Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

Why EU Car Manufacturers Are Actually "Slow-Walking" 2020 EV Sales

“Good article (in German) explaining why EU car manufacturers are slow-walking EV sales: 2020 will be taken as baseline for a 37.5% CO2 reduction by 2030. They don’t want to over-deliver this year and face a tougher target. Watch the numbers soar in 2021!”

You know, that's a better reason why Tesla is shipping cars to Europe from Giga Shanghai than they just wanted the higher margins. Obviously, they could sell them in China (regardless of the screwball short-seller narrative that China demand must be drying up already) so I did wonder about that.

Tesla is selling as many as physically possible in Europe to help adjust the 2020 CO2 baseline lower!

Todd Burch

14-Year Member

Ford CEO: Mach-E is the first true competitor with Tesla — a Tesla is not a Mustang - Electrek

"The vehicle is a game changer. For me, the Mach-E is the first true competitor with Tesla. It’s got Detroit swagger. It’s a Mustang. Tesla is not a Mustang."

As much as I hate to say it, Ford's CEO does have a point. This car will appeal to people that cannot see themselves in a Tesla.

I'm fine with that, it advances the EV agenda.

Lol. Most “Mustang people” I know won’t buy an e-Mustang no matter how much you call it a Mustang.

I don’t think they’re taking the right marketing approach.

Unfortunately, removing oil subsides will pop the cost of gasoline - a “third rail” of politics.We're moving into a phase where the necessary legislation will have much broader appeal. Think of the true cost of solar technology in 2008 vs now, or stationary battery storage. The type of legislation we need is something along the lines of ending all energy subsidies in all forms. That appeals to a lot of blue & red people.

Once the cost basis and value proposition of EVs/renewables crossed a certain point relative to fossil, it was game over. That was about 2013ish. Now we simply need anti-corruption measures to speed the transition. I think you'll find the few actual conservatives remaining are perfectly open to what's needed.

You’re a hero, Fred.A horrifying number of posts (50!) about the capital gains tax, much of it bickering, have been shipped off to the place where only interesting discussions survive: Capital gains tax after election (out of main)

To the two main culprits: please consider that hundreds of people had to wade through what felt more like an ego trip than a useful contribution to this thread.

I agree. Who cares what those broke losers have to say anymore. “Dustbin of history”.The mission is to accelerate the world's transition to sustainable energy. If the EV tax credit does that, I'm for it. Especially since fossil fuel subsidies aren't going anywhere.

Agreed EVs will trounce ICE vehicles regardless, but the faster the better.

I no longer care what Gordon Johnson, TSLAQ and others like them say. IMO, we need to completely divorce our thought process and free our minds from these frauds. Under no circumstances will they stop arguing or ever admit being wrong.

Looks like FSD is heading to Norway and Canada soon:

Source: https://twitter.com/kjell_arne/status/1323360437757530112

Norway already got autonomous buses in pilot projects in several cities.

Source: https://twitter.com/kjell_arne/status/1323360437757530112

Norway already got autonomous buses in pilot projects in several cities.

I'm not allowed to post details, but let's just say I know someone personally at Tesla that is high up enough the food chain that he can confirm similar plays against Tesla over the years. If ever needed, he's amassed a mountain of data to go after the shorts legally, but ultimately the fight was taken to the shorts financially, to hurt them where they could be hurt the most.

Attachments

Super important question - which will AFFECT how people treat their TSLA shares between now and end of year.. I was studying Biden's proposed draft tax plan and the rules wrt treating capital gains taxes - the % will go up for folks depending on income level. My question - if he does get elected - when will those rules likely take effect - 2021 or 2022? As a reference point - Trump got elected in 2016 and his tax plan got elected in 2018.. The IRS just came out with cap gains tax tables for 2021 but just wondering if those could change? Just looking for educated opinions here or a definitive answer if anyone has one.. My research has me thinking this is undecided at this point but just want to confirm.. Thanks

btw - was super bullish on TSLA last week on Friday.. Enjoy the dip!!

Biden winning not enough...Dems would need not only to control both Senate and House but they all need to agree to this provision. If repubs control Senate no chance it gets into law.

Mach-E is over-hyped, like the long string of "Tesla killers" that preceded it.

In marketing the Mach-E, Ford uses the usual smoke and mirrors -- mixing and matching specs and prices from different models to make it appear better than it is.

