It was entertaining listening to her last podcast when she described her experience trying to access funds she had just deposited in a bank for a home purchase. I think she holds traditional banks in lower regard than traditional automakers.It also means Cathie Wood might become one of the wealthiest women in the financial industry. I'm going to love to watch her pass up her clueless male cohorts with stinky cologne!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Months ago I’ve asked him that too, but to no avail (and Karen as well). I suppose Factchecking is happy where he is now: on Twitter, slowly but steadily building up a gathering of followers (close to 800 now).

Any possibility you can help me find FC on twitter? Lots of names like that, none that look like that and with a found of 800 that I can find ...

Mo City

Active Member

Don't sweat this at all. The fewer the the doubts, the higher TSLA goes. I promise you as revenue and earnings increase, so will TSLA.Has anyone thought about what impact positive surprises (Earnings/P&Ds) will have going forward as Tesla market cap has tipped more to becoming more fairly valued?

There is an argument that the more bullish the market is on Tesla future value (represented by Market Capitalization & earnings multiples), the less impact positive surprises would have on the share price. I am not sure that theory holds up in the current environment, with most companies including Tesla being given some slack due to CV impact, but might be more valid from next quarter.

While I do not think the current Tesla market cap reflects perfect future execution from Tesla (it is not pricing in 40-50% compounded growth for the next decade with sustained high gross margins), it no doubt reflects much rosier company performance than it did 6 or 12 months ago (perhaps 20-25% compounded growth for a few years with modest decrease in gross margins). So I think the bar is going to be raised for what causes big stock price moves upward going forward as expectations are now higher than they were.

In other words, when half the market used to believe the TSLAQ Durp-durps there were big reactions when Tesla reported deliveries/profits above expectations - but now most of the market has consigned the TSLAQ theories to the same drawer as climate deniers & flat earthers and expects profits going forwards.

Keep your seat belt on.

StealthP3D

Well-Known Member

UGH... I'm so tempted to by FSD on my Model X just to support 2Q #'s.. but I would hate for it to be all for naught. Therefore, it has to make sense to spend $7k for the actual service.. which idk if I can justify. Thoughts? Encouragement?

I have five reasons why you should buy FSD immediately:

1) Tightwads never make much money. It's a losing mindset.

2) You have a Model X without FSD?? What are you, some kind of Luddite?

3) Would you want Elon Musk to think you were worthy of hiring?

