I always remember the FSD car in Demolition Man and it's retractable steering wheel and the 'safety foam' when it crashes!! Great film!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nolimits

Member

Hoping today won’t be disappointing. With the Gs upgrade, I am expecting an above 600 finish and push through the MMs, and hold against option sellers. Anyone thinking Possibly another vaccine news on Monday to bring to ATH?

Artful Dodger

"Neko no me"

Fun Fact: Since the day of the TSLA stock dividend announcement (August 11), we are up +116% in 116 days.

Coincidence?

Cheers!

Coincidence?

Cheers!

UnknownSoldier

Unknown Member

More proof this is a simulation?Fun Fact: Since the day of the TSLA stock dividend announcement (August 11), we are up +116% in 116 days.

Coincidence?

Cheers!

Troy offers his latest forecast for 2021.

https://twitter.com/TroyTeslike/status/1334718363944292353

To summarize:

Fremont: 398K

Shanghai: 432K

Berlin: 27K

Austin: 10K

Grand Total: 867K

My 2 cents:

Fremont and Shanghai look about right, though his Model Y numbers might be on the low side. If 550K in Shanghai happens as rumored, then we are looking at 1M grand total.

I believe his numbers for Berlin and Austin are way too low, but everything hinges on how quickly DBE is scaled up. IMO, the fact construction on both sites proceeds at such a rapid pace bodes well for how quickly they will ramp. Troy is being very conservative with only 37K (27K in Q4 alone) between them. It could end up being 3-4x that.

It looks to me that Troy's production estimates are rather low for next year.

Production capacity is 590k at Fremont at end Q3, multiply by 0.85 to get actual production this is about 500k, but the Model Y is still ramping up so I would expect a few more than 500k from Fremont. Shanghai looks about right maybe a bit high, production capacity at end of next year is supposed to be 550k, 85% of that is 467k, but the total for next year will be lower as they are ramping up.

If Berlin are ramping up to 500k at end 2022 starting mid 2021 a very rough estimate would be capacity of 150k at end of 2021 and production of 25% of that capacity so maybe 40k. Austin is about one quarter behind Berlin but the factory is larger so a guess of 20k.

To summarize my guestimate:

Fremont: 500k

Shanghai: 400k

Berlin: 40k

Austin: 20k

Grand Total: 960k

Fun Fact: Since the day of the TSLA stock dividend announcement (August 11), we are up +116% in 116 days.

Coincidence?

Cheers!

Remember all the times we discussed how awesome it'd be if the stock just gained less than 1%/day for an extended period?

Turns out, we were right. (+116% in 116 days corresponds to 0.667% rise daily for the period.)

You’re referring to the Ultralite/EV1, correct?Give it bit more ground clearance (or variable height suspension) and this is actually something I'd love to own.

Bent steel plates for rough trucks, cast composite bodies for normal cars.

Fused front/rear doors to reduce part count.

Love it.

Just lose the mirrors

I have a feeling that Shanghai production in Nov-Dec will be higher than a lot of analysts expected and estimates will need to be upped. With higher scale and LFP I expect prices will come down, then they will add new markets in Singapore, Thailand and maybe even Indonesia as a part of a factory deal. Thus I think Shanghai will max out Model 3 all of 2021. I expect Y to ramp much faster than 3 as it shares many parts and they now have skilled workers they can shift around and logistics up and running in China.It looks to me that Troy's production estimates are rather low for next year.

Production capacity is 590k at Fremont at end Q3, multiply by 0.85 to get actual production this is about 500k, but the Model Y is still ramping up so I would expect a few more than 500k from Fremont. Shanghai looks about right maybe a bit high, production capacity at end of next year is supposed to be 550k, 85% of that is 467k, but the total for next year will be lower as they are ramping up.

If Berlin are ramping up to 500k at end 2022 starting mid 2021 a very rough estimate would be capacity of 150k at end of 2021 and production of 25% of that capacity so maybe 40k. Austin is about one quarter behind Berlin but the factory is larger so a guess of 20k.

