Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

Thanks, just added two May 15 $900 calls after reading this and the posts by @BenPrice. Don't worry, if it doesn't work out the blame is all mine.

Get paid sir.

I will be too.

Cannot wait for earnings now...too many heavy hitters propping us up. Anybody short must close now given macro environment.

Attachments

Wonder whether yesterday's hitpiece from the Sacramento Bee editorial board is related to Mclatchy's buyout offer from a couple of hedge funds today. Seems fishy... The string of hitpieces based on the Bee editorial seems very similar to something that would come out from Definers Public Affairs.

McClatchy Gets Takeover Offer From Chatham, Brigade Capital

McClatchy Gets Takeover Offer From Chatham, Brigade Capital

Bid from hedge funds would allow newspaper publisher to leave chapter 11 bankruptcy this year

By Jonathan Randles

April 16, 2020 2:19 pm ET

McClatchy Co. said Thursday it has received a takeover offer from two hedge-fund managers—and senior debtholders—that would get the newspaper publisher’s business out of chapter 11 bankruptcy this year.

Hedge funds Chatham Asset Management LLC and Brigade Capital Management LP have offered to forgive $263 million in McClatchy senior debt in exchange for purchasing the assets of the publishing business.

McClatchy Gets Takeover Offer From Chatham, Brigade Capital

Last edited:

Artful Dodger

"Neko no me"

Lol, I'm ahead quite nicely at $787 thanks, wot with my DCA around $268...You’re behind 787

Closing in on 3x, nice since tomorrow is my 2nd anniversary in TSLA. Original plan was 50% CAGR, hold to a Million. Well ahead of that pace now, and HODLing!

Cheers!

I won’t hold you to it, but is it still worth buying calls tomorrow? hahaGet paid sir.

I will be too.

Cannot wait for earnings now...too many heavy hitters propping us up. Anybody short must close now given macro environment.

MC3OZ

Active Member

woodisgood

Optimustic Pessimist

I won’t hold you to it, but is it still worth buying calls tomorrow? haha

I was vacillating between buying today versus holding out until tomorrow on a max pain push-down. Usually make the wrong call but this one might work out.

Artful Dodger

"Neko no me"

Dow futures rip 800 points higher amid report Gilead drug showing effectiveness treating coronavirus | CNBC.comYes, the After-hrs climb started moments after this CNBC report was posted:

Trump issues guidelines to open up parts of US where coronavirus cases decline, testing ramps up | CNBC.com

- President Donald Trump is set to unveil broad new federal guidelines laying out conditions for parts of the U.S. to start relaxing the strict measures imposed to try to slow the spread of the coronavirus.

- The new guidance will identify the necessary circumstances for areas of the country to allow employees to start returning to work – but the decision will ultimately be made by state governors, two sources told CNBC.

- The new guidance ramps up pressure on governors to loosen their restrictions, even as health experts and business leaders alike warn that widespread testing systems are needed before Americans can safely start returning to their normal lives.

"U.S. stock futures surged on Thursday night after a report said a Gilead Sciences drug was showing effectiveness in treating the coronavirus. The move pointed to a jump for the stock market on Friday.

"Dow Jones Industrial Average futures were up 800 points, or about 3.4%. S&P 500 futures gained 3.2% while Nasdaq 100 futures were up by 2.1%.

"Gilead shares jumped by 14% in after-hours trading after STAT news reported that a Chicago hospital treating coronavirus patients with Remdesivir in a trial were recovering rapidly from severe symptoms. The publication cited a video it obtained where the trial results were discussed."

"Dow Jones Industrial Average futures were up 800 points, or about 3.4%. S&P 500 futures gained 3.2% while Nasdaq 100 futures were up by 2.1%.

"Gilead shares jumped by 14% in after-hours trading after STAT news reported that a Chicago hospital treating coronavirus patients with Remdesivir in a trial were recovering rapidly from severe symptoms. The publication cited a video it obtained where the trial results were discussed."

Last edited:

I won’t hold you to it, but is it still worth buying calls tomorrow? haha

I’m trying to stick to the trading thread now - so to respect the nice members who asked for momentary advice to be in that thread I will be doing that.

I expected to lose a tiny bit on my decision today given max pain and potential for manipulation but the Recent cap raise, news from China, and likelihood of Fremont re-open should protect near term decisions to a degree. I also believe most big money shorts have either closed or must close near term due to the weird global situation. Lastly the Munro news and customer news on Model Y certainly support it being highly competitive.

I think short term moves are “safe” but also no out of the money option is anything besides risk.

I may add tomorrow if we dip to facilitate max pain, but it seems out of control at the moment.

Last time I’ll use “round table” for momentary stuff. Apologies to the members who this upsets - simply replying to a direct question.

juanmedina

Active Member

I won’t hold you to it, but is it still worth buying calls tomorrow? haha

I kept waiting for that red and it never happened lol.

I kept waiting for that red and it never happened lol.

I pulled the trigger at literally 2:59 CST :facepalm emoji

Sorry I was wrong on that.

dqd88

Member

Nearly every stock is up AH. Across the board. Tomorrow will be very green.

Probably due to optimistic view of the White House reopening plan, maybe also due to Gilead's Remdesivir and other drugs.

