Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Wheel ticks, accelorometer and steering angle are feedback from the vehicle itself and are always necessary for control loops.Of more relevance is that apart from radar+camera(s) the #Tesla FSD already uses a range of sensors. Per Karpathy's autonomy day presentation these include (and are not limited to): ultra-sonic parking sensors, wheel ticks, accelerometers, wheel steering angle, etc.

Apart from the car already using non-camera sensors, there should be a significant cost reduction to justify removing a sensor - compared to the increase in the risk of having an avoidable collision. Lidar seems expensive (and cumbersome) enough to not use it (because it is of limited help). But a radar is much cheaper and has already been designed into the car. As for the above examples, any sensor that is already deemed necessary for other purposes (e.g. the ultra-sonic parking sensors) should obviously be kept, since they offer no potential for reducing cost.

ultrasonic sensors are probably necessary as cameras don’t have a sufficiently wide field of view at super close range. E.g., if you’re inches away from an obstruction that is very low in a parking spot.

Radar is only necessary for superhuman performance. It’s unlikely needed to be 10X better than human. And while human driven vehicles are on the road, it is dangerous for even a Robotaxi to drive in extremely poor visibility. Think being in the middle of a 100 car pileup in dense fog.

I'll take a 19% rise on Monday thank you very much.I think last time made a report on Tesla was also during the weekend. The Monday following stock price went up by about 19%. Mind you Cathie Wood was not as known back then. I also don’t know if the jump was caused by the report. There could be other factors involved.

However if it does not ...no big deal because it is all but inevitable it will have a much bigger rise in da future.

Truly is "Game,Set and match"

There’s no need for insurance In autonomous Robotaxi. Tesla assumes all liability and pays out directly.This guy didn't like Ark's assumptions in their model very much. I do agree the insurance part of bear vs bull is confusing. I wonder if they assume Tesla will cover the insurance part on a true fully autonomous robo taxi.

My few short term calls and I would love history to repeat itself, but I think it's more likely that the media focuses on the discrepancy between ARK's and Tesla's production forecasts, and on ARKs belief in robotaxis which wall street still has a hard time swallowing. These criticisms will suppress the stock movement in the short term.I think last time made a report on Tesla was also during the weekend. The Monday following stock price went up by about 19%. Mind you Cathie Wood was not as known back then. I also don’t know if the jump was caused by the report. There could be other factors involved.

But in the long term, it will be hilarious when history does repeat itself and all these people who thought Cathie was nuts in 2019, then regretted not listening to her in 2020 once again make the same exact mistake and miss out on another 4-5x. Some people never learn.

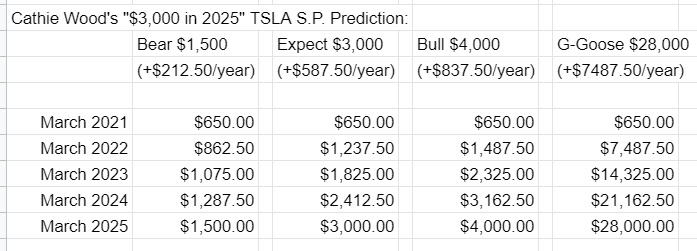

Cathie's S.P. Target average per year. If my $1,700 strike LEAPS expire in March 2023, that's a little close, but manageable/tolerable. Bear case, not so much, but I'm way more bullish than that. Cathie did not include the Semi nor storage, so arguably conservative estimates. I'm willing to accept that I might have to salvage underwater LEAPS by rolling them out to later expiring LEAPS if there's an extended downturn, but I have confidence in uncle Elon.

What am I missing? Thoughts?

... I'll just sit back and wait for everyone's validation now, like we all do after making a post here...

Edit-added Golden Goose as / @Christine600

What am I missing? Thoughts?

... I'll just sit back and wait for everyone's validation now, like we all do after making a post here...

Edit-added Golden Goose as / @Christine600

Attachments

Last edited:

