Fusion energy is known in the literatureIt is a pity that this video is only in German and that there are no sub titles in English. It was really interesting.

First he talks about Model S Plaid. They have the experience that the claims for acceleration of Tesla does not hold true when they measure them. Most of it is because of different methods of measuring between USA and Europe. (rolling acceleration versus stand still)

The journalist then goes through the slides of the why. He came to the conclusion that Tesla had a big advantage in price per kW/h a few years back but that other manufacturers almost caught up. It is not that the price of batteries did not go down fast enough; it is that the price of Tesla’s batteries did nog go down enough.

Then journalist goes through every aspect what Tesla claims during Battery Day and look if it is really revolutionary what Tesla is doing. He methodically explains what everything means and what the advantages are. The conclusion is that every aspect is already known in the literature so, no, it is not revolutionary. However, he does think it all is very clever what they are doing. What is revolutionary is that they are doing it all together and that they are open about it. The vertical integration is also a big advantage.

Then he goes on about the $25K Tesla which was announced. Considering the experience with Model 3 he thinks that the European price will be closer to 30K Euro’s. In that price range there are other models announced from Skoda and VW ID3. So that is not really revolutionary either.

At the end he asks if it was fair that the stock market reacted the way it did. Well, he would not have bought more just because of battery day but would not have sold either. Then again he doesn’t hold any Tesla share or any other car manufacturer shares as he thinks it is unethical for car journalist to hold these kind of shares.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tslynk67

Well-Known Member

That's assuming one buys and holds. Very few people on this board have the discipline and serenity to do nothing. Most here are gamblers.

You can do both and many of us do.

Tslynk67

Well-Known Member

congrats!!! Beautiful car!

now pls go do a drone shoot around Fremont and kato, thanks!

Maybe there's an open window, or vent, get some internal footage?

Very positive outlook for Tesla by German battery expert:

Tesla can fall short of its battery goals and still dominate rivals, says expert | TESLARATI

Original German source Spiegel Mobility that the Teslarati article is based on:

Google Translate

Tesla can fall short of its battery goals and still dominate rivals, says expert | TESLARATI

Original German source Spiegel Mobility that the Teslarati article is based on:

Google Translate

UkNorthampton

TSLA - 12+ startups in 1

Wow that should raise alot of questions-- they just spent a whole presentation saying they have reduced the size and footprint of upcoming battery factories. Does this mean they are actually going to make alot(!!) of batteries or maybe as the market thinks, they are going to make more Costcos so they can just go local and get the batteries.

They surveyed the land and liked the lithium content of the clay, the silicon rich sand and adjacent salt deposit. They'll be doing research, loads of cells, materials processing - oh and they might need an airport for SEVTOL - Supersonic Electric Vertical Take Off and landing.

It's interesting that most of the electric plane research projects are low altitude light planes, when it might be better for an electric (or hybrid) plane to be optimised for high-latitude, thin air, less drag flight. You need lots of power for take-offs, aborted landings, otherwise you want efficient cruise. Optionally at a high speed if you want supersonic, less important if replacing Boeing's MBA-optimised failures.

