possible but disagree on very likely.Agree or disagree: It is very likely TSLA closes at $670 or above next Thursday or Friday?

Comments also much appreciated.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

Dreadnought

Member

People drive differently. This will inevitably lead to whining about FSD. For aggressive drivers, it will be too docile. For overly cautious drivers, it will be too aggressive. And for those in between they will experience both because sometimes FSD is more aggressive than they would have been and at other times too slow. Add to that the inherent desire to feeling superior (remember this basic selling point of religions?) and difficulty of giving over control. It will take longer to subside than for the reduction in casualties to be apparent, I think. But then (again like religion) social pressure and fear will promote its adoption. Fear of losing one’s driving license or freedom to go where you want when old, or social pressure to have FSD : you don’t want to kill anyone now your reaction speed is worsening and you can’t turn your head as well, do you? Feelings of superiority (status) can also help adoption: My car has full self driving. To;dr: apart from the technical aspect lots of psychology is involved.

Idiotic high prices will be a deterrent. The value of FSD for a Semi Owner is different than for a retired person.

The same points about being too agressive or too docile could be made about a human driver. If that was a concern, nobody would be taking a cab. But this perspective is missing that once you are a passenger, it doesn't matter if the drive takes a bit longer. You can watch out of the window, play with your phone or take a nap. Anyone who uses Autopilot today is giving up control already. And while it can be a lot of fun to drive a Tesla by yourself, it can also be boring in rush hour traffic or exhausting on long distances. I for sure wouldn't mind to completely pass control to the car under these circumstances.

It does take a leap of faith to enter a car without a steering wheel (or sit in the back row with no human at the helm). I give you that. There will be some hesitation, not much unlike when the first trains went into service. People were afraid that the incredible speed alone could kill you. And there will be accidents. But just like people were seeing the advantages of rail transportation despite the risks, they will adopt autonomous cars as soon as they're viable.

Tesla can easily implement different pricing for FSD personal and robotaxi use. However, they have an incentive both from a business and mission point of view to maximize the fleet use of FSD.

MC3OZ

Active Member

I agree, it's the best looking Tesla in the entire line-up. But looks is not what determines it's importance going forward. The biggest problem is it costs too much to make and so will only ever sell in relatively low volumes.

I don't think that matters, what matters is if they make money on the Model S.

Overtime they will be walking down the cost of making the Model S, and simplifying the build process.

That means some combination of improved specs, lower price or higher margins...

But it is in a market segment where customers are prepared to pay a bit more for a larger car with better specs and finish.

Tesla has been able to create great performance, and do well in this segment.

IMO confusion stems from the fact that the Model S hasn't always had the latest innovations in the last few years, it isn't always worthwhile making production changes especially with a single factory when ramping newer more important high volume models.

Model S/X and Roadster are very likely to be only ever built in Fremont, they will never be high volume but will make money and dominate to some extent in their market segments. Even if most people never own one or never drive one they are an important part of the Tesla Brand and the Tesla image

IMO Tesla is unique in that it makes high end cars like; Mercedes, BMW, Audi and even Ferrari, but also increasingly mid-market cars and lower priced cars like Ford, Toyota and GM. Tesla can survive in a wide range of price points.

The only confusion so far is many customers think Teslas are expensive because of the Roadster, and Model S/X. Many of the general public still not know how affordable a Model 3/Y are, nd they will equally be surprised by even cheaper models. But word gets around, the car buying public are relatively quick learners, that is because the quicker learners help educate the slower learners.

I view Model S as classic / iconic, I'll never own one, but I would like to drive one, especially a new Plaid Model S.

Plaid Model S will be "top dog" until the Roadster comes out, that will help sell all Teslas, including lower spec Model S and be a great source of free marketing..

