God, I hope this malaise doesn't last as long as that.As a long-termer, this definitely feels like when we were in the 350-400 range pre-split.

The FUD is definitely ramping. Maybe the big oil companies can see that with bidens focus on renewable energy etc, that this may be the last chance they have to stop the EV market exploding upwards.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Are you sure they're aluminum? (Ducks from Lodger)The magnetic signage kept falling off the aluminum door?

2daMoon

Mostly Harmless

Or, at least buy time for them to get clear of the blast zone.As a long-termer, this definitely feels like when we were in the 350-400 range pre-split.

The FUD is definitely ramping. Maybe the big oil companies can see that with bidens focus on renewable energy etc, that this may be the last chance they have to stop the EV market exploding upwards.

Last edited:

Things are different now than they were back then. Many more people are invested in Tesla, the company is now in the S&P500, they've posted six consecutive profitable quarters in a row, and they are growing like weeds on fertilizer.God, I hope this malaise doesn't last as long as that.

The MM's can exert as much pressure as they want to manipulate the stock, but not for extended periods of time like they used to be able to. At some point the upward pressure will overwhelm their efforts and breakouts will occur. And Tesla's popularity (and retail support) has grown such that FUD efforts are short lived manipulations at best.

They can only slow the Tesla Train down, but I don't believe they can stop it anymore. It's too far gone for that now, the writing is on the wall so to speak.

UkNorthampton

TSLA - 12+ startups in 1

Shouldn't there be a slow drip drip buy of shares from S&P500 trackers? Is the volume so low that MMs can manage that amount?Things are different now than they were back then. Many more people are invested in Tesla, the company is now in the S&P500, they've posted six consecutive profitable quarters in a row, and they are growing like weeds on fertilizer.

The MM's can exert as much pressure as they want to manipulate the stock, but not for extended periods of time like they used to be able to. At some point the upward pressure will overwhelm their efforts and breakouts will occur. And Tesla's popularity (and retail support) has grown such that FUD efforts are short lived manipulations at best.

They can only slow the Tesla Train down, but I don't believe they can stop it anymore. It's too far gone for that now, the writing is on the wall so to speak.

Todd Burch

14-Year Member

2daMoon

Mostly Harmless

I don't think they have to add any shares to stay balanced.Shouldn't there be a slow drip drip buy of shares from S&P500 trackers? Is the volume so low that MMs can manage that amount?

However, IIUC, once the upward trajectory reaches a point of discomfort the shorts will eventually have to cover by buying, and this ought to accelerate the eventual breakout rise in SP.

In the mean time, the shorts are making it easy for those backing up the truck to load up on chairs while the getting is good.

Some might go so far as to say, ...

Shorting TSLA is like tossing gasoline on a fire.

Last edited:

So ... is this worrying anyone? Like I guess a lot of you, I have a lot of unrealized capital gains in my portfolio. The problem with selling stock is that you have to pay taxes on it, which means your re-investment amount has now been slashed. So if you don't need to sell stock, you might not want to. In addition, inflation is a very real worry this time around, so being invested in the stock market isn't a bad idea. But if this passes (below), stock prices will come down. What to do, what to do...