G

goinfraftw

Guest

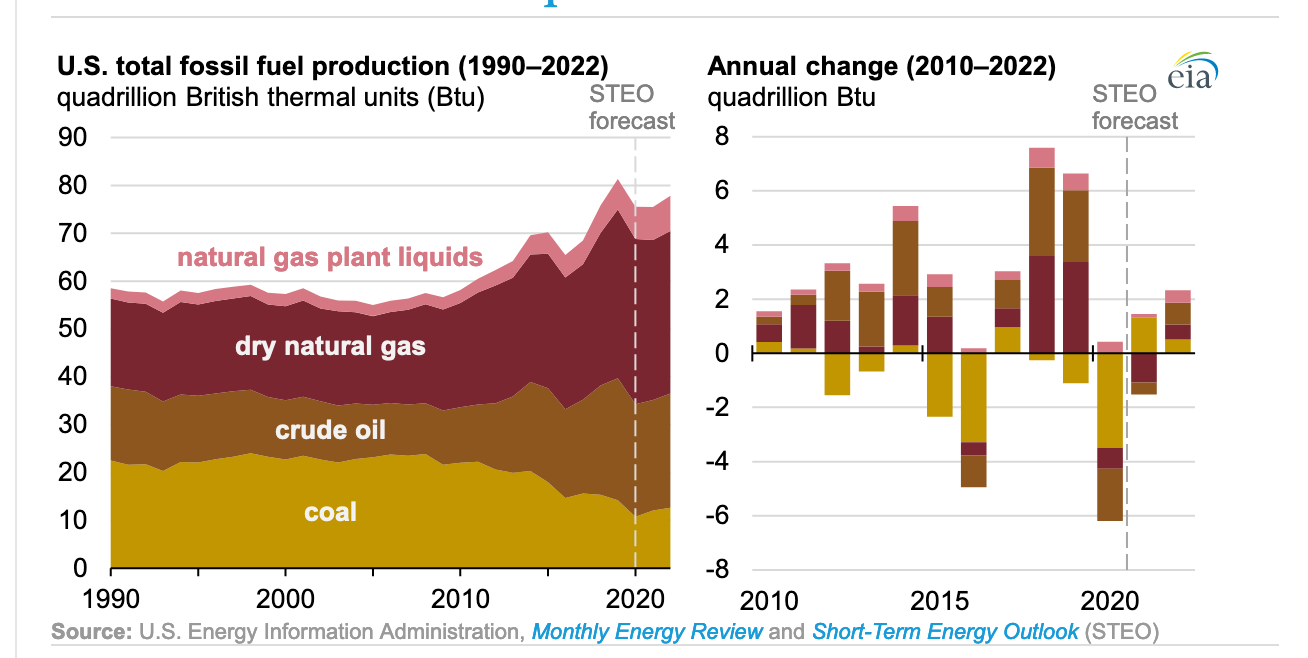

Anyone have data on fossil fuel consumption projections over the next 2-4 years?

Edit: Here's the historical. Fossil Fuels

Edit: Here's the historical. Fossil Fuels

No other analysts include ride hailing or robotaxies which their report is based on. Why not stick more to things that actually generate revenue already vs throwing in so much speculation? When robo taxies become a thing and is generating revenue, don't worry, every analysts knows how to figure the numbers out. Figuring out robotaxi revenue can be done on a napkin and doesn't need this much fanfare. Getting to robotaxi is the hard part and it's no guarantee that Tesla can do it.Ark’s rationale for not including Energy was that they wanted their forecasts to be directly comparable to other analysts (all of whom were ignoring energy).

Include a new row for the Golden Goose estimate. They did not specify one - only hinted at $28000 in one of their slides if every number turn out perfectly for Tesla. 4000 isn't that eye popping for some of us bulls.Cathie's S.P. Target average per year. If my $1,700 strike LEAPS expire in March 2023, that's a little close, but manageable/tolerable. Bear case, not so much, but I'm way more bullish than that. Cathie did not include the Semi nor storage, so arguably conservative estimates. I'm willing to accept that I might have to salvage underwater LEAPS by rolling them out to later expiring LEAPS if there's an extended downturn, but I have confidence in uncle Elon.

What am I missing? Thoughts?

View attachment 646524

... I'll just sit back and wait for everyone's validation now, like we all do after making a post here...

There’s no need for insurance In autonomous Robotaxi. Tesla assumes all liability and pays out directly.

Uninsured Robotaxi driving? I don't think that will ever happen in the future.

Insured by Tesla themselves? Yes.

Are we at 5 really? GF1 is kinda a joke at current size, and I don't see any signs of further build-out - do you?We are at five GF now. We are certainly going to 10. I can see 15 by 2030.

Thank you. THAT'S the reason I'm willing to accept the risk inherent in LEAPS.Include a new row for the Golden Goose estimate. They did not specify one - only hinted at $28000 in one of their slides if every number turn out perfectly for Tesla. 4000 isn't that eye popping for some of us bulls.

I was not thinking about that, except perhaps far back in my subconscious... I'll add the Golden Goose.

G

goinfraftw

Guest

Here we go: Fossil fuel production expected to increase through 2022 but remain below 2019 peak - Today in Energy - U.S. Energy Information Administration (EIA)

It's projected to increase over the next few years at least.

It's projected to increase over the next few years at least.

Just discovered another flaw in Ark’s report.

They took 2019 CapEx and applied it against 2020 production increase of 144k vehicles.

