And I'm pretty sure they had more panel gaps than Tesla is being accused of having.During WW II the US built the 442 foot long,14 ton Liberty (cargo)Ships at the average of three ships every two days!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

You are the reason we can't discuss politics here. You color your question with divisiveness. That builds as each side argues and we are no longer talking about TSLA at all and it turns into a sugar show. Mods feel free to delete this and related posts.Deleted post

Last edited by a moderator:

Sudre

Active Member

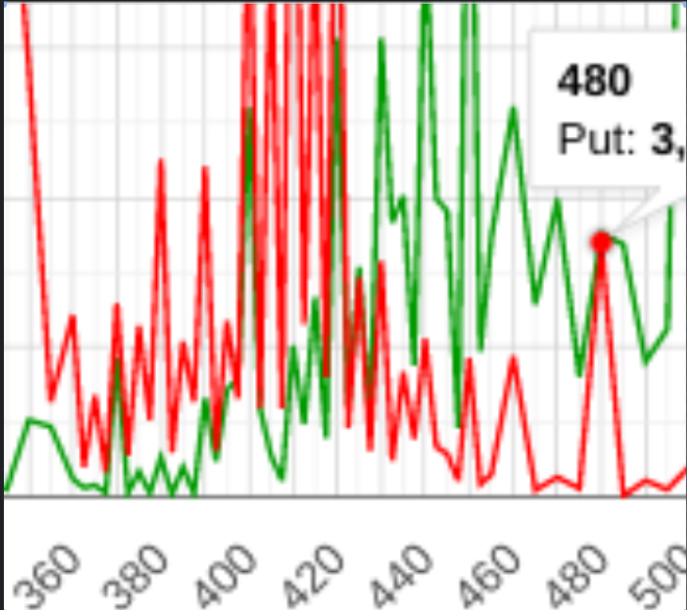

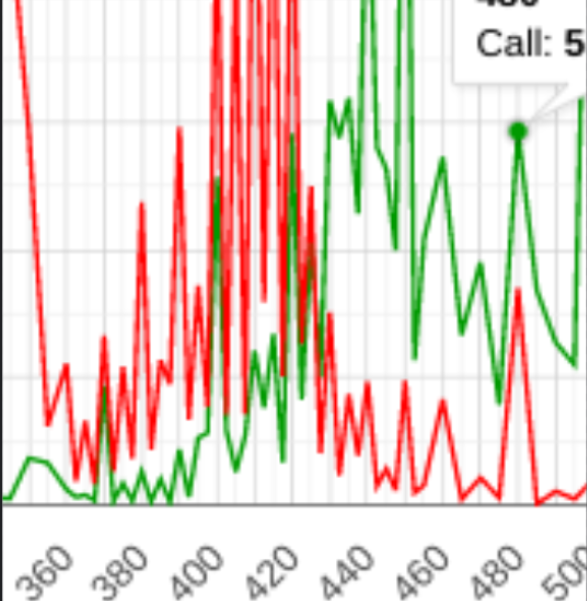

Looks like CALLs were the hot commodity yesterday. Look at those $480 strikes I have had my mouse hanging over in each screen grab. Funny how I knew they would end the PUT bulge with a large sell of CALLs at that price. The MMs already have those shares so they are going to sell the strike in both directions and profit on the fees and premiums.

Tuesdays which you should recognize from yesterdays post....

Today OI which remember shows the work of yesterdays trading.

CALLs gone wild day yesterday. Everyone must have been feeling bullish... boy that mood changed this morning for everyone with a few articles mentioning revenue guidance of assorted choice picked companies. It seems too contrived. I never understood the drop when an article mentions a few companies forecasting lower revenue forecasts because all companies drop, even those that are showing, forecasting, and proven revenue growth. It always sounds like a setup so the funds can buy more shares at lower prices.... back to TSLA option moves...

Note the $420 increase in CALL activity. I bet they are selling lots of those this morning. This is where I keep saying max pain changes daily. While I mentioned $425 the other day, I bet they move it under $420 after today. This market drop is too perfect. They will probably be able to round out those lower end PUTs too. This is THEIR buying opportunity to get cheap shares to cover the $420 CALLs (and others) they plan on being in the money this Friday. Not that I will say it will surely be above that because Macros are in the pooper and Macros trump all. I think Friday is expected to have a higher SP... we shall see.

