Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

thx1139

Active Member

Dont know there is a lot of anti rich sentiment and we are talking about people that have annual income over $1 million. Also what are the chances this is on short term gains. Long term gains likely lower.Would be political suicide. If it passed, they could kiss the majority goodbye.

They should stabilize the market by announcing that this is retroacted at least. Those who are front running this will get burned either way, or else the popularity of this bill is down the tube. Those who sold early doesn't have to pay the tax hike and leaving retirement accounts holding the bagWould be political suicide. If it passed, they could kiss the majority goodbye.

bkp_duke

Well-Known Member

Dont know there is a lot of anti rich sentiment and we are talking about people that have annual income over $1 million. Also what are the chances this is on short term gains. Long term gains likely lower.

The "anti rich" don't bankroll the campaigns of the those on both sides. The bankers and the like do. This is pure political pandering to the base, nothing more. Won't ever pass. Margins in House and Senate are too narrow.

And now back to your regular, scheduled programming.

Looks like my 755 Calls for tomorrow got a big help from this news. I should send a thank you to the WH.

EDIT - we literally closed at Max Pain. MM's must be loving this setup for tomorrow.

On topic, the stock is closing at $749.69 today.

Hmm... Technically only one digit was incorrect. I'll take it.

Tslynk67

Well-Known Member

Indeed - THEY were playing the tables to keep it below $750 for the week, rather successfully too, I may add, when they got a massive macro assist allowing them to take it right down to the MP number at $720What a surprise, heavy selling (manipulation) each time Tesla tried to get back to $720. Goal seems to be a close below $720, and looks like "they" will achieve their goal.

TBH I think they wouldn't expend that much energy keeping it down here, they already hedged for $750 I imagine, so might let it run up a bit tomorrow

henchman24

Active Member

I don't see a way >40% actually passes, but I feel any short/long capital gains structure should incentivize behavior. If you want to encourage long-term investment and growth, don't just make it an on/off at 1 year. Keep short-term the way it is, but then phase it down over the next 4 years to <10%... maybe make over 10 years 5%. Add 5% to all except short term if a person make over 500k.

lafrisbee

Active Member

could be..

The MM's closed today just below MaxPain so when it the SP closes around $800 tomorrow they can have a moral victory; "If Yesterday was Friday."

Could be...

The MM's closed today just below MaxPain so when it the SP closes around $800 tomorrow they can have a moral victory; "If Yesterday was Friday."

Could be...

Alternatively, you could chuckle at the desperation and fear driving the Street and their pet media outlets as they pull out all the stops to spew all of this FUD.I'm so disgusted how a reckless driving fatality is being opportunistically launched into this all out FUD event. Usually I let FUD bounce off me, but this has reached a new level of absurdity. Literally every media source I look at is pushing this false information. I need to take a news/media/mental health break.

Though, yes, it is healthy to take media breaks.

lafrisbee

Active Member

I think that was intentional. They wanted to screw with you.Hmm... Technically only one digit was incorrect. I'll take it.

I haven't seen this video referenced here:

It's from July, 2020 so not recent. Still very interesting.

Elon Musk talks AutoPilot and Level 5 Autonomy at China AI conference

It's from July, 2020 so not recent. Still very interesting.

Short term gains are already taxed as ordinary income, i.e. up to the 40%-ish for high income individuals.Dont know there is a lot of anti rich sentiment and we are talking about people that have annual income over $1 million. Also what are the chances this is on short term gains. Long term gains likely lower.

My concern is whether this will discourage buy-and-holding, thereby increasing instability in the market.

dhanson865

Well-Known Member

“there is no increase in the capital gains rate for taxpayers with income below $1 million.”.....Guess that does not apply to us TMC'ers since we are all make over $1M/year.

So far I've kept my AGI below $80,000 every year and haven't had to pay any capital gains taxes. I like the 0% tax rate column. (I guess living in a fly over state helps there also).

bkp_duke

Well-Known Member

Short term gains are already taxed as ordinary income, i.e. up to the 40%-ish for high income individuals.

My concern is whether this will discourage buy-and-holding, thereby increasing instability in the market.

If the politicians were smart, they would be looking at a small per-transaction tax. It would have near-zero impact on retail investors, but would generate revenue from the MMs and other big boys. To boot, it would probably have a positive impact on share price manipulation as well, not that we care about such things.

