So we agree the overnight drop is from Corona?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Adding TSLA to the S&P 500 will cause a dramatic contraction of the effective 'float' since Index funds don't need to trade daily to track the index (just after qtrly 'rebalancing' announcements).

My take on this situation is that the S&P Committee has been unduly infulenced by large MMs and Hedge Funds who are currently benefitting from TSLA volutility, and wish to extend their run of outsized profits as long as possible.

Ironically, it is this Hedgy "Purple Patch" that is causing the S&P Committee to ignore their own published guidelines. Instead, they've substituted their own 'judgement' to keep TSLA out, and come up with hollow-sounding PR statements as post-hoc justification.

I could go on. I likely will. Stay tuned.

Cheers!

P.S.

It's significant to remember that, back in January before Co-vid shook up 2020, the talking heads on CNBC were saying that TSLA would be added to the S&P 500 at the end of the year. This is insider information revealed casually as if it was common knowledge. My take is that the S&P Committee decided what they would do at least a year ago, and 'events-be-damned' their plan is more important than mere 'events'.

According to Luvb2b, SP500 inclusion should increase (not decrease) volatility. If I remember correctly, it was because the float is smaller and therefore the same size transactions have a greater effect on the price.

There is one difference: back in 2005, over 50% of all Options trading done on the NASDAQ wasn't placing bets for or against AMZN.

Adding TSLA to the S&P 500 will cause a dramatic contraction of the effective 'float' since Index funds don't need to trade daily to track the index (just after qtrly 'rebalancing' announcements).

My take on this situation is that the S&P Committee has been unduly infulenced by large MMs and Hedge Funds who are currently benefitting from TSLA volutility, and wish to extend their run of outsized profits as long as possible.

Todd Burch

14-Year Member

So we agree the overnight drop is from Corona?

I don't necessarily. We already knew cases were increasing both in the US and Europe yesterday when the price was up 3.3%. I think we should be careful about reading too much into low-volume price changes.

I think it's more likely due to failing stimulus talks. NASDAQ futures started dropping in the early morning hours.

But still, even with the "terrifying" drop the current price is higher than we opened at yesterday. Plus there was another upgrade today...so who knows where the price will end up?

Tslynk67

Well-Known Member

So we agree the overnight drop is from Corona?

It's stimulus and C19 fear, yes - across the board, with the MM's taking advantage to push $TSLA back below $450 again...

Still, better to be 2-3% down from $461 than 2-3% down from $446, no?

Seems we dropped back to where we were, yesterday morning

HG Wells

Martian Embassy

So we agree the overnight drop is from Corona?

Yes, that's what drinking two six packs will do to yah.

humbaba

sleeping until $7000

Traditional automakers raise and lower "Cash Back" offers. At least in the US

In dealer parlance "Cash on the Hood." OEMs can and do change incentives within 12 hrs.

I thought media doesn't affect Tesla sales.

How can lowering prices increase sales if "Tesla sells every car they can make."

Curious they are not making similar price cuts on Model X.

I'm curious how you square "Tesla is demand constrained" with their projected battery deficit requiring significant investment in battery production in order to meet their battery needs.

Tslynk67

Well-Known Member

Target Px increased to 333 USD by Morgan Stanley

It's only Moron Stanley's price upgrades that cause $TSLA to drop...

Edit: previous PT was $272, so this is a ~23% hike, which is pretty substantial

Last edited:

ZachF

Active Member

Ark Invest is now researching a new and completely different field: YouTube comedy sketches! This is brilliant!

Cathy is so awesome...

Artful Dodger

"Neko no me"

According to Luvb2b, SP500 inclusion should increase (not decrease) volatility. If I remember correctly, it was because the float is smaller and therefore the same size transactions have a greater effect on the price.

That's a dubious

Further, the 'more volatile after addition' thesis flies in the face of past experience with the growth of other large tech companies like Apple and Amazon. They were attacked while in their growth phases because MMs/Hedgies considered them vulnerable. Now, not so much.

Same will hold true for Tesla. Market can't screw with the company's fate anymore, just the SP. That will fade as more BILLIONS flood in to purchase TSLA from passive Index Funds.

Last edited:

Jack6591

Active Member

Should Joe Biden be elected as the 46th President of the United States, will the 4th of November be a major catalyst for TSLA?

Who will become the Secretary of Energy?

Who will become the Secretary of Energy?

