Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

No, we're at "media attention"

My response is more simply: it's a stupid graph. It might apply to specific companies at specific times, but it's not some "general trend for company stock graphs".

The worst thing about these "trying to fit a standard shape onto a graph" things is that you can usually find some spot where it works if you position and scale it right, but it offers basically no predictive value. The Peak Oil crowd has always loved doing this with Hubbert Curves, for example. There used to be a constant stream of graphs like this, saying that US oil production was going to crash:

Here's what actually happened.

Last edited:

特拉风T☰SLA mania on Twitter

Tomorrow’s MIC Model 3 delivery event will also mark the official start of Model Y project at Giga Shanghai!

Giga Shanghai has gone PLAID!View attachment 496970

Thanks for this; would they start this project if they would have troubles in Fremont starting Y production?

This vindicates Y production & deliveries will start in Q1.

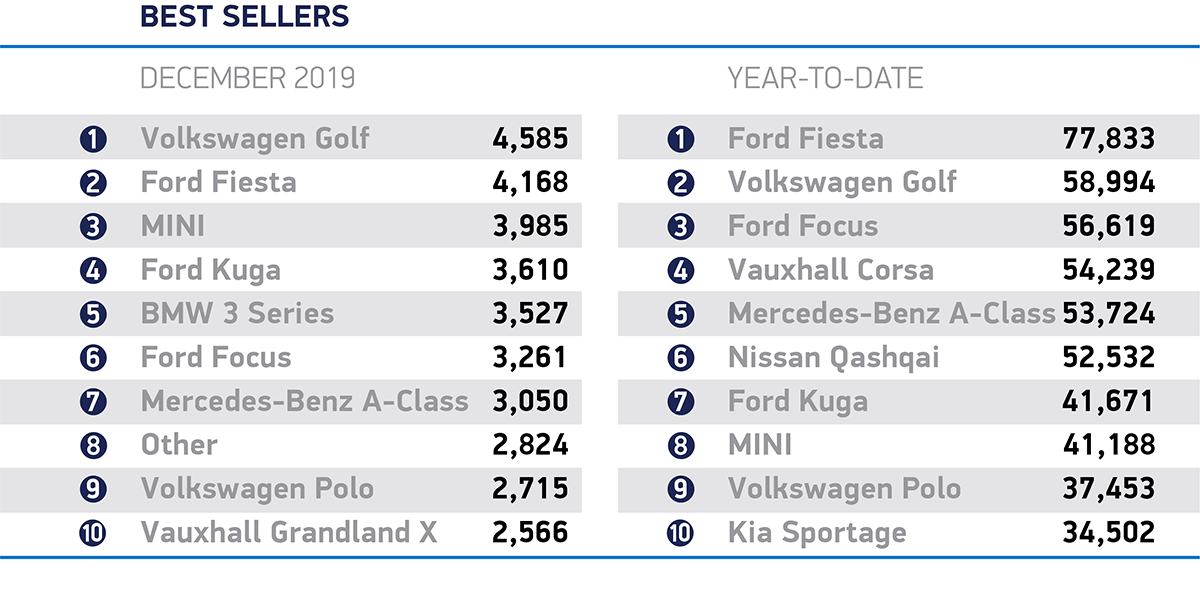

The December registration numbers for the UK just got published, and the Model 3 made the Top 10 again, with 2824 registrations.

Yes, due to Tesla not being a member of the SMMT, the Model 3 is the “Other” one!

Also, pure BEV cars registered were 4939, compared to 1540 in Dec. 2018. That’s a 220.7% increase (biggest contributor by far to that is the Model 3). I’d say we’re on the right track!

Yes, due to Tesla not being a member of the SMMT, the Model 3 is the “Other” one!

Also, pure BEV cars registered were 4939, compared to 1540 in Dec. 2018. That’s a 220.7% increase (biggest contributor by far to that is the Model 3). I’d say we’re on the right track!

Last edited:

Singer3000

Member

I’m not the only one that saw this photo and saw Iron Man and the Avengers?