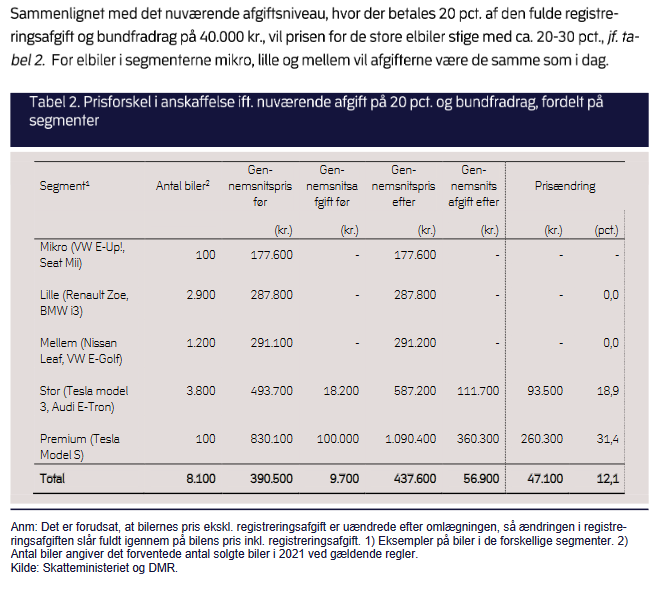

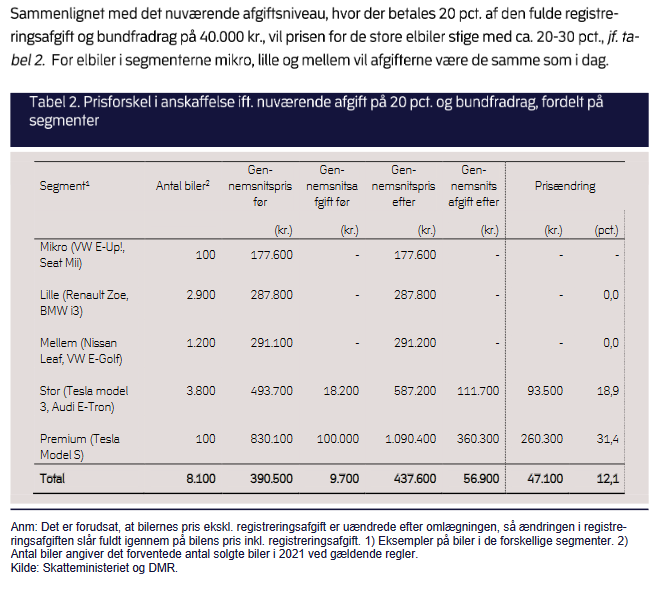

The danish government is proposing to reach 500.000 BEV's on the road by 2030.

To accomplish this they are proposing new incentives.

Sadly the incentives have been thought up by the equivalent of the gnomes from south park (1. steal underpants 2. ???? 3. profit), so they are raising prices on all BEV's over 400.000 DKK (62k$) from January 1st 2021.

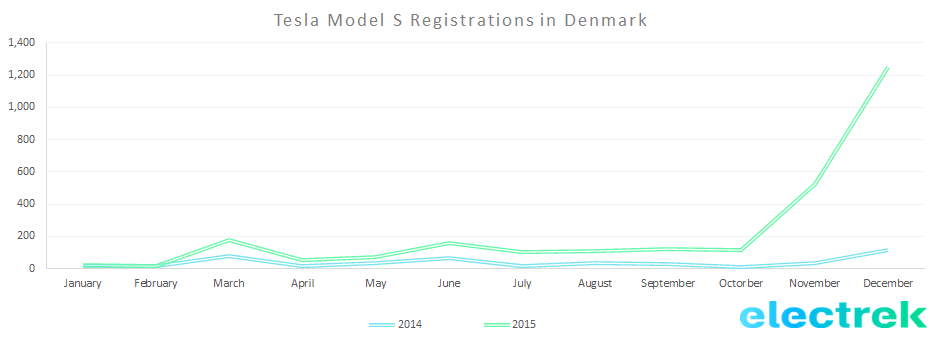

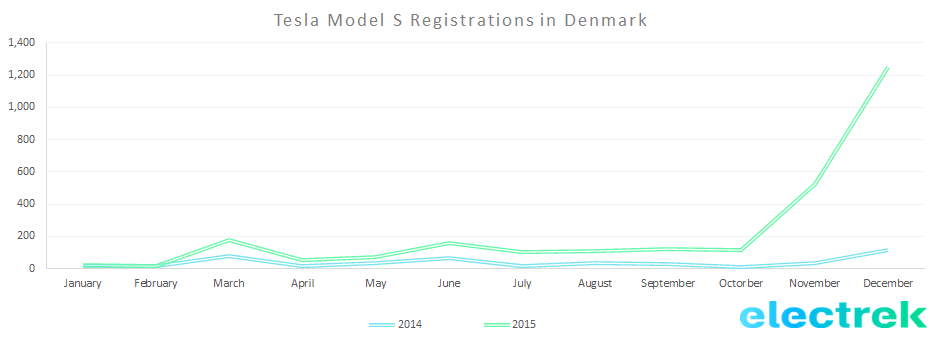

Last time something like this was proposed was in 2015 where Tesla Model S went from 0% tax in 2015 to 150% tax january 1st 2016.