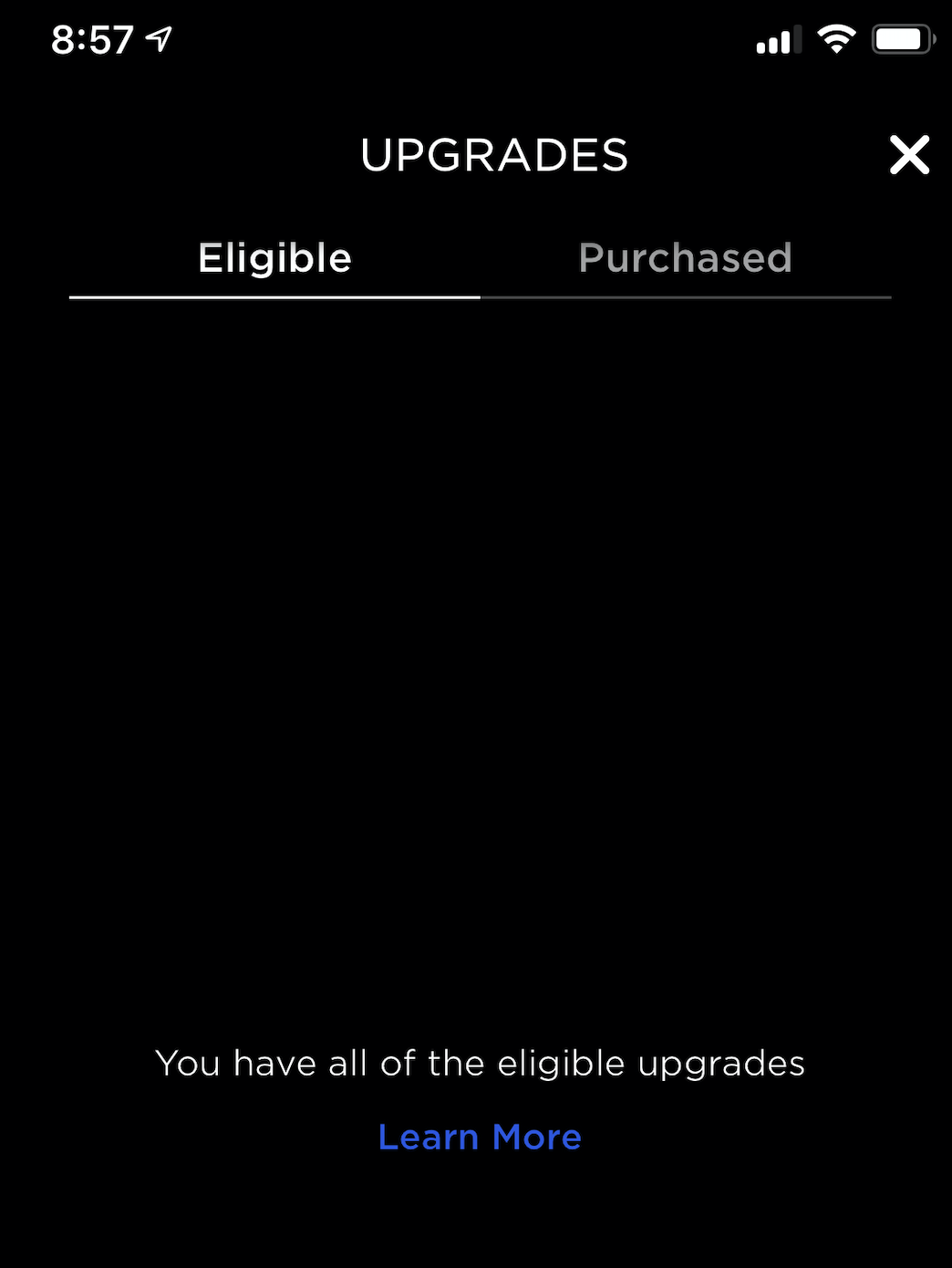

4) When you click on "Upgrades" on your Tesla App it will return a very cool message: "You have ALL available upgrades"!

5) You only live once.

StealthP3D

Well-Known Member

Well we had better not fall $7000 short of profitability!

I don't know - this thread could use a confirmed goat that everyone can agree upon for time immortal.

Stretch2727

Engineer and Car Nut

Any possibility you can help me find FC on twitter? Lots of names like that, none that look like that and with a found of 800 that I can find ...