Tslynk67

Well-Known Member

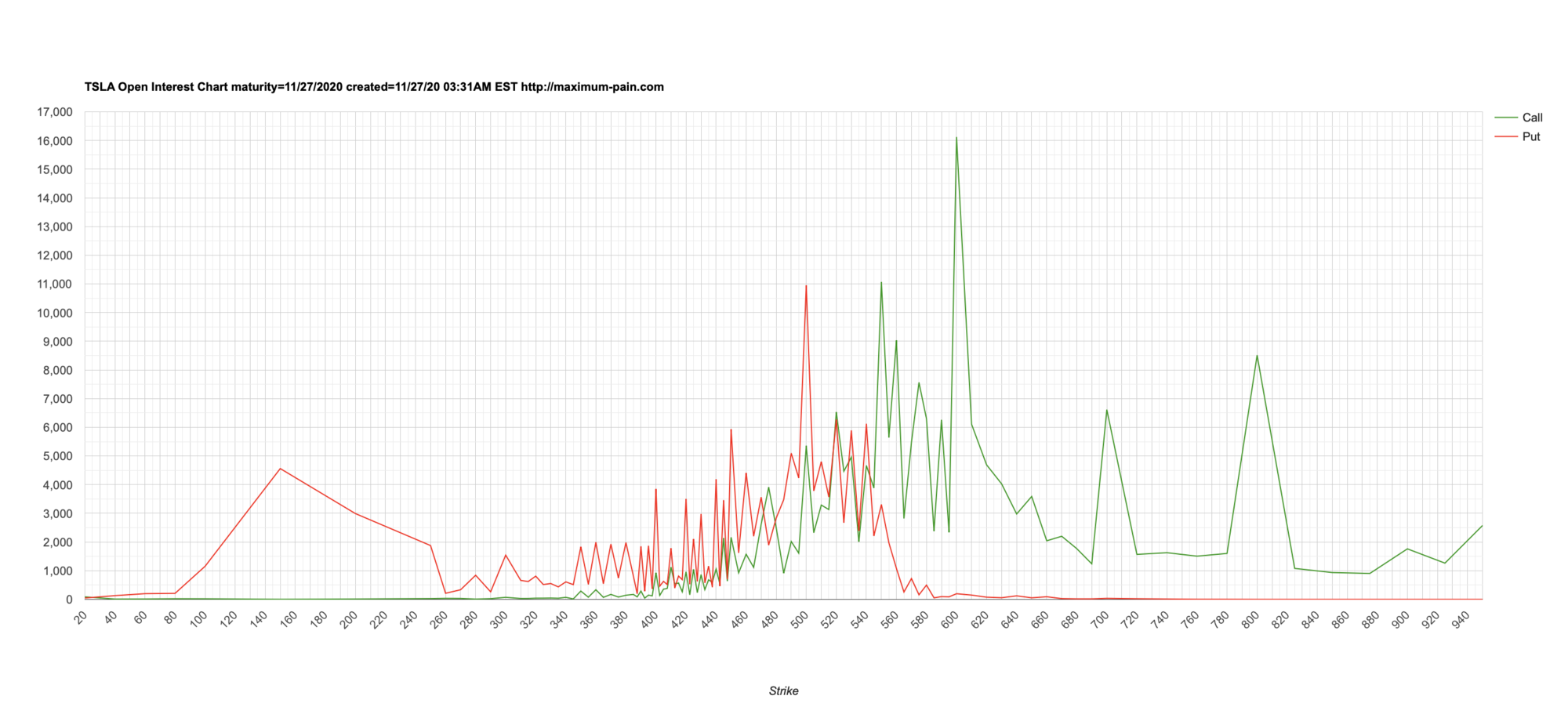

So, with expected lower volumes (although not a given for this special pandemic-Thanksgiving), what will the manips target?

MP is indicated as $505, but this is not in line with the situation on the field where $542.50 +/- $2.49 would be the closing price of choice for the THEM.

They went for this bigly for the first couple of hours on Wednesday and failed, totally, even though volume was relatively moderate. Would require an even bigger move down today, ~4%

Maybe they've hedged already and won't expend the effort, time will tell.

On the other hand, a 4% move up brings $600 into play, and then I'd expect a fight-to-the-death.

MP is indicated as $505, but this is not in line with the situation on the field where $542.50 +/- $2.49 would be the closing price of choice for the THEM.

They went for this bigly for the first couple of hours on Wednesday and failed, totally, even though volume was relatively moderate. Would require an even bigger move down today, ~4%

Maybe they've hedged already and won't expend the effort, time will tell.

On the other hand, a 4% move up brings $600 into play, and then I'd expect a fight-to-the-death.

