RobStark

Well-Known Member

I prefer "Harvesting Pine Tree farm for cardboard" has begun.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

The NYU prof was comparing Tesla to Toyota, like for like, auto to auto.... but noting Tesla will need apple like margins as well, which only insinuates the improbability of doing that, thus the current stock price is way too high and must go down to a more realistic level.Doesnt Apple have revenue like Toyota, and profit like Apple? Its market cap is 1.3 Trillion.

They may swap out the little plastic insulators on the DC charge pins if it's an older model 3 and hasn't had service they changed the design. Swapped mine out yesterday when they rotated the tires.So I had set a service appointment to check why my model3D was showing full charge range of only 298 miles. Here is the text I got (attached). The point is they remotely checked my driving pattern and said my battery is just fine.

I showed this text to my colleagues and they were so impressed at this next level customer service, and how this car platform is so different.

And to top it off, they will now use the appointment to retrofit the FSD computer.

What a great experience.

Someone wanted to burn a large pile of cash.ok noob question .... whyyyyyyyyy are there 70,000 $100 puts there????

people nervous about a repeat of last Tuesday here

The hammer comes down on Friday, but this week MMs have had plenty of time at lower prices to Delta Hedge, so it may not be as severe as your worst fears.I feel the fear of a hammer down in the last minutes.

@geneclean55 has it right. Weird how that got missed if it was truly filed yesterday.

https://www.sec.gov/Archives/edgar/data/1318605/000008025519001855/tsla13gadec18.htm

Fool me once, shame on youpeople nervous about a repeat of last Tuesday here

The nyu prof on CNBC is a prime example of the need of a paradigm shift in how to see Tesla. He says to justify the valuation, Tesla needs to have revenues like Toyota and margins like Apple, otherwise stock not justified at current levels..

Maybe I'm reading this wrong, but isn't this filing from 12/31/2018?

Expert class in how to explain Tesla’s position. Without a doubt the best at getting the message across with short and sweet detail. Excellent, Must listen.CNBC - half-hour ago:

Ya know, he would come out on stage with one of these facesAhh, 2020 is going to be a good one.

by all means add to the list

Not sure the recall should be claimed as the day before the cap raise. I received my recall email letter from Tesla back on Feb 6th, and although I like to think Tesla considers me really special, in reality that's probably not the case, so I assume that 15,000 other people got it at the same time. So 8 days before the cap raise. Not a secret if 15,000 people are in on it.

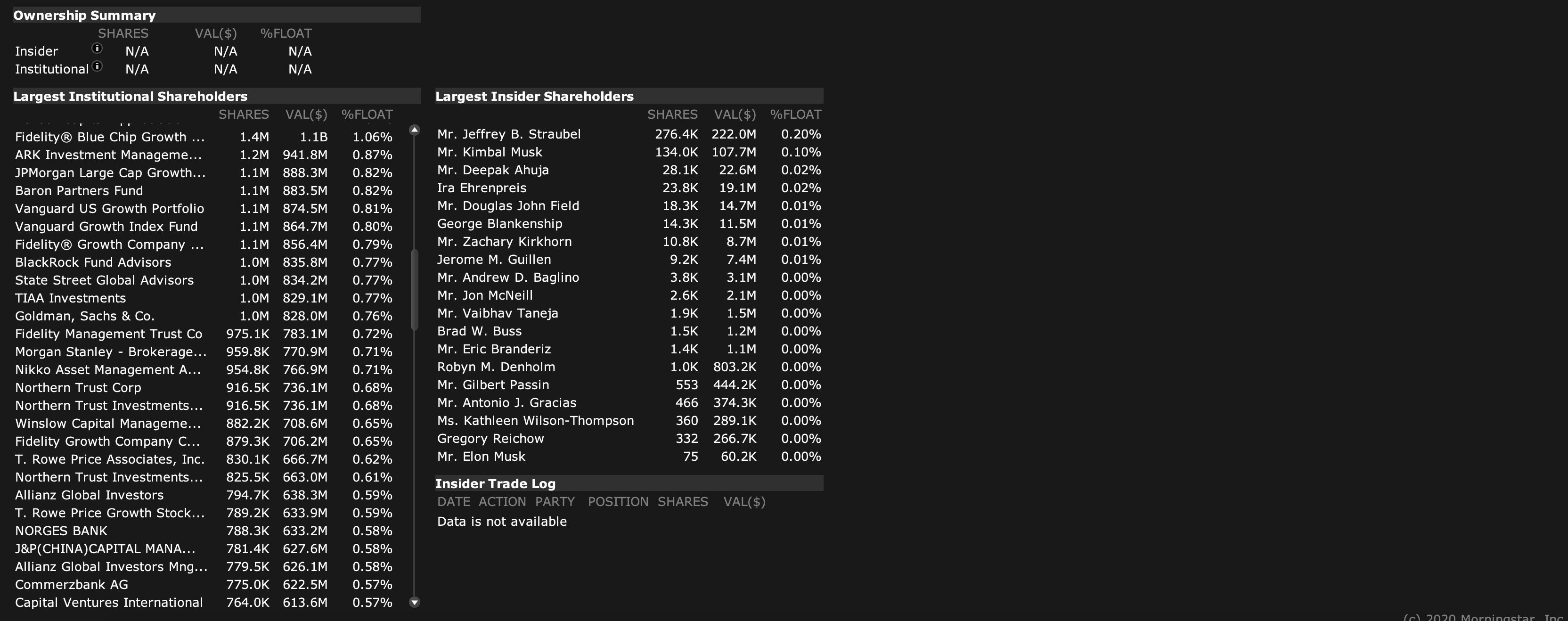

you are right. He misread the year. There is no new T Rowe Price filing for 2020.Maybe I'm reading this wrong, but isn't this filing from 12/31/2018?

Filing for q3 2019 TSLA shares owned by T Rowe was for 830,000 shares.I think you are right. It's just an old filing from 2/2019