https://twitter.com/truth_tesla?lang=en

StealthP3D

Well-Known Member

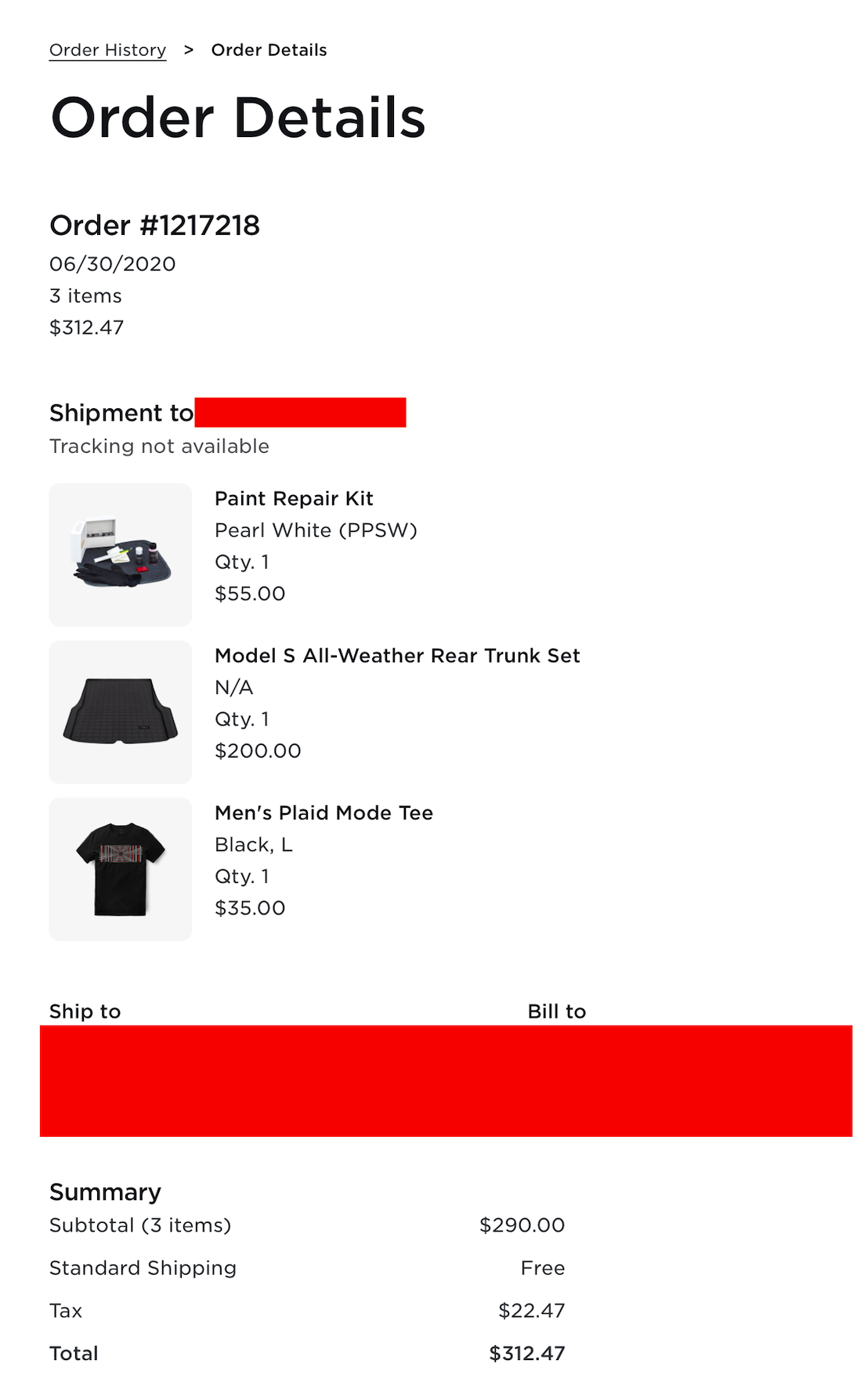

STEM t-shirts, mugs and water bottles for everyone in my house.

Alas, they have not been able to match our Y config yet, but 23 hours to go!

Fire Away!

(Its STILL the batteries, Stupid!)

I think they have to ship the product to count it in this quarter's financials.

So over-the-air updates are the way to go. Both our Tesla's already have everything they offer so I can't help out here. I did buy a Cybertruck baseball cap that arrived last week

So if we make profitability by less than $25 I'm gonna take full credit!

JusRelax

Active Member

Once again, I am not an advocate of bad mouthing any and all tesla competitors, but.... NKLA, come on... this is just so embarrassing:

https://twitter.com/WholeMarsBlog/status/1277797781692792832

https://twitter.com/WholeMarsBlog/status/1277797781692792832

geneclean55

Active Member

Oh they are definitely going for it. Ordered some merch an hour ago... just received shipping confirmation.I think they have to ship the product to count it in this quarter's financials.

So over-the-air updates are the way to go. Both our Tesla's already have everything they offer so I can't help out here. I did buy a Cybertruck baseball cap that arrived last week.

So if we make profitability by less than $25 I'm gonna take full credit!

JusRelax

Active Member

My MX is currently in the shop for my fsd computer upgrade, and paid for MCU2 upgrade. Done tomorrow, booked for this qtr.

The other observation that I have about why NKLA is doing so well is that there's a huge population of anti-Tesla and anti-Elon types that will cheer on any challenger to dethrone the new king

so they can lose money both shorting TSLA and going long on NKLA. Strategery!

