Krugerrand

Meow

I disagree with the sentiment that tesla should not be aiming for consecutive profitable quarters and instead be continuing to plough all money back into R&D and expansion. Although I fully understand the philosophy of 'get big fast', I would argue that the company should concentrate a bit harder on showing some profit from here on (not a huge profit...but just not a loss).

Primarily the only direct effect a profit is going to have, is that the markets will lose one of their big sticks to beat them with, and the increased financial stability would lead to an stock price bump. Why should any super-bull or long term investors care about the short-term SP?

1) Many top-level and highly skilled employees will have remuneration tied to the SP. I'd guess a lot of them are motivated by the eventual value of stock & stock options. The longer they work with a flat SP, the less likely they are to stay / more tempted they can be by rivals, or the more expensive their compensating salary will have to be

2) There is a non-zero percentage of the population who believe tesla is always in financial trouble. cars are a big long-term expense and people do not want to be stuck with a car that's not supported ESPECIALLY a cutting-edge tech one which no other company knows how to service or support. This is a very real concern.

If I ran Tesla, I'd always be aiming to be profitable every quarter from here on, even if only trivially, and even if that slightly slowed expansion.

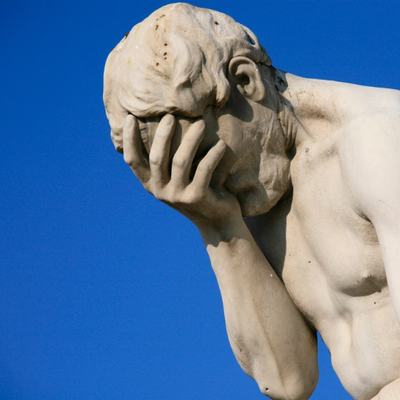

Been there, done that, got screwed for it. What a short memory you have.