Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

You forgot one more thing. Apparently this week was a bull trap, which means next week is the bear trap. It's nonsense that only bulls get trapped when everyone and their mother thinks Tesla will drop after inclusion. The market needs to make sure no one can make money when using market fundamentals to gauge which way something goes vs actual fundamentals of the company.I'm HODLing.

The news feed is telling me there will be a drop in the share price post inclusion (implying now is the price to sell at).

The volumes and share price don't make sense to me (again, trying to convince me to sell).

The FUD has increased significantly in the last week or so...

When I think I am being manipulated I take a step back and look at the situation.

I'm HODLing.

- The Tesla fundamentals are great.

- The Tesla Secret Master Plan is being executed almost flawlessly.

- There is no safer investment out there

- There is no better investment in our collective futures.

- I have no need to sell anything

Artful Dodger

"Neko no me"

10-day moving average MA(10): $622.15You want to know who is The God of Wall Street?

Find the guy that got to decide Closing Cross would be $622.

Diff. from Close: $0.62

StealthP3D

Well-Known Member

It's condescending that you think I don't know that.

I disagree. You are the one who reported the one day performance metrics of TSLA vs. your recently acquired stocks. If you thought one day performance metrics were "utterly meaningless" I wouldn't have expected you to report the numbers as if they meant something.

Artful Dodger

"Neko no me"

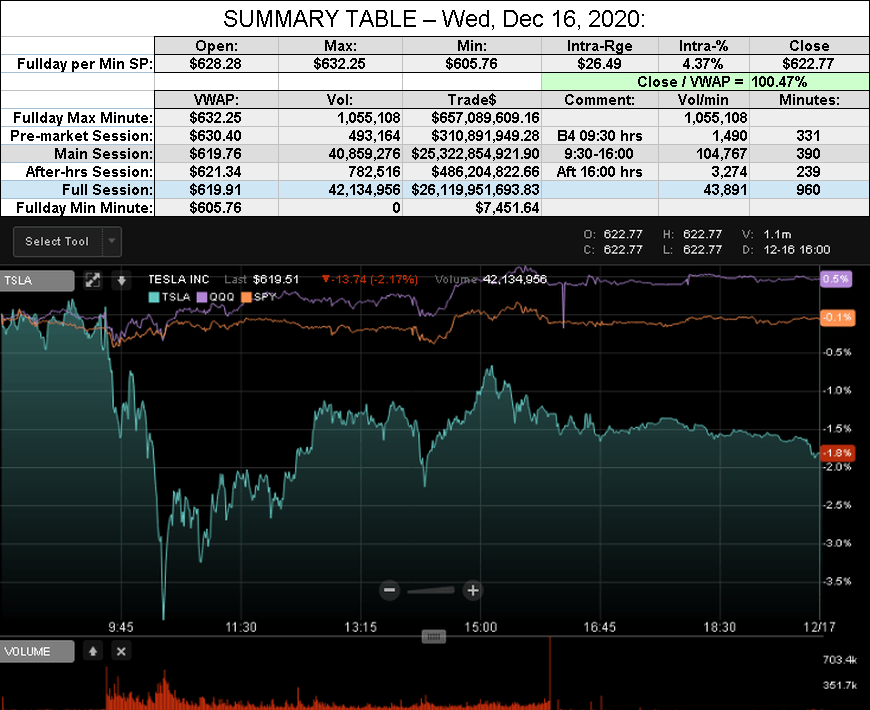

After-action Report: Wed, Dec 16, 2020: (Full Day's Trading)

Headline: "TSLA Hugs its 10-Day MA on D-3"

QOTD: @MP3Mike "There are a lot of deck chairs that need rearranged"

Comment: "Low volume; attraction to 10-day Magnet "

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Hugs its 10-Day MA on D-3"

Traded: $26,119,951,693.83 ($26.12B)

Volume: 42,134,956

VWAP: $619.91

Close: $622.77 / VWAP: 100.47%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $550 (+$10 since Tue)

Mkt Cap: TSLA / TM $590.324B / $215.644B = 273.75%

Note: Yahoo Finance yet to update TSLA Mkt Cap re shares issued Dec 11 (SEC Filing)

CEO Comp. Status: (est'd Mkt Cap including Dec 11 shares)Volume: 42,134,956

VWAP: $619.91

Close: $622.77 / VWAP: 100.47%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $550 (+$10 since Tue)

Mkt Cap: TSLA / TM $590.324B / $215.644B = 273.75%

Note: Yahoo Finance yet to update TSLA Mkt Cap re shares issued Dec 11 (SEC Filing)

TSLA 30-day Closing Avg Market Cap: $546.97B

TSLA 6-mth Closing Avg Market Cap: $373.69B

Mkt Cap req'd for 6th tranche ($350B) reached Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche.

