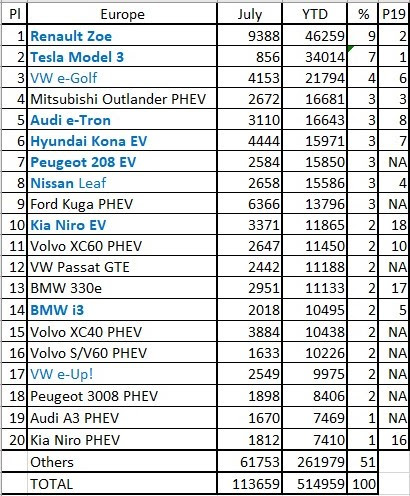

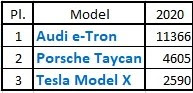

4) Your 50X EBIT calculation relies on an EBIT that is not 2020 and not 2021. When will Berlin produce 750K vehicles in a year? When will Austin produce 1 million in a year? I agree that building these factories is great and necessary for Tesla to be on its 50% CAGR path, but if you're going to compare an EBIT multiple for other companies, you need to use the same year. You're not saying AAPL today is 32x 2023's EBIT.

Wasn't your main argument that Wall St. is short sighted? And that therefore it could dip, because it'll take the company's fundamentals more than Wall. St.'s short sighted 1-2 year investment horizon to catch up to the current SP of $2,000?

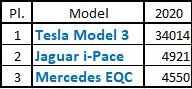

I'm pointing out that you don't have to look that far into the future (just a few years beyond these factories) to come up with a far higher price target than today's stock price. I think a 50x EBIT valuation is still more than fair for TSLA at that point in time considering it'll still have a lot of growth potential ahead of it, so I can use that 50x EBIT multiple to make up a "post-Shanghai/Berlin/Austin" price target for TSLA. Analysts usually discount these future valuations to some extent, which I did not do, but even after discounting that $4,600 to today, you should still end up with a price target well north of $2,000, even if you only look 3-4 years into the future.

5) You're right that FSD will open up a whole new tier for Tesla. But the regulatory approval you agree is needed is years out - more time than Tesla actually making it all work. I believe Elon when he says Tesla will get there, and I like what I've seen so far, but I also believe that FSD will happen in Elon years, as he himself has previously acknowledged on past promises achieved, just not on schedule.

I disagree with this very strongly. Tesla is gathering data at lightning pace:

- For the sake of this example, assume Tesla creates safer than a human FSD in late 2022.

- Tesla should have ~4M Hardware 2+ vehicles on the road at this point in time.

- Let's say 25% of them have the FSD package, so 1M.

- Let's say the average vehicles travels ~10k miles per year, so these vehicles will travel 10B miles total each year collectively, still under supervision.

After 1 year, Tesla now has 10B miles it can take to regulators. Provided this data confirms that Tesla's self-driving vehicles are indeed safer than a human by a significant margin, 10B miles will go a very long way towards convincing regulators. That should be in the ballpark of what will undeniably prove that Tesla's FSD system saves lives, and why wouldn't regulators approve something that saves lives?

This is imo Tesla's biggest advantage in the race towards a safer than a human, regulatory approved FSD system. It is the only company that has the ability to collect enough data to

prove to regulators that their system saves lives.

6) I'm on-board with S&P 500 being a near-term stock price catalyst. Although this is such a widely held view that I have to believe that a not insignificant part of TSLA's rise is due to front-running that inclusion. So much so that I'm starting to wonder if there won't be lots of willing sellers who bought in simply to sell to the Index funds that need to wait and then need to buy quickly. But, that's a separate discussion.

I don't think so, but time will tell.

7) "comparing AMZN in 2000 and TSLA in 2020 is completely pointless, and TSLA's all time high still being around $2,000 in 10 years is so incredibly unlikely imo that I am betting against that happening with my entire net worth by being long TSLA."

It's not pointless. Like I said, history may not repeat, but it does rhyme. I'm not saying TSLA's ATH will be around $2K in 10 years. First, I expect TSLA to continue making new highs until S&P 500 inclusion is complete, and that could easily be $3,000. That said, I'm not expecting much from battery day, but that's dependent on whether Elon treats Battery Day as a technology demonstration (like he did Autonomy Day), or as a technology-drives-future-business demonstration, which is what the analysts are looking for.

Whatever the trigger, whether a macro-event or an execution blip (and TSLA has seen both so far, but before this kind of huge late 20th century Amazon-like run-up), it's possible that Mr. Market will do its normal panic thing and take profits, with stop-loss orders (which we've read that some people here have) triggering and domino-ing, and so TSLA's price could crash. And, like Amazon, Tesla the business would still continue to execute well overall, with the stock price needing something like FSD approval or Tesla Energy growth to be the equivalent of Amazon's AWS, which was needed for the company to re-take it's ATH out - and even that took more years.

And I freely admit it may not happen. I've expressed this as a concern since the beginning, not a certainty.

That so many people have reacted so strongly makes me feel like I've hit a hidden nerve that some may not want to admit. And remember that I'm not only an original Roadster owner, I've been HODLing TSLA longer continuously than most people here: since mid 2011. So, I'm not one to freak out and sell it all on a whim, and I've survived Rawlinson leaving and Model S battery impact fires and Model X delays and Model 3 delays and funding secured and 2019Q1 delivery drop-off and executive departures and everything else.

Agree with you on Battery Day.

Agree with you that if there's a serious drop, it'll be aggressive, but imo much more so due to delta hedging than due to a handful of stop losses.

Disagree with you on Tesla's fundamentals and valuation.

I also think we have different views of TSLA's stock price over the coming years. Obviously it's not going to 10x every 12 months. And I plan to severely deleverage soon and convert options to common stock, because I don't think the risk reward is there, and too much near term price appreciation is baked into options prices. However, I'd be surprised if it's under $2,000 12 and 24 months from now, and I believe it'll for the most part continue to slowly appreciate in value after it settles down a bit post S&P inclusion. I just don't know whether it will settle at $2,xxx, $3,xxx, or maybe even $4,xxx albeit quite unlikely.