Do we know the size of the car? Is it a model S in size or model 3?The Lucid Air is EPA 517 miles est. on a 113kWh battery

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Come now. "Ransom" seems a bit harsh.CNBC is just trying to punish Tesla for not paying the advertising ransom.

...

Extortion.

Thx for this info, A.Disappointing test results from Auto-Motor-Sport having the ID.3 58KWh for a true test drive. Price in Germany $58k

I trust that media outlet quite a bit they are fair in their tests and balanced in judgment. The criticized Tesla in a fair way but call the Model 3 the clear market leader.

In short:

Main positive: it drives well and steering is good

- Panel Gaps (!) badly built

- Cheap material

- Electronic make a lot of issues

- Navigation stops unintended

- Voice does not work

- Range only 161mi

- Consumption 23Kwh per 100km versus the promoted 16 KwH per 100Km (Model 3 has 14)

You get less range for a higher price with the ID.3 versus a Model 3 which makes me to revise my so far positive outlook for it in Germany. It still will sell but in the one to one comparison tesla is beating them also with the price hands down.

VW ID.3 mit Problemen im ersten Test: Fährt gut, patzt bei Verarbeitung und Elektronik

Could you comment on the fact that most German OEM’s have corporate contracts with the larger companies on the supply of company cars for their staff. The issue being that VAG has that type of contracts and Tesla doesn’t.

KnowLittle

Member

He has a youtube channel - https://www.youtube.com/channel/UCi-s2uPq3WfQkje9k8sjvcgAnyone checked on TT007 this week?

His style is much less abrasive (he is quite calm & logical) when speaking compared to the TMC posts. His interview with DaveT a couple years back was opened my eyes to a different style of investment. Not my cup of tea, but it appears to have done well for him.

(Short answer he moved to common stock from calls last week before the crash & has leveraged his margin up since then. I think he is doing more than ok.)

Todd Burch

14-Year Member

Do we know the size of the car? Is it a model S in size or model 3?

Closer to S size I believe.

However, note this is EPA est, which is probably Lucid's estimate of what the EPA rating will be. I'd take it with a grain of salt until the actual EPA testing results are in.

Artful Dodger

"Neko no me"

I say, "it wouldn't have worked" because of the way the 6-mth moving average Mkt Cap works, daily changes in Mkt Cap have a minimal effect on the MA (about 1/125th of the daily change is reflected in the 6mth MA.OOooO, got me thinking that maybe Elon didnt want to impact the q3 ER results due to his compensation so they engineered a downward moment with ATM money raise. Definitely very low probability but what say?

Fun Fact: the SP could have gone from $498.32 on Aug 31 all the way to $385.29 on Sep 01 and STAYED THERE all last week, but the 6-mth MA Mkt Cap would still have exceeded $200B on Fri, Sep 04 (thus triggering the 3rd tranche).

Cheers!

bhtooefr

Active Member

Do we know the size of the car? Is it a model S in size or model 3?

Looks like it's similar length to a Model S or to mid-size luxury sedans, but the interior renders show quite a bit more rear seat room - like levels comparable to long-wheelbase full-size luxury sedans (where the Model S is more comparable to mid-size luxury sedans.)

Last edited:

anthonyj

Stonks

Just ordered a Model X Performance in the hopes that it magically turns into a Plaid version on 9/22 for the same price

Oh I'm not worried about Lucid at all. Knowing how hard it was for Tesla to finally hit profitability, Lucid have a long road ahead and they may have to pour some $$ into advertisement. It's not like Elon will send lucid up into space during star ship test flight.Closer to S size I believe.

However, note this is EPA est, which is probably Lucid's estimate of what the EPA rating will be. I'd take it with a grain of salt until the actual EPA testing results are in.

I am worried about Lucid as much as Fisker. Sell a few thousand to people rich enough to not care about service or warranties. The rest of the public sticks to what works.

I give legacy a higher chance of succeeding than start ups knowing the true achilles heel is service (drags on profitability and demand) per Elon.

ByeByeJohnny

Active Member

That rule is for the S&P Equal Weight Indexes.

Can someone explain it fully since I still don't get how it's done inbetween the quarterly rebalancings?

I agree the wordings we've found about taking the deleted companies weight is only for some of the other indices. However it doesn't seem to say how it's done for the S&P500 instead either. This implies it's a full rebalancing because otherwise wouldn't the funds need a lot more money to buy Tsla than they would get from selling the deleted company? Where would that money come from? But if it's a full rebalancing anyway what's the difference to the regular quarterly rebalancings?

Knightshade

Well-Known Member

Could be there’re some bait balls (Bait ball - Wikipedia) of Robinhood and other retail, but I suspect they’ll be more resilient than the sissies inHermès tiesPatagonia vests.

FWIW (not much, anecdotes and all) some small investors who are investing $ they can't really afford to lose and using margin to get more got hit pretty hard with margin calls in the recent pullback and were forced to dump shares at a loss.

Certainly stupid of em to be in that position, but apparently some brokers are making it worse by increasing margin limits on the fly for TSLA too.