What if the actively managed funds, and other big sharks in the waters, have realized that instead of screwing retail investors (a relatively minor component of the market, which they can get back to soon enough), this setup gives them a chance to screw the S&P 500 index (well - funds actually)?

Maybe we're just swimming along in the school with them, as we all front run the S&P 500 inclusion?

Yes, this is what might be happening now. The front runners and other funds know the propensity of mms to manipulate this stock down due to options. So they are waiting patiently and buying every dip. That is why I think things will get really interesting on Monday or maybe it will start today.

The TSLA story is such an exception in that a lot of the retail investors success came at the expense of the big boys who have hoped the company would go bankrupt.

JohnnyEnglish

Member

In addition FSD being available will force the rest of the industry to offer similar capabilities on all of their offerings and adopt the Tesla approach of building the complete sensor suite into every vehicle produced. Because the competition offer so many different body styles compared to the 4 Tesla offer (S3XY) the redesign effort and mods to manufacturing will be costly and soak up large amounts of engineer effort. Tesla's competitive edge will increase further.I think this is false. If FSD progress is real this will lead to so much halo effect on the entire company, more cars sold, higher take rate, higher FSD price, higher insurance margins etc. And the value of selling the upgrade in itself is a lot of money. 2M cars in 2022, 50% take rate, $10k package = $10B in profit, PE50 -> $500B market cap. For FSD alone, even without considering robotaxi $100k value per vehicle greatest appreciation in history if Elon is correct.

...

565$, with both SP500 and Nasdaq100 slightly up. Walking it slowly down as expected.Yes, this is what might be happening now. The front runners and other funds know the propensity of mms to manipulate this stock down due to options. So they are waiting patiently and buying every dip. That is why I think things will get really interesting on Monday or maybe it will start today.

The TSLA story is such an exception in that a lot of the retail investors success came at the expense of the big boys who have hoped the company would go bankrupt.

Edit: 563

I think you're wrong about this. The market is inherently forward-looking even though stock market analysts lag. FSD is such a revolutionary technology that investors will start "pricing it in" the shares gradually, as it becomes apparent to people of normal intelligence and learnings that it's going to happen. The revenue doesn't need to modelled in analyst's spreadsheet in order to start being "priced in" to the shares. And some analysts are already doing crude modeling of FSD revenues.

I think you're right about that, but who cares? Let the shorts scream from the hill top. It simply doesn't matter. No one of any importance listens to them.

With all the talks about FSD value and impact on the SP, I see nobody talk about the value of FSD in the trucking industry, Trucking is worth 800-1000B each year in the US alone. The biggest cost/impediment is due to the driver needing to sleep (In Europe the law does not allow drivers to drive more than 9 hours a day or 56 hours a week or only 90 hours in 2 consecutive weeks). Imagine the productivity gain when trucks can transport goods 24X7 and charging while unloading/loading. Platooning with FSD is obviously another huge pie with some estimating ~180B in operational cost saved.

A great strategy for Tesla after completing FSD would be to license it out to other truck companies. This way they allow Tesla cars to retain their uniqueness in the auto industry as well as make big DOUGH with licensing FSD. Licensing FSD to other auto makers very early would probably be incorrect.

I used to work for a VC firm where we dived really deep into finding the next Uber for freight.

Only if these non-Tesla trucks are 100% EV, otherwise this won't be compatible with Tesla's mission to accelerate the transition to renewable. Trying to become the "next Uber for freight" is not in line with the company's vision unless it's all electric.A great strategy for Tesla after completing FSD would be to license it out to other truck companies. This way they allow Tesla cars to retain their uniqueness in the auto industry as well as make big DOUGH with licensing FSD. Licensing FSD to other auto makers very early would probably be incorrect.

But then again, which company will produce EV trucks in volume to justify such a partnership? NKLAQ?

For now, I'd prefer Tesla to build their own fleet as quickly as possible and to use FSD as a competitive advantage. Until other EV truck manufacturers up their game.

petit_bateau

Active Member

Russ' $TSLA "Base", "Bear", "Best", and "Elon's 20M units" Share Price Predictions for 12/31/2030

I think @Robocop makes an important point. $AAPL market cap is ~$2T today. If you assume that $TSLA continues to be the dominant force in a growing EV market profit-wise (like Apple over Android), with Solar/Battery/HVAC(?) compounded growth, Tesla Network becomes reality, high-profit margin Tesla App Store created, etc., then it is reasonable that $TSLA might have a $4T market cap by 12/31/2030. Here's why:.......