To summarize my guestimate:

Fremont: 500k

Shanghai: 400k

Berlin: 40k

Austin: 20k

Grand Total: 960k

Would not be surprised it it ends up being

Fremont: 500k

Shanghai: 450k

Berlin: 40k

Austin: 10k

Grand Total: 1M

Words of HABIT

Active Member

Both 1992 GM Ultralite 1 and 2022 GMC Hummer EV are non-functioning prototypes (so far). The Nikola Badger pick-up only made it so far as a computer rendering.Hi folks,

Just so you know the level of competetive progress that GM has made in its 30 year history of EV prototypes:

THIRTY YEARS OF GM PROGRESS:

1992 GM Ultralite1:

View attachment 614356

2022 GMC Hummer EV:

View attachment 614357

Albeit, that's "virtual" progress because the 1992 prototype was real (made from carbon fiber by Scaled Composites in Mojave, California), whereas the 2022 prototype is a computer rendering (made from photons in Wallyworld, Wakanda).

The End can't come soon enough.

Cheers!

2daMoon

Mostly Harmless

No, this wasn't Stallone. Stallone was in Judge Dredd, this remake was done by Karl Urban. It's one of my favorite films, but I've no idea how it would pertain to Tesla at all. Maybe Tesla defeats all odds against it to triumph in the end?

For me it was "Judgement Is Coming" on the movie poster that rang true as the market is coming to know Tesla and are finally judging it for all it is and will become.

Why my search turned it up, I have no idea.

Words of HABIT

Active Member

Since S+P inclusion announcement, TSLA is up approx. 45% due to front runners. IMHO I believe Elon's sledgehammer soufflé letter was an attempt to temper advancement of the share price until such time as Tesla is added to the index. To smooth out the share price rise. Knowing that S&P tracking funds must purchase +-$140B in Tesla between December 14th and December 21st (December 28th @Artful Dodger) TSLA should reach minimum $700 by index inclusion.

Not 24 hours later Goldman Hacks issues a $760 target, inciting further run up prior to the commencement of funds that are required or expected to puchase Tesla due to the S&P inclusion. Therefore I expect the run-up will now be much higer than $700, however there is greater chance of a more significant drop immediately after inclusion.

Long term, no issues whatsoever.

Not 24 hours later Goldman Hacks issues a $760 target, inciting further run up prior to the commencement of funds that are required or expected to puchase Tesla due to the S&P inclusion. Therefore I expect the run-up will now be much higer than $700, however there is greater chance of a more significant drop immediately after inclusion.

Long term, no issues whatsoever.

Artful Dodger

"Neko no me"

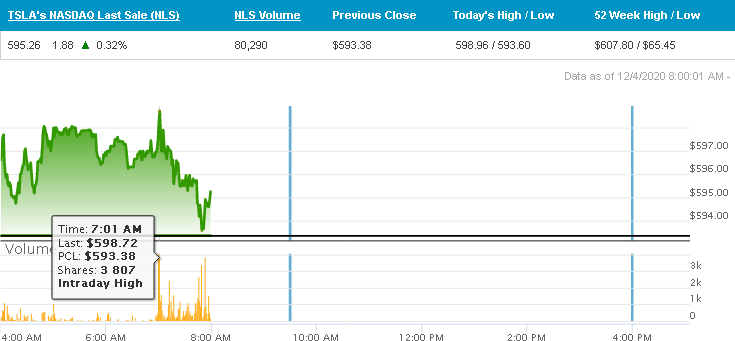

08:00 a.m. Whistle: Fri, 04 Dec 2020

TSLA share price: $595.26 +1.88 +0.32%

NASDAQ Volume 08:00 AM: 372,721 (Moderate)

Cheers!

TSLA share price: $595.26 +1.88 +0.32%

NASDAQ Volume 08:00 AM: 372,721 (Moderate)

Cheers!