Those are my guesses for the day. Don't trade on anything mentioned here.

Tuesdays which you should recognize from yesterdays post....

Today OI which remember shows the work of yesterdays trading.

CALLs gone wild day yesterday. Everyone must have been feeling bullish... boy that mood changed this morning for everyone with a few articles mentioning revenue guidance of assorted choice picked companies. It seems too contrived. I never understood the drop when an article mentions a few companies forecasting lower revenue forecasts because all companies drop, even those that are showing, forecasting, and proven revenue growth. It always sounds like a setup so the funds can buy more shares at lower prices.... back to TSLA option moves...

Note the $420 increase in CALL activity. I bet they are selling lots of those this morning. This is where I keep saying max pain changes daily. While I mentioned $425 the other day, I bet they move it under $420 after today. This market drop is too perfect. They will probably be able to round out those lower end PUTs too. This is THEIR buying opportunity to get cheap shares to cover the $420 CALLs (and others) they plan on being in the money this Friday. Not that I will say it will surely be above that because Macros are in the pooper and Macros trump all. I think Friday is expected to have a higher SP... we shall see.

Those are my guesses for the day. Don't trade on anything mentioned here.

The issue, as I understand it, is that the messages are autogenerated rather than Mod generated, and the Mods have little control over what the message is. So it's the underlying system that needs help.

Can't say for sure, but I can choose whether culprit is informed of reason for action and I always exercise informing. Seems only fair and prudent. There are auto options that can be selected. As a really half-assed mod I have the time to enter personal touch. The real deals, the others, don't because they are diligent and do the heavy lifting.

And incidentally the average discharge rate in the cars is somewhere around 0.2C, depending on vehicle.Those timings only work if you assume a discharge rate of 1C.

It would likely be different for planes, but it would not surprise me to see the design call for an average discharge rate of <1.0C

JRP3

Hyperactive Member

It's not bad for the market.isn't it about raising taxes which is bad for the market?

Throughout 1980s, President Reagan took the top marginal tax rate down from 70% to 28%. The average growth rate between 1979 and 1989 was a sturdy 3.05 percent. In the early 1990s, Presidents Bush and Clinton raised the top marginal rate from 28% to nearly 40%. The average growth rate between 1989 and 1999: a slightly higher 3.23 percent.

Going back three decades, the five years of greatest GDP growth -- 1983-1984, and 1997-1999 -- occurred in years where the top marginal rate was 50% and 39.6%, respectively. Today it is 35%.

History Does Not Show That Higher Taxes Hurt the Economy

If we call them Blue Guy and Red Guy it's less political lol.

It works only in Intel and AMD forums.

llirk

Member

Thank you for your continued analysis around option action during these volatile times as it helps us make more informed decisions. It's also refreshing to read TSLA investment related information which has saved me from vehemently agreeing or disagreeing with all the recent political posts!Looks like CALLs were the hot commodity yesterday. Look at those $480 strikes I have had my mouse hanging over in each screen grab. Funny how I knew they would end the PUT bulge with a large sell of CALLs at that price. The MMs already have those shares so they are going to sell the strike in both directions and profit on the fees and premiums.

Tuesdays which you should recognize from yesterdays post....

View attachment 603139

Today OI which remember shows the work of yesterdays trading.

View attachment 603140

CALLs gone wild day yesterday. Everyone must have been feeling bullish... boy that mood changed this morning for everyone with a few articles mentioning revenue guidance of assorted choice picked companies. It seems too contrived. I never understood the drop when an article mentions a few companies forecasting lower revenue forecasts because all companies drop, even those that are showing, forecasting, and proven revenue growth. It always sounds like a setup so the funds can buy more shares at lower prices.... back to TSLA option moves...

Note the $420 increase in CALL activity. I bet they are selling lots of those this morning. This is where I keep saying max pain changes daily. While I mentioned $425 the other day, I bet they move it under $420 after today. This market drop is too perfect. They will probably be able to round out those lower end PUTs too. This is THEIR buying opportunity to get cheap shares to cover the $420 CALLs (and others) they plan on being in the money this Friday. Not that I will say it will surely be above that because Macros are in the pooper and Macros trump all. I think Friday is expected to have a higher SP... we shall see.

Those are my guesses for the day. Don't trade on anything mentioned here.