If you price out a Mach-E and try to match options with the Model Y it is not remotely competitive:

Range, performance, charging, charging network and standard equipment for the Model Y LR AWD ($49,990) are far better than the 2021 Mustang Mach-E Premium AWD Extended Range that costs almost $5,000 more ($54,700).

Model Y v Mach-E

Range: 326 mi v. 270 mi

0-60 4.8s v. 5.1s (target)

Max charge rate: 250 kW v. 150 kW

Supercharger network v. no

Autopilot v Co-Pilot360 scheduled for release in late 2021 for limited highway use only ala Supercruise

Front and rear heated seats v. front heated seats only

Sentry Mode/Security Camera v. no

Auto dimming heated mirror v. no

Movies/Games/Karaoke/Dog Mode v. no

Tesla also has more advanced active safety features and will very likely have better overall safety (crash avoidance and crashworthiness).

Plus the ability to order FSD.

In contrast, the Mach-E offers no standard features that Model Y doesn't have after the recent updates. Mach-E is currently eligible for the $7500 tax credit but that doesn't make up for its shortcomings, and the current tax credit system may not last long in any case.

Mach-E will also suffer because it will be sold through dealers who have a long tradition of steering customers away from EVs so they can make money on service for ICE vehicles.

There are multiple threads on Mach-E on TMC with more info, including this one:

Why not buy a Mustang Mach-E?

In marketing the Mach-E, Ford uses the usual smoke and mirrors -- mixing and matching specs and prices from different models to make it appear better than it is.

If you price out a Mach-E and try to match options with the Model Y it is not remotely competitive:

Range, performance, charging, charging network and standard equipment for the Model Y LR AWD ($49,990) are far better than the 2021 Mustang Mach-E Premium AWD Extended Range that costs almost $5,000 more ($54,700).

Model Y v Mach-E

Range: 326 mi v. 270 mi

0-60 4.8s v. 5.1s (target)

Max charge rate: 250 kW v. 150 kW

Supercharger network v. no

Autopilot v Co-Pilot360 scheduled for release in late 2021 for limited highway use only ala Supercruise

Front and rear heated seats v. front heated seats only

Sentry Mode/Security Camera v. no

Auto dimming heated mirror v. no

Movies/Games/Karaoke/Dog Mode v. no

Tesla also has more advanced active safety features and will very likely have better overall safety (crash avoidance and crashworthiness).

Plus the ability to order FSD.

In contrast, the Mach-E offers no standard features that Model Y doesn't have after the recent updates. Mach-E is currently eligible for the $7500 tax credit but that doesn't make up for its shortcomings, and the current tax credit system may not last long in any case.

Mach-E will also suffer because it will be sold through dealers who have a long tradition of steering customers away from EVs so they can make money on service for ICE vehicles.

There are multiple threads on Mach-E on TMC with more info, including this one:

Why not buy a Mustang Mach-E?

Last edited:

Sudre

Active Member

I didn't get much time to look over the options charts for this week but I will throw this out quickly so don't hold me to it.. I tried to take an OI chart from last Thursday which I had for this week and scale it to the same as todays OI for this Friday. Directly below is what OI we had for this Friday, last week.... not much. Those PUT peaks are around 3000.

Today we look at what transpired Friday and you can see those PUTs from last week basically rolled to this week. If anyone studies option trading you know when your PUT is in the money you buy it back and resell at a later date and a less amount. The lower strike PUTs are now in the 6000s as far as quantity. (circled in blue below)

Max Pain is not a single number (listed currently at 410). Max Pain is actually anything between $400.01 and $419.99. The CALLs and PUTs are basically even in that range. I think THEIR goal will be to nullify everything between 400 and 450 by having almost equal Calls to Puts. Currently, it is still early. If the election works out to what THEY think will be good for Tesla, I am expecting a pop maybe even over 450 to gets some PUTs to fill in where needed then a push back down under $450. If the election goes with status quo THEY are probably good with the setup they have now.

If we get negative Macros again this all goes out the window again and things get rolled again.

Today we look at what transpired Friday and you can see those PUTs from last week basically rolled to this week. If anyone studies option trading you know when your PUT is in the money you buy it back and resell at a later date and a less amount. The lower strike PUTs are now in the 6000s as far as quantity. (circled in blue below)

Max Pain is not a single number (listed currently at 410). Max Pain is actually anything between $400.01 and $419.99. The CALLs and PUTs are basically even in that range. I think THEIR goal will be to nullify everything between 400 and 450 by having almost equal Calls to Puts. Currently, it is still early. If the election works out to what THEY think will be good for Tesla, I am expecting a pop maybe even over 450 to gets some PUTs to fill in where needed then a push back down under $450. If the election goes with status quo THEY are probably good with the setup they have now.