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $373.69B

Mkt Cap req'd for 6th tranche ($350B) reached Mon, Dec 07, 2020

Nota Bene: Operational milestones are req'd for this tranche.

FINRA Volume / Total NASDAQ Vol = 55.0% (55th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 29.8% (40th Percentile rank Shorting)

FINRA Short Exempt ratio was 2.40% of Short Volume (59th Percentile Rank Exempt)

FINRA Short / Total Volume = 29.8% (40th Percentile rank Shorting)

FINRA Short Exempt ratio was 2.40% of Short Volume (59th Percentile Rank Exempt)

QOTD: @MP3Mike "There are a lot of deck chairs that need rearranged"

Comment: "Low volume; attraction to 10-day Magnet "

View all Lodger's After-Action Reports

Cheers!

When I feel like selling before the stock drops, I turn around and ask my accountant how much tax I would pay, every time I turn back and push the HODL button really hard.

Yes, it’s enough to make your head swim.

Sell now, get a huge profit, and maybe the price plummets after inclusion… now you owe a pile of money in taxes with a greatly reduced portfolio value.

After the split, $500 was a fair price, or $420. Company fundamentals have only gotten better since then. There could be a down period. But then, earnings call, good deliveries, factories being built and opening… S&P500 shenanigans will all be in the past in six months, and you’ll be glad to have chairs you could never buy back at the price you might have sold for.

Zhelko Dimic

Careful bull

That's 4M sharesI don't think the capping has anything to do with S&P inclusion, just the usual options/IV play, but on steroids for this week. Lots for them to lose $650 and above, and if they can convince call holders the same, then they can re-buy those calls for peanuts.

Here's the chart for Friday - 41m shares at play at $700 strike, that's insane

View attachment 618131

Thanks for the clarification, so by "capital flowed" you were talking market cap increase as opposed to (cash) money invested into Tesla. I wasn't sure if you had some other data source that could provide net position changes. (Versus the hypothetical of one share traded at $1k just before close).TSLA Mkt Cap at the Close on Tue, Dec 8 - "..." on Nov 16

The Mkt Cap values are in my daily After Action reports, or you can compare them to Google's daily charts:

View attachment 618327View attachment 618331

Note that I've added in $5B Mkt Cap for the Dec 11 shares, since S&P DJI documents state that, during the freeze period, weights will not be adjusted except for "corporate events". Issuing new shares qualifies, and I think that's one reason that Tesla wanted to expedite the "At-the-Market" offering so that the shares would be delivered by Dec 11.

Even then, from a Tesla point of view, only the $5 billion in new shares sold is capital to them. Stock appreciation is good for empolyees and peeps with shares or options though.

Respect to Artful Dodger, but how can you assume the market cap corresponds to net inflow? Small amounts of inflow can cause large increases in the SP, especially on low volume / AH. Moreover, Tesla is very streaky, which I think would exacerbate that discrepancy.TSLA Mkt Cap at the Close on Tue, Dec 8 - "..." on Nov 16

The Mkt Cap values are in my daily After Action reports, or you can compare them to Google's daily charts:

View attachment 618327View attachment 618331

Note that I've added in $5B Mkt Cap for the Dec 11 shares, since S&P DJI documents state that, during the freeze period, weights will not be adjusted except for "corporate events". Issuing new shares qualifies, and I think that's one reason that Tesla wanted to expedite the "At-the-Market" offering so that the shares would be delivered by Dec 11.

Please note I am not referring to the $5B raise, which obviously was a net inflow and contributes to near term liquidity.

StealthP3D

Well-Known Member

Great to see that confirmation. That scenario made zero sense to me. How can a fund screw over investors in that fund by taking on risk just to increase earnings in another fund? Seems like a breach of fiduciary responsibility.

This doesn't prohibit speculation (the taking on of risk) by funds - it prohibits transfers between funds at other than the market price. If the transfer is set up as a futures contract in advance of the transfer, then the price at transfer would not be the current market price - it would be value of the futures contract at the time the agreement was entered into.

This would be unlikely to be useful for Index funds even if their individual rules don't prohibit it, but benchmarked funds will account for more of the post announcement buying than index funds (albeit spread over a much longer timespan).

