Well, we all were at first.Hamilton was a Brit - we celebrate him as one of our own. Somebody had to sort you lot out...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Last edited:

Favguy

Member

$1650.71

1. We closed really close to $1650. Obvious manipulation is obvious.

2. We closed slightly above $1650. I am pleasantly and inconsolably aroused.

3. We closed below $1700. Sorry, no ballet dancing in short shorts for y'all today.

4. Had we closed above $1700, (2) + (3) in combination would have been a bit embarrassing. I'm glad fate showed mercy upon you all, sparing your eyes so you didn't have to witness THAT show.

You do realise we will all be expecting you to undertake 2 & 3 when we do actually exceed $1700 now don't you?

Runarbt

Active Member

Todd Burch

14-Year Member

You do realise we will all be expecting you to undertake 2 & 3 when we do actually exceed $1700 now don't you?

Now the entire forum knows you're looking forward to this.

ZachF

Active Member

"After hours 1,650.00 −0.71 (0.043%)"

lol

lol

tinm

2020 Model S LR+ Owner

Over in Tesla Straße 1 they are getting roofs, walls and tarmac today. GF4Tesla did the filming:

And in Texas they are getting new machines. Big drills - and perhaps pile drivers? Have a look in Terafactory Texas' latest vid:

The Texas videos aren't yet interesting in my opinion, unless you like watching dirt being moved on a massive basis. Berlin is taking shape, and that's great.

I love how somebody somewhere must have taken my suggestions to heart about annotating the videos, because I'm seeing that often and the value of the videos has gone up.

My general take on the two factory efforts, in terms of the drone videos, is, a 60-second-or-less summary would give me 97% of the same information. For Texas, a tweetbot that just spat out daily status like:

dirt.

and the next day:

still dirt.

and the next day:

mostly dirt and some steel beams arrive

etc would obviate the need for a video alltogether.

Don't get me wrong, these drone videos are a fantastic resource just like the ones from China. It's real information, nobody lying, no executives or Wall Street or media pundits spinning and speculating or shoving a not-quote-true narrative at the public and more importantly at investors. The drones give us great insight.

Twenty minutes a day of watching drone videos though, too much video and not enough insight.

That said, by all means keep it going! Don't stop because I'm impatient.

Sudre

Active Member

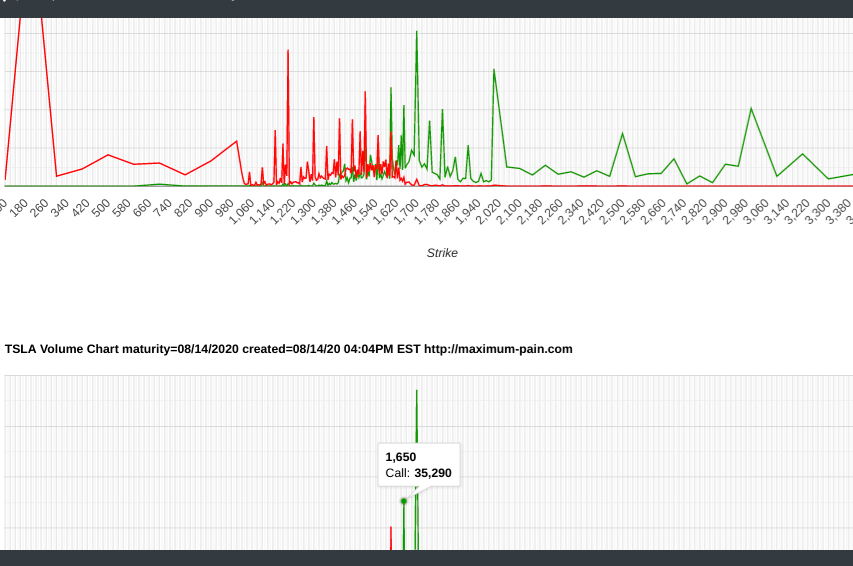

I don't think $1650 was what Mr MM had in mind. Way too many 1650 Calls today. I am sure most people took profits and a fair number won't actually buy the shares but still not the profits the MMs were hoping for (they still made good money today). They really wanted it just under. IF they could have got it under 1650 they would have had a bunch of shares to dump which were hedging. At least they still get the billions in option fees and cost.

Top is this mornings open interest. Bottom is the top of volume.

Top is this mornings open interest. Bottom is the top of volume.

Any chance of more new this friday? Have there been S&P inclusions friday, or?

Yes, it has happened on all of the 5 working days. Ref some tweet by Gary Black.

IamJohnGalt

Member

As the saying goes: "Pimping ain't EZ!"

...but someones gotta do it.

well .. this aged uh .... wellWe have traded in a fairly narrow range today so far. Looks like 1650 is where “they” feel comfortable with it.

I think we’d all be happy to end the week there. And we’re spared a ballerina act we’d probably never be able to unsee.

Tslynk67

Well-Known Member

TSLA all-time closing high

Mullet + banjo = cool? Hmmmm

Was that a circus midget??

Is that whipped cream or Cool Whip on top?Aye, cheers everyone - an amusing little "Belgian" pale ale, 9% ABV, not that I've ever heard of this before, but seems it comes from my adopted county. This isn't my first and won't be my last. Bottoms up!

View attachment 576247

woodisgood

Optimustic Pessimist

I don't think $1650 was what Mr MM had in mind. Way too many 1650 Calls today. I am sure most people took profits and a fair number won't actually buy the shares but still not the profits the MMs were hoping for (they still made good money today). They really wanted it just under. IF they could have got it under 1650 they would have had a bunch of shares to dump which were hedging. At least they still get the billions in option fees and cost.

