Could the gigsbux bitcoin investment/liquidity test and the idea of share representation via NFT be related? I remember several forum members salivating at the idea of blockchain-backed stock certificates and the implications for protection against naked shorting-selling."Tesla is swimming in money" YES!

Reasons for going into bitcoin could be multiple:

- Inflation hedge

- Tech bet: Tesla may have long term crypto plans.

- PR: Some negative, some positive. But Bitcoin exposure has resulted in a lot of attention, worth a lot of money.

Lastly, there might be slight obfuscation angle: It is nice to have some flexible value for 'tuning' the ERs going forward. We know by now, that so-called analysts don't analyze a lot, they are either mouth-pieces for their company, or have a 30+ portfolio, and little time to really delve into the substance of any one company. It may suit Tesla to play into that lack of in-depth analysis, in order to keep grinding, keep executing and slowly take over the world, without detractors truly understanding just how fantastic they are doing.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

CLK350

Member

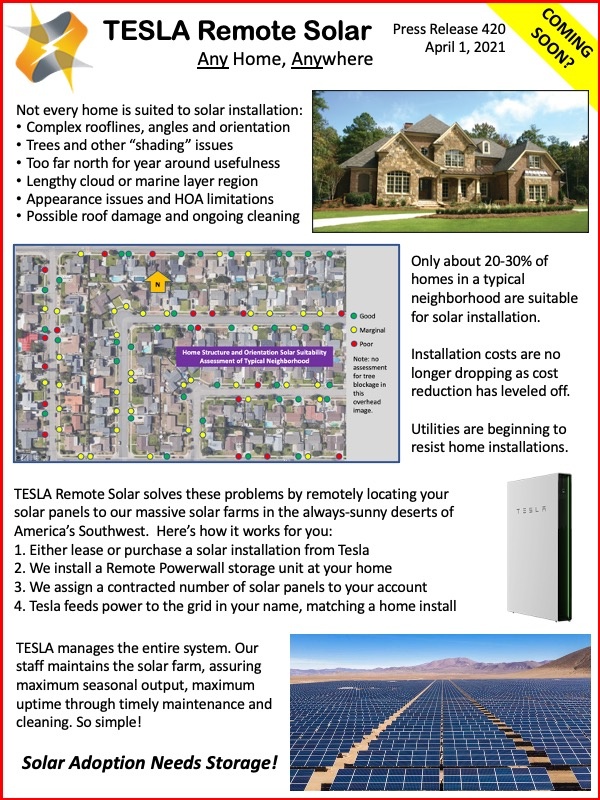

On Tesla solar, energy and VPP, I'd like to share here an idea from Ed who posted this comment on a post Q1 CleanTechnica article.

Tesla may already be working on this, for all I know. If not, not sure where /how this should be taken up - ideally the DOE would put out a contract to private groups for a modernization initiative of the US power grid, much like NASA subcontracted the space program to a competitive field of new private companies. And a Gwynne Shotwell Tesla equivalent could take charge of this project. Now THAT would catapult the SP and advance the mission. They could also hire Joshua Novacheck, who was the author of that study showing the benefits of linking west and eastern grids.

Keep the solar roofs for new housing and adequate roof situations, else go the VPP way - and install local small solar/ wind farms to help decentralization as optimal. Seems perfectly reasonable. Better spend some USD (virtual paper money from the Feds) there than giving it to the banking establishment, where it ends up in Swiss (or the modern equivalent) accounts, or for yachts, new condos and high rises used less than 20% of the time, etc.

From the comments section of that CleanTechnica article recapping Q1 news, Ed's contribution:

" We got some Musk Stream-of-Conciousness on a range of topics, but my big takeaway that he spent quite a bit of time on how difficult it is to install solar panels on individual homes. Putting a Powerwall between the meter and the power panel is a snap, but the engineering to put panels on no-two-alike roofs is a costly and difficult enterprise. I have taken recently to using the FAKE sell sheet to make the point that the solution is to put a homeowner's investment in panels in the desert. It will be better performing and cheaper. With Powerwalls at the home and controlled by the utility, the system will have best performance and the best reduction in the Duck Curve effect. Something like this needs to happen."

Tesla may already be working on this, for all I know. If not, not sure where /how this should be taken up - ideally the DOE would put out a contract to private groups for a modernization initiative of the US power grid, much like NASA subcontracted the space program to a competitive field of new private companies. And a Gwynne Shotwell Tesla equivalent could take charge of this project. Now THAT would catapult the SP and advance the mission. They could also hire Joshua Novacheck, who was the author of that study showing the benefits of linking west and eastern grids.

Keep the solar roofs for new housing and adequate roof situations, else go the VPP way - and install local small solar/ wind farms to help decentralization as optimal. Seems perfectly reasonable. Better spend some USD (virtual paper money from the Feds) there than giving it to the banking establishment, where it ends up in Swiss (or the modern equivalent) accounts, or for yachts, new condos and high rises used less than 20% of the time, etc.