If we get negative Macros again this all goes out the window again and things get rolled again.

Actually, Tesla survived from Daimler-Benz investments, not from the government loan (which they paid back, unlike Ford). That loan came later.Never is a strong statement. Tesla survived from government subsidies.

Other countries support their industries, and it's only fair that we do the same.

Artful Dodger

"Neko no me"

After-action Report: Mon, Nov 02, 2020: (Full-Day's Trading)

Headline: "TSLA Closes at 400 on U.S. Election Eve"

'Short' Report:

Comment: "Medium-range volume and intra-day SP range today awaiting News"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Closes at 400 on U.S. Election Eve"

Traded: $11,600,348,293.98 ($11.60B)

Volume: 29,102,800

VWAP: $398.60

Close: $400.51 / VWAP: 100.49%

TSLA closed ABOVE today's Avg SP

Mkt Cap: TSLA / TM $379.644B / $184.556B = 205.71%

Note: Yahoo Finance updated TSLA Mkt Cap on Oct 27 for Sep 9th Cap raise shares (per 10-Q). Google Charts updated Mkt Cap on Oct 28.

CEO Comp. Status:Volume: 29,102,800

VWAP: $398.60

Close: $400.51 / VWAP: 100.49%

TSLA closed ABOVE today's Avg SP

Mkt Cap: TSLA / TM $379.644B / $184.556B = 205.71%

Note: Yahoo Finance updated TSLA Mkt Cap on Oct 27 for Sep 9th Cap raise shares (per 10-Q). Google Charts updated Mkt Cap on Oct 28.

TSLA 1-mth Moving Avg Market Cap: $402.90B

TSLA 6-mth Moving Avg Market Cap: $291.34B

Nota Bene: Mkt Cap for 5th tranche ($300B) tracking for Nov 09, 2020

TSLA 6-mth Moving Avg Market Cap: $291.34B

Nota Bene: Mkt Cap for 5th tranche ($300B) tracking for Nov 09, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 53.2% (53rd Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 41.0% (46th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.39% of Short Volume (44th Percentile Rank)

FINRA Short / Total Volume = 41.0% (46th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.39% of Short Volume (44th Percentile Rank)

Comment: "Medium-range volume and intra-day SP range today awaiting News"

View all Lodger's After-Action Reports

Cheers!

MC3OZ

Active Member

You know, that's a better reason why Tesla is shipping cars to Europe from Giga Shanghai than they just wanted the higher margins. Obviously, they could sell them in China (regardless of the screwball short-seller narrative that China demand must be drying up already) so I did wonder about that.

Tesla is selling as many as physically possible in Europe to help adjust the 2020 CO2 baseline lower!

There is obviously easy market share and regulatory credits available in the EU, and a lack of volume competition.

IMO the other carmakers are dreaming if they think they are selling significant volumes of ICE vehicles in the EU in 2030.

Because this is Europe, we can use a soccer analogy our EU friends will understand, the competition has scored an "own goal".

bkp_duke

Well-Known Member

Why that sounds very Libertarian of you!

Guilty as charged.

Artful Dodger

"Neko no me"

FSD sales might offset that lowering of margin on smaller Tesla vehicles though, even without Robotaxi.

Ooh, ur getting so WARM. Even if Model 1 costs $15K to build (and sells at cost), with FSD's current price of $10K then Tesla's margin on a Model 1 Robotaxi is 67% (why sell one without FSD?)

How is this margin possible? Because the incremental COGS of adding FSD software is ZERO. Tesla has already paid for FSD in full in its R&D buget!

Wanna know how fast this "FSD leverage" affects Tesla's margin on Model 1 as FSD price increases?

- FSD $10K - Margin 67%

- FSD $15K - Margin 100%

- FSD $20K - Margin 133%

- FSD $30K - Margin 200%

And these profit numbers just continue for any Model 1 / Robotaxi that Tesla DOESN'T sell (ie: buys them internally to add to the Tesla Network as Company-owned Robotaxis. That's because the revenue is ONGOING, not just a one-time payment. If Tesla doesn't build the Model 1 out of long-life stainless steel and use a 'forever' LFP battery with a V2G charging solution, then Zach is not doing his job!