---

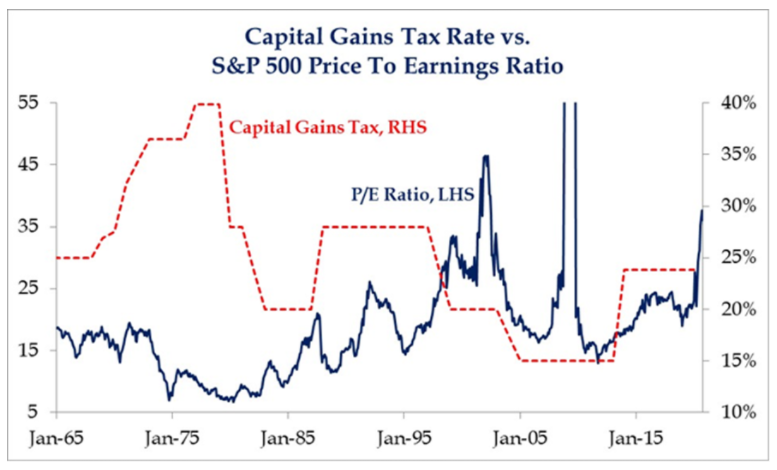

President Biden is set to announce tax increases on the wealthy as soon as next week to pay for an increase in funding for childcare and education. The proposal, called the "American Families Plan," would reverse some of former President Trump's tax cuts from 2017, while the capital gains tax for Americans making over $1M per year could nearly double to 39.6%. Coupled with an added 3.8% tax linked to the Affordable Care Act, that's a potential 43.4% levy. The new package would also include an increase in the top income tax rate, building on a recent infrastructure proposal to raise the corporate tax rate to 28%. Biden's proposals on capital gains would only affect the federal rate. Wealthy individuals who live in California and New York, which tax capital gains as regular income at 13.3% and 11.85% (plus 3.88% in NYC), would see total capital gains duties of nearly 60%. From a strategy standpoint, increases to the capital gains tax will likely present a secular headwind to multiples going forward. Over the last 40 years, capital gains taxes have been moving in a downward trend while multiples have been moving higher. With the opposite expected to occur now, we will likely see this trend reverse.

---

President Biden is set to announce tax increases on the wealthy as soon as next week to pay for an increase in funding for childcare and education. The proposal, called the "American Families Plan," would reverse some of former President Trump's tax cuts from 2017, while the capital gains tax for Americans making over $1M per year could nearly double to 39.6%. Coupled with an added 3.8% tax linked to the Affordable Care Act, that's a potential 43.4% levy. The new package would also include an increase in the top income tax rate, building on a recent infrastructure proposal to raise the corporate tax rate to 28%. Biden's proposals on capital gains would only affect the federal rate. Wealthy individuals who live in California and New York, which tax capital gains as regular income at 13.3% and 11.85% (plus 3.88% in NYC), would see total capital gains duties of nearly 60%. From a strategy standpoint, increases to the capital gains tax will likely present a secular headwind to multiples going forward. Over the last 40 years, capital gains taxes have been moving in a downward trend while multiples have been moving higher. With the opposite expected to occur now, we will likely see this trend reverse.

mekberg

Member

Pledged asset line. Pay off over time, or never, depending on your needs.So ... is this worrying anyone? Like I guess a lot of you, I have a lot of unrealized capital gains in my portfolio. The problem with selling stock is that you have to pay taxes on it, which means your re-investment amount has now been slashed. So if you don't need to sell stock, you might not want to. In addition, inflation is a very real worry this time around, so being invested in the stock market isn't a bad idea. But if this passes (below), stock prices will come down. What to do, what to do...

---

President Biden is set to announce tax increases on the wealthy as soon as next week to pay for an increase in funding for childcare and education. The proposal, called the "American Families Plan," would reverse some of former President Trump's tax cuts from 2017, while the capital gains tax for Americans making over $1M per year could nearly double to 39.6%. Coupled with an added 3.8% tax linked to the Affordable Care Act, that's a potential 43.4% levy. The new package would also include an increase in the top income tax rate, building on a recent infrastructure proposal to raise the corporate tax rate to 28%. Biden's proposals on capital gains would only affect the federal rate. Wealthy individuals who live in California and New York, which tax capital gains as regular income at 13.3% and 11.85% (plus 3.88% in NYC), would see total capital gains duties of nearly 60%. From a strategy standpoint, increases to the capital gains tax will likely present a secular headwind to multiples going forward. Over the last 40 years, capital gains taxes have been moving in a downward trend while multiples have been moving higher. With the opposite expected to occur now, we will likely see this trend reverse.

View attachment 656318

Today is a good setup for a possible afternoon explosion.

Options expiring today may be like lotto tickets. Although Friday usually MMs are firmly in control, this has happened in the past on a Friday. Remember one in particular where price exploded at 2pm and there all these OTM options that suddenly profited in percentages in the thousands.

This is also known as gambling.

Not an advice

Options expiring today may be like lotto tickets. Although Friday usually MMs are firmly in control, this has happened in the past on a Friday. Remember one in particular where price exploded at 2pm and there all these OTM options that suddenly profited in percentages in the thousands.

This is also known as gambling.