MMs make money when the market does the opposite of what most option buyers think will happen.You forgot one more thing. Apparently this week was a bull trap, which means next week is the bear trap. It's nonsense that only bulls get trapped when everyone and their mother thinks Tesla will drop after inclusion. The market needs to make sure no one can make money when using market fundamentals to gauge which way something goes vs actual fundamentals of the company.

It does almost seem like a nice and honest job when your job is to screw the greatest number of people.

StealthP3D

Well-Known Member

I think the issue is liquidity. Many have argued for a mother of all squeeze to occur as not enough shares can be found to supply indexers. However, if big firms can bring their own shares to the pool and let market pricing sort it out, the above scenario won't happen. Additionally, assuming speculators can see this unfold in real time, they'll quickly figure out that they don't hold as much leverage as they thought they did, which means they'll more likely let go of their shares. The mere fact that this week has been uneventful so far must have spooked many into selling.

With so many posts here completely missing the mark, I'll nominate this as one of the best! ^ Good job!

It's hard to believe you posted it hours ago and yet it only had 4 positive votes! Maybe people only upvote posts that make $$ dance in their heads.

StealthP3D

Well-Known Member

Right, but if I'm a shareholder in fund XYZ it's not serving my interests for the fund to sell TSLA just to help out a sister fund. That's sketchy AF. For instance I own some of Vanguard's Windsor fund. They don't hold Tesla but say they do. If that fund sells TSLA so that VFINX (their S&P500 fund) can buy those shares without a price spike, they are actively choosing to decrease my returns so that VFINX can "have a better price". That can't be legal. (of course they can pretend it was just standard trading but the incentive doesn't seem high enough to skirt the law)

That's not what @dl003 said. The transfers would all be done at market price. It's not to "have a better price" for one fund over the other. It actually benefits both funds for the following reason: It can be tricky if you have a lot of shares to acquire or liquidate because, no matter which it is, the very act of acquiring or liquidating tends to make the price go in an unfavorable direction for you. This brings price stability for both parties.

TheTalkingMule

Distributed Energy Enthusiast

You're traveling an awful long distance to win semantical and mostly pointless arguments this week. Yes, theoretically two Vanguard funds could set up some kind of arrangement to transfer funds at an other-than-market price. But there's almost zero chance they do and nearly zero chance they will, so who cares? One fund will almost certainly sell as an entity distinct from the other who will then buy or will have already bought. The OP was correct enough.That's not what @dl003 said. The transfers would all be done at market price. It's not to "have a better price" for one fund over the other. It actually benefits both funds for the following reason: It can be tricky if you have a lot of shares to acquire or liquidate because, no matter which it is, the very act of acquiring or liquidating tends to make the price go in an unfavorable direction for you. This brings price stability for both parties.

Big deal if you are a vw shareholder.

Every legacy is always late to the party, including jumping in the ev train just to boost share price due to Tesla's meteoritic rise. Nikola, nio, li, xpeng and even Gm have played this card. Vw and the rest are lagging. How hard is it to say " we are going to invest into 100% ev" just to have stock price jump. Easiest way to gain valuation on the market right now.

Tesla had to work their ass off and reinvent the battery to get here. The rest just needs a business plan..lol.

“Volkswagen’s travails have highlighted the pressure confronting global car makers, from General Motors to Toyota, as they seek to meet the challenge of reducing carbon emissions.”

WSJ is trying to make it sound like a noble mission… The only challenge legacy auto makers are thinking about is from Tesla, and Deitz is out front about recognizing that.

Big deal if you are a vw shareholder.

Every legacy is always late to the party, including jumping in the ev train just to boost share price due to Tesla's meteoritic rise. Nikola, nio, li, xpeng and even Gm have played this card. Vw and the rest are lagging. How hard is it to say " we are going to invest into 100% ev" just to have stock price jump. Easiest way to gain valuation on the market right now.

Tesla had to work their ass off and reinvent the battery to get here. The rest just needs a business plan..lol.

not sure if you saw the note Diess put out a while ago. It was thoughtful and committed... seemed like he threw down the gauntlet and said ‘we have to be like Tesla or we are done, and I’m willing to lose my position if you disagree’.

it’s a net positive for the planet and may become Tesla’s only real competitor.

woodisgood

Optimustic Pessimist

It does almost seem like a nice and honest job when your job is to put screws into the greatest number of people.

FTFY

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K