $5b in new senior secured debt to make payment etc on the notion the $TSLA battery brand and car are worth at least $10b in a worst-case bankruptcy"

That Gasparino tweet didn't age well: two weeks later Tesla posted +~$1b FCF Q3 results, ~3 months later posted +~$1b FCF Q4 results, and paid back both bonds in cash.

We should also remember that a key feature of FUD tactics is that "Doubt" about a complex high-tech company is much cheaper to add than to remove.

I agree the last thing Tesla needs is more debt financing that leverages their balance sheet and reduces cash flow. But they should sell stock, preferably to a strategic investor who can also work with Tesla on increasing the value of that investment. Maybe there will be a good time after the Model Y unveiling to take this forward.

In the past folks here including @Fact Checking have expressed the notion that debt financing is superior because it prevents dilution (which grows in kind if the stock goes up) but this is not a company that has a stable cash cushion for such a luxury. If they did then we would not be seeing such extreme cost cutting measures being implemented.

If Tesla could deleverage their balance sheet they would be able to invest in growth again and would likely be rewarded with a valuation increase worth more than the initial dilution.

Lastly, Elon's insistence not to raise capital is part of the bear thesis. This is the part I have a hard time disagreeing with as it makes no sense to me. Tesla has good product ideas, but they lack capital to execute them. If they want to capture these markets they need to move fast. Model S/X refresh is another great example. I'm sure Tesla would like to have funded that program but they likely had to delay it to prioritize capital for Model 3. People in the S forum have been speculating about a refresh since 2016.

Adam Jonas:

“Without an additional capital raise, we are prepared for Tesla’s gross cash to fall further below ($2 billion),” he said. The new sales model is “uncharted territory” for Tesla, a company that used to highlight its advantages in promoting the brand and engaging with customers without a middleman, he said.

Source: Tesla stock slides to 4-month low as analysts question recent decisions, fret about cash burn

Tesla's lack of dealerships means that they require more capital for inventory because all their inventory sits on their books, instead of the dealers. They will need capital for things like spinning up the fabbing of HW3 manufacturing in volume, investing in Model Y, Semi and Roadster parts suppliers and manufacturing lines where will the capital come from for these programs to actually happen on schedule? The continued positive cashflow we've seen seems to be a big unknown to me with the huge price drops and 35k model 3.

Anyone here thinks the SR is going to be made in a completely new production line? What is musk referring to when it comes to volume production and S curve? No such thing happened with the MR when that was in the mix.

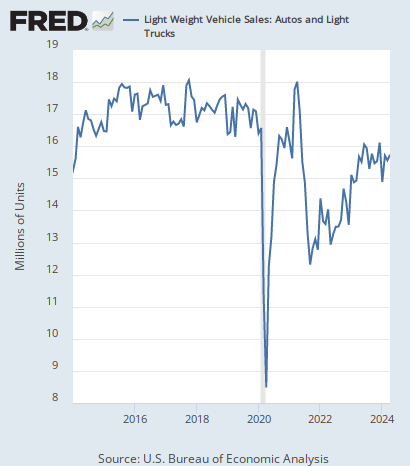

BTW., latest BEA U.S. car sales data (SAAR) is out for February:

16.53m annualized seasonally adjusted sales, a -2.3% YoY drop over 2018.

I should know this, but this data includes BEV sales, correct? They aren't broken out into a separate category for some reason?

Model3 35000 transcript if somebody didn't read it yet

Dropbox - Tesla Call Transcript (2.28.19).pdf

So if you do go to the store they'll simply show you how to buy the car online and then in order to get the need for a test drive.

Maybe my English is bad and this sentence is hard to understand, but doesn't it say that you can arrange test drive from the gallery store?

And some confusing text about getting SR delivered in June, but this was probably if you are not a reservation holder.

edit: SR is not software limited MR, it has fewer cells

Dropbox - Tesla Call Transcript (2.28.19).pdf

So if you do go to the store they'll simply show you how to buy the car online and then in order to get the need for a test drive.

Maybe my English is bad and this sentence is hard to understand, but doesn't it say that you can arrange test drive from the gallery store?