Now, like Ark Investments did, I'll combine my weighted probabilities predictions of the price on 12/31/2030:

10% * $ 2,090 [Bear] = $ 209

40% * $ 4,200 [Base] = $1,680

40% * $19,133 [Best] = $7,653

10% * $27,045 [Elon] = $2,704

I predict the 12/31/2030 share price will be $12,246 which is an average CAGR of 35.8%.

It would be an interesting exercise if others posted their 2030 "bear", "base", and "best" case scenarios (with their derivation) for 12/31/2030 by 1/1/2021 [2]. Then we can HOLDR and see who came closest a decade from now! If my $19,133 "best case" comes true I will buy ALL of you a gourmet lunch (who fly in on your private electric jets) to attend the 2031 Tesla Annual Stockholders Meeting!

Russ

Scenario analysis like yours or Ark's are a good way to view this. Here is a very crude version of that.

If you consider that AAPL gets a ~$2t market cap from a 12% global market share for $1k devices & their associated revenue & cost ecology. In comparison TSLA's mid-case of 10mln cars/yr by 2030 would represent an approx 12% global market share of $30k devices and their asociated ecology, and so by 2030 would be the equivalent of (in 'now' money) of $60t. Given that TSLA's current mkt cap is $0.5t on ~$600 shareprice then a potential 120x growth is identifiable. There are all sorts of caveats one can apply to this, including the relative capex spend necessary to achieve this due to the out-sourcing vs in-sourcing, and the gross margin % of software/services vs hardware vs energy, but nonetheless I agree there is a very significant potential for continued profitable growth and corresponding mkt cap.

regards, pb/dspp

Tslynk67

Well-Known Member

565$, with both SP500 and Nasdaq100 slightly up. Walking it slowly down as expected.

Edit: 563

Was the same on Wednesday, also into the first 90 minutes of main market, then the buyers stepped-in...

I'd expect some Monday FOMO buying towards the end too.

A lot will depend on whether the manips feel they can unwind some of their delta-hedges as the day progresses - that would dump a load of shares and bring us down.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

With all the talks about FSD value and impact on the SP, I see nobody talk about the value of FSD in the trucking industry, Trucking is worth 800-1000B each year in the US alone. The biggest cost/impediment is due to the driver needing to sleep (In Europe the law does not allow drivers to drive more than 9 hours a day or 56 hours a week or only 90 hours in 2 consecutive weeks). Imagine the productivity gain when trucks can transport goods 24X7 and charging while unloading/loading. Platooning with FSD is obviously another huge pie with some estimating ~180B in operational cost saved.

A great strategy for Tesla after completing FSD would be to license it out to other truck companies. This way they allow Tesla cars to retain their uniqueness in the auto industry as well as make big DOUGH with licensing FSD. Licensing FSD to other auto makers very early would probably be incorrect.

I used to work for a VC firm where we dived really deep into finding the next Uber for freight.

It's also the time & pollution restrictions (especially in EU). Electric HGVs aren't silent, nor is unloading them, but better than ICE trucks. Cities will increasing implement pollution charges/restrictions, perhaps dynamic. I think pollution's effects on health will get MUCH greater attention very soon.

Once EV HGVs are in use I think there will be further benefits that I can't see yet. Fleet managers will act fast if they see a commercial reason, very competitive business.

All it takes is a first bite at the market, then total cost of ownership, technology improvement, drivers preferences, realisation and trends will lead to near 100% adoption very rapidly (more demand than supply). A few niche cases will remain, but getting above 80% will be quick in my opinion.

With electric HGVs (and eventual takeup of FSD), car drivers will notice their clunky diesel is outdated compared to even the lowly/workaday HGV (as some might think). I think it will be embarrassing to current luxury brand drivers to have diesels. Exec, sales and schoolrun prestige SUVs will switch to EV. Commercial vans will follow (again demand way higher than supply of compelling vans). Then it's down to the last 10-30% of vehicles, many small, low mileage and older with owners who have fewer charging options.