The methodology seems reasonable to a first approximation, but it misses a key point. 2019 CapEx enabled a GigaShanghai production capacity of 250k cars / year. They neglected to account for the effect of the 1st year ramp (and CapEx extends over many years/units). On a more minor point, they also neglected COVID shutdowns.

So CapEx per incremental unit of capacity = $1.3B / 250k cars / year capacity = $5200 / incremental unit. Which in addition to being far less than their $9200 number, is also less than their BULL case 2025 estimate of $6k / incremental unit of capacity.

GigaShanghai is truly a wonder!

However now that Tesla plans to start producing cells, it would seem like CapEx / unit would grow appreciably going forward.

They took 2019 CapEx and applied it against 2020 production increase of 144k vehicles.

The methodology seems reasonable to a first approximation, but it misses a key point. 2019 CapEx enabled a GigaShanghai production capacity of 250k cars / year. They neglected to account for the effect of the 1st year ramp (and CapEx extends over many years/units). On a more minor point, they also neglected COVID shutdowns.

So CapEx per incremental unit of capacity = $1.3B / 250k cars / year capacity = $5200 / incremental unit. Which in addition to being far less than their $9200 number, is also less than their BULL case 2025 estimate of $6k / incremental unit of capacity.

GigaShanghai is truly a wonder!

However now that Tesla plans to start producing cells, it would seem like CapEx / unit would grow appreciably going forward.

gabeincal

Active Member

Yes - and I do!

Can you provide an example of the diagonal spread that you do please?

They probably systematically re-architecture frequently. Jim Keller is a fan of this principle, so it’s likely the FSD team does this too. It prevents wasting time on dead-ends.

I think it is great that they are being agile and iterating rapidly. I was just pointing out that the changes they are making are a sign that a wide public beta release is further away than many were anticipating - probably months rather than weeks away.

Last edited:

Jack6591

Active Member

Anyone have data on fossil fuel consumption projections over the next 2-4 years?

Edit: Here's the historical. Fossil Fuels

My apologies...it’s the weekend. Tesla is in a target-rich environment.

I fear you might be right.

I think there was a big rewrite around 2 years ago, going from still frames to video. That also took a while.

Oh well. This is a huge endeavor.

Elon is pushing as hard as possible - he is not holding back.

But, in a weird way, solving FSD in 2-4 years might actually be more lucrative than solving it in 6 months.

FSD is still, to many just another tech-nerd pipe dream. It might very well not work. Why bother?

When (if)Tesla solves FSD they will instantly have a huge, fluorescent target on their back.

Tesla pre-FSD is just dangerous and annoying to big oil. Tesla with FSD: this is now a mortal threat.

You think fudsters, big oil and even country actors are fighting Tesla hard now? Just wait for Tesla to solve FSD, and their campaign to delay or sabotage Tesla will reach a fever pitch.

The higher production capacity Tesla has when FSD is fully ready, the better.

That is why Elon is ramping factory capacity and battery production so hard: He cannot forecast the arrival of FSD with precision, but knows that whenever it does arrive Tesla will need to operate in plaid mode.

Of course, the huge downside to Tesla being 'late' on FSD is that competitors might come first. But, as has been discussed before, most of them, except comma.ai, are relying on lidar and maps, and that just takes longer to scale.

Low power DL board + AWS like training tool for video DL + software stack for taking in multicamera video all towards supporting real time navigation in unpredictable environs.

Anyone think there's a product in that?

Nobody commenting on Ark's new forecasts?

ARK’s Price Target for Tesla in 2025 is $3,000 Per Share

ARK’s 2025 price target for Tesla is $3,000. ARK’s bear and bull case suggest it could be worth $1,500 and $4,000 per share, respectively.ark-invest.com

Interesting that they left out energy

No reasonable way to model it right now

Pras

Member

They did mention that it is likely overestimated. Also capex may increase as tesla brings more battery production in-house. So offsetting here a bit.Just discovered another flaw in Ark’s report.

They took 2019 CapEx and applied it against 2020 production increase of 144k vehicles.

The methodology seems reasonable to a first approximation, but it misses a key point. 2019 CapEx enabled a GigaShanghai production capacity of 250k cars / year. They neglected to account for the effect of the 1st year ramp (and CapEx extends over many years/units). On a more minor point, they also neglected COVID shutdowns.

So CapEx per incremental unit of capacity = $1.3B / 250k cars / year capacity = $5200 / incremental unit. Which in addition to being far less than their $9200 number, is also less than their BULL case 2025 estimate of $6k / incremental unit of capacity.

GigaShanghai is truly a wonder!

However now that Tesla plans to start producing cells, it would seem like CapEx / unit would grow appreciably going forward.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K