Singer3000

Member

An interesting question is what price level would be needed today to succeed with a takeover against the Board’s (and largest shareholder’s) recommendation. Personally I doubt it can be done now.That was my and @neroden's take as well - and it clearly explained the rush to control the narrative: according to later SEC documents Elon tweeted the $420 tweet from his private jet, with minimal input from other board members.

Back then Elon probably already suspected that Q3/Q4'2018 is going to be fantastic, because they knew their cost base and had a lot of pent-up demand. This was the report that I believe Elon read and which might have increased urgency and triggered the $420 tweet:

And prior August 7 we did notice weird TSLA buying pressure here on TMC, which started after the July 4th bear attack that drove the price below $300:

Note that on the $420 tweet day the price was already at around $350, $365 intraday, fueled by Q2 earnings that already showed a positive inherent cash flow (modulo working capital fluctuation) and the Saudi speculation, which was later on confirmed to be a 4% stake in Tesla.

Also note that "$420" might have been a joke in part, but it was also exactly a +20% buy-out premium over the ~$350 price levels on August 7, so a fair offer. (350*1.2 = 420)

Note how the next 2 weeks after the $420 tweet were spent (successfully) organizing a $20b buy-out consortium that emphatically did not include the Saudi PIF. The Saudis also later on hedged (shorted) their stake and invested in another EV maker, so the relationship clearly cooled down.

Bears immediately hung on to "The $420 tweet was a lie, it's impossible to take Tesla private!" false narrative and started shorting big time, helped by institutionals and eventually the SEC itself.

In hindsight, had the Saudi PIF taken over Tesla and taken it private, we'd possibly not have seen the $400+ levels of today.

So SEC confrontation aside, Elon did Tesla investors a big favor by making Tesla "uninvestable" for a year or so, this avoided the Saudi takeover (the bone-saw memes would never stop ...), and it also kept VW-Porsche from taking over Tesla at the $180 price levels earlier this year, which I'm sure they were looking at...

The German "Manager Magazin" published a well sourced piece that also quoted members of the Porsche family bemoaning Tesla's high share price ... when it was below $200:

Tesla: Daimler, BMW und Volkswagen machen Jagd auf Elon Musk

"Hunting down Tesla"

"Electro-visionary Elon Musk fails due to the downsides of the auto business. Important investors lose confidence, the German premium providers are attacking. Tesla is ready for a takeover."

...

"The Tesla dream still glows in Diess, according to top VW managers familiar with his thinking. He believes that Volkswagen can benefit from Tesla's battery and, above all, software expertise. "He would get in immediately if he could," says one of his top people. The money is there too, for the beginning a participation is enough. It was more difficult with the approval of the major shareholders, the families Porsche and Piëch."

Right after they leaked this to Manager Magazin, Porsche family members "denied" the report:

I think they wanted to drive the price down a bit more by creating the impression that despite Diess being the super best friend ever of Elon, they are still not interested in bailing out Tesla - and then gobble up Tesla for the EV tech.

Then early September, they were on again:

Tesla: Wolfgang Porsche schließt Beteiligung nicht aus - manager magazin

"Volkswagen co-owner Wolfgang Porsche apparently does not rule out a stake in the US electric car maker Tesla."

I think they were still under the impression that the Taycan would pressure Tesla, and that Tesla has cash flow troubles and needs a bailout.

Lucky for us, VW-Porsche miscalculated, Q2 already drove the share price to $250 levels, and Q3 financials started the rally to $420 ... and Elon never had any interest in selling Tesla's assets to VW.

I don't think VW-Porsche has the money to take over Tesla at these price levels - and Elon would not agree to a one-sided partnership that gives Tesla's software crown jewels to Volkswagen - which I think VW had in mind in the summer.

So yeah, IMO Tesla investors dodged two takeover/dilution bullets in the span of a single year ...

The possibility of takeovers needs to be understood too when buying options: in a takeover much of the time value of an option can go to zero, which wipes out deep out of the money option holders.