Isn’t it Emmet Peppers that said in an interview with Dave Lee on investing that he took for 3M in contracts for calls of TSLA reaching $700?he agrees with youSince S+P inclusion announcement, TSLA is up approx. 45% due to front runners. IMHO I believe Elon's sledgehammer soufflé letter was an attempt to temper advancement of the share price until such time as Tesla is added to the index. To smooth out the share price rise. Knowing that S&P tracking funds must purchase +-$140B in Tesla between December 14th and December 21st (December 28th @Artful Dodger) TSLA should reach minimum $700 by index inclusion.

Not 24 hours later Goldman Hacks issues a $760 target, inciting further run up prior to the commencement of funds that are required or expected to puchase Tesla due to the S&P inclusion. Therefore I expect the run-up will now be much higer than $700, however there is greater chance of a more significant drop immediately after inclusion.

Long term, no issues whatsoever.

TheTalkingMule

Distributed Energy Enthusiast

Hedge funds used to get paid by fooling investors into volunteering fees in the hopes that hedge funds could reliably beat the wider market by a greater amount than those fees. Now that's been completely disproven, they're making money by manufacturing volatility. Ideally the SEC would be all over these shenanigans. Clearly that's not happening.Since S+P inclusion announcement, TSLA is up approx. 45% due to front runners. IMHO I believe Elon's sledgehammer soufflé letter was an attempt to temper advancement of the share price until such time as Tesla is added to the index. To smooth out the share price rise. Knowing that S&P tracking funds must purchase +-$140B in Tesla between December 14th and December 21st (December 28th @Artful Dodger) TSLA should reach minimum $700 by index inclusion.

Not 24 hours later Goldman Hacks issues a $760 target, inciting further run up prior to the commencement of funds that are required or expected to puchase Tesla due to the S&P inclusion. Therefore I expect the run-up will now be much higer than $700, however there is greater chance of a more significant drop immediately after inclusion.

Long term, no issues whatsoever.

Goldman's role in this inclusion is an interesting one. As a guy looking to sell CC's at an artificial peak, I hope they hold options through the true inclusion buying window and not just mid-December

Last edited:

CyberDutchie

Active Member

Looking at premarket, I predict today will be a boring day for TSLA, low volume and capped within 590 to 595 range. Hope I’m wrong and we break 600, but next week is more likely for that to happen.

samppa

Active Member

These arrived today in here in Helsinki. Looks to be MIC.

Looking at premarket, I predict today will be a boring day for TSLA, low volume and capped within 590 to 595 range. Hope I’m wrong and we break 600, but next week is more likely for that to happen.

My expectation is that it'll struggle to get to $600 and probably get dragged down to kill options. There's so many $600 calls that market makers would probably prefer to make them expire worthless. My guess would be in a trading range of $585-$600 with no fundamental news for today.

It was very clear that the players involved were keen on keeping this below 600 for the week.

Would love if they lost control on a Friday. Has happened before, but probabilities are low.

Would love if they lost control on a Friday. Has happened before, but probabilities are low.

Words of HABIT

Active Member

@samppa, in Helsinki, is it customary to hang Teslas from your Christmas trees? Cool.These arrived today in here in Helsinki. Looks to be MIC.

Knightshade

Well-Known Member

Hi folks,

Just so you know the level of competetive progress that GM has made in its 30 year history of EV prototypes:

THIRTY YEARS OF GM PROGRESS:

1992 GM Ultralite1:

View attachment 614356

2022 GMC Hummer EV:

View attachment 614357

Albeit, that's "virtual" progress because the 1992 prototype was real (made from carbon fiber by Scaled Composites in Mojave, California), whereas the 2022 prototype is a computer rendering (made from photons in Wallyworld, Wakanda).

The End can't come soon enough.

Cheers!

30 years?

Hell, how can you forget their 1956 video showing self driving cars?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K