Yeah this is an unsurprising development but a very good one. Travis Scott is on the ultra A-list of rap right now, whether you like his music or not (I think he's just ok)6.7M subscribers:

0:45 and forward for Tesla

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Live stream from GF3 is on now. This link might work

微博

They’re giving a basic introduction to EV, Model 3, safety features, supercharger network, explaining the crumple zone in the front of the Model 3 and other safety features. I haven’t seen any shots of the production line. But it’s certainly audible.

Blah blah blah Model three blah blah blah Tesla

Well... English sounds the same to me tbh. Tesla you say?!

Lots of noise in the background. Almost like they’re in the middle of a car factory or something

微博

They’re giving a basic introduction to EV, Model 3, safety features, supercharger network, explaining the crumple zone in the front of the Model 3 and other safety features. I haven’t seen any shots of the production line. But it’s certainly audible.

Blah blah blah Model three blah blah blah Tesla

Well... English sounds the same to me tbh. Tesla you say?!

Lots of noise in the background. Almost like they’re in the middle of a car factory or something

Last edited:

MichaelP90DL

Active Member

Fox Business: Tesla has rallied "too far, too fast." (Short-seller's claim).

Tesla has rallied 'too far too fast'

Tesla has rallied 'too far too fast'

If you’re short you are in a ton of trouble. You can cover your position now, or play the “how many cars did Tesla deliver?” Game. There’s belief that if the Q4 delivery numbers allow Tesla to meet guidance that the real short squeeze will take place. This could send the shares soaring as again.Fox Business: Tesla has rallied "too far, too fast." (Short-seller's claim).

Tesla has rallied 'too far too fast'

If you’re long on TSLA then the delivery numbers/guidance really don’t mean a whole lot. If they come up short and the stock drops it’s not the same dagger shorts face. We knew after Q1 and Q2 this year that there was too much on the horizon to keep Tesla down. Many trusted the process and it’s paid off. Every year there’s more to look forward to. I doubt things continue to roll along perfectly but I’m confident we will get where we want to go.

Artful Dodger

"Neko no me"

Fun Facts:

S&P 500 Companies - S&P 500 Index Components by Market Cap

Cheers!

- If TSLA were on the S&P 500 index today, it would be ranked #67 by market cap

- If TSLA shares reach $580 by the time it is added to the S&P 500 index, it will added at the No. 50 ranking of the 505 stock symbols which comprise the index

S&P 500 Companies - S&P 500 Index Components by Market Cap

Cheers!

Hooooo, man he's gonna be pissed when we go to plaidFox Business: Tesla has rallied "too far, too fast." (Short-seller's claim).

Tesla has rallied 'too far too fast'

With this post, and with the one that @Curt Renz provided, I will stand corrected.....AND notify my broker that Form 8949 is the definitive source - not what they had told me. I apologize for the apparent misinformation....and that I learned something.In the US, the Trade Date is used for recording tax gain or loss (exception for short sales)

This is from IRS Instructions for Form 8949: "Use the trade date for stocks and bonds traded on an exchange or over-the-counter market. For a short sale, enter the date you delivered the property to the broker or lender to close the short sale.

So for US members, you can still sell equities on the 30th or 31st to generate gains or losses for tax purposes.

Net losses are limited to $3,000; any losses above $3,000 are carried-over to the following year.

Buckminster

Well-Known Member

Also if Brexit happens will cars sold in the UK result in reduced payments from Fiat ?

The more important issue is:

How will Tesla survive without FCA payments following FCA/Peugeot bankruptcy?

Tesla bear pissed me off again, sparking today's Tesla rant on another forum...

Tesla's business is quite sound, regardless of what those TeslaQ fanatics are telling you. Tesla's imminent failure is only in your mind, but I encourage you to double down on your short position if you're so sure of yourself. Tesla is at an all time high - so it can only go down now, right?

Tesla has been growing exponentially, and exponential growth is capitol capital intensive. Tesla's growth is clearly reflected in their increasing market share. The number of Tesla vehicles on the road has tripled every two years.

2013: ~ 25k

2015: 100k

2017: 300k

2019: 900k

Can you see where this is going?

Tesla has reached an economy of scale that has led to strong positive cash flow and is expected to lead to strong profits and likely inclusion in the S&P 500 in 2020. According to Yahoo Finance, 27 out of 27 analysts forecast positive earnings in 2020, with an average of $5B on $30B of revenue. But I guess they forgot to poll your TeslaQ "analysts" on their carefully considered Tesla business model.