More info about GF4:

follow this guy on twitter: #Gf4 #Gigafactory4 (@Gf4Tesla) | Twitter

He provided official documents from Tesla: Environmental Impact Assessment by Countrys - Google Drive

(tried to translate the with google, the original German ones are there too)

follow this guy on twitter: #Gf4 #Gigafactory4 (@Gf4Tesla) | Twitter

He provided official documents from Tesla: Environmental Impact Assessment by Countrys - Google Drive

(tried to translate the with google, the original German ones are there too)

Mars ☰mperor

Member

Thanks for this; would they start this project if they would have troubles in Fremont starting Y production?

This vindicates Y production & deliveries will start in Q1.

Right now it's impossible to know if there is any correlation with Fremont Model Y.

Model Y program starting so early in Giga Shanghai is still good news IMO.

Model Y could really come faster than we all think, both out of Fremont and Shanghai.

Fact Checking

Well-Known Member

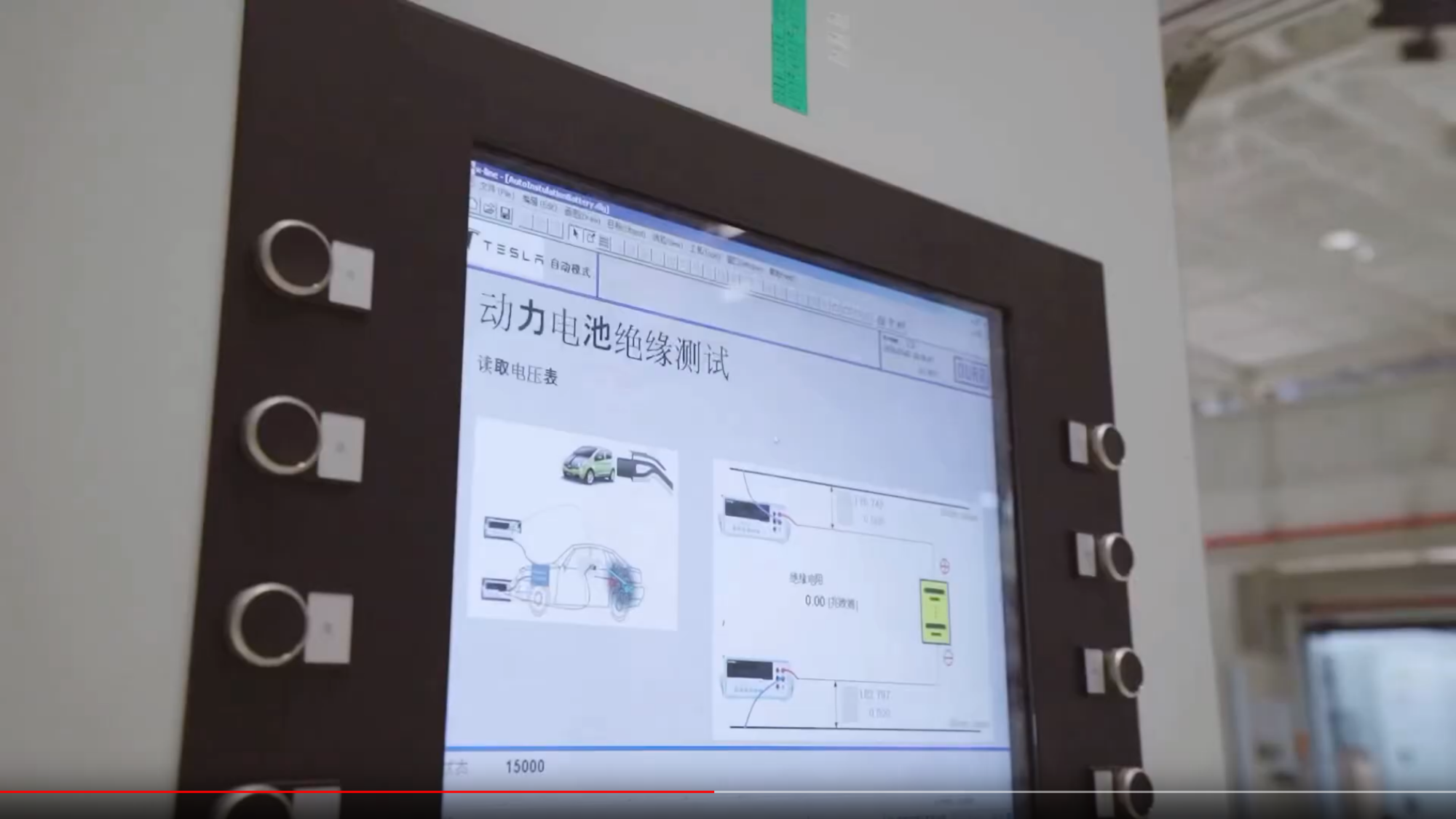

New video from GF3 which was produced by Tesla China and was posted to YouTube by JayInShanghai:

In that video they are primarily showing the QA process. I'm wondering what this QA station might be:

ATEQ is making automated leak-testing equipment for cleanroom environments, but this doesn't look like such a facility.

My guess: the screens provide calibration images for the Autopilot cameras? These screens with the test images are in front of and behind the car, and can be moved to different positions automatically.

This QA station, which appears to be testing the charging interface, is funny:

Clearly not a Tesla on the visualization:

And the Windows interface isn't the usual Tesla Factory OS either.

In that video they are primarily showing the QA process. I'm wondering what this QA station might be:

ATEQ is making automated leak-testing equipment for cleanroom environments, but this doesn't look like such a facility.

