Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

HG Wells

Martian Embassy

haid

Member

Remember that scene in "Hunt for Red October" where the Russian sub took the safety device off the torpedo so that it could be used in close proximity? That's kind of like what is happening ...

https://twitter.com/truth_tesla/status/1339953776329961474?s=20

Nasdaq regulators secretly conferred whether to lift TSLA's +10% rally circuit breaker, to allow more liquidity today. Presumably they were worried about an index squeeze halting the stock and amplifying the squeeze.

woodisgood

Optimustic Pessimist

Is it going to get hyphy? I was promised hyphy.

woodisgood

Optimustic Pessimist

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

For what it's worth, Rob Maurer just covered this issue on his livestream - he's looking for 130M share demand, expecting a 30M dump out of the gate from extended index funds, etc., for a net of 100M share demand.

He's also really tempering expectations based on conversations he's had over the last day or so from folks who are saying that HFs have been preparing for this for a long time, people can short on close, etc.

Listened to him - I think it's very reasonable what he says: This inclusion has been on the radar for a long time and a lot of money is on the line. There are big hedge funds and HF-traders who are pros when it comes to index arbitrages and shorting will create a lot of "artificial liquidity" and so we shouldn't expect a big peak.

TheTalkingMule

Distributed Energy Enthusiast

I could see your bottom three triggering today, if my internal model of the closing cross is at all accurate. So....50/50 chance of that.I don't expect anything to trigger really. The process is likely greased well, somehow.

But what if?

pz1975

Active Member

Wow I think you called it!15 minutes away from the Robinhood retail options dump. It is typical for Robinhood to sell all options that the holder does not have cash to exercise about an hour before close.

Model S M.D.

Ludicrous Radiologist

bkp_duke

Well-Known Member

I love my shares, so if index managers want the shares they have to pony up big time.

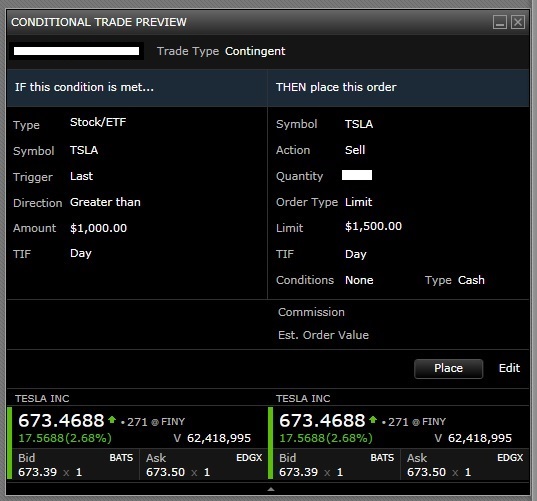

My bullish AF conditional trade. Set this up for all my shares.

My bullish AF conditional trade. Set this up for all my shares.

TheTalkingMule

Distributed Energy Enthusiast

Just to be sure.....normal GTC limit orders flow right into the closing cross, correct?

There's no need to set some other type of order specifically for the cross?

If that's all true, and the previous few pages of process clarification are true, 3:50-4:00 is going to break the internet because the entire shortfall will be arbitraged by algos and traders in 1/4 of a second. Best have your orders in place well before 3:45.

I think we'll trickle up to $700 shortly, then pop at 3:50 to god knows what, then I have no idea......hopefully we all come out alive.

There's no need to set some other type of order specifically for the cross?

If that's all true, and the previous few pages of process clarification are true, 3:50-4:00 is going to break the internet because the entire shortfall will be arbitraged by algos and traders in 1/4 of a second. Best have your orders in place well before 3:45.

I think we'll trickle up to $700 shortly, then pop at 3:50 to god knows what, then I have no idea......hopefully we all come out alive.

StealthP3D

Well-Known Member

I'm trying to figure this out too. In terms of potentially "catching a spike", I placed a limit sell order as a "DAY + EXT", which can execute through e*trade any time between 7AM-8PM EST. I chose this over a LOC order because I would take this price before, after or during the closing cross.

I could be completely wrong, of course... Maybe there's a spike above my price that ONLY occurs during the cross, but I am hopping I'd still be eligible for the cross based on this from the NASDAQ FAQ.

Does anybody know this to be incorrect, or have a different perspective?

View attachment 618927

I'm not an expert on this and different brokerages do have their own unique ways of doing things so if you have any doubt, ask your broker.

That said, if the cross closing price is higher than your limit order, it looks like it would probably execute (unless there were other orders ahead of yours with the same limit price). However, if I were to do this, I think I would place the order just as a regular hours order and then, if it doesn't execute, enter it as an extended hours order. KISS principle.

I haven't had time to think about this. Too busy today talking to IBKR about holding ITM options expiring today until final minutes before close

I just sold mine in the morning. Didn't want them to burden my surfing sessions.

So please enlighten me: is there anything stopping MM from abusing their power, and massively naked short the stock to "balance" the market? That's why they are allowed to do it after all right?

Then they can slowly unwind their short in the next few trading days next week?

am i missing something?

The risk that on Monday Tesla will for each issued share issue an additional dividend share?

I believe Tesla already have the paperwork in order to do a two for one split, so in principle it could happen at any time - and the experience from the previous split seems to indicate that the re-issuing of shares would require that all shares were accounted for.

More from Rob: Per a trader, benchmarked fund managers are unhappy with having to make a decision on TSLA (to buy or not to buy), since its inclusion in the S&P will affect their alpha. They could decide to add TSLA at close (up to 200M shares approx.) so they can continue to ignore its effect on their performance. He's also describing conversations with a trader theorizing that benchmarked funds will act as a support for the price on any drop post-inclusion, so they can generate alpha.

New I love my shares, so if index managers want the shares they have to pony up big time.

I love my shares more than you love yours.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K