From the comments section of that CleanTechnica article recapping Q1 news, Ed's contribution:

" We got some Musk Stream-of-Conciousness on a range of topics, but my big takeaway that he spent quite a bit of time on how difficult it is to install solar panels on individual homes. Putting a Powerwall between the meter and the power panel is a snap, but the engineering to put panels on no-two-alike roofs is a costly and difficult enterprise. I have taken recently to using the FAKE sell sheet to make the point that the solution is to put a homeowner's investment in panels in the desert. It will be better performing and cheaper. With Powerwalls at the home and controlled by the utility, the system will have best performance and the best reduction in the Duck Curve effect. Something like this needs to happen."

Last edited:

Who knows if this will come to pass, but it seems like it would have both short and long term implications for Tesla’s demand.

“Coming this summer: Gas stations running out of gas”

Basically, too few properly certified drivers available for tanker trucks to distribute fuel to stations. I sure hope it happens. It would be a convenient illustration of how fragile ICE infrastructure really is. And how that “5 minute fill up at the pump” argument in favor of ICE misses so much nuance.

“Coming this summer: Gas stations running out of gas”

Basically, too few properly certified drivers available for tanker trucks to distribute fuel to stations. I sure hope it happens. It would be a convenient illustration of how fragile ICE infrastructure really is. And how that “5 minute fill up at the pump” argument in favor of ICE misses so much nuance.

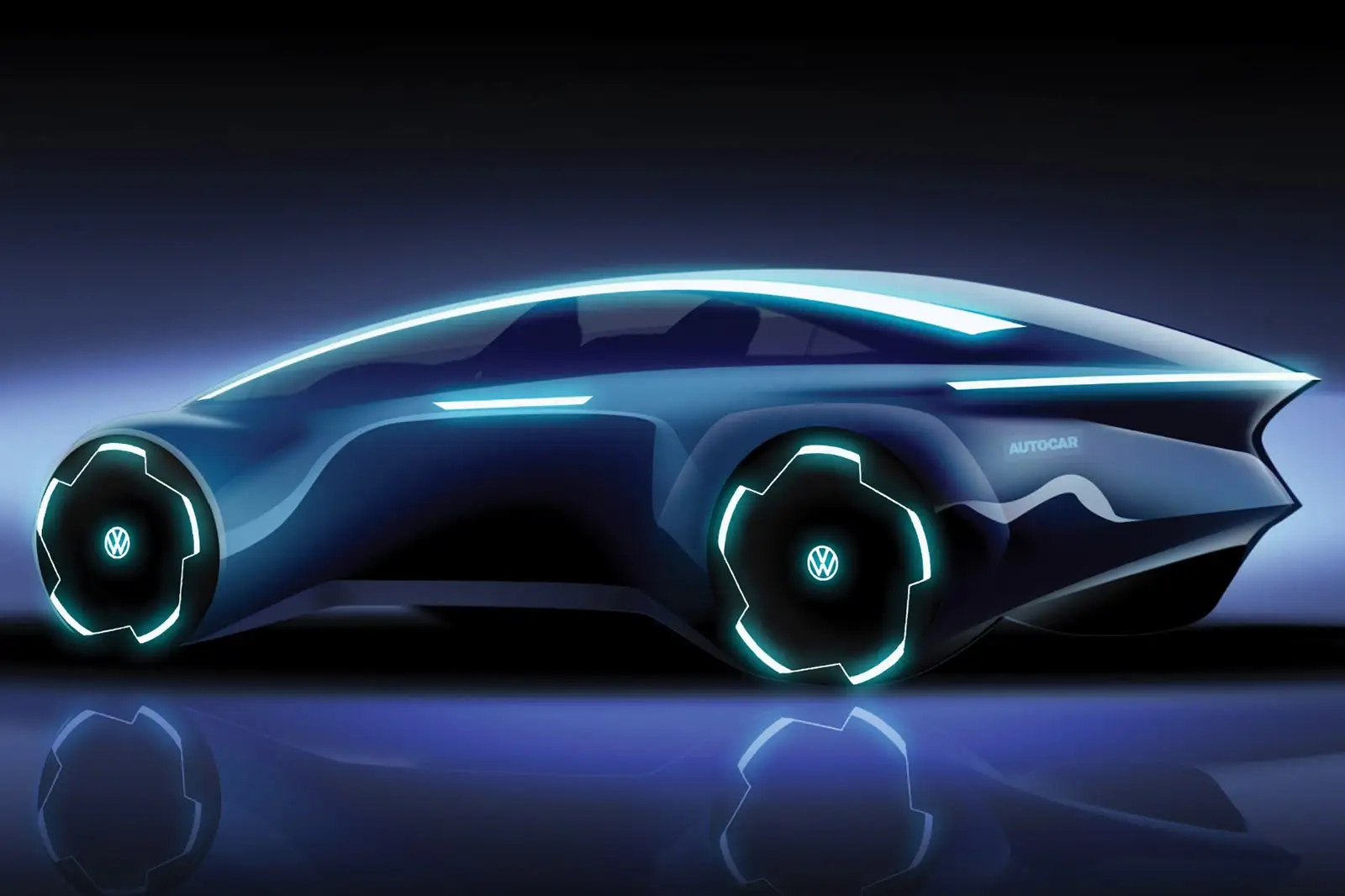

Volkswagen Project Trinity to herald car-buying revolution | Autocar

Level 4 autonomous EV to offer options and extras as post-purchase downloads

"Volkswagen’s new flagship model, which it’s developing under the codename Project Trinity and is due in 2026, will spearhead the firm’s next generation of bespoke electric cars with a focus on offering long-range, semi-autonomous driving – and it will change the way that cars are bought.