CLK350

Member

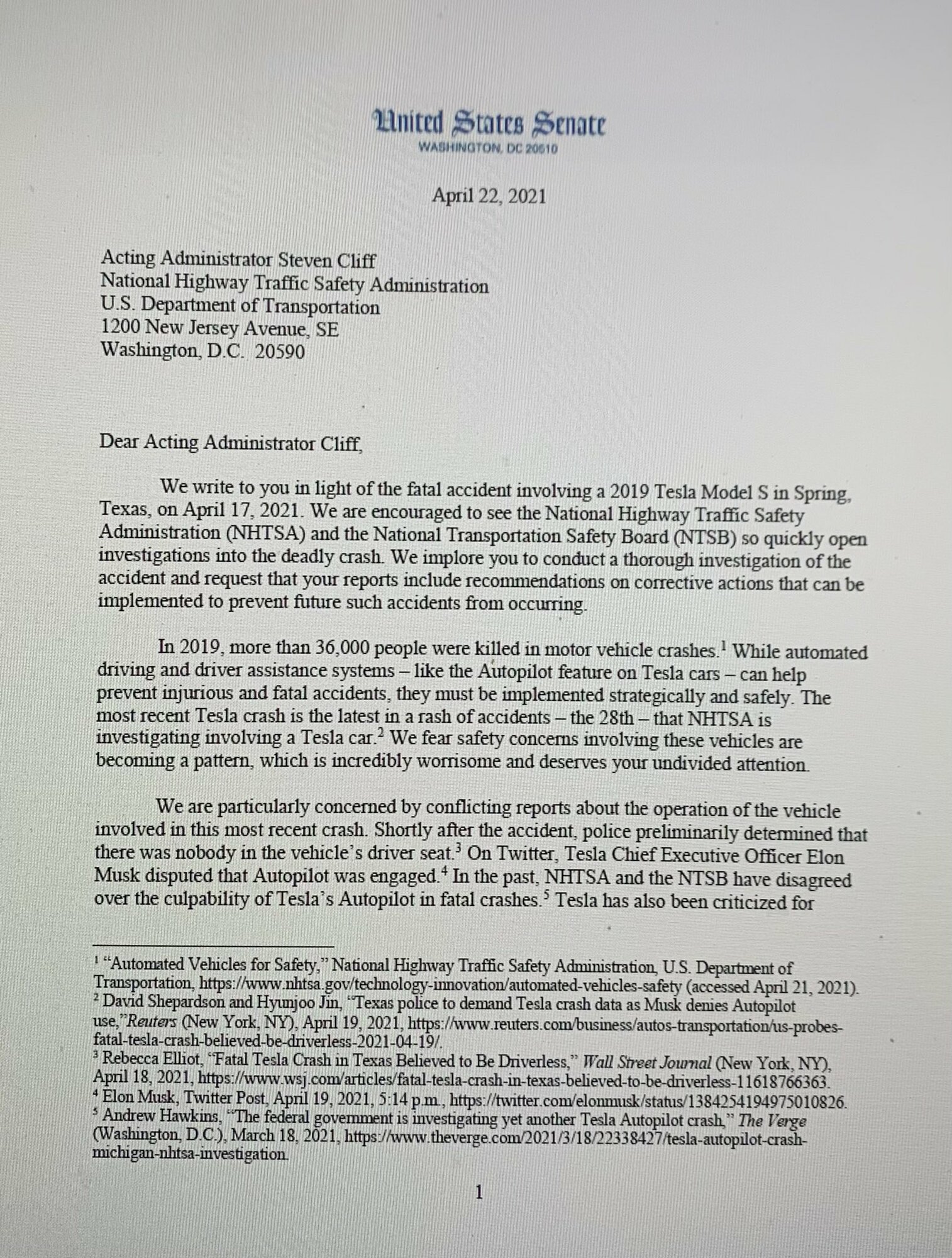

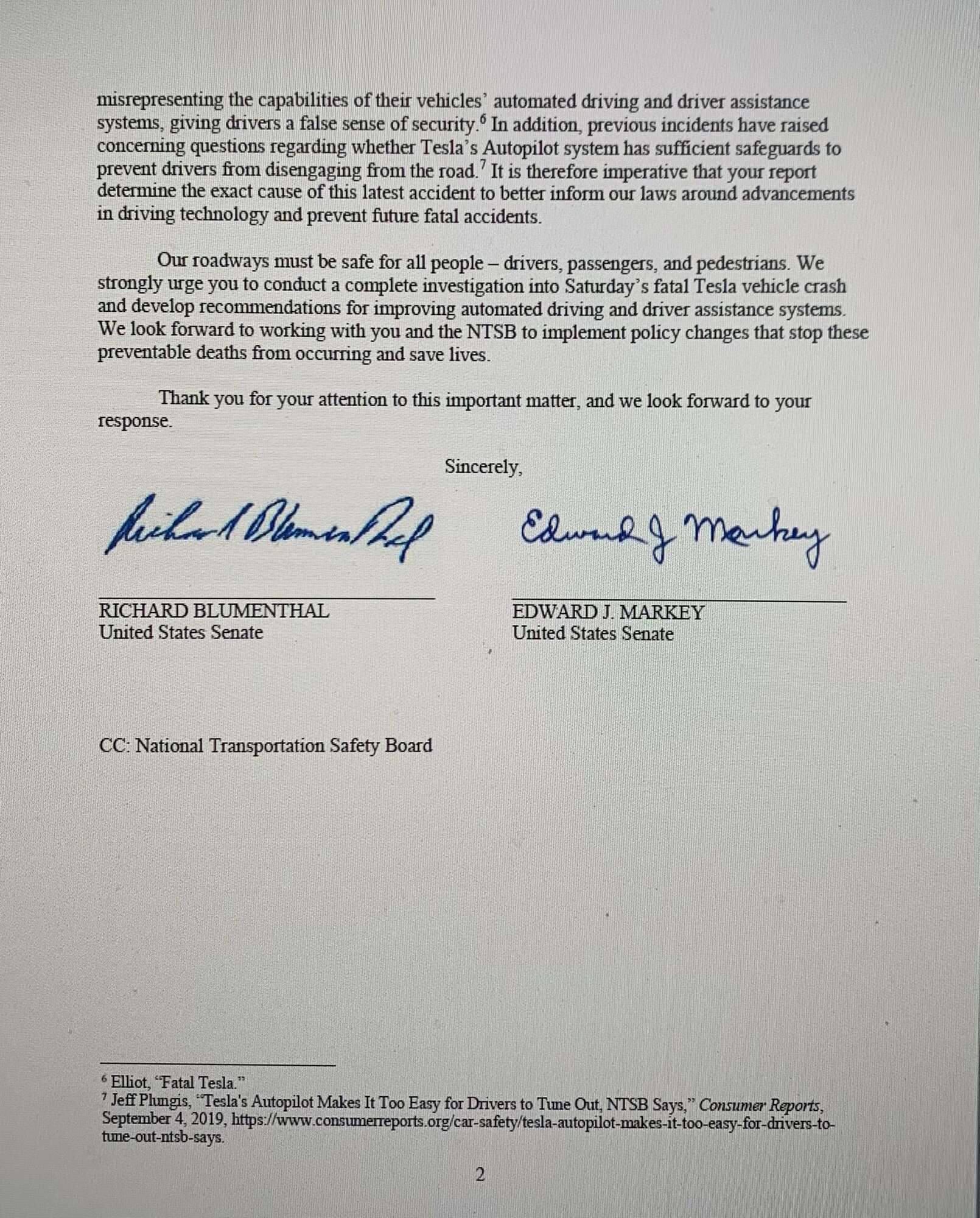

For the record here, our US senators repeating and aggravating the false narrative of the Texas accident - our politicians have no judgment OR are corrupt, which should be grounds for dismissal in any well run organization. Any way to get some sort of legal action here? I'm flabbergasted. Via Gary Black's Tweet - he advocates Tesla get a PR established to defend against such false narratives. Maybe a Pravduh comics series could be established to debunk, document these antics, and in this instance shame these senators. Subsidized by our tax moneys, working against the interests of a successful US company and in favor of companies that outsource their work overseas, favoring oil interests that also include as not so minor sidekicks the other oil producer nations, the swamp of Arab countries and Russia. Not sure where to include the South American oil interests, another can of worms from our dysfunctional foreign policies.

Last edited:

ZeApelido

Active Member

All I know is us Bay Area folk with insane housing prices but also higher incomes come out as losers when these tax policies get more aggressive .

bkp_duke

Well-Known Member

For the record here, our US senators repeating and aggravating the false narrative of the Texas accident - our politicians have no judgment OR are corrupt, which should be grounds for dismissal in any well run organization. Any way to get some sort of legal action here? I'm flabbergasted.

View attachment 656068

View attachment 656069

Couldn't find anything quickly on Blumenthal, but Markey looks to be in the pocket of the Big Oil lobbyists, and got caught accepting their donations and sheepishly returned them.

Sen. Markey to return almost $47,000 in donations from fossil fuel-connected lobbyists

Massachusetts Sen. Ed Markey plans to refund more than two dozen campaign contributions that broke a popular pledge to refuse money from fossil fuel-connected executives and lobbyists.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K