Tesla, Inc. (TSLA) Analyst Ratings, Estimates & Forecasts - Yahoo Finance

There is a kind of buyer exhaustion that Tesla has tapped into - they're tired of buying crappy cars, they're tired of the same rehashed styles, they're tired of going to the gas station, they're tired of getting their oil changed, they're tired of replacing belts, transmissions, mufflers...

They want a fun, zippy car of the future that they look forward to driving rather than dreading the chore of "traffic"

Consumers love Tesla's vehicles. I'm sure you can find this or that dissatisfied customer or horror story, but the fact of the matter is well over 90% of Tesla owners will never buy a different brand of car again. "Tesla customers are more satisfied than those of any other auto brand for the third consecutive year, according to Consumer Reports, which placed Tesla first on its 2019 list of auto brands ranked by owner satisfaction.

https://www.*.com/tesla-tops-consumer-reports-owner-satisfaction-list-2019-2

This is why Tesla never pays for advertising. Their customers are their sales force. A sales force that's been tripling in size every 2 years. Two people bought Tesla's after riding in my car once. No heavy sales pitch or anything. Oh my god, this is so cool! etc. Who ever said that after riding in a Camry?

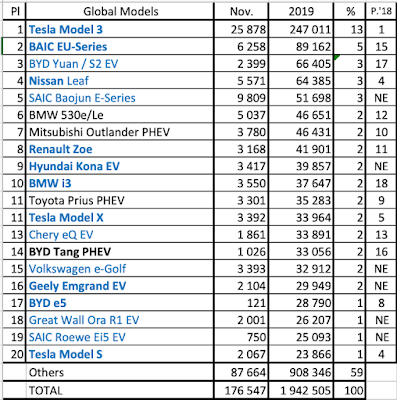

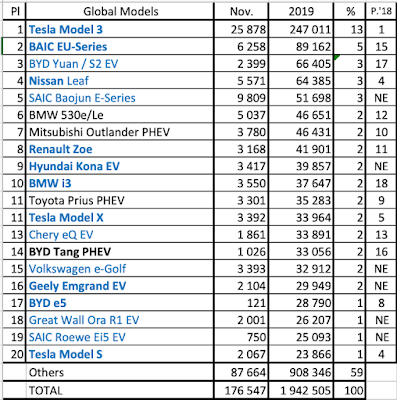

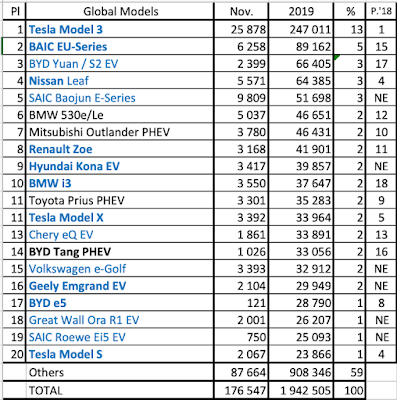

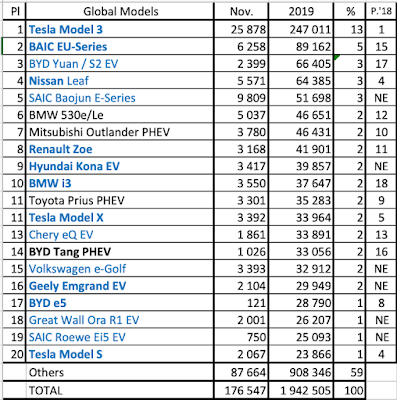

Here is the current state of the world EV market:

Where the hell is VW? Fifteenth place. VW cannot buy their way to the top.

They have to become better than the most beloved car on the market. So far, it's not looking good:

Volkswagen ID.3 Has Encountered 'Massive Software Problems'

Completely absurd to say you've won the race while you're already being lapped.

Cheers!

Tesla's business is quite sound, regardless of what those TeslaQ fanatics are telling you. Tesla's imminent failure is only in your mind, but I encourage you to double down on your short position if you're so sure of yourself. Tesla is at an all time high - so it can only go down now, right?

Tesla has been growing exponentially, and exponential growth is capitol capital intensive. Tesla's growth is clearly reflected in their increasing market share. The number of Tesla vehicles on the road has tripled every two years.