My guess: the screens provide calibration images for the Autopilot cameras? These screens with the test images are in front of and behind the car, and can be moved to different positions automatically.

This QA station, which appears to be testing the charging interface, is funny:

And the Windows interface isn't the usual Tesla Factory OS either.

Last edited:

New official video from GF3:

In that video they are primarily showing the QA process. I'm wondering what this QA station might be:

ATEQ is making automated leak-testing equipment for cleanroom environments, but this doesn't look like such a facility.

My guess: the screens provide calibration images for the Autopilot cameras? These screens with the test images are in front of and behind the car, and can be moved to different positions automatically.

This QA station, which appears to be testing the charging interface, is funny:

Clearly not a Tesla on the visualization:

And the Windows interface isn't the usual Tesla Factory OS either.

Surely the bullseye circles are for camera calibration.

The QA interface you refer to appears to say something like "power battery final test", according to Google Translate.

RobStark

Well-Known Member

This youtube channel will be following the going ons at GF Berlin.

In German with English subtitles.

In German with English subtitles.

特拉风T☰SLA mania on Twitter

Tomorrow’s MIC Model 3 delivery event will also mark the official start of Model Y project at Giga Shanghai!

Giga Shanghai has gone PLAID!View attachment 496970

In the comments someone is saying the date on the picture is 2020.3.20. So a Model Y program opening ceremony in March 2020?

That might make the ? mark building the model Y factory in Fact Checking's posts since that is where they are removing the old parking lots and clearing ground.

Something to keep an eye on anyways as we attempt to understand the layout.