This last set of vehicles is what perplexes me most, many can be replaced by Robotaxis which are cheaper than parking fees. Scrappage schemes would be useful, but rather than money off new cars, pay cash to get them off the roads and people can decide what to do - taxi/new EV.

When this switches, it will be fast. 2030 too far by far, many markets switched by 2025. 2030 could be phase out date for old fossils if scrappage scheme, less pollution are publicly supported.

565$, with both SP500 and Nasdaq100 slightly up. Walking it slowly down as expected.

Edit: 563

yep.

engle

Member

Agree or disagree: It is very likely TSLA closes at $670 or above next Thursday or Friday?

Comments also much appreciated.

Unless my 780 SAT math is off, going from Wednesday's $574 close (I am ignoring pre-market trading) to $670 over the next 6 trading days (actually 5.5) would require an average CDGR (Compound Daily Growth Rate) of "only" 2.61% each of the 6 days. That is certainly in the realm of possibility during this FOMO leading up to S&P indexer forced buying in the days before 12/14 (I expect 50% then) and 12/21!

(Definitely *not* investment advice regarding short-term options trading). I was burned small time by options gambling in the '90s so I don't play that game anymore. I'd rather play in the World Series of Poker again it's more social and fun!

Someone commented that tens of thousands of U.S. $TSLA HODLERS may have encouraged their relatives over Zoom Turkey to eat some $TSLA of their own as a way to indirectly brag about their paper gains this year. I agree with this and expect more "Robinhood" FOMO Friday and in the coming week.

Interesting!Thanksgiving 2019. Black Friday is the lowest volume in the middle of the screen. 2018 was MUCH uglier

View attachment 612246

My gut feeling is that MM might have a decent chance today. That could make Monday another fun day.

If the MM succeeds today ill add some new call options.