As everyone but the gnomes could have foreseen, this happened:

source: Denmark's best-selling car in December was for the first time an electric car: the Tesla Model S - Electrek

Most likely we will see a rush of buying Model S/X and higher priced Model 3's in december 2020 as history repeats.

To accomplish this they are proposing new incentives.

Sadly the incentives have been thought up by the equivalent of the gnomes from south park (1. steal underpants 2. ???? 3. profit), so they are raising prices on all BEV's over 400.000 DKK (62k$) from January 1st 2021.

Last time something like this was proposed was in 2015 where Tesla Model S went from 0% tax in 2015 to 150% tax january 1st 2016.

As everyone but the gnomes could have foreseen, this happened:

source: Denmark's best-selling car in December was for the first time an electric car: the Tesla Model S - Electrek

Most likely we will see a rush of buying Model S/X and higher priced Model 3's in december 2020 as history repeats.

UkNorthampton

TSLA - 12+ startups in 1

People think that Elon was just playing when he said he will move Tesla out of CA. Fremont will be shut down on phases and hopefully for CA, another TeraFactory will be built there. Or maybe not.

Edit: that would explain Gavin’s bs about Ford also!

Watch where Model S Plaid gets made and how. Mega castings, cells integrated - Texas.

I'm not bothered where they are made, as long as they ARE made.

My respect and thanks to California for being an incubator for EVs and Tesla and also for better US vehicle standards.

You should apologize to the gnomes for that. There's no way they can be compared to either the that is Danish car tax regulations or the politicians responsible for it.The danish government is proposing to reach 500.000 BEV's on the road by 2030.

To accomplish this they are proposing new incentives.

Sadly the incentives have been thought up by the equivalent of the gnomes from south park (1. steal underpants 2. ???? 3. profit), so they are raising prices on all BEV's over 400.000 DKK (62k$) from January 1st 2021.

[SNIP]

Most likely we will see a rush of buying Model S/X and higher priced Model 3's in december 2020 as history repeats.

I had high hopes that Tesla Model 2 might be mine one day, but by the time they start selling it, the registrations will very likely be back at 120% (yes 120%, no comma). I'm not poor, but a $55.000 car is too much for me.

Maybe in 10 years when we start see them on the used market. Unless ofc Tesla makes them so well that they won't actually be sold used, what with the new battery and all

UkNorthampton

TSLA - 12+ startups in 1

Thanks for sharing, will watch it in full this weekend. I'm guessing some here might not appreciate their cautious tone but as far as I can tell they are serious analysts trying to unpack everything in a methodical and dispassionate way. They spent some time on two big things that I've been mulling since BD: 1) silicon anode (any graphite? cycle life implications? check out TLF w/ Prof. Shirley Meng for background on anodes) and 2) raw materials (nickel in particular, which Elon has mentioned several times). The video gives a back of the envelope estimate on a lower bound for TSLA nickel demand and global supply estimates in 2030. The cathode topic is also extensively discussed and there is a lot of complexity there that I had not appreciated.

Anyway, a lot of helpful info towards tracking TSLA progress w/ their new master plan for the next decade, couldn't be more excited to see how the puzzle eventually fits together.

The way the metallic silicon is held in a conductive plastic binder reminds me of something.

First I have to check an assumption. In a normal cell, if lumps of silicon get broken up by continual expansion due to lithium ion inclusion - presumably the silicon falls away and are not useful anymore. However, if the expansion and contraction of the silicon in the new cells grinds up the silicon into dust - does it still work because it's still in the binder? Does the binder help prevent the silicon from breaking by applying a compressive force? Does the binder have a degree of flow to encase any broken silicon?