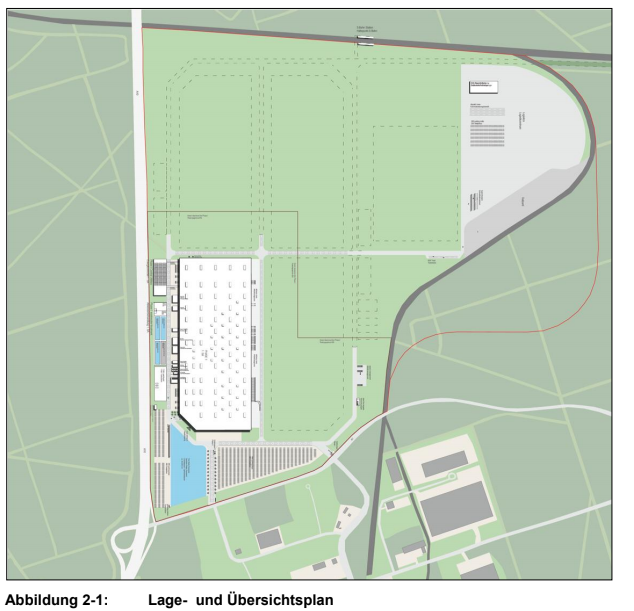

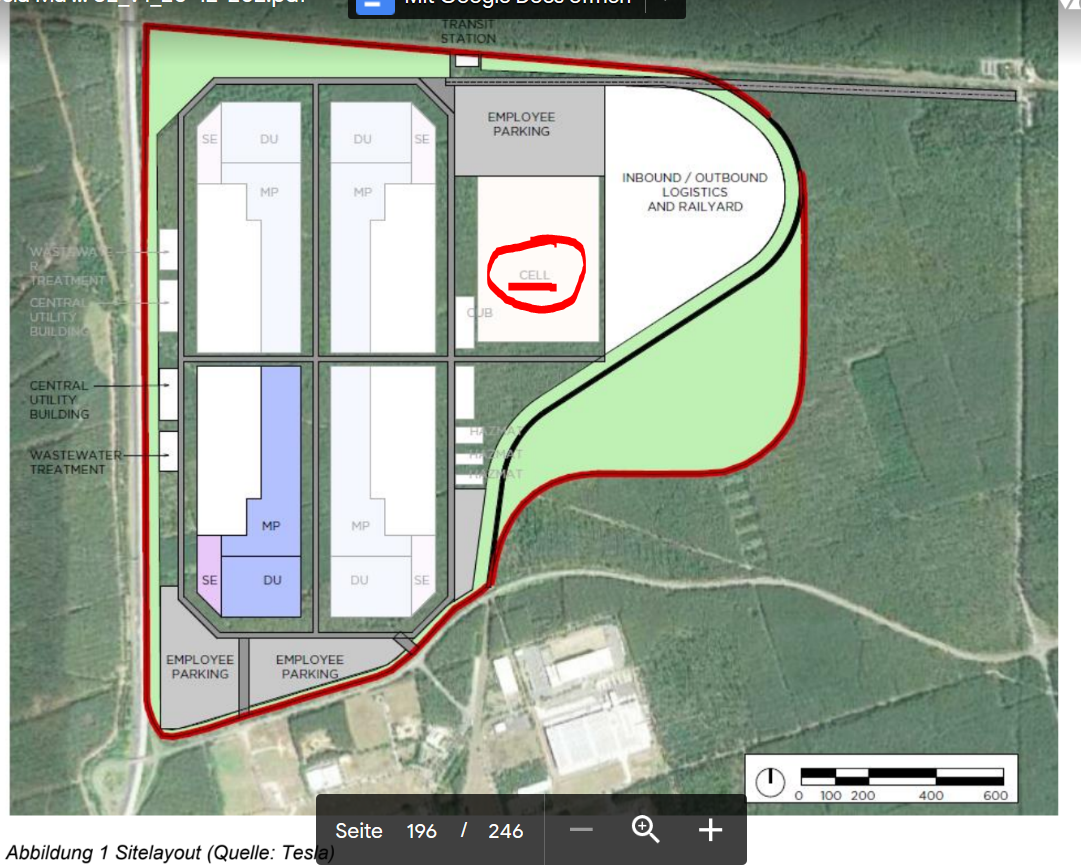

Some pics for the above mentioned official documents

First cuttings. red for first building and parking, orange for logistic space, incl. train shipping yard.

Dimensions first main building: 24m x 300m x 740m (H x W x L). Little building in the north west is the energy hub building (just like in GF3). They will use natural gas for the paint dry ovens.