engle

Member

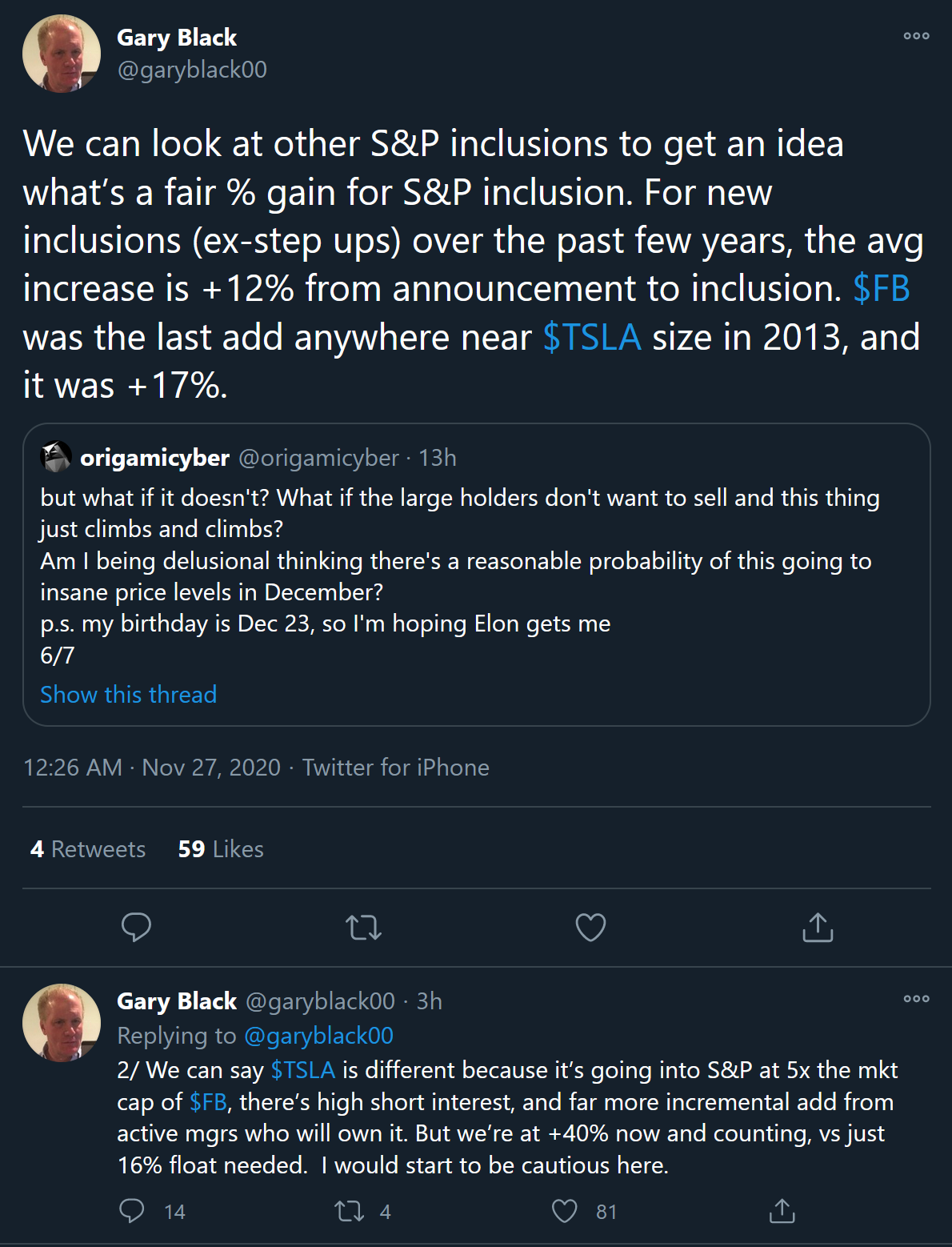

https://twitter.com/garyblack00/status/1332239429591834629

Gary Black @garyblack00 29m:

"$TSLA following same pattern as last few days: Down pre-market as those who’ve sold weekly calls sell stock to buy the calls back cheap; causes S/T traders who thought TSLA going to $600 to bail out; institutional managers who want to buy TSLA at lower prices come in and prices go back up."

Makes sense to me!

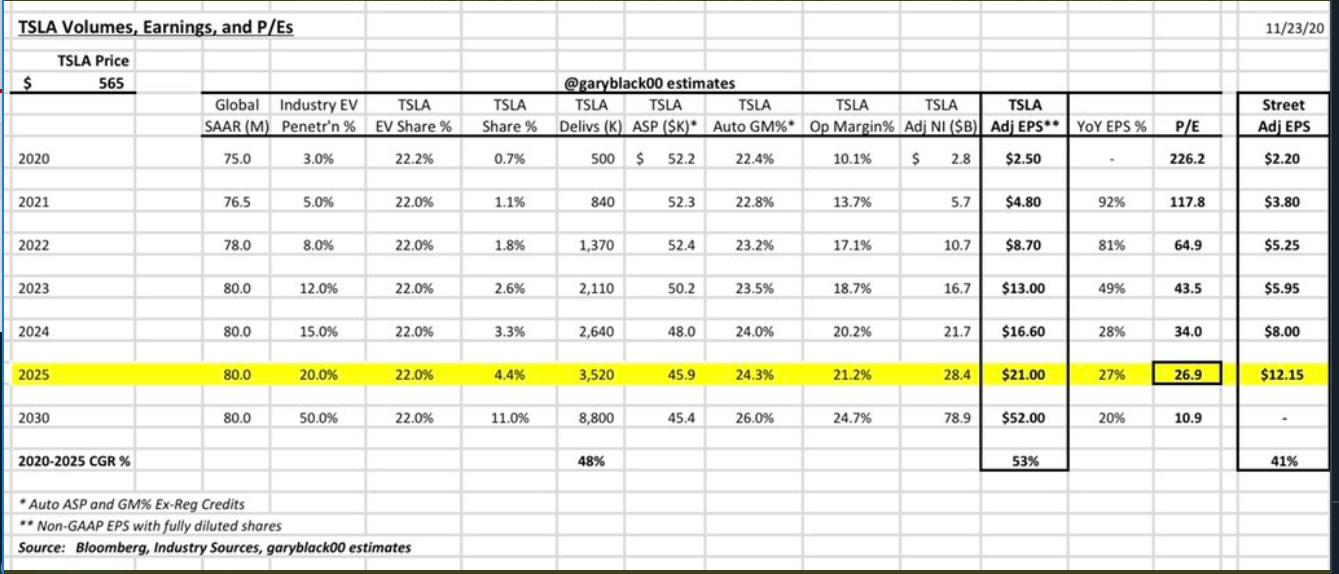

Here's how Gary Black models $TSLA through 2030:

Note he has P/E declining to 10.9 in 2030 as $TSLA becomes subject to the law of large numbers. I think it will be higher than

that due to Tesla's high-margin software revenues from FSD and their forthcoming Tesla 3rd Party App Store.