Reopening plan:

https://fm.cnbc.com/applications/cnbc.com/resources/editorialfiles/2020/04/16/WHReopeningDoc.pdf

Congrats folks, I think we're officially in the recovery zone.

RIP Jim Chanos, et al

Probably due to optimistic view of the White House reopening plan, maybe also due to Gilead's Remdesivir and other drugs.

Reopening plan:

https://fm.cnbc.com/applications/cnbc.com/resources/editorialfiles/2020/04/16/WHReopeningDoc.pdf

Congrats folks, I think we're officially in the recovery zone.

RIP Jim Chanos, et al

Last edited:

SW2Fiddler

We Are Cognitive Dissidents

ARKK is up on Thinkorswim.Slightly OT

Anyone know why ARKK is down 20% after hours? Seems insane for what it is. Hopefully not TSLA related!

good luck Kathy!

dqd88

Member

Gave you a like.Remdesivir? The drug I tweeted about a month ago? Zero Likes.

Poor Richard’s Ghost on Twitter

FYI, to optimize and market a tweet/youtube video/etc, I would advise putting the key words in - in your case the words Remdesivir, Gilead, etc. Didn't see that.

Congrats folks, I think we're officially in the recovery zone.

Fcuk you Jim Chanos, et al

Fixed it for you.

I'm 99.9% sure that this blog has previously made some complete garbage "articles" on SpaceX hirings. It's been a little while, so I can't recall all the details, but it was also thinknum, and the layout looked identical to this one. The so-called data they presented on SpaceX was completely useless.

Actually, make that 100% sure - It's the same blogger and everything.

I haven't looked closely at this article, but just maybe keep it in mind.

MC3OZ

Active Member

As to what this means, I think IT, Engineering and Manufacturing staff are the staff competitors are most likely to poach, a downturn is a good to to acquire or re-acquire talent, when competitors may be cost cutting and have their eye off the ball.

I also think they want to fly out of the blocks with Q2 production when Fremont re-opens for the following reasons:-

- In case there is a V shaped recovery

- In case there is a delayed reopen, or a later shutdown.

- To get inventory on the boat to Europe ASAP.

- They can always shut later in the quarter for retooling if demand is an issue.

So production is a bigger unknown and a bigger risk than demand at this time, that might flip, but only after at least 3-4 weeks of solid production.

It is always worth acquiring and retaining scarce talent, people remember who gave them a job in tough times and might be a bit more loyal.

Talent is probably the biggest issue constraining the Tesla rate of growth long term, not capital, raw materials, parts, production or demand.

(EDIT:: Or if the article is garbage I retract some of that, but the need to fly out of the blocks Q2 remains a constant).

G

goinfraftw

Guest

Neoen Australia: Hornsdale Tesla Battery Extension Completed

Hornsdale extension was just completed.

Hornsdale extension was just completed.

Artful Dodger

"Neko no me"

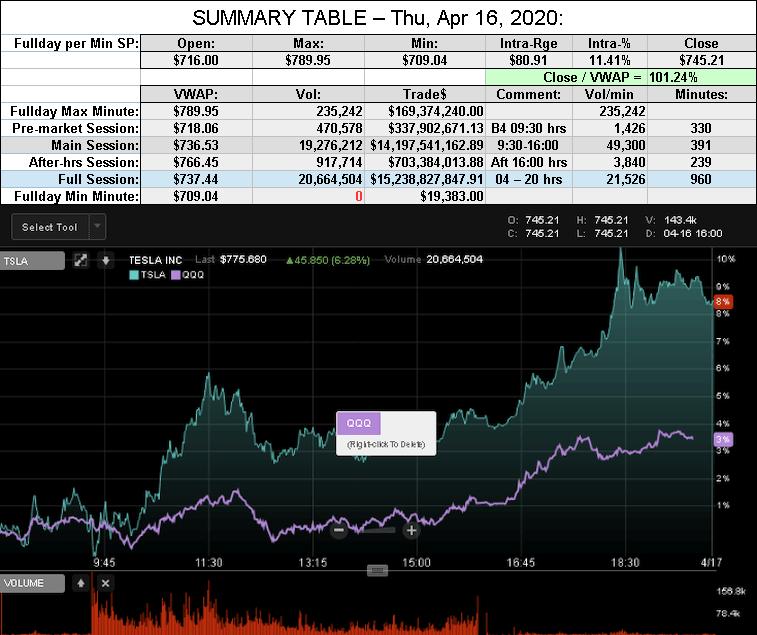

After-action Report: Thu, Apr 16, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 60.4% (53rd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 52.4% (58th Percentile rank FINRA Reporting)

Comment: "After-hrs macro boost"

VWAP: $737.44

Volume: 20,664,504

Traded: $15,238,827,847.91 ($15.24 B)

Closing SP / VWAP: 101.24%

(TSLA closed ABOVE today's Avg SP)

Volume: 20,664,504

Traded: $15,238,827,847.91 ($15.24 B)

Closing SP / VWAP: 101.24%

(TSLA closed ABOVE today's Avg SP)

FINRA Short/Total Volume = 60.4% (53rd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 52.4% (58th Percentile rank FINRA Reporting)

Comment: "After-hrs macro boost"

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K