Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Thanks for the shout-out!

@Quesder you can find the blog posts Peter is referring to in my signature below.

Etna

Member

Bet TSLA

Active Member

And they're hooking it up:Another big battery being proposed for Australia. This time a 600MW facility in Victoria to reinforce the link to South Australia and provide network services. This is linked with Victoria deciding to go it alone on network planning given the slow pace and inaction at Federal level.

Neoen, Mondo plan massive 600MW Victoria big battery near Geelong | RenewEconomy

The project is by Neoen, the same developer who collaborated with Tesla for the Hornsdale Power Reserve. It looks an ideal application for Megapack. The article also gives a good run-down of some of the other batteries currently being planned or developed in Australia.

https://www.renewablesnow.com/news/...n-works-at-tesla-big-battery-expansion-694830

The energy side of the business continues its growth.

Mo City

Active Member

I don't think Joplin has a snowball's chance of being selected for the Cybertruck GF. IMO, the fact they made their offer public indicates they are an outsider in the process throwing a late, desperate Hail Mary.The upgrades are nice but I believe what’s pushing us is the Missouri factory offer. It’s a huge deal because it shows the demand for this company and the jobs they bring. On its current growth rate Tesla could employee millions.

Not many companies come along where you can jump in and give back to your state for decades to come. This offer represents a massive shift. I believe many investors view this in the same light as Amazon’s growth. (Even though we found out earlier this year that Bezos was jealous of Musk’s ability to bid out a factory across the country)

It's either Austin (I actually wanted San Marcos) or Nashville.

Artful Dodger

"Neko no me"

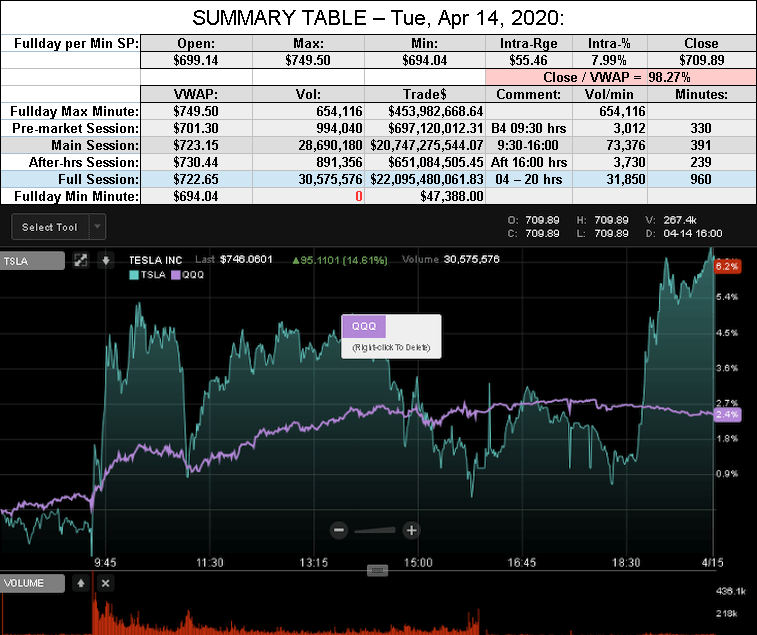

After-action Report: Tue, Apr 14, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 61.6% (54th Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 49.5% (54th Percentile rank FINRA Reporting)

Comment: "Bactrian to the Future"

VWAP: $722.65

Volume: 30,575,576

Traded: $22,095,480,061.83 ($22.10 B)

Closing SP / VWAP: 98.27%

(TSLA closed BELOW today's Avg SP)

Volume: 30,575,576

Traded: $22,095,480,061.83 ($22.10 B)

Closing SP / VWAP: 98.27%

(TSLA closed BELOW today's Avg SP)

FINRA Short/Total Volume = 61.6% (54th Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 49.5% (54th Percentile rank FINRA Reporting)

Comment: "Bactrian to the Future"

StealthP3D

Well-Known Member

The mention of Tesla is at the 1:41 minute mark.

CNBC - today:

Also mentions TSLA's #1 in solar at 2:45 mark.

Artful Dodger

"Neko no me"

Danke.Goldman Sachs initiates buy rating at $864.

Tesla initiated with a Buy at Goldman Sachs TSLA - The Fly

Amazing how every time TSLA flies higher for no reason an analyst upgrade comes right after..

Tesla initiated with a Buy at Goldman Sachs TSLA - The Fly

'Goldman Sachs analyst Mark Delaney initiated coverage of Tesla with a Buy rating and $864 price target. The analyst is positive on the company's product lead position in electric vehicles - a market where he expects "long-term secular growth". Delaney further cites Tesla's early mover advantage, brand recognition, vertical integration, as well as traction from its Model Y launch in the important SUV and crossover market.'

what tamberino only handles downgrades and bear cases? they’re so specialized they change analysts for a bullish call?

I'm super happy about TSLA performance (I'm around 85% TSLA now, the lowest % for me ever), but still can not wrap my head around: less than 2 months ago TSLA was at ATH and the whole World thought that COVID19 was just a Chinese thing and will go away soon. Now, we have a World recession this year, 2-3 months minimum of lost economic activity and TSLA is heading back towards ATH. It makes total sense if you value TSLA for a long term potential, but since when the market started doing that? Since 2013 it was always focused on the next 1-2 quarters, why did it stop caring about the next 6 months now?

Amazing how every time TSLA flies higher for no reason an analyst upgrade comes right after..