History smistory....My side is right!

j6Lpi429@3j

Closed

I dont care what the stock does for once because I have CAKE.

bkp_duke

Well-Known Member

Why don't we go with something that is viewed as more "middle of the road":

How do taxes affect the economy in the long run?

I can say, for FACT, that I hired more employees due to tax cuts in the past 4 years. These were NOT planned hires that would have happened anyway.

If taxes are raised, I fully expect to furlough those same employees.

There is a limited pool of funds for wages, lower taxes expands that pool, for my business. Higher taxes, shrinks it.

Electroman

Well-Known Member

I thought this was very well thought out and written, and so don't understand all the disagrees. Covid is going full blast and the hopes of full reopening this year or even early next year is fading. Once the market fully understands that, it will give back 15 to 20% or more by end of Q1 next year.NOT INVESTMENT ADVICE I'm not licensed to give you that! (Only licensed in CA, US for real estate #01069533 since 1990).

My prediction is this huge Covid-19 Winter Wave infecting the USA and Europe will take the Market down just as the previous surprise wave did in March 2020 by a similar percentage. This time, it will be a more drawn out decline instead of a rapid panic plunge.

There will be a "Blue Bounce" after Biden / Harris are elected but the results will be delayed. Swing state polls are tightening. Many people secretly vote for Trump while telling pollsters they will vote for Joe just like what happened to Hillary. There will be civil unrest in parts of the USA over the results - especially if Trump pulls off another November surprise while losing the popular vote - amplified by media coverage of it which will negatively affect the markets, too.

The market will recover and hit new highs in late Spring to early Summer of 2021 as Covid-19 case rates decline. The only good Covid-19 news this time is the death rate percentage is down significantly as the virus is spreading at a much higher rate among younger populations. Us "seniors" (detest that label my +3 STD. DEV. IQ has not decreased and my energy has not slowed, either!) have mostly learned by now how to avoid infection.

I would not be a $TSLA buyer right now because I think the price is going lower into the $300's before recovering and hitting new all-time highs in 2021 over $600. All of this massive economic disruption weakens Tesla's competition further which is great for us. $TSLA is still the best place to be. Due to CAGR, I think it is clearly the large-cap stock with the highest probability of eclipsing Apple to become the market cap leader of the last half of the 2020s. Applying $TSLA's anticipated average CAGR through 2030 to the SP makes that obvious.

$TSLA will get added to the S&P 500 Index as early as the December 2020 rebalancing but no later than March 2021. It will cause the predicted spike in the shares due to supply and demand factors. When it happens, the price will reach $500+ again but the panic buying will cause an overshoot so the peak level will not hold as we've seen every time there was panic buying such as after the 5-1 split was announced.

In my case, I'm extremely fortunate to be able to take my family to Taipei, Taiwan until we have to bring our son back whenever UCLA reopens their campus. The earliest is late March 2020. I expect they will decide to keep Zooming so we won't return to California until September 2021. The silver lining for us is we'll be able to visit all the countries in the Asian region that are relatively Covid-safe. I hope to arrange a tour of GigaShanghai through my Shenzhen friend (last name Xi with a VIP rich Uncle ;-). She attends private Rolls Royce parties, flies in private jets, owns three homes in the US, numerous businesses, and investments including a hotel in Shanghai and a winery in France since she enjoys red wines.

View attachment 603126

JRP3

Hyperactive Member

History doesn't correlate higher taxes with a worse economy. If it did I'm sure you'd accept that dataWhy don't we go with something that is viewed as more "middle of the road":

How do taxes affect the economy in the long run?

I can say, for FACT, that I hired more employees due to tax cuts in the past 4 years. These were NOT planned hires that would have happened anyway.

If taxes are raised, I fully expect to furlough those same employees.

There is a limited pool of funds for wages, lower taxes expands that pool, for my business. Higher taxes, shrinks it.

dc_h

Active Member

GDP numbers tomorrow, which will probably show a big QOQ increase - will be interesting to see how the market reacts to the news.

The market is far more interested in forward looking data. TSLA down today is matching the market, which might be a bummer for covered call sellers, since our volatility continues to decline. Good news for leaps buyers, since volatility is down and the odds of TSLA rising over 2 years is pretty solid. The odds of Tesla having a great quarter are pretty solid as well, but there are huge macro issues concerning Covid, election stability and future pandemic relief could be delayed until 2021. The Bush admin partnered with incoming Obama admin to push forward recession relief. It may not have been the best thought out, but it was like Starlink, better than nothing beta. If Trump loses, I don't see lame duck congress or admin helping push forward relief. If Trump wins, relief would likely be smaller than Dems want and more targeted to big business, like coal miners, frackers, airlines, and cruise lines.