Anyway - the thing that prompted my thoughts - Plastic Armour - Plastic armour - Wikipedia

Last edited:

After watching a bunch of follow up videos on battery day and having a bit more time to think about the updates - doesn't the tabless electrode now seem so obvious that all previous batteries sound stupid. There is just so much to be gained from amending a relatively simple manufacturing technique rather than all the time, experimentation, supply chain consequences, etc. required to muck about with cell chemistry changes.

The whole purpose of a battery is to shift electrons from one electrode to another in a process that creates heat as a side product - and up until now every battery maker has decided to hinder this process by forcing all the electrons to go through a tiny funnel and then travel a long distance through the electrode - constricting electron flow and heat removal while increasing heat generation.

The implementation, which is very clever, surely should have been figured out by the traditional battery makers previously. Ultimately it is just a relatively minor change to the way the electrode backing is cut and rolled. Instead of making this change people have poured billions into expensive and inefficient thermal management systems to try and solve the heat issue.

It's got to be the brilliant people and culture at Tesla that allowed them to figure out a game changing tech like this when it should have been staring all the professional battery makers in the face.

The whole purpose of a battery is to shift electrons from one electrode to another in a process that creates heat as a side product - and up until now every battery maker has decided to hinder this process by forcing all the electrons to go through a tiny funnel and then travel a long distance through the electrode - constricting electron flow and heat removal while increasing heat generation.

The implementation, which is very clever, surely should have been figured out by the traditional battery makers previously. Ultimately it is just a relatively minor change to the way the electrode backing is cut and rolled. Instead of making this change people have poured billions into expensive and inefficient thermal management systems to try and solve the heat issue.

It's got to be the brilliant people and culture at Tesla that allowed them to figure out a game changing tech like this when it should have been staring all the professional battery makers in the face.

UkNorthampton

TSLA - 12+ startups in 1

After watching a bunch of follow up videos on battery day and having a bit more time to think about the updates - doesn't the tabless electrode now seem so obvious that all previous batteries sound stupid. There is just so much to be gained from amending a relatively simple manufacturing technique rather than all the time, experimentation, supply chain consequences, etc. required to muck about with cell chemistry changes.

The whole purpose of a battery is to shift electrons from one electrode to another in a process that creates heat as a side product - and up until now every battery maker has decided to hinder this process by forcing all the electrons to go through a tiny funnel and then travel a long distance through the electrode - constricting electron flow and heat removal while increasing heat generation.

The implementation, which is very clever, surely should have been figured out by the traditional battery makers previously. Ultimately it is just a relatively minor change to the way the electrode backing is cut and rolled. Instead of making this change people have poured billions into expensive and inefficient thermal management systems to try and solve the heat issue.

It's got to be the brilliant people and culture at Tesla that allowed them to figure out a game changing tech like this when it should have been staring all the professional battery makers in the face.

There were comments on the Autoline (Sp?) video by Bob that it wasn't new. I've seen some others as well but I forget where.

The difficulty is in engineering/manufacturing engineering and one very important aspect... Cell makers aren't thinking about thermal in the same way as EV car makers. A holistic/systems approach really is useful in joining the dots and balancing/building on incremental improvements to make the whole MUCH better..

Now with cells not heating up very quickly - does that lead to a cold-gate slow charging problem?

Probably not as long as you have cells that can accept faster charge rates, heat can be scavenged from motor/regen and your car has a heat pump which works at that temperature (extreme cold might be a problem, so add in a resistive heater to start things off).

It does however show that you have to think about all aspects together.

MC3OZ

Active Member

The silicon anode and lithium extraction from clay are the two innovations from BD that I find most surprising.

I'm not surprised Tesla was working on either of these areas, just surprised how good the solutions are.

More generally on 4680, with tab-less electrodes this seems to be the ideal size and DBE might not be needed.

So it is possible Tesla could keep DBE and their manufacturing process proprietary, but licence tab-less and sell equipment to make tab-less 4680.