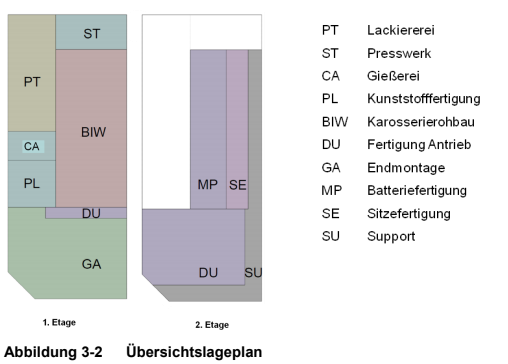

PT = Paint, ST = Stamping, CA = Casting, PL = plastics, BIW = body in white, DU = drive unit, GA = general assembly, MP = battery assembly (stated that cells will be delivered), SE = seats, SU = support

1. Etage = ground level, 2. Etage (right) = upper level

EDIT: found a little extra bonus Seems like there is room for a cell manufacturing builing!

Seems like there is room for a cell manufacturing builing!

First cuttings. red for first building and parking, orange for logistic space, incl. train shipping yard.

Dimensions first main building: 24m x 300m x 740m (H x W x L). Little building in the north west is the energy hub building (just like in GF3). They will use natural gas for the paint dry ovens.

PT = Paint, ST = Stamping, CA = Casting, PL = plastics, BIW = body in white, DU = drive unit, GA = general assembly, MP = battery assembly (stated that cells will be delivered), SE = seats, SU = support

1. Etage = ground level, 2. Etage (right) = upper level

EDIT: found a little extra bonus

Last edited:

Bloomberg: Musk to Come to Shanghai for Debut of Made-in-China Tesla

Rumors that Elon going to china for Model 3 deliveries.

Also includes some FUD about Chinese demand from GF3 being only 21k vehicles for the year. Also some FUD about competition in China.

Rumors that Elon going to china for Model 3 deliveries.

Also includes some FUD about Chinese demand from GF3 being only 21k vehicles for the year. Also some FUD about competition in China.

Last edited:

Depends, there are two types of Semi construction: Custom and Popcorn. Freightliner and Kenworth are examples of Custom. Volvo (and I think, International) are an examples of Popcorn.It’s a mystery. Could be Lathrop, since semi is likely only assembly. If there is any stamping, it could be done from Fremont. Traditional semis are very custom built.

Analyst discusses the Tesla killers:

Moe Salih on Twitter

Moe Salih on Twitter

Bloomberg: Musk to Come to Shanghai for Debut of Made-in-China Tesla

Rumors that Elon going to china for Model 3 deliveries.

Also includes some FUD about Chinese demand from GF3 being only 21k vehicles for the year. Also some FUD about competition in China.

Meh, it's not that bad. The 21k was presented as an (obviously bogus) supply limitation, not demand, while two other more realistic cases were presented alongside it.

Fact Checking

Well-Known Member

Meh, it's not that bad. The 21k was presented as an (obviously bogus) supply limitation, not demand, while two other more realistic cases were presented alongside it.

View attachment 497001

Well, the "forecast" is based on three assumptions, two of which were already falsified:

The supply chain ramp-up is a valid constraint, but it has to be seen in context of sharing all parts with Model 3 production in Fremont, which is already at ~7k/week level: ramping up the existing supply chain by another 3k/week is only a moderate increase over those levels and cannot be compared to the supply chain risks of a new product.

There's no excuse for Bloomberg to cite this forecast without noting that the assumptions are already falsified in large part. Bloomberg also didn't note the "history of failed Bloomberg predictions" related to the speed of Tesla turning the GF3 swap into a high-tech car factory.

Fo all interested in some more GF4 data:

In 3 shifts 8484 people

Material delivery 236 trucks are planned daily

Removal of finished cars daily, 137 trucks !!!

Material delivery by train, 4 full trains daily.

Some calculations:

137 x 6 x 7= 5754 cars every week

137 trucks daily, means ~297k cars/year + cars transported by train.

#Gf4 #Gigafactory4 on Twitter

In 3 shifts 8484 people

Material delivery 236 trucks are planned daily

Removal of finished cars daily, 137 trucks !!!

Material delivery by train, 4 full trains daily.

Some calculations:

137 x 6 x 7= 5754 cars every week

137 trucks daily, means ~297k cars/year + cars transported by train.

#Gf4 #Gigafactory4 on Twitter

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K