The only limit is working capital from profits. I've previously estimated that 5M S3XY cars/yr generate enough profit to pay in full for 6.4M Models 1 per year, while reducing Tesla's taxes to zero. Yeah, that's $192B annual profit from 6.4 Million sales of Model 1 Robotaxi.

And that's not even considering Model 2 Robotaxi's or any other combination of fleet products.

Do do folks here now understand why Elon is pushing so hard to get FSD working? You can give the printer away for free if you're the only one selling ink...

Elon says that eventually their FSD lead will dissipate as other companies also solve the autonomy problem. However, this does not negate Tesla's "First Mover Advantage". If Telsa can build a fleet of 65M robotaxi's over 10 yrs before other's start delivering functional robotaxi's, then Tesla's lead will be unassailable. The other companies will be reduced to simply buying their factories, and paying licencing royalties to King Tesla.

I think it will be enough money to build a City on Mars.

Cheers!

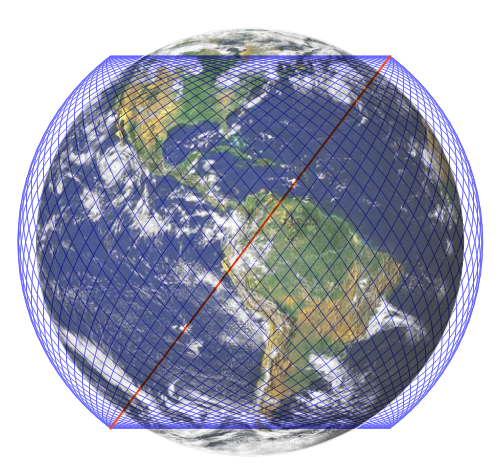

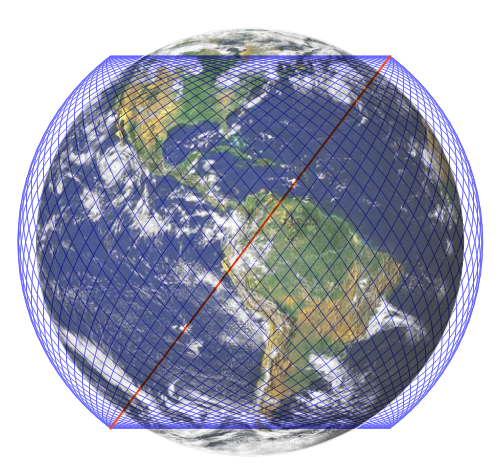

After hours OT. StarLink photobombs Hubble Space Telescope.

https://twitter.com/planet4589/status/1323358505923977217?s=21

https://twitter.com/planet4589/status/1323358505923977217?s=21

Last edited:

StealthP3D

Well-Known Member

IMO the other carmakers are dreaming if they think they are selling significant volumes of ICE vehicles in the EU in 2030.

True, demand for fuel burners will probably be in the gutter in 5 years time. But there are non-vehicular advantages to lowering the 2020 CO2 baseline.

Artful Dodger

"Neko no me"

After hours OT. StarLink photobombs Hubble Space Telescope.

OT:

Lol, HST orbits at 568 km alt:

which is higher than Starlink birds (550 km). Unless that picture was looking down at Broadway...

The Starlink constellation, phase 1, first orbital shell: 72 orbits with 22 each, 1584 satellites at 550 km altitude:

EDIT: BTW, the difference in Orbital velocity for a satellite at 568 km altitude vs one at 550 km alt is 9.834 m/s or about 22 mph.

There would be no blur at that low speed. The 'Humble' photo is a fake. Back to retweeting Romanian politics for him.

which is higher than Starlink birds (550 km). Unless that picture was looking down at Broadway...

"Concerns have been raised about the long-term danger of space debris resulting from placing thousands of satellites in orbits above 600 km (370 mi), as well as the negative impact to optical and radio astronomy on Earth. In response, SpaceX has lowered the Starlink satellite orbits to 550 km (340 mi) or below"

The Starlink constellation, phase 1, first orbital shell: 72 orbits with 22 each, 1584 satellites at 550 km altitude:

EDIT: BTW, the difference in Orbital velocity for a satellite at 568 km altitude vs one at 550 km alt is 9.834 m/s or about 22 mph.

There would be no blur at that low speed. The 'Humble' photo is a fake. Back to retweeting Romanian politics for him.

Last edited:

JRP3

Hyperactive Member

Not according to NASA:Lol, HST orbits at 568 km alt,

" Low Earth Orbit: Altitude of 340 miles (295 nautical miles, or 547 km)"

About the Hubble Space Telescope

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K