Not an advice

Pledged asset line. Pay off over time, or never, depending on your needs.

You mean borrow against your portfolio if you need income? Yes that works (especially at these interest rates). But the worry is that the value of especially growth stocks are going to go down. By a lot. The market always over reacts.

But this should be temporary in the end, no? Long time investors shouldn’t be affected at all.You mean borrow against your portfolio if you need income? Yes that works (especially at these interest rates). But the worry is that the value of especially growth stocks are going to go down. By a lot. The market always over reacts.

Guess this is definitely a medium term concern. But even so, if Tesla doubles from here in the next two years, what is the right play?

Jack6591

Active Member

I have heard this before...

apnews.com

apnews.com

Invest Big for Big Payoff.

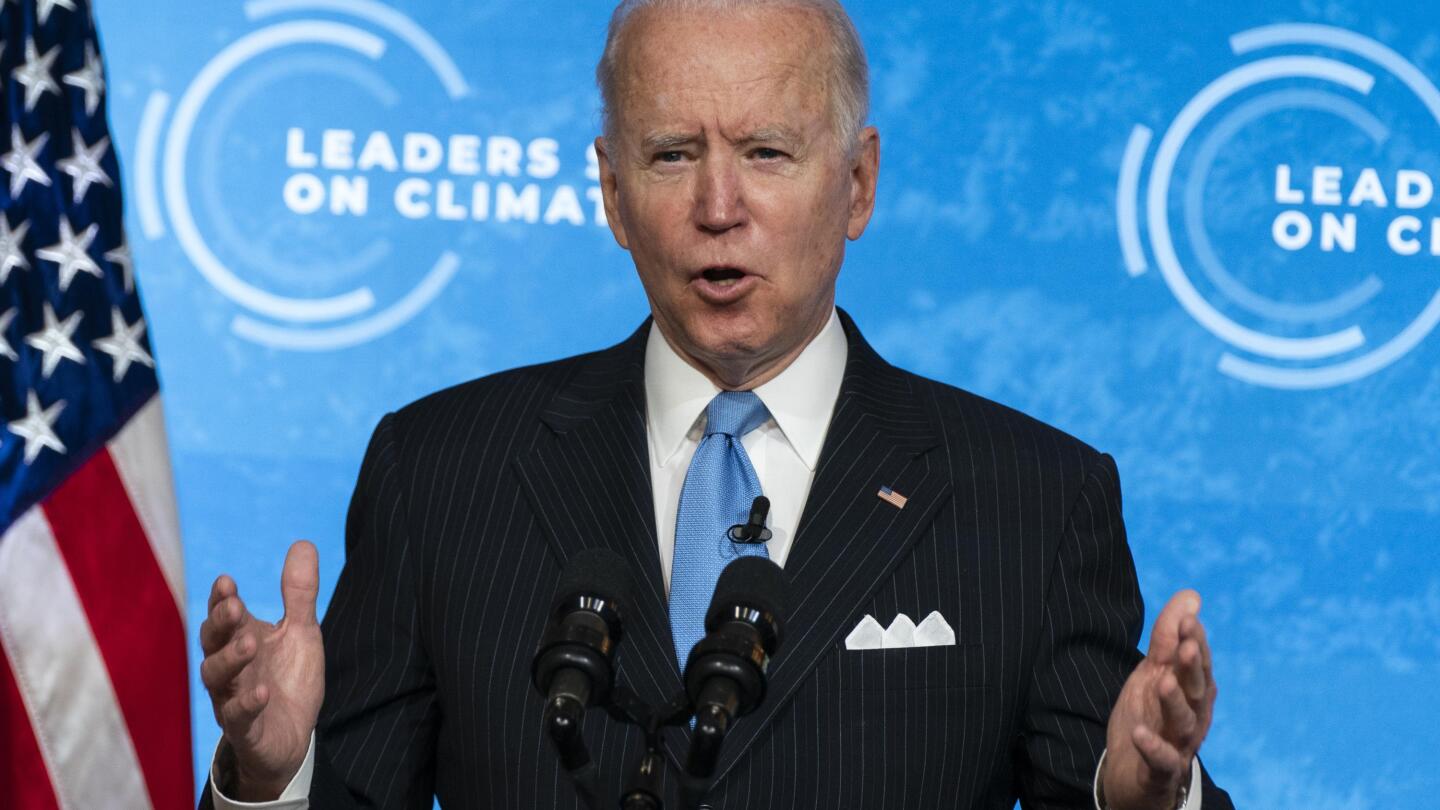

Go forth and spend: Call for action closes US climate summit

In closing President Joe Biden's global climate summit, world leaders shared stories of their own nations' drives to break away from climate-wrecking fossil fuels.