I wish I had more dry powder to buy, but I think I'd wait to see what happens after the polls close. Long term, the fed will keep pumping and that will lead to asset inflation, even while productivity continues to drive down the price of good and services. Until the pumping stops, which the fed will signal months in advance, the market will continue to rise. *I'm not judging the process, but the fed sees few options outside of pushing the market to help maintain the economy. It would be interesting if they would expand their comfort zone and buy up credit card debt in a deal with the banks to reduce credit card rates. That would help sustain the economy more than propping up American Airlines or the fossil fuel industry. (sorry for OT at the end there).

bkp_duke

Well-Known Member

History doesn't correlate higher taxes with a worse economy. If it did I'm sure you'd accept that data

You are trying to attribute a single variable to a multivariable effect (economic growth).

I don't think you or I have economics degrees and are qualified to make that assertion.

What I can only speak to, as a small business owner, is that when my taxes go down, I re-invest the extra $$$ in my business to grow it, and that investment is in people, specifically, in terms of new hires.

FS_FRA

Member

If we call them Blue Guy and Red Guy it's less political lol.

Somehow reminds me of the wonderful children's book by David McKee:

bkp_duke

Well-Known Member

You are trying to attribute a single variable to a multivariable effect (economic growth).

I don't think you or I have economics degrees and are qualified to make that assertion.

What I can only speak to, as a small business owner, is that when my taxes go down, I re-invest the extra $$$ in my business to grow it, and that investment is in people, specifically, in terms of new hires.

@Pezpunk - why the disagree?

That last sentence should be viewed as a statement of fact. Literally, when you tax me, I work less, when you reduce my taxes, I work more.

My wife is self-employeed, and near the end of the year she literally closes up shop for a few weeks to a few months at a time to keep us from bumping up into a higher tax bracket. That's simply a statement of fact, we watch our income to mitigate tax effects. I know several other physicians that do the same thing, they don't want to work 80h weeks and then see > 50% of that income not go into their pockets (between state and fed taxes).

engle

Member

I thought this was very well thought out and written, and so don't understand all the disagrees. Covid is going full blast and the hopes of full reopening this year or even early next year is fading. Once the market fully understands that, it will give back 15 to 20% or more by end of Q1 next year.

Yes. for example, UCLA has world-renowned medical facilities in addition to their medical, nursing, and dental schools. They have already implemented weekly mandatory COVID-19 testing of ALL students who are still there (e.g. medical students who cannot dissect a cadaver over Zoom), faculty and staff. Even with all that detection capability, they announced a few days ago they will NOT reopen their campus Winter quarter (Late Jan through March 2021). LA County has by far the greatest Covid-19 problem in the State. UCLA's budgetary loss this year will be much greater than US Berkeley's ~$300M due to the fact that UCLA has far more empty student housing. Think about the economic loss to the surrounding Westwood commercial district of not having about 45,000 students on campus spending money? Most are in their parent's homes around the world and their only expense is the food for their home-cooked meals.

Long term, schools like UCLA (I joke it's UZLA now [Zoom]) will profit from Covid-19. My son reports that almost all of their courses are now delivered over Zoom. The instructors are evolving and improving Zoom versions of said courses each quarter. This means UCLA will be able to offer the same degree programs to students who are qualified but did not make the "cut" due to a lack of physical space on campus. They did not lower tuition when their classes went Zooming. They (and other top universities) will make a fortune if they do this after Covid-19 is over at the expense of lesser universities that students would have attended if they did not gain admittance to a most competitive one. This is one example of a Black Swan event accelerating disruption that was occurring at a slower rate as society rapidly evolves to cope with the Black Swan. Unfortunately, those who fail to evolve or adapt are left behind...

Deleted post...but following response is definitely permissible

Tesla, TSLA & the Investment World: the 2019-2020 Investors' Roundtable

Last edited by a moderator:

Artful Dodger

"Neko no me"

Let's see if the support ~414 holds.

If not, what's next? 406?

Nicely sussed. (406.50 is the intraday low)

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K