Just ordered a Model X Performance in the hopes that it magically turns into a Plaid version on 9/22 for the same price

My expectation is Plaid is its own, quite expensive, option (like Ludicrious used to be) bumping the top end S/X back up to 140k-145k range or so since clearly folks are willing to pay that and more for less capable offerings from Porsche (and presumably Lucid depending how much Plaid leapfrogs them).... and the 'regular' P will remain in its current price slot as a cheaper alternative for folks wanting most of the performance but not planning to track the car.

Lol even in car buying you speculate. You just can't help your gambling self.Just ordered a Model X Performance in the hopes that it magically turns into a Plaid version on 9/22 for the same price

Octovalve

It was reported that the frunk of the model 3 was recently updated to possibly allow the addition of the Octovalve. Sandy Munro also noted the Octovalve has gone through several iterations their year. The latest appeared to be significant. This was the biggest factor in Model Y nearly meeting 3 efficiency despite larger size.

I expect battery day to include Plaid S and X and to include the Octovalve for both cars. Between improved battery performance, the Octovalve could add 10-15% range by itself. 500 miles seems very likely for the S and 400+ for the X.

I think specific products are likely for Battery Day to make sure analysts and the market understand the implications of the announcements. Battery Day isn’t an endpoint, but the beginning of a new chapter that is likely to bring 50% density improvements over the next 5 years and at least 50% decline in costs per KWh.

Bottom line, I don’t think the changes measured for 3 and Y are weather related.

I think you may be conflating the Octovalve with the introduction of a heat pump in the Model Y. The latter is what will contribute to the greater efficiency in that purely resistive heating (which is power hungry) will no longer be the sole means of providing cabin heat.

The Octovalve is simply a packaging/cost-reduction optimization. While it is indeed part of that overall thermal management system, it doesn't really contribute to efficiency, but more so space/weight/part-count savings.

People made the same mistake with the introduction of the "Superbottle" on the Model 3... while clever in that it combined a number of previously separate components in to a single unit, it didn't actually introduce any new capability or efficiency... again it was design optimization...

In addition to Giga Texas might this be used to ramp up their own battery production?Lol, you've never worked as a Developer, have you? "Let's take all our key people, and piss away their time in meetings and training new guys..."

The only thing the FSD team needs is DOJO, and it was already fully funded.

This $5B Cap Raise pays for Giga Texas, IN FULL. Soon, Giga Texas will be producing $5B PER YEAR in gross profits! BRILLIANT OUTCOME!

Artful Dodger

"Neko no me"

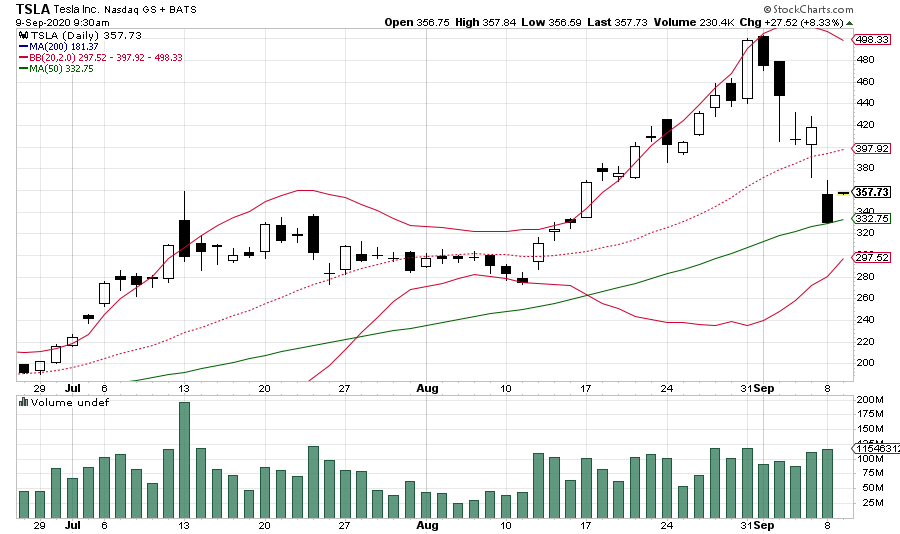

Here's this morning's 09:30 ET tech chart:

Krugerrand

Meow

Rob Maurer: "Even though Tesla is down 34% from its peak last Monday; it's still... and I think this is really important context to remember, is up 13.5 % from a month ago today, 284% year to date, and 612% from one year ago."

Glass half full/bright side is always a positive way to go through life. Every once in a while, though, I want a full glass of whiskey, not two fingers worth. Ya know?

TheTalkingMule

Distributed Energy Enthusiast

- Range only 161mi

- Consumption 23Kwh per 100km versus the promoted 16 KwH per 100Km (Model 3 has 14)

I'm Tesla fanboy as well - but to be fair - they drove 2 cycles, one eco-oriented with <17kwh/100km and one aggressive (german style) with 23kwh/100km.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K