2013: ~ 25k

2015: 100k

2017: 300k

2019: 900k

Can you see where this is going?

Tesla has reached an economy of scale that has led to strong positive cash flow and is expected to lead to strong profits and likely inclusion in the S&P 500 in 2020. According to Yahoo Finance, 27 out of 27 analysts forecast positive earnings in 2020, with an average of $5B on $30B of revenue. But I guess they forgot to poll your TeslaQ "analysts" on their carefully considered Tesla business model.

Tesla, Inc. (TSLA) Analyst Ratings, Estimates & Forecasts - Yahoo Finance

There is a kind of buyer exhaustion that Tesla has tapped into - they're tired of buying crappy cars, they're tired of the same rehashed styles, they're tired of going to the gas station, they're tired of getting their oil changed, they're tired of replacing belts, transmissions, mufflers...

They want a fun, zippy car of the future that they look forward to driving rather than dreading the chore of "traffic"

Consumers love Tesla's vehicles. I'm sure you can find this or that dissatisfied customer or horror story, but the fact of the matter is well over 90% of Tesla owners will never buy a different brand of car again. "Tesla customers are more satisfied than those of any other auto brand for the third consecutive year, according to Consumer Reports, which placed Tesla first on its 2019 list of auto brands ranked by owner satisfaction.

https://www.*.com/tesla-tops-consumer-reports-owner-satisfaction-list-2019-2

This is why Tesla never pays for advertising. Their customers are their sales force. A sales force that's been tripling in size every 2 years. Two people bought Tesla's after riding in my car once. No heavy sales pitch or anything. Oh my god, this is so cool! etc. Who ever said that after riding in a Camry?

Here is the current state of the world EV market:

Where the hell is VW? Fifteenth place. VW cannot buy their way to the top.

They have to become better than the most beloved car on the market. So far, it's not looking good:

Volkswagen ID.3 Has Encountered 'Massive Software Problems'

Completely absurd to say you've won the race while you're already being lapped.

Cheers!

Tesla is making non car guys into car guys and forcing car guys to defend their inferior cars. It’s beautifulTesla bear pissed me off again, sparking today's Tesla rant on another forum...

Tesla's business is quite sound, regardless of what those TeslaQ fanatics are telling you. Tesla's imminent failure is only in your mind, but I encourage you to double down on your short position if you're so sure of yourself. Tesla is at an all time high - so it can only go down now, right?

Tesla has been growing exponentially, and exponential growth is capitol capital intensive. Tesla's growth is clearly reflected in their increasing market share. The number of Tesla vehicles on the road has tripled every two years.

2013: ~ 25k

2015: 100k

2017: 300k

2019: 900k

Can you see where this is going?

Tesla has reached an economy of scale that has led to strong positive cash flow and is expected to lead to strong profits and likely inclusion in the S&P 500 in 2020. According to Yahoo Finance, 27 out of 27 analysts forecast positive earnings in 2020, with an average of $5B on $30B of revenue. But I guess they forgot to poll your TeslaQ "analysts" on their carefully considered Tesla business model.

Tesla, Inc. (TSLA) Analyst Ratings, Estimates & Forecasts - Yahoo Finance

There is a kind of buyer exhaustion that Tesla has tapped into - they're tired of buying crappy cars, they're tired of the same rehashed styles, they're tired of going to the gas station, they're tired of getting their oil changed, they're tired of replacing belts, transmissions, mufflers...

They want a fun, zippy car of the future that they look forward to driving rather than dreading the chore of "traffic"

Consumers love Tesla's vehicles. I'm sure you can find this or that dissatisfied customer or horror story, but the fact of the matter is well over 90% of Tesla owners will never buy a different brand of car again. "Tesla customers are more satisfied than those of any other auto brand for the third consecutive year, according to Consumer Reports, which placed Tesla first on its 2019 list of auto brands ranked by owner satisfaction.

https://www.*.com/tesla-tops-consumer-reports-owner-satisfaction-list-2019-2

This is why Tesla never pays for advertising. Their customers are their sales force. A sales force that's been tripling in size every 2 years. Two people bought Tesla's after riding in my car once. No heavy sales pitch or anything. Oh my god, this is so cool! etc. Who ever said that after riding in a Camry?

Here is the current state of the world EV market:

Where the hell is VW? Fifteenth place. VW cannot buy their way to the top.