AAR from my Denver Model 3 pickup tonight: holy crap are they delivering the Ys. Mine was one of the only 3s I saw bring delivered. There was an S, an X, and a couple dozen Ys.

This was the first Y I've seen up close and personal. My other car is an X, and the Y really does look as though an X and a 3 had a baby. It's larger in person than it looks in photos, as well. No one is going to mistake it for a 3 up close.

Anyway, I picked up at 6:30 pm and they were still going strong and planning to be there for a couple hours more.

This was the first Y I've seen up close and personal. My other car is an X, and the Y really does look as though an X and a 3 had a baby. It's larger in person than it looks in photos, as well. No one is going to mistake it for a 3 up close.

Anyway, I picked up at 6:30 pm and they were still going strong and planning to be there for a couple hours more.

I wonder if Elon's leaked email about maybe breaking even is some kind of trap. Set expectations of a small loss, or break even at best, then announce a profit. Unhappy bears.

UnknownSoldier

Unknown Member

One of you guys should post over on the Tesla Motors reddit sub also encouraging people to buy upgrades lol. Tomorrow is the last day!

StealthP3D

Well-Known Member

AFAIK nothing else came into the S&P 500 with anywhere NEAR the market cap tesla will have (meaning a lot more of it needs to be bought by index funds) and also that level of short float needing to fight the index funds for covering shares

That right there is key. The size of the required purchases relative to the float. The other big advantage I think Tesla has over most (or all?) other S&P 500 additions is a large percentage of big shareholders that will hold come hell or high water. Tesla is growing revenues so quickly that many big investors will not be selling on valuation alone (because it appears the company can out-grow any price bubbles in relatively short order). This could push the price much higher than many anticipate because those index tracking funds have no choice but to buy.

StealthP3D

Well-Known Member

Ok, got inspired by you jerks to spend some money in the Tesla store. Would have spent more but they haven't restocked kids t-shirts in months it seems.

Just like car inventory, they like to run out at the end of the quarter to improve financials.

StealthP3D

Well-Known Member

I think we've been hardened to analyze competition to Tesla from years of defending and deflecting and hopefully digesting the short narrative for a decade now. I know that I've learned what to look for when a company talks a good game. Every time Milton makes some outrageous claim, it reminds me of what Elon may have looked like at the time to the uninformed. And then I look into why it's different.

We can now shred the comparison with ease having the trump card of credibility, accomplishments, results and actual product. One is real, the other isn't. I do agree with others here though that rather than become one of the NKLAQ, take the high road and ignore it.

The other observation that I have about why NKLA is doing so well is that there's a huge population of anti-Tesla and anti-Elon types that will cheer on any challenger to dethrone the new king. It seems obvious to us that they really haven't even looked into what the challenger's arsenal is or even if they have one. It doesn't matter to them because it's ABT (Anything But Tesla). I run into this on other BEV forums all the time and they will take any little scrap of negativity and that's their argument to pile on with claims that Tesla is the devil and Musk is a cult leader. They have a confirmation bias that runs wild without cause and no matter what evidence you provide, they will not budge. They have a religious detachment from reality of "don't confuse me with the facts, my mind is made up".

It's somewhat pathetic that they will avoid Tesla at all costs while suffering with slow charging, frustrating road trips, uncomfortable seats, lack of OTA, etc., and try to puff up the features of a Bolt or Leaf as superior to the point of flagrant lying. Truly the definition of delusional.

It's not just Tesla haters that are bolstering NKLAs share price. A lot of people incorrectly assume they "missed out" on TSLA. It doesn't occur to them that the growth has only just begun.

New Tesla iOS app just hit tonight. 3.10.7

Sadly, I still can't upgrade my AWD to P. Maybe tomorrow. lol

Usually these updates are for a reason. Maybe Green will find some hints soon. Hopefully we can give more to the cause tomorrow.

Sadly, I still can't upgrade my AWD to P. Maybe tomorrow. lol

Usually these updates are for a reason. Maybe Green will find some hints soon. Hopefully we can give more to the cause tomorrow.

The Martian

Member

Already have all the upgrades. So, I did my part.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K