Top is this mornings open interest. Bottom is the top of volume.

View attachment 576285

It was that last bit of FOMO that pushed them over the edge. I did my part by forcing another 100 shares worth of delta-hedge at 12:59.

Tslynk67

Well-Known Member

Indeed.

Bought to you by the letter "M"

smorgasbord

Active Member

I'm trying to explain the split mechanics to myself, which means explaining it to myself as if I were a child. (Not sure if that's Denzel's 2 year old or Groucho's 4 year old).

At any rate, Tesla Investor Relations says:

Each stockholder of record on August 21, 2020 will receive a dividend of four additional shares of common stock for each then-held share, to be distributed after close of trading on August 28, 2020. Trading will begin on a stock split-adjusted basis on August 31, 2020.

Tesla is literally giving every shareholder 4 additional shares for every 1 share they own. The par value of TSLA shares is, I believe $0.001 each. So, if you own 100 shares you get 400 more, worth $0.40 total, as a dividend from the company. But the company's worth hasn't materially changed.

If you own shares on Aug 21 (I assume at close of trading), you will get the additional shares a week later (after close Aug 28). Thus, the effective date for trading is the following market open, Aug 31 (after the weekend).

Of course, Tesla is not saying what these shares should be trading at. Mr. Market will continue to value these shares collectively. Since there is no capital raise associated with these new shares there is no dilution. Since the par value is so small, the cost to Tesla in issuing them is insignificant. The $0.001 par value is low and TSLA shares are not likely to be like pre-1982 pennies where the value of the copper in a penny is worth more than $0.01.

So, what happens is that at market open on Aug 31, Mr. Market will collectively divide Tesla's previous friday's market cap by the new number of shares and that's what shares will initially trade at - although in practice that won't exist for even a micro-second as this is a fully liquid market. But, ignoring standard market liquidity changes, what in practice happens is that Mr. Market will value 500 new shares on Monday the same as it valued 100 old shares last friday because those both represent the same ownership percentage of Tesla, the company.

Tesla is still not controlling the price of a share, whether pre- or post-split. In the US, Federal taxes are based on what you sell for minus the cost basis and timing of those transactions, so the split does not affect even short or long term considerations. I think now that Florida repealed its "intangible personal property" tax in 2007 there are no longer any US states that tax individuals based on what they own rather than what they transact (real estate is the obvious exception across the board), and even then the value of what you own doesn't change by having it in more pieces, because after all you still own the same percentage of Tesla as a company that you owned before.

The rest is all market mechanics based on the percentage of ownership in Tesla, the company. So, a single standard US option contract for 100 shares also gets split into five option contracts, with strike prices cut to 1/5, and thus Mr. Market will value those accordingly in terms of trading. I say "Mr Market will value those" because it's important to recognize that no-where in this action is any one person, company, or entity setting the price of TSLA shares nor the price of option contracts on TSLA shares.

At any rate, Tesla Investor Relations says:

Each stockholder of record on August 21, 2020 will receive a dividend of four additional shares of common stock for each then-held share, to be distributed after close of trading on August 28, 2020. Trading will begin on a stock split-adjusted basis on August 31, 2020.

Tesla is literally giving every shareholder 4 additional shares for every 1 share they own. The par value of TSLA shares is, I believe $0.001 each. So, if you own 100 shares you get 400 more, worth $0.40 total, as a dividend from the company. But the company's worth hasn't materially changed.

If you own shares on Aug 21 (I assume at close of trading), you will get the additional shares a week later (after close Aug 28). Thus, the effective date for trading is the following market open, Aug 31 (after the weekend).

Of course, Tesla is not saying what these shares should be trading at. Mr. Market will continue to value these shares collectively. Since there is no capital raise associated with these new shares there is no dilution. Since the par value is so small, the cost to Tesla in issuing them is insignificant. The $0.001 par value is low and TSLA shares are not likely to be like pre-1982 pennies where the value of the copper in a penny is worth more than $0.01.

So, what happens is that at market open on Aug 31, Mr. Market will collectively divide Tesla's previous friday's market cap by the new number of shares and that's what shares will initially trade at - although in practice that won't exist for even a micro-second as this is a fully liquid market. But, ignoring standard market liquidity changes, what in practice happens is that Mr. Market will value 500 new shares on Monday the same as it valued 100 old shares last friday because those both represent the same ownership percentage of Tesla, the company.

Tesla is still not controlling the price of a share, whether pre- or post-split. In the US, Federal taxes are based on what you sell for minus the cost basis and timing of those transactions, so the split does not affect even short or long term considerations. I think now that Florida repealed its "intangible personal property" tax in 2007 there are no longer any US states that tax individuals based on what they own rather than what they transact (real estate is the obvious exception across the board), and even then the value of what you own doesn't change by having it in more pieces, because after all you still own the same percentage of Tesla as a company that you owned before.

The rest is all market mechanics based on the percentage of ownership in Tesla, the company. So, a single standard US option contract for 100 shares also gets split into five option contracts, with strike prices cut to 1/5, and thus Mr. Market will value those accordingly in terms of trading. I say "Mr Market will value those" because it's important to recognize that no-where in this action is any one person, company, or entity setting the price of TSLA shares nor the price of option contracts on TSLA shares.

woodisgood

Optimustic Pessimist

well .. this aged uh .... well

Yes, when even the court jester is able to anticipate the advance of the opposing army, that's kind of bad.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K