They have to become better than the most beloved car on the market. So far, it's not looking good:

Volkswagen ID.3 Has Encountered 'Massive Software Problems'

Completely absurd to say you've won the race while you're already being lapped.

Cheers!

The only thing I would add to your rant, which I wholeheartedly agree withTesla bear pissed me off again, sparking today's Tesla rant on another forum...

Tesla's business is quite sound, regardless of what those TeslaQ fanatics are telling you. Tesla's imminent failure is only in your mind, but I encourage you to double down on your short position if you're so sure of yourself. Tesla is at an all time high - so it can only go down now, right?

Tesla has been growing exponentially, and exponential growth is capitol capital intensive. Tesla's growth is clearly reflected in their increasing market share. The number of Tesla vehicles on the road has tripled every two years.

2013: ~ 25k

2015: 100k

2017: 300k

2019: 900k

Can you see where this is going?

Tesla has reached an economy of scale that has led to strong positive cash flow and is expected to lead to strong profits and likely inclusion in the S&P 500 in 2020. According to Yahoo Finance, 27 out of 27 analysts forecast positive earnings in 2020, with an average of $5B on $30B of revenue. But I guess they forgot to poll your TeslaQ "analysts" on their carefully considered Tesla business model.

Tesla, Inc. (TSLA) Analyst Ratings, Estimates & Forecasts - Yahoo Finance

There is a kind of buyer exhaustion that Tesla has tapped into - they're tired of buying crappy cars, they're tired of the same rehashed styles, they're tired of going to the gas station, they're tired of getting their oil changed, they're tired of replacing belts, transmissions, mufflers...

They want a fun, zippy car of the future that they look forward to driving rather than dreading the chore of "traffic"

Consumers love Tesla's vehicles. I'm sure you can find this or that dissatisfied customer or horror story, but the fact of the matter is well over 90% of Tesla owners will never buy a different brand of car again. "Tesla customers are more satisfied than those of any other auto brand for the third consecutive year, according to Consumer Reports, which placed Tesla first on its 2019 list of auto brands ranked by owner satisfaction.

https://www.*.com/tesla-tops-consumer-reports-owner-satisfaction-list-2019-2

This is why Tesla never pays for advertising. Their customers are their sales force. A sales force that's been tripling in size every 2 years. Two people bought Tesla's after riding in my car once. No heavy sales pitch or anything. Oh my god, this is so cool! etc. Who ever said that after riding in a Camry?

Here is the current state of the world EV market:

Where the hell is VW? Fifteenth place. VW cannot buy their way to the top.

They have to become better than the most beloved car on the market. So far, it's not looking good:

Volkswagen ID.3 Has Encountered 'Massive Software Problems'

Completely absurd to say you've won the race while you're already being lapped.

Cheers!

‘Buyers are exhausted of dealing with car dealers and their shenanigans which makes the whole car buying at the dealership experience incredibly stressful. Add to that the extra ‘recommended service’ the dealers try to add every time the ICE cars have to be taken in for routine service. Tesla buyers are thrilled they never have to deal with this nonsense again!

That’s a great one. I’ll save that for next timeThe only thing I would add to your rant, which I wholeheartedly agree with

‘Buyers are exhausted of dealing with car dealers and their shenanigans which makes the whole car buying at the dealership experience incredibly stressful. Add to that the extra ‘recommended service’ the dealers try to add every time the ICE cars have to be taken in for routine service. Tesla buyers are thrilled they never have to deal with this nonsense again!

There will be way more Y from Fremont in 2020. GF3 is almost certainly at 150k per year now except the parts (mostly batteries) are not ready. Fremonts run rate is 500k or very close right now.

If Tesla becomes 2170-cell constrained after the ramp up of Model Y, then they will probably give precedence to Model Y orders over Model 3 ones, since that brings more revenue for the same amount of battery.

Fun Facts:

See the whole index by weight here:

- If TSLA were on the S&P 500 index today, it would be ranked #67 by market cap

- If TSLA shares reach $580 by the time it is added to the S&P 500 index, it will added at the No. 50 ranking of the 505 stock symbols which comprise the index

S&P 500 Companies - S&P 500 Index Components by Market Cap

Cheers!

How does the S&P weight factor impact the number of shares that have to be bought?

Does the weight of about 0.45 (about place 50) versus 0.01 (about place 500) indicate a 45x dollar value or number of shares that have to be bought?

