Their announcement was that it would be fully included on the 21st, whether done in tranches or not. The announcement clearly moved the market. If they retracted it now, the SEC would be very unhappy with them.They want to get this over with before Christmas imo. They definitely can't have the inclusion happen between 21st and New Year's. Imo it's most likely happening by the 21st.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

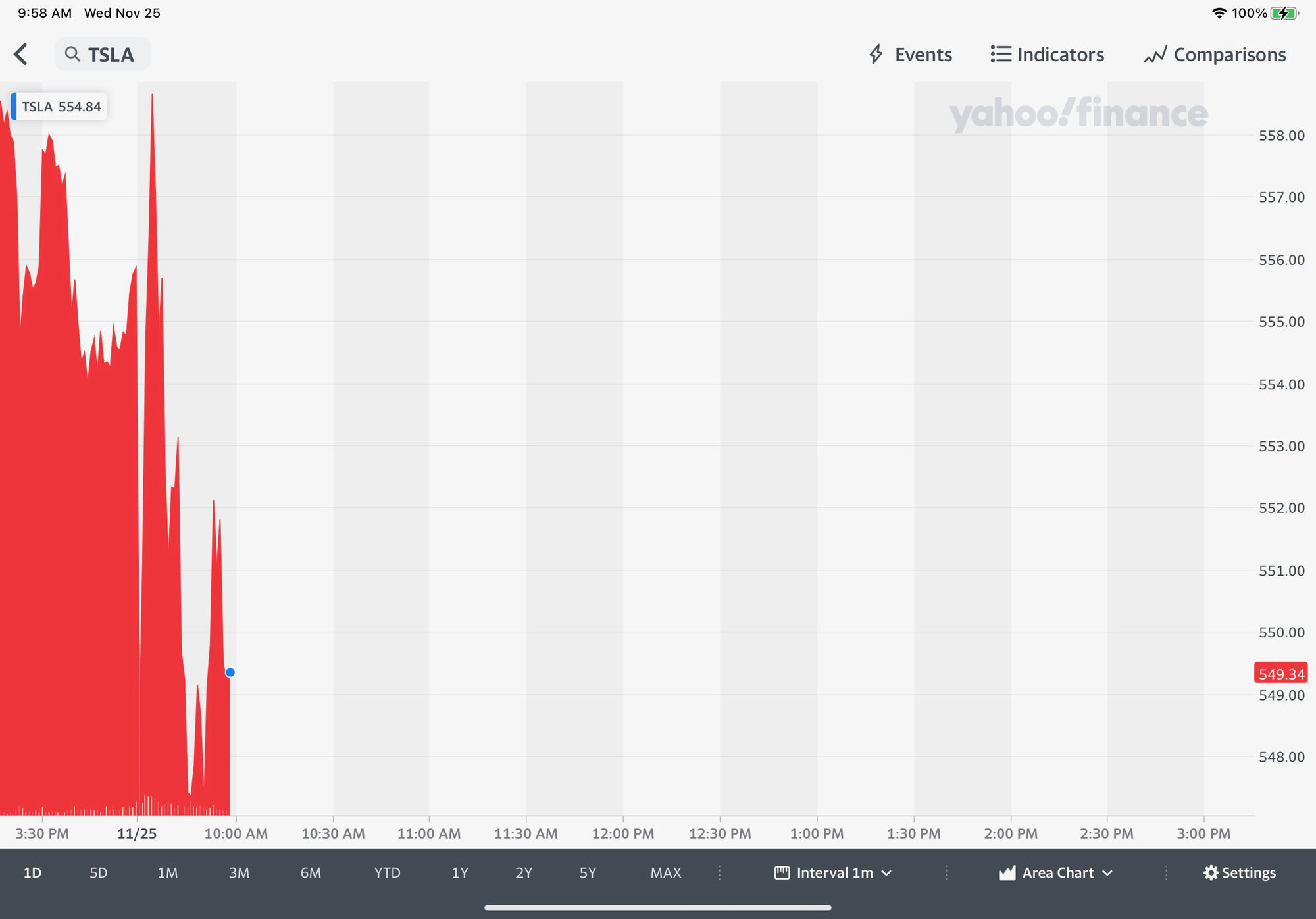

Lots of effort to keep TSLA below $550 this a.m. Big selling to rapidly stop TSLA from running soon after the open. Once TSLA was brought below $550, the capping started. As TSLA made a run towards $550 a bit ago, the typical pattern of large sell orders being put in and then pulled started. A brief spat of volume ran over the cappers for a bit, allowing Tesla to run above $550. But, MMs and others ensured that TSLA was brought below the target again. Volume is key to the game on both sides. Will be interesting to see how the day develops, in particular with the Thanksgiving holiday coming tomorrow where volume could really dry up this afternoon as traders leave early.