And some confusing text about getting SR delivered in June, but this was probably if you are not a reservation holder.

edit: SR is not software limited MR, it has fewer cells

neroden

Model S Owner and Frustrated Tesla Fan

James Anderson of Bailie Gifford has said in public that he'd provide the funding.I agree the last thing Tesla needs is more debt financing that leverages their balance sheet and reduces cash flow. But they should sell stock, preferably to a strategic investor who can also work with Tesla on increasing the value of that investment.

Adam Jonas is, as I have always said, an idiot. This is Tesla's original business model.Adam Jonas:

“Without an additional capital raise, we are prepared for Tesla’s gross cash to fall further below ($2 billion),” he said. The new sales model is “uncharted territory” for Tesla

What do you guys think about ARKK as a growth stock fund?

I've owned some ARKQ for a while. It was my way of diversifying. I just can't do Banks or Healthcare, so broad Tech is my flavor.

Why so many ARKs by the way?

Thekiwi

Active Member

Anyone here thinks the SR is going to be made in a completely new production line? What is musk referring to when it comes to volume production and S curve? No such thing happened with the MR when that was in the mix.

MR was identical to the LR with a depopulated pack.

SR has a different interior with new components (Seats/dash etc), and the battery pack is a different design to the MR/LR pack, being produced on a new battery pack production line design.

gringotuanis

Member

Then we'll just vote Ivanka Trump in. Don't worry everyone will keep the country out of looney liberal socialist hands for generations.The TL; DR: next election too crazy; will try to do useful stuff instead; unspoken: run in 2024 if Democrats lose to Trump again

neroden

Model S Owner and Frustrated Tesla Fan

They have national health care in China (like all of Europe, like Canada, like Mexico). The US is unique in having a batshit insane jury-rigged system of employer-based health insurance, which is making American companies uncompetitive.What are health care benefit costs per employee in China?

$10 per month?

Single payer health care would restore the competitiveness of American business, but the leeches in the health insurance and hospital conglomerate businesses (and pharma) don't want that.

anthonyj

Stonks

He isn’t making sense. Honestly nothing makes sense right nowAnyone here thinks the SR is going to be made in a completely new production line? What is musk referring to when it comes to volume production and S curve? No such thing happened with the MR when that was in the mix.

Do you even read what you post? Four jobs. Four.

tivoboy

Active Member

My you’ve come a long way lady?There breaks $280.

SO glad I got an 18 Apr $300 back when the stock was in the $273-274 range.

Just hope we don't hit $310 by the end of the week, as I've capped myself with short-term spreads

gringotuanis

Member

I 2nd this. I bought the truck from the "cheap" dealer as it was brand new and it didn't matter. They gave me a better price. Then for service I take it to the nicer part of town where they seem to know more and do a better job w service.I have bought 8 new vehicles, not one has ever been serviced at the dealer I bought it from.

If you live in a big city you shop around. You get service at closest dealer.

China's national insurance is close to nothingThey have national health care in China (like all of Europe, like Canada, like Mexico). The US is unique in having a batshit insane jury-rigged system of employer-based health insurance, which is making American companies uncompetitive.

Single payer health care would restore the competitiveness of American business, but the leeches in the health insurance and hospital conglomerate businesses (and pharma) don't want that.

In China you will be dead if you don't have enough money to pay hospital firstly LOL

And no one cares LOL

neroden

Model S Owner and Frustrated Tesla Fan

Update on the missing transcript issue:

"yo @Tesla & @elonmusk why was there a press call about the $35K model 3 that was closed to the public (and shareholders!!) w/ no transcript released. super frustrating for long-term supporters. completely goes against democratization of information and financial markets"

Elon: "Tesla comms is fixing. That was a mistake."

Awesome. Good.

The rule of thumb I read was that cutting prices on a car $5000 *doubled* addressable market.

The stores weren't pulling their weight.

Speaking of stores, they didn't help my sale at all, and I bought online anyway. The guy that gave us a Model S test drive the year prior never even knew I bought one. Besides, I found myself knowing more about the car than they did, and when I later walked in for solar, they asked "who's your power provider", I said "SRP" and the response was literally, "Sorry, we can't help you." (Long story why, but really?)

gringotuanis

Member

I agree with his post. Tesla causes it's own problems, and I am not a new investor. Just an annoyed old one. You'd think Musk and Tesla would learn to not sneak around doing media calls to a private group. I tried to get on that call. Major insult to shareholders.Are you a new investor by any chance?

tivoboy

Active Member

Has nasa actually made any money?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K