Has there ever been a company added to S&P 500 as high as 50?

If you’re short you are in a ton of trouble. You can cover your position now, or play the “how many cars did Tesla deliver?” Game. There’s belief that if the Q4 delivery numbers allow Tesla to meet guidance that the real short squeeze will take place. This could send the shares soaring as again.

If you’re long on TSLA then the delivery numbers/guidance really don’t mean a whole lot. If they come up short and the stock drops it’s not the same dagger shorts face. We knew after Q1 and Q2 this year that there was too much on the horizon to keep Tesla down. Many trusted the process and it’s paid off. Every year there’s more to look forward to. I doubt things continue to roll along perfectly but I’m confident we will get where we want to go.

On that note I have taken the liberty of sharing some of the wisdom found here on TMC with some of Tesla's anti-investors:

Lars Kr. Lundin on Twitter

BTW, when a short sale is made, extra shares are created out of thin air, so the increased supply is in itself a cause of downward pressure. Is there anything similar to be said for out of the money puts options?

Look, I keep saying it. They are totally hitting 83.5k.On that note I have taken the liberty of sharing some of the wisdom found here on TMC with some of Tesla's anti-investors:

Lars Kr. Lundin on Twitter

BTW, when a short sale is made, extra shares are created out of thin air, so the increased supply is in itself a cause of downward pressure. Is there anything similar to be said for out of the money puts options?

Artful Dodger

"Neko no me"

See, now you're thinking ahead!How does the S&P weight factor impact the number of shares that have to be bought?

Does the weight of about 0.45 (about place 50) versus 0.01 (about place 500) indicate a 45x dollar value or number of shares that have to be bought?

Has there ever been a company added to S&P 500 as high as 50?

Vanguard 500 Index Fund Investor Shares

NYSEARCA: VOO $130.17B Market Cap

Vanguard 500 Index Fund has total net assets of $520.3B

SPDR S&P 500 ETF Trust

NYSEARCA: SPY

Market Cap: $305.17B

NYSEARCA: VOO $130.17B Market Cap

Vanguard 500 Index Fund has total net assets of $520.3B

SPDR S&P 500 ETF Trust

NYSEARCA: SPY

Market Cap: $305.17B

So if TSLA was added to the S&P 500 index at its current SP of $430, just these 2 Index Funds (and there are many such Index Funds) would need to purchase approx. $1.5B in shares. You recall what the Saudi PIF purchase of $2B did to the TSLA SP in Spring 2018, and that buying was spread out over a number of months.

Further, if TSLA's SP is around $580 when its added to the S&P 500, then the 2 Index Funds mentioned above would need to buy about $2B worth of TSLA shares.

Obviously, if Longs are reluctant to sell, and Shorts head for the exit in a panick, then the SP goes up exponentially, rather than the linear $2B/$175B = 1.2% caused in a neutral redistribution of shares. I'd expect a 10-20x as a multiplier for that redistribution, which then implies between a 12-25% rise in SP caused by Index Funds purchasing $2B of TSLA stock.

But there will be other buyers besides these 2 large funds. Many other buyers.

Cheers!

Tesla has rallied 'too far too fast'[/QUOTE]

This article (below), particularly with its title, seems a companion piece to the above, which feels like wishful thinking:

How Tesla's risky bet on making cars in China could pay off

to wit, it’s hard to see any serious way in which building a factory in China is anything but a de-risking effort. I place this in the investor thread because I think it informs the almost perverse negative bias in reporting on Tesla which, ceteris paribus, puts negative pressure on the share price. At some point this bias will have to dissipate in the face of objective progress on so many fronts. And that dissipation alone can be a catalyst to an appreciating share price.

This article (below), particularly with its title, seems a companion piece to the above, which feels like wishful thinking:

How Tesla's risky bet on making cars in China could pay off

to wit, it’s hard to see any serious way in which building a factory in China is anything but a de-risking effort. I place this in the investor thread because I think it informs the almost perverse negative bias in reporting on Tesla which, ceteris paribus, puts negative pressure on the share price. At some point this bias will have to dissipate in the face of objective progress on so many fronts. And that dissipation alone can be a catalyst to an appreciating share price.

The Netherlands achieved a new ATH of Tesla registrations per day yesterday: 711: Tesla Model 3 op kenteken

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K