StealthP3D

Well-Known Member

Hmmm... that's weird. Fidelity is having this weird glitch in my portfolio today where all the numbers are red instead of green. It looks so abnormal.

Your monitor might be messed up. Just buy two more monitors and make sure they all show the same colors. If not, go with 2 out of three.

TravelFree

Active Member

So basically you're saying you buy when the price is lower, then sell as the price has gone up, then buy back when the price is lower again? Rinse, repeat, and voila you make more money than just buying and holding? Interesting concept, now if you could just give me a heads up every time the price is about to go down and then again in advance every time the price is going to go up, that'd be greatly appreciated. Thanks.

I'll describe the simple strategy and ignore your "give me" sarcasm:

Step 1: Buy your first shares in this strategy and hold until the shares double in price. Now sell 50% of those shares. The remaining shares are now all zero bases as you have pulled your basis out and bought something that has real use to improve your life. Rinse-Repeat if you want.

Step 2 begin to trade half of those remaining shares on the buy low sell high moves. The timing is not important because with zero commission you could be trading several times a day as the market swings in small increments several times a day. Just follow the timing for the day and be sure your trades execute with market delays that won't make those trades at a loss due to short cycle timing. At best I average two moves a day when working a stock. The big boys can do this several times a minute.

This works really well in a flat market with small swings. It is boring to claim you made a hundred $ in a day on a stock but when you do this eventually every day it adds up, you'll have enough to be long on a hundred shares where you can sell weekly covered calls and collect more cash to buy more shares.

So now you combine the strategies to build share count even faster. But always maintain a long position in 50% of your shares if the company is growing. If that ever changes, then sell out the long position as well.

This isn't my strategy it is described by Jim Cramer and several others who have been at this successfully longer than me. But it worked for me as all my stocks have been at zero basis now for 3 years. I've been at this for 13 years since retiring from my business in TV advertising.

I've been learning from this thread about LEAPS for those long held positions. I need to do some what-if games to see if the risk / reward is worth it. At any rate, I would only do them on 50% of my long blocks of shares. I see they are safer with the SPY because of diversity as opposed to a single company. So many stock Bulls never look at the what-if it goes bad. I examine both and why. What if Musk should leave Tesla? And his replacement is like Steve Balmer at Microsoft, there are many examples like this. But LEAPS in the SPY would be balanced with diversity- No?

StealthP3D

Well-Known Member

Their announcement was that it would be fully included on the 21st, whether done in tranches or not. The announcement clearly moved the market. If they retracted it now, the SEC would be very unhappy with them.

I don't think the SEC would have a case as long as S&P is not acting in bad faith (trying to manipulate the market so they can trade the price swings). The S&P doesn't buy and sell stocks - they simply manage their market indices.

If you jiggle the HDMI or VGA cable long and hard enough...eventually the colors on the screen flicker and change to a greenish color....works for meYour monitor might be messed up. Just buy two more monitors and make sure they all show the same colors. If not, go with 2 out of three.

On 11/30 (I think we will see their press release after the market closes), S&P Indices will announce what percentage of $TSLA their clients, the wonderful "must buy at any price and hold" passive S&P 500 index funds shall have to buy close to but before market open on 12/14 and 12/21/2020. S&P will also summarize the feedback they received from the investment community to their survey. The purpose of the survey was to CYA the secretive S&P index committee.

I don't think that the final percentage will be announced until Friday 12/11. (Or 12/4 if they do two tranches.)

engle

Member

Agree with most of it except the bolded. The number of shares to be bought remains the same, what changes is the price they are paying for each share.

@vikings123 thanks for correcting my post. I'd forgotten some of the gory details from my lengthy July 6, 2020 post, "S&P 500 Future TSLA Addition Analysis" about "Mean S&P 500 Float-Adjusted Market Cap", etc. I wrote it after investing several hours studying S&P website documents.