His latest thoughts "we are at +40% I would start to be cautious here":

3/ $TSLA has several catalysts in Dec/Jan that will help close the value gap between $565 price and $720 value. TSLA could give back some gains after inclusion as $FB did in 2013, but take off again after New Year‘s with 4Q vols, Biden’s inaugural address, and FY’21 vol guide.

Gary Black @garyblack00 29m:

"$TSLA following same pattern as last few days: Down pre-market as those who’ve sold weekly calls sell stock to buy the calls back cheap; causes S/T traders who thought TSLA going to $600 to bail out; institutional managers who want to buy TSLA at lower prices come in and prices go back up."

Makes sense to me!

Here's how Gary Black models $TSLA through 2030:

Note he has P/E declining to 10.9 in 2030 as $TSLA becomes subject to the law of large numbers. I think it will be higher than

that due to Tesla's high-margin software revenues from FSD and their forthcoming Tesla 3rd Party App Store.

His latest thoughts "we are at +40% I would start to be cautious here":

3/ $TSLA has several catalysts in Dec/Jan that will help close the value gap between $565 price and $720 value. TSLA could give back some gains after inclusion as $FB did in 2013, but take off again after New Year‘s with 4Q vols, Biden’s inaugural address, and FY’21 vol guide.

Attachments

Last edited:

Artful Dodger

"Neko no me"

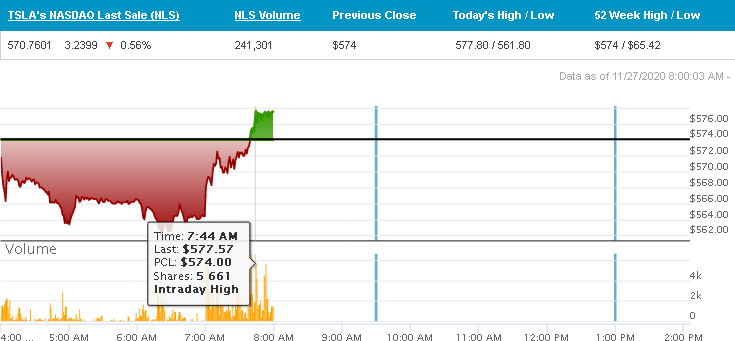

Well howdy, 7 AM cowboys have entered the paddock.

8 AM Volume is 670K

Cheers!

Nov. 27, 7:02 a.m. EST · Pre-market 570.00 −4.00 (0.70%)

Nov. 27, 7:44 a.m. EST · Pre-market 577.49 +3.49 (0.61%)

Nov. 27, 7:44 a.m. EST · Pre-market 577.49 +3.49 (0.61%)

8 AM Volume is 670K

Cheers!

Last edited:

RobStark

Well-Known Member

IMO Tesla is unique in that it makes high end cars like; Mercedes, BMW, Audi and even Ferrari, but also increasingly mid-market cars and lower priced cars like Ford, Toyota and GM. Tesla can survive in a wide range of price points.

Tesla isn't unique in this respect.Mercedes,BMW, and Audi sell cars at lower price points than Tesla

Ford and Toyota sell quite a few cars in the $100k plus category. 2021 Ford GT will sell for about $500k and a Lexus LS 500h goes upwards of $200k.

GM sells $4k cars in China as well as $120k Escalade Platinums. It will shortly start selling electric cars that compete directly with Rolls Royce. GM's cheapest car in the US starts at $13,500.

$577.74 new intraday ATH in premarket

(Is it correct to call it intraday in premarket? I'm a noob)

(Is it correct to call it intraday in premarket? I'm a noob)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K