Artful Dodger

"Neko no me"

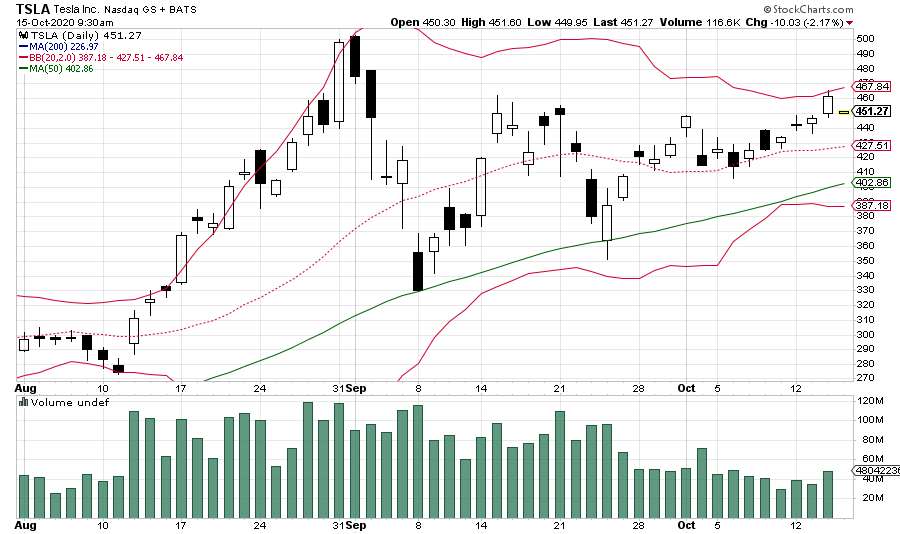

Here's today's Tech chart from 09:30 EDT:

Cheers!

Cheers!

Tslynk67

Well-Known Member

Should Joe Biden be elected as the 46th President of the United States, will the 4th of November be a major catalyst for TSLA?

Who will become the Secretary of Energy?

You're assuming there'll be a result on the 4th already. I hope for clarity and stability there is.

Whatever the result, I pine for normal, boring politics, like to good old days...

Looks like someone started buying in the last two minutes...

Don TLR

Active Member

How can it be a competitor when it’s not out for years, and sure go buy one for something other than a commuter car, where are you going to charge it? The supercharger network is a huge selling point worth thousands that the competition will have to undercut their prices to compete with that, at that point you know they’re losing money.It does mean Elon sees Lucid as a competitor.

It seems personal with Peter Rawlinson.

I guess we will see price cuts to Model X when Lucid Gravity is close to production.

Tesla China's base Model Y to start at $41K and see an output of 360K/year: report

Tesla MIC base Model Y price to be cut to ¥ 275K as the co will keep price difference with M3 at ca 10% as to get more data needed for building Tesla ecosystem, Tianfeng Securities estimates. MIC MY might boost >¥ 250K SUV sales as it might sell 30K units/month, Tianfeng added. (41k)

Tesla MIC base Model Y price to be cut to ¥ 275K as the co will keep price difference with M3 at ca 10% as to get more data needed for building Tesla ecosystem, Tianfeng Securities estimates. MIC MY might boost >¥ 250K SUV sales as it might sell 30K units/month, Tianfeng added. (41k)

Todd Burch

14-Year Member

My theory on Lucid:

Lucid is full of people who left Tesla. I think Musk resents that those people abandoned Tesla and went to create a competitor. Lucid also has some of the "barnacles" that were scraped off of Tesla's back, were laid off, and got hired by Lucid.

Although in general Musk wants EV competition, I think Musk wants Lucid specifically to fail because of these reasons. Just a theory though, but the tweet from a few weeks back made it seem that Elon had a chip on his shoulder for Rawlinson because he left Tesla at a critical time.

Lucid is full of people who left Tesla. I think Musk resents that those people abandoned Tesla and went to create a competitor. Lucid also has some of the "barnacles" that were scraped off of Tesla's back, were laid off, and got hired by Lucid.

Although in general Musk wants EV competition, I think Musk wants Lucid specifically to fail because of these reasons. Just a theory though, but the tweet from a few weeks back made it seem that Elon had a chip on his shoulder for Rawlinson because he left Tesla at a critical time.

Tslynk67

Well-Known Member

That big effort to push below $450 was intended to trigger stop-losses, I guess. Seems there weren't many set

Tslynk67

Well-Known Member

My theory on Lucid:

Lucid is full of people who left Tesla. I think Musk resents that those people abandoned Tesla and went to create a competitor. Lucid also has some of the "barnacles" that were scraped off of Tesla's back, were laid off, and got hired by Lucid.

Although in general Musk wants EV competition, I think Musk wants Lucid specifically to fail because of these reasons. Just a theory though, but the tweet from a few weeks back made it seem that Elon had a chip on his shoulder for Rawlinson because he left Tesla at a critical time.

I hope this isn't the case, because it would be rather petty and immature. I'd rather see Elon encourage these start-ups, not kill them.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K