"However, S&P 500 rules state that "Weighting. Each index is weighted by float-adjusted market capitalization."

TSLA: Shares Outstanding = 185.48M; Float = 147.62M; % Held by Insiders = 20.51%; % Held by Institutions = 57.93%.

Float-adjusted market capitalization = 147,620,000 x $1,371.58 = $202,472,000,000 ($202B). ("Float-adjusted" removes the shares held by insiders like Elon that are presumably mostly not for sale.)

According to S&P, Mean S&P 500 Float-adjusted Market Cap Weighted today is $53,391.96M x 505 Constituents = $26,962.94B. TSLA would be 0.75% of this, which is its float-adjusted market cap as of 7/6/20 close.

S&P also states there is over USD 4.6 trillion indexed to the S&P 500. $4,600B x 0.75% = $34.5B worth of TSLA stock the indexers will be forced to buy. At today's close, that represents 25,153,472 shares or 17% of the "float". Will that be enough to cause an extreme spike up in the price when TSLA is added? By contrast, today's volume was 20.5M and the average is 14.2M."

"When TSLA is added to S&P 500 it will also get added to the "S&P 500 Top 50" at the next annual reconstitution after the close of the third Friday in June 2021, using a reference date of the last business day of May 2021."

Note those were all pre-split numbers.

I also predicted this on July 6th which came true 2 months later:

"Still, I will go out on a limb and predict that $TSLA will exceed $2,000/share within a week of being added to the S&P 500 on 9/28/2020. ... Do I get to revise my prediction upwards to $2,500?

https://www.spglobal.com/spdji/en/d...odology-sp-us-indices.pdf?force_download=true

This could be the cause of the dip this morning : Tesla recalls 9,500 Model X and Model Y cars over roof, bolt issues — CNBC

Tesla is recalling more than 9,500 of its Model X and Model Y electric vehicles over potentially faulty roof trim and bolts that could be inadequately tightened

...

The larger recall covers 9,136 Model X cars produced between Sept. 17, 2015 and July 31, 2016, according to a National Highway Traffic Safety Administration filing. The agency said the front and spine cosmetic roof trim may have been applied without the necessary primer and the pieces may separate over time.

Tesla also recalled 401 2020 Model Y vehicles over a potential issue with its bolts.

Tesla is recalling more than 9,500 of its Model X and Model Y electric vehicles over potentially faulty roof trim and bolts that could be inadequately tightened

...

The larger recall covers 9,136 Model X cars produced between Sept. 17, 2015 and July 31, 2016, according to a National Highway Traffic Safety Administration filing. The agency said the front and spine cosmetic roof trim may have been applied without the necessary primer and the pieces may separate over time.

Tesla also recalled 401 2020 Model Y vehicles over a potential issue with its bolts.

corduroy

Active Member

Early black Friday sale, 10% off short term calls.

Edit: It was a flash sale, over now

Edit: It was a flash sale, over now

Last edited:

ZeApelido

Active Member

Hmmm... that's weird. Fidelity is having this weird glitch in my portfolio today where all the numbers are red instead of green. It looks so abnormal.

Whenever this anomaly happens I just rotate the monitor 180 and go back to making bad jokes.

Typical CNBS....9500 < 7 million GM cars recalled for safety airbag issues...didn't see CNBS post that...hmmmm...and its gonna cost GM $1.2b to fix. Imagine if $TSLA had a $1.2b bill....This looks to be cause of dip this morning : Tesla recalls 9,500 Model X and Model Y cars over roof, bolt issues — CNBC

Tesla is recalling more than 9,500 of its Model X and Model Y electric vehicles over potentially faulty roof trim and bolts that could be inadequately tightened.

GM recalling 7 million vehicles for airbag problems after losing fight with safety regulator - CNN

Something that's been bugging me: just because TSLA might drop, possibly hard, after inclusion, doesn't mean that SPY will underperform. Outflow from TSLA will likely go back to the rest of the index. If money doesn't bleed out from the index as a result of TSLA's movement, can we really say that SPY will suffer?Yeah, as a long-term investor the exact method of inclusion is not that important to me. But I do think an extended inclusion would likely allow the funds to buy in at lower prices. Anything that could take the pressure off TSLA shares and spread the demand over time could provide an advantage to the funds. The S&P wants their index to perform well and the lower the inclusion price the higher the better the index will perform.

