Margin calls go out tomorrow and have to be satisfied by the new cash the day after, right? I.e. somebody not watching may not be aware tomorrow and forced liquidations would only take place on Fri?Remember that short interest peaked when TSLA was at $180 - there was a lot of new shorting below $200. The rise to $250 already squeezed out about 5 million shares worth of shorts - the rise to $300 levels is a +65% rise from $180 levels.

Also, while many (most?) longs own TSLA shares without margin and your losses are capped at the capital you invested, you can only short by using margin, and the losses are unlimited. So the psychology of shorts reacting to a rising stock is very different.

There's no doubt in my mind that a lot of shorts are going to exit - and it doesn't really matter whether it's triggered by margin calls or by loss limits.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

JusRelax

Active Member

Just listened to the call.... here are some of my takeaways:

1. Zachary Kirkhorn needs to be on every conference call. No offense to Elon, but Zack was the superstar of this call.

2. Listen closely in the future for developments in Tesla Energy. It seems that Tesla Energy will be the focus of a dominant portion of Elon's time/energy for the near future.

3. Elon was probably very annoyed that autopilot uses brakes so much because of how inefficient it is compared to regen braking. Improvements in single-pedal driving/better regen braking are the result of this.

4. Faster supercharging for SR and SR+ is not only great for customers; it's a great business move. Getting people in/out of superchargers quicker means not having to build out superchargers quite as quick (or, on the opposite side of the coin, less complaints that superchargers are always full).

Funniest moment of the call: When asked about possible software revenue stream, Elon replying that cars from other companies have no soul.

1. Zachary Kirkhorn needs to be on every conference call. No offense to Elon, but Zack was the superstar of this call.

2. Listen closely in the future for developments in Tesla Energy. It seems that Tesla Energy will be the focus of a dominant portion of Elon's time/energy for the near future.

3. Elon was probably very annoyed that autopilot uses brakes so much because of how inefficient it is compared to regen braking. Improvements in single-pedal driving/better regen braking are the result of this.

4. Faster supercharging for SR and SR+ is not only great for customers; it's a great business move. Getting people in/out of superchargers quicker means not having to build out superchargers quite as quick (or, on the opposite side of the coin, less complaints that superchargers are always full).

Funniest moment of the call: When asked about possible software revenue stream, Elon replying that cars from other companies have no soul.

sundaymorning

Active Member

Do shorts have stricter margin call rules ? A lot of us survived 50% SP drop without margin calls.

Some banks require up to 30% reserves to short Tesla.

StealthP3D

Well-Known Member

This is an interesting statement. I was wondering if a substantial covering before the ER (to the tune of at least 5-8M shares out of 40M), the number is more of a gut feeling than a fact, could be explained by someone leaking something.

Otherwise, shorties telling each other to hold to their beliefs while covering is a pretty screwed up thing to do.

I think Tesla's progress was evident to anyone paying attention. I mean, most of us here wouldn't be long if we didn't think Tesla was making good progress on getting costs down and volume and production efficiency up. So I don't believe there was any leak of significant info.

And I'm with Jack Rickard's theory on the shorts. In other words, I think most of the shorted shares are representing oil interests. At some point they might decide it's no longer worth it. The bang for the buck is a lot better when trying to slam a company in the formative stages into bankruptcy or at least slow them down. Now that Tesla is starting to fire on all cylinders (haha), there will come a time when it doesn't make any sense for them to continue to spend the resources attacking Tesla's share price. Because it does cost big money to do that. I also think the market makers are assisting, there is corruption beyond just the big money players shorting the stock. I'm thinking a new administration in 2021 might investigate this. I wouldn't be surprised to see corrupt market makers charged with actual criminal charges.

Just listened to the call.... here are some of my takeaways:

1. Zachary Kirkhorn needs to be on every conference call. No offense to Elon, but Zack was the superstar of this call.

2. Listen closely in the future for developments in Tesla Energy. It seems that Tesla Energy will be the focus of a dominant portion of Elon's time/energy for the near future.

3. Elon was probably very annoyed that autopilot uses brakes so much because of how inefficient it is compared to regen braking. Improvements in single-pedal driving/better regen braking are the result of this.

