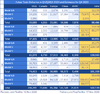

38 days of trading between now and Dec 24th (last day on which Index Funds can have they shares in place):

- Given ASP @ 440 for arguement's sake (that's near the SP that Tesla set in September's "At-the-Market" share offering)

- Given the S&P's $51B stock transfer requirement, that means about 116M shares need to be bought

- over 38 days, that's about 3 million shares per day being locked up

- given 60M shares/day Volume, that's about 5% of daily trading

This is going to be v.tough to hold down. MMs r in trouble. Only saving grace is the fact that Index Funds don't need to purchase a fixed number of shares, only a fixed value of shares.

This is important. It means that if the shares they purchase today go up in value due to a 'squeeze', their total value of holdings of TSLA goes up with it, and REDUCES their future need to buy shares.

Some forward thinking Index Funds could even become Sellers if they buy what they need early at a realitively low ASP, and then a squeeze sees their value exceed the Fund's requirements.

All of this points to an early peak, IF and that's a big unknown, Index Funds can purchase outside the normal +/- 3 day window from the S&P effective date. The Fund itself sets these rules (imp. NOT the S&P Committee), and I suspect they'll make an exception to buy TSLA in the same way the S&P Committee itself has take the extraordinary of pre-announcing the listing of TSLA 5 weeks ahead of time.

Cheers!