Looked on Grubhub - couldn't find any thing delivering Toyota cars!Toyota's president says Tesla may have a recipe, but lacks a 'real kitchen and a real chef'

Elon should consider adding a Tesla chef’s apron to the store - “Tesla - Saving the Real World.”

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

insaneoctane

Well-Known Member

Can a stock's beta only apply to decreases?Pretty good job there MMD. Tesla went from being up 4X Nasdaq in percentage gains at the peak this morning(1.7% Nas, 5.2% Tesla) to barely 2X.

Volume is already drying up so..........welcome to another week of nothing happening.

Where was the video of the mighty Hummer clawing it's way up mountains, through rivers and leaping tall buildings in a single bound? After all it was an article in praise of the great GM. /sInteresting how, in most segments where they had to get video of a real EV driving over hill and dale, all they could find were videos of Teslas!

Edit - They should all be within the range of Nikola CGI skills that GM acquired. /s

Last edited:

Tslynk67

Well-Known Member

Offloaded my 20th Nov c300's today, which I'd bought back when the SP was around $1385 in July. 3x the original cost which isn't bad, but could and should have been better.

I also sold my 336 trading shares. I need $200k in December for completing the house purchase and I decided with all the ongoing uncertainties, better to have the cash on hand. Looks like Mr President isn't going to give up soon, and with C19 ramping up, happy to de-risk.

Good news is that I haven't sold a sing core-share, and I'm doing all I can to not to - that's why I want the IV to pick up, so I can start selling covered calls and get some free wonga.

I also sold my 336 trading shares. I need $200k in December for completing the house purchase and I decided with all the ongoing uncertainties, better to have the cash on hand. Looks like Mr President isn't going to give up soon, and with C19 ramping up, happy to de-risk.

Good news is that I haven't sold a sing core-share, and I'm doing all I can to not to - that's why I want the IV to pick up, so I can start selling covered calls and get some free wonga.

tinyrodent

Member

Curious to see if you have ever looked into SBLOC's or if they even offer that in Brussels to keep your $TSLA shares.Offloaded my 20th Nov c300's today, which I'd bought back when the SP was around $1385 in July. 3x the original cost which isn't bad, but could and should have been better.

I also sold my 336 trading shares. I need $200k in December for completing the house purchase and I decided with all the ongoing uncertainties, better to have the cash on hand. Looks like Mr President isn't going to give up soon, and with C19 ramping up, happy to de-risk.

Good news is that I haven't sold a sing core-share, and I'm doing all I can to not to - that's why I want the IV to pick up, so I can start selling covered calls and get some free wonga.

Mike Ambler

Member

Toyota's president says Tesla may have a recipe, but lacks a 'real kitchen and a real chef'

Elon should consider adding a Tesla chef’s apron to the store - “Tesla - Saving the Real World.”

In Japanese!

Tslynk67

Well-Known Member

Curious to see if you have ever looked into SBLOC's or if they even offer that in Brussels to keep your $TSLA shares.

Yes, it is done here, but didn't look particularly favourable. I took a mortgage instead for 80% of total purchase costs, at ~1% fixed rate. But we also need to renovate and this will be another $600k and I couldn't borrow that. Most of this cost is in 2022 though, so I have time to trade to get some cash together. I'm OK to sell my core shares for $800, or write calls at that strike for a decent enough premium.

dedicatedtek

Member

In Japanese!

Elon - the Real Iron Chef

People still talking about the quality of the tequila lol? You guys realize these empty bottles now goes for 800 bucks on Ebay.

you mean some already have received their shipment?

edit: received, drank, and listed the empty on ebay...already???

Last edited:

Can totally see Tesla Apron as a merchandise product. Imo this is how Tesla should play with competition, make silly jokes about what the other companies are saying about Tesla. Thus Tesla get’s all the attention even when journalists are talking with other companies.

Scratch that....currently browsing for a Prius C nowCurrently browsing Toyota's website for a Prius Plus.....

FTFY: Elon - the Real Iron Phosphate ChefElon - the Real Iron Chef

ByeByeJohnny

Active Member

Austin passed a huge proposition for public transport in the election. Just a short tunnel part included for now. But maybe Elon thinks he can get them to put everything below ground.

I'm going to have to start day trading a little with this pattern. Morning jump then walk down the rest of the day. Annoying.

Iron phosphate chef.Elon - the Real Iron Chef

Last edited:

Maybe it's just for under TeraFactory transportation...Austin passed a huge proposition for public transport in the election. Just a short tunnel part included for now. But maybe Elon thinks he can get them to put everything below ground.

Sudre

Active Member

I would say THEY have their eye on something under $430 and above $425... for now. It's only Monday.

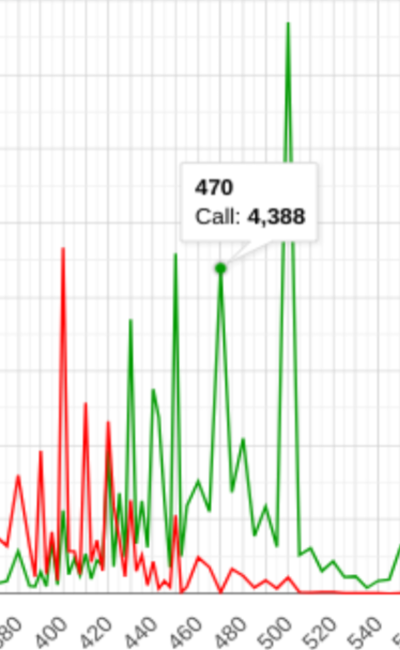

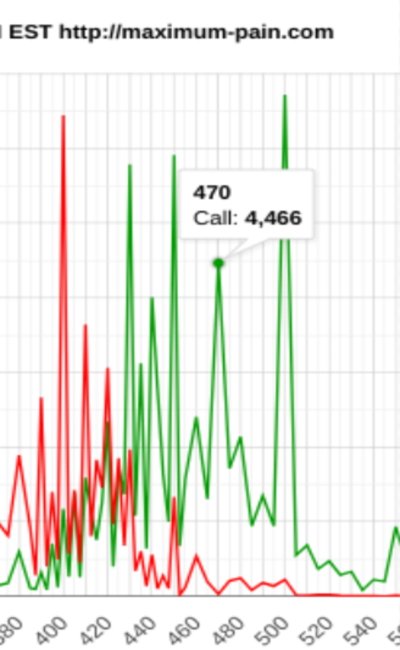

OI chart on last Friday for options expiring this Friday. $420 PUTs were already starting to gain traction.

Todays OI chart. Looks like for now those $430 strike CALLs are the line in the sand... for now. I think someone is crossing that line... LOL

OI chart on last Friday for options expiring this Friday. $420 PUTs were already starting to gain traction.

Todays OI chart. Looks like for now those $430 strike CALLs are the line in the sand... for now. I think someone is crossing that line... LOL

Mike Smith

Active Member

https://twitter.com/Gf4Tesla/status/1325723311591075841

"Rumors say that 'IDRA' has already finished the first gigapresses for GigaBerlin. They will be disassembled for transport and will soon be on their way to GigaBerlin."

https://youtu.be/dH8f08NorOA

If anyone was wondering, Idra was bought a few years ago by a large Chinese company so no Tesla can't buy it.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K