4. Faster supercharging for SR and SR+ is not only great for customers; it's a great business move. Getting people in/out of superchargers quicker means not having to build out superchargers quite as quick (or, on the opposite side of the coin, less complaints that superchargers are always full).

Funniest moment of the call: When asked about possible software revenue stream, Elon replying that cars from other companies have no soul.

1. Zach is actually good at answering questions. Elon goes on tangents and I say to myself "oh gosh, don't say something you will regret!"

2. I think Elon is very excited about Tesla Energy and also how solar has been ramping up. I did think he interrupted the one executive a bit too much though. Maybe he is just so amped that it was such a great quarter and the future looks so bright that he couldn't contain himself.

StealthP3D

Well-Known Member

Have some common sense please... bears are hibernating this time of the year.

Mostly true, but if it was a TSLAQ bear, I would throw a stone at it just to make sure it was really just hibernating and hadn't decided that the world was too fu**-up to continue.

Fact Checking

Well-Known Member

That part (20%) may be just hedge of Market Makers on all existing puts they've sold...

If so then they will fuel the rally even more: delta hedging long shares of put options are sold almost automatically, now that the delta of a lot of popular strikes will probably collapse.

I.e. the short squeeze of over-sized options positions is almost automatic, through market makers.

(BTW., I don't think that's the case: near the money options open interest isn't nearly enough to explain the very high Tesla short interest.)

Last edited:

Fact Checking

Well-Known Member

Is this accurate:

"Gigafactory Shanghai was built in 10 months and is ready for production, while it was ~65% less expensive (capex per unit of capacity) to build than our Model 3 production system in the US."

The entire GF3 is 65% cheaper than the Model 3 production lines in Fremont? Am I reading this correctly?

Yep, and you heard it from the TMC uberbulls first:

Elon said this about 'capex per vehicle':

Elon Musk:

"In terms of the new products, with Model Y, we've completed ensuring of ensign of Model Y, and the parts are - [indiscernible] for production Model Y. Three quarters of the Model Y is common with the Model 3, so it's a much lower CapEx per vehicle than Model 3. And the risk is also quite low."

He even gave a specific number:

Elon Musk:

Absolutely. I mean, we're confident that our CapEx per unit of production for Shanghai factory and for Model Y will be less than half of what we did for Model 3. Internally, we think it might be a quarter but that's probably too good to believe, but it's definitely less than half.

I.e. Model Y capex would be 25%-50% of Model 3 capex - with much lower execution and schedule risks.

So if Model 3 capex to reach 0.5m/year capacity was $2.5b, then they are expecting 0.5m/year Model Y capacity to cost maybe

According to yesterday's call GF3 3+Y per unit of production capacity capital cost is 35% of the cost of the Fremont Model 3 lines - right in the middle of the 25%-50% range Elon guided for.

Antares Nebula

Active Member

@Cherry Wine (or whoever else) was asking about TA given today's move. I'm not a TA expert, but I think it's safe to say that the TA is kinda broken on this big move. Particularly, it crashed up through all the moving averages and bollinger bands by a wide margin. I think if anything, you can refer to fib (fibonacci) levels with the 389 top and 176 bottom. Also you can look at prior points of support and resistance around these levels (prior pivots).

I won't venture to guess what will happen tomorrow. Have to see how it plays out over the next few days to get a better idea.

One thing to keep in mind is that CMG and NFLX did a headfake after an initial move up on earnings. But for some reason I doubt Tesla will do that that, save for some minor pullback.

I won't venture to guess what will happen tomorrow. Have to see how it plays out over the next few days to get a better idea.

One thing to keep in mind is that CMG and NFLX did a headfake after an initial move up on earnings. But for some reason I doubt Tesla will do that that, save for some minor pullback.

Antares Nebula

Active Member

I understand the capex efficiency will generally be better for newer lines and models. But, here, we're talking about building a whole new factory vs putting up two/three M3 lines in Fremont. The only conclusion I can draw from this is that the robot lines and their associated engineering, setup, etc. is much more expensive than the land and cost of constructing a new factory building(s). And then with things also being much cheaper in China...Yep, and you heard it from the TMC uberbulls first:

According to yesterday's call GF3 3+Y per unit of production capacity capital cost is 35% of the cost of the Fremont Model 3 lines - right in the middle of the 25%-50% range Elon guided for.