Tesla initiated with a Buy at Goldman Sachs TSLA - The Fly

'Goldman Sachs analyst Mark Delaney initiated coverage of Tesla with a Buy rating and $864 price target. The analyst is positive on the company's product lead position in electric vehicles - a market where he expects "long-term secular growth". Delaney further cites Tesla's early mover advantage, brand recognition, vertical integration, as well as traction from its Model Y launch in the important SUV and crossover market.'

It's possible it goes up because they are accumulating then they announce the upgrade after.

Pumping and dumping seems to only be illegal for people like us. Lol

Artful Dodger

"Neko no me"

It's only 16 hrs/day if you don't follow the premarket in Frankfurt... Then its 18 hrs/day.This job used to be 6.5 hours. But now there's 9.5 hours of extra time every day? I'm pretty sure 16 hour workdays are outlawed almost everywhere. We need an union.

FRA: TL0 - Google Search

Well when the virus stuff began bringing the markets down Cramer and many others pointed out that the virus will separate winners and losers. Bad balance sheet, bad product will not survive. Good balance sheet, good product will. Tesla was always going to be a winner following this and I think that’s why the Q1 numbers were important. Also there’s more money on the sideline waiting to jump on the winners bandwagon and I think we’ll see this continue to happen if Tesla keeps executingI'm super happy about TSLA performance (I'm around 85% TSLA now, the lowest % for me ever), but still can not wrap my head around: less than 2 months ago TSLA was at ATH and the whole World thought that COVID19 was just a Chinese thing and will go away soon. Now, we have a World recession this year, 2-3 months minimum of lost economic activity and TSLA is heading back towards ATH. It makes total sense if you value TSLA for a long term potential, but since when the market started doing that? Since 2013 it was always focused on the next 1-2 quarters, why did it stop caring about the next 6 months now?

I hope it’s Texas! It makes the most sense with SpaceX sitting in Boca Chica. Also I’ll get my truck early if Texas builds the factory. Normally California is first hahaI don't think Joplin has a snowball's chance of being selected for the Cybertruck GF. IMO, the fact they made their offer public indicates they are an outsider in the process throwing a late, desperate Hail Mary.

It's either Austin (I actually wanted San Marcos) or Nashville.

Goldman Sachs analyst Mark Delaney this evening "initiating" TSLA with a BUY rating and $864 price target is essentially transitioning to a huge upgrade from the SELL rating and $158 price target of their former analyst David Tamberrino.

https://www.tipranks.com/analysts/mark-delaney

https://www.tipranks.com/analysts/david-tamberrino

Artful Dodger

"Neko no me"

I like how you got one funny rating because an upgrade from Goldman is so rare, but it appears to be legitimate: squawksquare on Twitter

Can't find much other news on it, though.

Yup, this nails it. TSLA started grinding up After-hrs at 18:41 EDT. Notice that the News Flash (image below) was sent at 18:39 hrs.

Tesla initiated with a Buy at Goldman Sachs

TSLA

"Goldman Sachs analyst Mark Delaney initiated coverage of Tesla with a Buy rating and $864 price target. The analyst is positive on the company's product lead position in electric vehicles - a market where he expects "long-term secular growth". Delaney further cites Tesla's early mover advantage, brand recognition, vertical integration, as well as traction from its Model Y launch in the important SUV and crossover market."

I like his point that there should be more Elons but we are discouraging them to everybody's detriment.

Unless I misunderstood...

On that point he is 100% right. There is Major money to be had by a smart people without them pushing their limits. If I see yet another photo sharing app or chat app I am gonna puke. Or yet another physics guy crafting another timing method to game the system on Wall Street. These people take that path of least resistance. Elon put it all on the line and likes living on the edge because otherwise he had no point in being. I know that feeling.

MC3OZ

Active Member

This tweet contains a great graph:- JPR007 on Twitter

The article itself is nothing we don't already know, but confirms we are in the minority, most industry experts are not currently brave enough to predict a rapid uptake of EVs.

EDIT: The technology cost curve is not real prices, they don't have enough price information, so the graph is an approximate representation of a real trend.. It is also an old article, I guess the point JPR007 was making is that COVID-19 is layered on top of this underlying dynamic.

The article itself is nothing we don't already know, but confirms we are in the minority, most industry experts are not currently brave enough to predict a rapid uptake of EVs.

EDIT: The technology cost curve is not real prices, they don't have enough price information, so the graph is an approximate representation of a real trend.. It is also an old article, I guess the point JPR007 was making is that COVID-19 is layered on top of this underlying dynamic.

Last edited:

- Elon says maybe Model 3’s patchwork rear frame could get retrofit with a casting later, but he has to pick his battles due to limited time/effort/money

This is why I LOVE Tesla. There's so much amazing, world-changing, world-saving stuff Tesla can do, it doesn't have enough resources to bother with the 'slightly' world-changing stuff.

Tesla only does MASSIVELY world-changing stuff

And they're hooking it up:

https://www.renewablesnow.com/news/...n-works-at-tesla-big-battery-expansion-694830

The energy side of the business continues its growth.

150MW "demonstration" project complete. Next one planned is 600MW.

As Neoen said previously, the upgraded battery facility will serve as “an Australian-first large-scale demonstration” of the potential for providing inertia to the network through energy storage....

Earlier this month, Neoen and its partner Mondo Power Pty Ltd filed a joint planning application for an up to 600-MW battery storage project in Victoria.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K