I am simply not that bullish on the funds having to overpay for TSLA. One way or another, I think they will get in at an average price less than $525. But I hope I'm proven wrong. Part of me hopes I'm proven right because lots of mom and pops hold SP500 Index funds.

Sudre

Active Member

THEY is not one person or MM. THEY is probably a dozen groups with more money under management than Elon has in stock options. THEY have different ideas about what THEY want to happen. One of them is even possibly short. That means that a bone has to be thrown and things move in step or there may become a battle that we would not want to see.Well, an impressive pre-market walk down to start proceedings - was $575 in Frankfurt earlier...

I still don't get why THEY wouldn't just delta-hedge every call bought from this moment. Hell, the two big players, Citadel and the other one I can remember, have gazillions of shares already. Let it side, guys!

As expected the Puts have finally filled in Yesterday. That is more premiums and fees for whomever is selling those Puts. For whatever reason this price holding at $550 will give them this whole morning to sell more Puts. I think the line at $550 is going to stay crossed and they are moving UP that line in the sand. Look at the $600 Calls launching. That is the new line in the sand. I think everything between $500 and $600 is going to end up to be max profit for THEM.

The SP has to move at a rate THEY can sell around. If it goes too fast they can't move that line with the max profits THEY like. Looking at several other stocks I track it appears THEY got lucky today because everything dipped a bit this morning. They don't even have to work this.

$500 strike Calls have been closed out. Looks like rolled to $600s.

engle

Member

I don't think that the final percentage will be announced until Friday 12/11. (Or 12/4 if they do two tranches.)

Correct. This is from page 25 of S&P's 41-page methodology:

"S&P Capped Market Cap Weighted U.S. Indices. The indices are rebalanced for reweighting purposes quarterly after the close of business on the third Friday of March, June, September, and December. The rebalancing reference date is the second Friday of March, June, September, and December respectively."

So in "our" case expect the reference date (pricing of all the constituents) is after market close on Friday, 12/11, with the rebalance and addition of either all or the second tranche of $TSLA after market close on Friday, 12/18. If S&P decides to pre-add either 50%, 33% or 25% of $TSLA's weight a week prior, then expect the reference date (for $TSLA's price and the others) is after market close on Friday, 12/04, with it's first tranche entry into the index after market close on Friday, 12/11. That would coincide with the partial deletion of existing S&P 500 name(s).

I have not seen the 12/04/2020 date posted elsewhere before until @MP3Mike just did. I think it is designed to give the indexers 5 trading days to "back up the truck"

https://www.spglobal.com/spdji/en/d...odology-sp-us-indices.pdf?force_download=true

(I've been up all night working not drinking so I was fuzzy on some of the details -- thanks for all your clarifications!)

Last edited:

pz1975

Active Member

If TSLA manages to close green on a day like today, then I imagine Shortsville will be somewhat stormy.

Krugerrand

Meow

Sorry for the late response (geddit?) but plz explain financial difference between unconsciousness and fake death?

One requires a hospital visit.

Alphacrux

Member

Every once in a while my Fidelity quote goes up to $555.38 and then returns to normal. Glitch? Anyone else seeing this?

StealthP3D

Well-Known Member

Something that's been bugging me: just because TSLA might drop, possibly hard, after inclusion, doesn't mean that SPY will underperform. Outflow from TSLA will likely go back to the rest of the index. If money doesn't bleed out from the index as a result of TSLA's movement, can we really say that SPY will suffer?

There are at least 2 good reasons why that would not be the case:

Selling after inclusion would be money that is not allocated only to stocks in SPY. Some of it would either not be re-invested or would be invested in non-SPY investments.

The second reason is more complex but basically the other stocks in SPY have more sensitivity to tracking their own underlying fundamentals than TSLA does. This means if outflow from TSLA flows into the other stocks, other holders of those same stocks are more likely to sell based on "overvaluation" while TSLA's supply and demand is less price sensitive (because no one has much of a clue on TSLA's underlying fundamentals).

Last edited:

Try looking at a different day, that should probably make a difference, like maybe Monday...If you jiggle the HDMI or VGA cable long and hard enough...eventually the colors on the screen flicker and change to a greenish color....works for me

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K