Buckminster

Well-Known Member

I thought we were all predicting profit, just not wanting to raise expectations?No Tesla long even dared to predict GAAP profits, but inside most of us knew that having out of delivery hell and attained sustained production, margins should improve.

Early in October I visited a showroom and one salesperson said that they purposely avoided delivery hell this quarter. The team has now come a long way towards running like a well oiled machine.

Buckminster

Well-Known Member

Just sayin...Guidance is Q3 (call it August), "3 month first spotted M3 to production" rule suggests Feb. Split the difference, full production of MY starts May. There is going to be much less interest in MY compared to M3 at this stage on the internet. Osborning will be minimal based on 1 photo.

Shipping multiple prototypes at the same time suggests they aren't struggling to build. They ought to be able complete homologation in record time if they have plenty of prototypes built and the fact that 75% of parts are already qualified.

Antares Nebula

Active Member

Can anybody confirm whether there was any other deferred revenue beyond the 30M for summon? Or do we not know this yet (waiting for 10Q)?

brian45011

Active Member

I think Elon is very excited about Tesla Energy and also how solar has been ramping up. I did think he interrupted the one executive a bit too much though. Maybe he is just so amped that it was such a great quarter and the future looks so bright that he couldn't contain himself.

For first nine months of 2018, Energy generation and storage revenue was $1,183MM with GM % of 12.4%

For first nine months of 2019, Energy generation and storage revenue was $1,095 MM with GM % of 12.7%

For first nine months of 2018, Energy generation and storage revenue was 8.3% of Total Revenue.

For first nine months of 2019, Energy generation and storage revenue was 6.4% of Total Revenue.

It might help if Tesla disclosed quarterly its Energy Generation & Storage backlog in MW and MWh.

Buckminster

Well-Known Member

New/updated dates I will be adding to the milestones thread:

- Semi production starting end 2020

- GF4 live in 21

- GF4 announcement Q4

- Megapack Q4

- MY production of 1000/week by summer 2020

- OTA to improve power on S, X, and 3 in a few weeks, 5% for 3, 3% for S and X, improvements for single-pedal driving

- V3 roof launch today

- Feature complete Q4 (no change)

- FSD capable end 2020

California is passing legislation that lets drivers take dead bears home to eat after being hit by cars. I know it's cruel. but we would expect a lot of bear meat on dinner table next year.Have some common sense please... bears are hibernating this time of the year.

brian45011

Active Member

Total Deferred Revenue 2Q19--$2.066BCan anybody confirm whether there was any other deferred revenue beyond the 30M for summon? Or do we not know this yet (waiting for 10Q)?

Total Deferred Revenue 2Q19--$2.185B

How much was deferred vs recognized during the quarter?

From the 2Q19 10Q:

Automotive sales revenue includes revenues related to deliveries of new vehicles, and specific other features and services that meet the definition of a performance obligation include access to our Supercharger network, internet connectivity, Autopilot and Full Self-Driving (“FSD”) features and over-the-air software updates. Deferred revenue related to the access to our Supercharger network, internet connectivity, Autopilot and FSD features and over-the-air software updates on automotive sales with and without resale value guarantee amounted to $1.19 billion and $882.8 million as of June 30, 2019 and December 31, 2018, respectively. Deferred revenue is equivalent to the total transaction price allocated to the performance obligations that are unsatisfied, or partially unsatisfied, as of the balance sheet date. Revenue recognized from the deferred revenue balance as of December 31, 2018 was $113.5 million for the six months ended June 30, 2019 . From the deferred revenue balance as of January 1, 2018, revenue recognized during the six months ended June 30, 2018 was $44.5 million. Of the total deferred revenue on automotive sales with and without resale value guarantees, we expect to recognize $567.0 million of revenue in the next 12 months. The remaining balance will be recognized over the various performance periods of the obligations, which is up to the eight-year life of the vehicle.

Interesting bit of controversy in an arstechnica article about Tesla's quarterly numbers.

