...or we just go back to 1500 as we are used to. ;-)well I am going to pretend like I know what is happening at the last hour of today...the daytraders that bought in during the early morning are getting their pound of salt before the market closes.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

[QUOTE="BlackS, post: 4908689, member: 72376"]View attachment 575457[/QUOTE]

If that PT had been $2100 he would have nailed it.

I did sell shares that I acquired since Friday. Too much margin for my comfort. It would have been more comfortable if I’d sold them at the end of the day. Something something something time the market. Can’t complain, I did squeeze out a little profit.

(Someone asked about everyone doing stuff besides shares. Not me. Can’t do option and Leaps are already beyond my comfort zone).

If that PT had been $2100 he would have nailed it.

I did sell shares that I acquired since Friday. Too much margin for my comfort. It would have been more comfortable if I’d sold them at the end of the day. Something something something time the market. Can’t complain, I did squeeze out a little profit.

(Someone asked about everyone doing stuff besides shares. Not me. Can’t do option and Leaps are already beyond my comfort zone).

woodisgood

Optimustic Pessimist

I should have.. but the burst to 79k lasted 10 minutes after which it was "only" 39k.. so.. greed.. :-/

The hardest part about call options is knowing when to take profits, and windows to do so often are extremely fleeting since the swings are large. You could be up 50K and few minutes later only up 10K. That feels like a 40k loss so you hang on. And maybe lose the rest.

If you play them conservatively, selling with 20-50% gains, the money left on the table can be staggering.

I’m seeing my short-term dated options through Battery Day and trying to resist any temptations to swing them in the very short-term (the caveat to this was yesterday when I absolutely knew to buy more but was fully in and didn’t want to touch margin).

Like many, I’m hoping to convert fully to shares for two decades. The stress when options amount to more than a bit of play money is far too great.

Runarbt

Active Member

Greed seems to be the downfall of us humans. Hope those options go back to $79k and higher!

..they expired last week unfortunately

Rolled while they still had some value, to this friday and next. However, sold when those tripled today.m way to early.

Options are tricky.. either I hold way too long, or not long enough..

Huskyf

Member

Artful Dodger

"Neko no me"

03-19-20 was the highest intraday gain (+26.1%) since Oct 23, 2019 (Q3 results). Today's just 16th place in rank order (and falling with the current short effort). It just feels good today because the absolute gains are staggering.When was the last time we had a chart that looked like this? No downward pressure at all, just a steady rise.

I feel like you’d have the answer at your fingertips, which is why I ask rather than doing the work.

July 13, 2020 was a good day too at +22.0% intraday, but you already know how shortzes peed in the pool that day.

Today's been good, but the shortzes have already whacked $50 off the intraday gains and are likely to keep trying right into the Close. It's what they do.

Cheers!