Invest Big for Big Payoff.

Todd Burch

14-Year Member

$730 has broken pretty definitively. If we climb a bit higher and don't see additional macro forces pulling us down, we may see things get intersting here in the afternoon. Technically there's one more day of trading for the FOMO (since results are released after close on Monday), but some people may be wanting in today.

2daMoon

Mostly Harmless

The volume this morning has been impressive.$730 has broken pretty definitively. If we climb a bit higher and don't see additional macro forces pulling us down, we may see things get intersting here in the afternoon. Technically there's one more day of trading for the FOMO (since results are released after close on Monday), but some people may be wanting in today.

Tslynk67

Well-Known Member

I assume the tax is only on realised gains - the text states "making", so if you don't sell, you don't pay, right? This is the whole push-back against the nonsense that Bernie S has been spouting about Musk being a billionaire, well he is, but only on paperSo ... is this worrying anyone? Like I guess a lot of you, I have a lot of unrealized capital gains in my portfolio. The problem with selling stock is that you have to pay taxes on it, which means your re-investment amount has now been slashed. So if you don't need to sell stock, you might not want to. In addition, inflation is a very real worry this time around, so being invested in the stock market isn't a bad idea. But if this passes (below), stock prices will come down. What to do, what to do...

---

President Biden is set to announce tax increases on the wealthy as soon as next week to pay for an increase in funding for childcare and education. The proposal, called the "American Families Plan," would reverse some of former President Trump's tax cuts from 2017, while the capital gains tax for Americans making over $1M per year could nearly double to 39.6%. Coupled with an added 3.8% tax linked to the Affordable Care Act, that's a potential 43.4% levy. The new package would also include an increase in the top income tax rate, building on a recent infrastructure proposal to raise the corporate tax rate to 28%. Biden's proposals on capital gains would only affect the federal rate. Wealthy individuals who live in California and New York, which tax capital gains as regular income at 13.3% and 11.85% (plus 3.88% in NYC), would see total capital gains duties of nearly 60%. From a strategy standpoint, increases to the capital gains tax will likely present a secular headwind to multiples going forward. Over the last 40 years, capital gains taxes have been moving in a downward trend while multiples have been moving higher. With the opposite expected to occur now, we will likely see this trend reverse.

View attachment 656318

This is where selling safe covered calls to get income might be useful for many here (that aren't already doing it)

Knightshade

Well-Known Member

So ... is this worrying anyone?

Not really.

But if this passes (below), stock prices will come down.

Why?

Where ELSE do you put your money?

President Biden is set to announce tax increases on the wealthy as soon as next week to pay for an increase in funding for childcare and education. The proposal, called the "American Families Plan," would reverse some of former President Trump's tax cuts from 2017, while the capital gains tax for Americans making over $1M per year could nearly double to 39.6%.

I can't speak for you, but I can probably get by with "only" 950k a year in income if I really have to.

I suspect that's true for most people.

So not terribly worrying.

Coupled with an added 3.8% tax linked to the Affordable Care Act

Seems dishonest to mention this here- That tax already exists- and on a much lower income level than 1 million--- I paid it this year in fact. It keeps existing regardless of anything Biden is suggesting.

The new package would also include an increase in the top income tax rate

Yes from 37% to 39.6%

Which is actually still lower than it was for the vast majority of the last 100+ years.

In fact it's the SAME rate we had during the economic boom of the mid-late 1990s. We had that rate as recently as 2017.

Somehow we survived.

lafrisbee

Active Member

a block of ice.You must be a real amateur, all the pros I know use salt licks, no fingerprints and they dissolve without a trace in water.

Todd Burch

14-Year Member

If the cap gains thing comes to pass, one option would be to sell a bit each year so you don't go over the income limit.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K