The author of the article cites TSLAQ as some sort of expert source to debunk these numbers. Basically with the implication being that Tesla is doing some financial fraud.

Tesla made a profit of $143 million in Q3 2019 on record deliveries

The author of the article cites TSLAQ as some sort of expert source to debunk these numbers. Basically with the implication being that Tesla is doing some financial fraud.

Tesla made a profit of $143 million in Q3 2019 on record deliveries

Dr Gitlin wrote:

The Q crowd on Twitter is already poking at the numbers in this document, but really we won’t know until the 10-Q how kosher this all is.

Buckminster

Well-Known Member

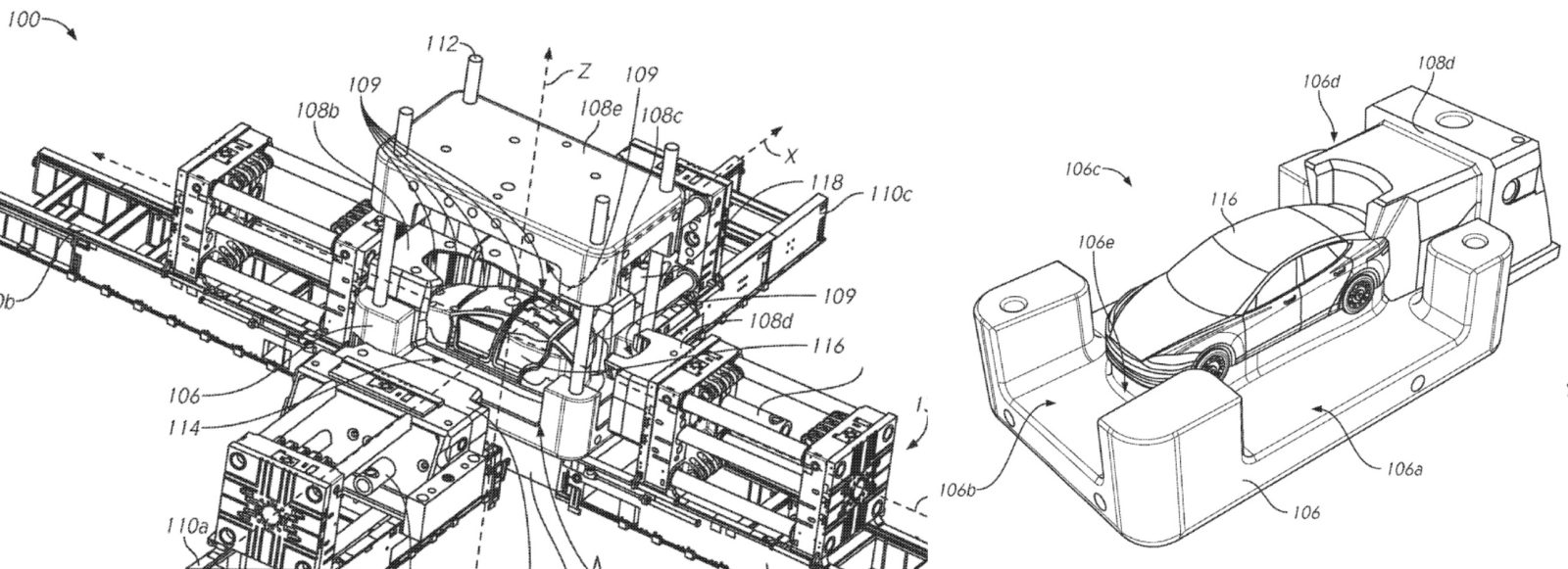

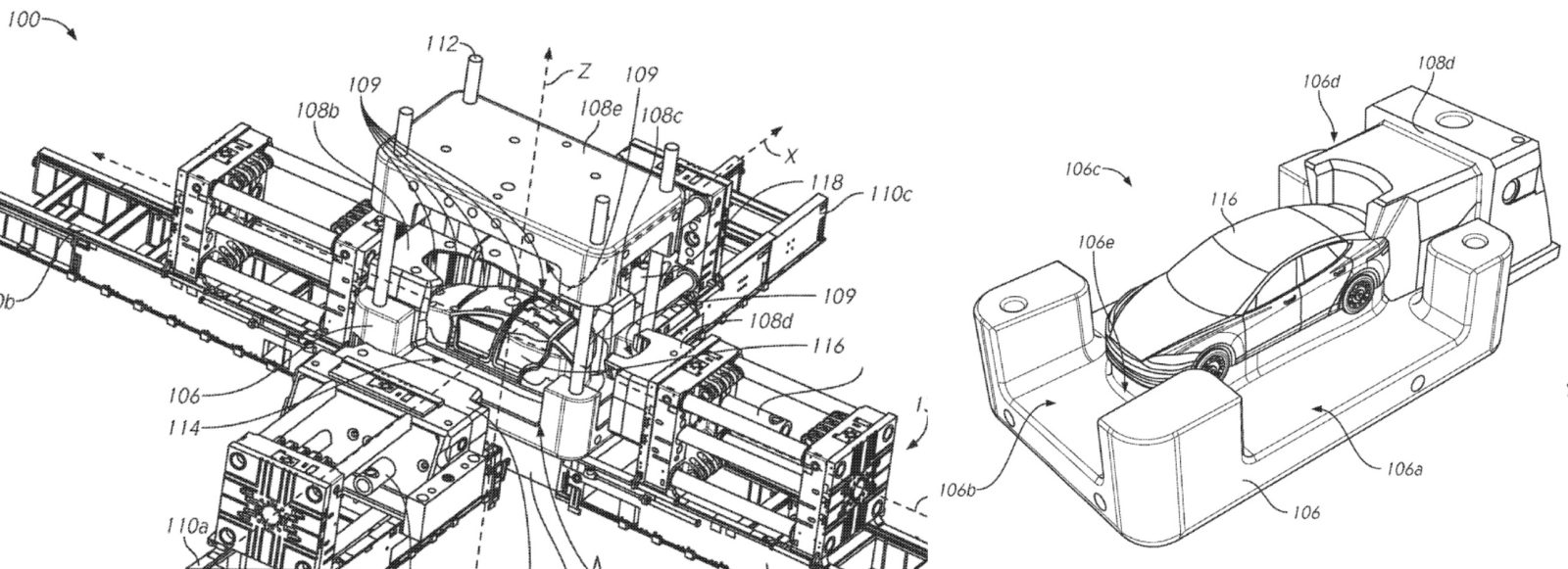

My take on the GF3 photos:

The stamping press is on another level. This is what they have at Freemont:

The lines are simple, singular, straight lines with little evidence of 3 dimensions. Lots of robots - simple short tasks for each. Robots (all Kuka) are less densely packed than Freemont. If Freemont is Alien Dreadnought v0.5, this looks to have reverted to v0.3. Compare to Freemont here (27 seconds in):

Wise decision to get the job done. Quality (including panel gaps) of M3 to my untrained eye and from distance already looks spot on.

It will be interesting to see if MY production gets us closer to v1.0 given that they have engineers close at hand. The eventual target being:

The stamping press is on another level. This is what they have at Freemont:

The lines are simple, singular, straight lines with little evidence of 3 dimensions. Lots of robots - simple short tasks for each. Robots (all Kuka) are less densely packed than Freemont. If Freemont is Alien Dreadnought v0.5, this looks to have reverted to v0.3. Compare to Freemont here (27 seconds in):

It will be interesting to see if MY production gets us closer to v1.0 given that they have engineers close at hand. The eventual target being:

TradingInvest

Active Member

Remember that short interest peaked when TSLA was at $180 - there was a lot of new shorting below $200. The rise to $250 already squeezed out about 5 million shares worth of shorts - the rise to $300 levels is a +65% rise from $180 levels.

Also, while many (most?) longs own TSLA shares without margin and your losses are capped at the capital you invested, you can only short by using margin, and the losses are unlimited. So the psychology of shorts reacting to a rising stock is very different.

There's no doubt in my mind that a lot of shorts are going to exit - and it doesn't really matter whether it's triggered by margin calls or by loss limits.

Mark Spiegel said he shorts more when TSLA goes lower, then he covers when it goes higher - essentially sell low buy high. No wonder he hates Tesla so much.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K