anthonyj

Stonks

Technically paid for mostly by the P85D that I sold, but the shorts did pay for a Roadster!Paid for by shorts, I assumeNice!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Technically paid for mostly by the P85D that I sold, but the shorts did pay for a Roadster!Paid for by shorts, I assumeNice!

Why did it take 3 days to finalize?OT, but not for me.

Got the VIN for my new Model X. Delivery date was set at 12-26, but delayed by me until 12-28, as it took 3 days for the sale of 308 shares on last Wed. to finalize. Called TIAA to initiate the withdrawal of the cash and was going to take three days(not counting Christmas) to move it to the retirement money market from which it can be withdrawn. So, the earliest I can start the transfer to my checking account is 8 am ET on Friday. I don't know how long that will take.

Are you really claiming all Tesla has to do to make it complete is to remove the word beta?Your statements are true but irrelevant to @verygreen's point. Until Tesla stops labeling it beta, it's by definition not complete in Tesla's own opinion.

Why did it take 3 days to finalize?

Damn I hope you can make it in time, transfers for me typically take 3 days.OT, but not for me.

Got the VIN for my new Model X. Delivery date was set at 12-26, but delayed by me until 12-28, as it took 3 days for the sale of 308 shares on last Wed. to finalize. Called TIAA to initiate the withdrawal of the cash and was going to take three days(not counting Christmas) to move it to the retirement money market from which it can be withdrawn. So, the earliest I can start the transfer to my checking account is 8 am ET on Friday. I don't know how long that will take.

4) 2020 is going to be an amazing year where several aspects of Tesla's business start contributing to profits - MIC 3, solar roof, FSD - potentially driving up the stock price to 500-600 or more by the end of the year. All these three things are something that most analysts have not priced into their estimates.

5) If we get a non-profitable Q4 I think there will be pullback to the 350 range, but I consider this unlikely. If this happens I think the back and forth profit/loss will cast a question mark in analysts minds, even if Q1 is profitable, dragging the share price down for the next 6-9 months... AKA buying opportunity.

You mean virtually or you reserved one atTechnically paid for mostly by the P85D that I sold, but the shorts did pay for a Roadster!

This news of a 60+ car pileup was posted earlier here. My wife said “hey there is probably a Tesla in there somewhere”, and noticed that the vehicle to the far right being loaded on the tow truck sure looks like a Tesla Model 3. Anyone agree/disagree?

Police: 69-vehicle pileup in Virginia leaves dozens injured

View attachment 492126

I wonder what kind of sales practices that would have BMW investigated?

BMW says being investigated by U.S. SEC

Maybe they were to optimistic in their emissions, MPG?

Investigation secured.

Not sure, but, if it is, it would make for more concise headlines,

Police: 69-vehicle pileup in Virginia leaves dozens injured

Another Tesla crash, more injuries

It kind of resembles a white Model 3 but it's definitely not. The trunk is too short and the rear end is too narrow. It looks like an inexpensive econo-car.

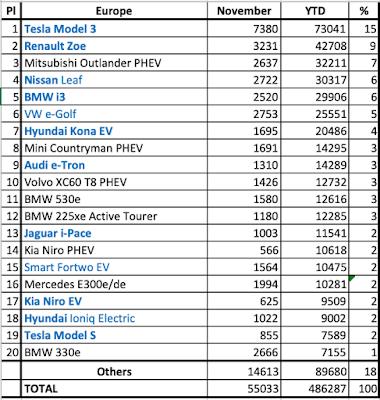

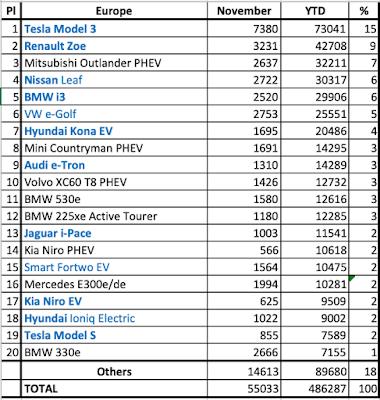

In the manufacturers ranking, Tesla (18%) is the leader, while last year winner BMW (14%) remains firm in the runner-up spot, ahead of Renault (9%), suffering from a short lineup, while Mitsubishi and Hyundai, stay outside the podium, both with 7% share.

EV Sales: Europe November 2019

I show after hours closing of 419.69All of the excitement today surrounding $420 (and $420.42 and $420.69) and I missed the most important piece of numerological information today: the closing price. It was hotly contested between the NSFW marijuana toking bulls and the bears who are trying to protect the world from Musk's villainous clutches. It was looking pretty grim for the bears as the stock price kept going up and up, thanks mostly to Musk's "star link" satellite mind control network that he purchased in the Ukraine from some dubious characters.

But I digress. Thanks to the tireless efforts of the care bears, as they expired one by one from the razor sharp slashes of margin calls, they sent out a beacon, a message to the world. That's right, the bears carefully controlled the stock price in the final minute, ensuring it would communicate the Truthto the world: $419.22.

What, you ask, is the significance of 419? This carefully coded message has at last been deciphered. Chanos did the careful encoding, entrusting the message to MBS who dealt swiftly with those who would interfere for the world must know. Know what? The truth of Elon Musk's terrible perfidy, to expose the seamy underbelly of his Ponzi scheme, the advance money taken from hundreds of thousands of unsuspecting citizens who wished to own his sham of a car, deceived by the promises of the Model 3, and most recently the cyber truck.

With the help of Nigerian princes, the bears did their best and left the mark of the advance fee fraud encoded in plain sight in the stock price: four-one-nine.

Nigerian (419) Scam

(okay, maybe that was a little bit of a stretch)

The market finally realized that Tesla has been wrongly valued in 2019 and tries to anticipate a better valuation for 2020 but I don't hear people really understanding what they have in front of them.

Having said that, this stock is far away from any sort of over evaluation and although I never will exclude that we dive again one day maybe to test $400 or $380 again all signs point to a better sentiment in 2020 and more higher highs.

Right now there is an upwards dynamic that will find a stop somewhere but we are in not known territory therefore no one knows and frankly said I don't care anyhow simply because I don't intend to sell a single share for the longer future so why should I bother.