So eventually Panasonic might convert all 2170 production at GF Nevada to 4680. Having 4680 as a widely available common cell format makes it very easy for Tesla to standise on 4680. So a few possabilities here, sometimes it may be possible to accelerate the mission and retain a competitive advantage.

I'm not surprised Tesla was working on either of these areas, just surprised how good the solutions are.

More generally on 4680, with tab-less electrodes this seems to be the ideal size and DBE might not be needed.

So it is possible Tesla could keep DBE and their manufacturing process proprietary, but licence tab-less and sell equipment to make tab-less 4680.

So eventually Panasonic might convert all 2170 production at GF Nevada to 4680. Having 4680 as a widely available common cell format makes it very easy for Tesla to standise on 4680. So a few possabilities here, sometimes it may be possible to accelerate the mission and retain a competitive advantage.

After watching a bunch of follow up videos on battery day and having a bit more time to think about the updates - doesn't the tabless electrode now seem so obvious that all previous batteries sound stupid.

The cells Tesla has been using have originally been developed for consumer electronics. Have never heard of a notebook being limited by current output of the battery, CPU heat is the limiting factor here IMHO.

tinyrodent

Member

Shanghai factory flyover. Construction and cleanup continues, but manufacturing still appears to be idle. There are very few Model 3 visible on site. Solar panels have been installed in at least three different areas of the new building rooftops, but not at large scale.

tinyrodent

Member

Tesla Battery Day Slides 2020/09/22Has somebody made slides of the battery day event? I cannot find it online. I am doing tons of research and going back to the video all the time definitely isn't efficient.

Thanks.

A curious thing about exponential growth is that you must start at some positive value. I'm aware that other vendors are supplying the first 100GWh of cells. Starting at 200 makes the ramp a little more gentle than starting at 100. Specifically, growing from 100 to 3000 in 8 years implies 53% annual growth rate, rather than 40% starting with 200. To see how this makes a difference in steepness, consider where the two geometric curves are in 2026 (mid point between 2022 and 2030). Starting at 100 gets to 548 in 2026, while starting at 200 gets to 775 at the mid-point. So I'm drawing the curve forward a bit.

Eventually contracts with suppliers will expire. So in the longer term, the initial 100 GWh cell supply is not so critical. I believe it will ultimately be replaced by more advanced cells. But numerically 100 out of 3000 is just not terribly important. So I think the 40% growth rate in combined production (internal + external) is better aligned with the growth of automotive and stationary products.

Translating this growth rate into an ROA needed for self-funding makes 40% much more doable than 53%. That is I think Tesla could indeed grow at 53% or higher, but it would obviously need more external capital than what 40% growth would require.

Someone should check the feasibility of 40% ROA on gigafactories. I backed into it as a requirement for self-funded growth at 40%, but that does not make it realistic. There is a way of expressing this hurdle as a cost of capital to apply to other costs of batteries. I'll play with this when I have a clear head.

The problem is that you are mixing two very different things in your starting number and ending number..

Here is what you’re doing:

2022 Production——2030 Production——Growth rate

-————————- ———————-———————-

Tesla + Suppliers— Tesla alone——————40%

Instead, either of the below is valid

2022 Production——2030 Production—-Growth rate

-————————————————-——————

Tesla alone—————Tesla alone—————56%

Tesla + Suppliers——-Tesla + Suppliers——??

Last edited:

tinyrodent

Member

Berlin factory flyover. Foundation pour has begun in the stamping area, where all the piles were driven; there is detail footage at the end of the video.

mars_or_bust

Member

https://twitter.com/elonmusk/status/1309678444020527104?s=21

Sandy might get his wish!

edit : not : https://twitter.com/elonmusk/status/1309657470973825025?s=21

A pity, and maybe a mistake, in my opinion. Arcimoto seems to have an ideal car for a niche market - with this nieche market being huge in countries like India.

2

22522

Guest

Texas is going to have a hard time passing these guys!Berlin factory flyover. Foundation pour has begun in the stamping area, where all the piles were driven; there is detail footage at the end of the video.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K