Ameliorate

Member

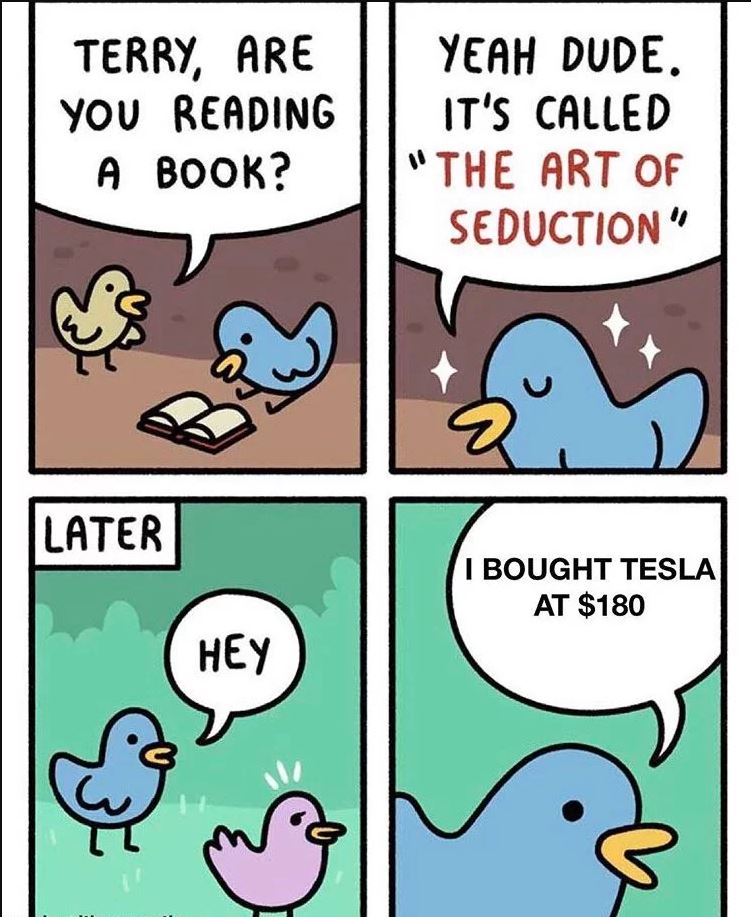

The real downside nobody is talking about here is that this meme will be less impressive soon.

Still good though. Sorry I have nothing of value to add, kinda like a split but it's gonna go up anyways there should be a reversal right about now off the lower BB ( SP 1537 as of posting)

there should be a reversal right about now off the lower BB ( SP 1537 as of posting)

Still good though. Sorry I have nothing of value to add, kinda like a split but it's gonna go up anyways

Last edited:

Driver Dave

Member

2,100 on split.

2,100 on split.

2,100 on split.

my new mantra.

2,100 on split.

2,100 on split.

my new mantra.

Vad42

Member

They would be independent business people running their own business. Not contractors.

So why wouldn't UBER/Lyft do/require the same? Why is that became such an issue for them? I'll be honest I didn't look into this issue at all, so it maybe an obvious thing...

Quesder

Member

Or the other way around : squeezing those shorties who think it is fine now againwell I am going to pretend like I know what is happening at the last hour of today...the daytraders that bought in during the early morning are getting their pound of salt before the market closes.

ADDENDUMB: And then it just magically stops and goes back up

2,100 on split.

2,100 on split.

2,100 on split.

my new mantra.

If you do that too much, you might get high.

Y'all don't let this afternoon fade kill the vibes.. this is a healthy consolidation given the huuuugeee run-up today. Sets us up for a more likely gap-up tomorrow morning in my mind. Let's get it!!!

Ok so we should expect the sp to rise about 5x in the next few days leading up to the stock split, right? And it's tax free. Awesome, I think I got it. Thanks for all the help everybody. But who is Timmy?

Volume at the $1,600 call strike is so high. Open interest was ~5,400 and volume is 67,000.

re: SIPP and ISA - I'm just concerned over any US withholding tax. I've got the same type of accounts - feel free to private message me. I'll post anything I get.

I just have a UK share account; I asked my broker what would happen. Answer: from 31st August the new (presumably about 20% of current) share price would be in effect. The new shares to be added to the portfolio are expected on or around 3rd September. Between 31st August and when the new shares are added the portfolio would look like it had declined by 80% in value, and if I wanted to sell shares I could only sell those existing 20% of the total that I had at that point until the other 80% new ones were added. Seemed clear.

I just have a UK share account; I asked my broker what would happen. Answer: from 31st August the new (presumably about 20% of current) share price would be in effect. The new shares to be added to the portfolio are expected on or around 3rd September. Between 31st August and when the new shares are added the portfolio would look like it had declined by 80% in value, and if I wanted to sell shares I could only sell those existing 20% of the total that I had at that point until the other 80% new ones were added. Seemed clear.

Hargreaves Lansdown? I just received a message from them confirming this as well.

StealthP3D

Well-Known Member

I just have a UK share account; I asked my broker what would happen. Answer: from 31st August the new (presumably about 20% of current) share price would be in effect. The new shares to be added to the portfolio are expected on or around 3rd September. Between 31st August and when the new shares are added the portfolio would look like it had declined by 80% in value, and if I wanted to sell shares I could only sell those existing 20% of the total that I had at that point until the other 80% new ones were added. Seemed clear.

That's quite a delay - probably due to the stock being a NASDAQ stock held in a UK account.

Yes, that's themHargreaves Lansdown? I just received a message from them confirming this as well.

Ya know, at the end of a session like today, I feel like the dude in the Mountain Dew commercial calling the race of the two water drops down the bottle... it's exhausting ;-)

August 31st is a public holiday in the UK, which I guess adds a one day delay on top.That's quite a delay - probably due to the stock being a NASDAQ stock held in a UK account.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K