…

The Project Trinity model will be sold in largely standardised form, with only a handful of hardware options made available to customers. Buyers will then be able to buy and ‘unlock’ the features they want through the car’s software. New features will also be offered for sale and downloaded through over-the-air software updates."

Wow. 2026 can’t come soon enough!

petit_bateau

Active Member

His numbers are correct and he explained it just the same way I do to folks. To me it indicates that he continues to look at the big problems, not just worrying about cars and rockets.I think the unknown details of Biden's tax plan have investors on edge and it's supposed to be unveiled tomorrow. I know many have stated that this forum has plenty of non Americans here but its worth keeping in mind that people on are edge and some are pulling their money in anticipation of this new bill which drives the price down whether you like it or not. I myself had a wealth manager implore me sell because of the Biden tax plan - I told him I was not interested in his services. Given that the plan could be retro active to Jan 1, 2021 or kick in Jan 1, 2022 or undergo pretty heavy changes between its current form and when/if it gets enacted I think the fear of uncertainty could push the the price down until at least the details of the proposal are made public, which as I understand is tomorrow night. Keep in mind there are lot's of newly minted investors taking the advice of advisors like above.

A note about the call. Did nobody else get the feeling when Musk said electricity usage would triple, he then caught him self, muttered an expletive as if he said something he didn't mean to say, and then said doubled for EV's and then circled back to triple for HVAC. Struck me as telling as to whats on his mind.

LiveLong&Profit

Member

This is a really good idea.Could the gigsbux bitcoin investment/liquidity test and the idea of share representation via NFT be related? I remember several forum members salivating at the idea of blockchain-backed stock certificates and the implications for protection against naked shorting-selling.

Don't know how that would actually work given the current regulatory framework. One thing is that SEC is not, should we say, very pro-active. Another thing is whether they would seek to stop innovative new ideas such as NFT's tied to shares. The people and institutions benefiting from the current lax enforcement of different forms of shorting with virtual shares might try to stop it, but... perhaps, given the Gamestop debacle perhaps their position has weakened.

For sure, Elon could use his 50M+ twitter account to go public with such a scheme.

JohnnyEnglish

Member

Your first option is much more likely than the second.This is big, it means this is a mule for driving dynamics testing, that probably means this mule has the full CT skateboard.......

Or, they could be just doing some baseline testing of competitions, nothing to see then.

LiveLong&Profit

Member

The old saying was: "A dollar short and a day late"

Volkswagen Project Trinity to herald car-buying revolution | Autocar

Level 4 autonomous EV to offer options and extras as post-purchase downloadswww.autocar.co.uk

"Volkswagen’s new flagship model, which it’s developing under the codename Project Trinity and is due in 2026, will spearhead the firm’s next generation of bespoke electric cars with a focus on offering long-range, semi-autonomous driving – and it will change the way that cars are bought.

…

The Project Trinity model will be sold in largely standardised form, with only a handful of hardware options made available to customers. Buyers will then be able to buy and ‘unlock’ the features they want through the car’s software. New features will also be offered for sale and downloaded through over-the-air software updates."

Wow. 2026 can’t come soon enough!

New, modern VW saying: "A billion short and a decade late!"

(I am being generous towards VW 'cause " 5-20 billion short and 14 years late" doesn't have the same ring to it...")

How do they think of these things?

Volkswagen Project Trinity to herald car-buying revolution | Autocar

Level 4 autonomous EV to offer options and extras as post-purchase downloadswww.autocar.co.uk

"Volkswagen’s new flagship model, which it’s developing under the codename Project Trinity and is due in 2026, will spearhead the firm’s next generation of bespoke electric cars with a focus on offering long-range, semi-autonomous driving – and it will change the way that cars are bought.

…

The Project Trinity model will be sold in largely standardised form, with only a handful of hardware options made available to customers. Buyers will then be able to buy and ‘unlock’ the features they want through the car’s software. New features will also be offered for sale and downloaded through over-the-air software updates."

Wow. 2026 can’t come soon enough!

MC3OZ

Active Member

Something about the press release no and the date is slightly suspicious....On Tesla solar, energy and VPP, I'd like to share here an idea from Ed who posted this comment on a post Q1 CleanTechnica article.

Tesla may already be working on this, for all I know. If not, not sure where /how this should be taken up - ideally the DOE would put out a contract to private groups for a modernization initiative of the US power grid, much like NASA subcontracted the space program to a competitive field of new private companies. And a Gwynne Shotwell Tesla equivalent could take charge of this project. Now THAT would catapult the SP and advance the mission. They could also hire Joshua Novacheck, who was the author of that study showing the benefits of linking west and eastern grids.

Keep the solar roofs for new housing and adequate roof situations, else go the VPP way - and install local small solar/ wind farms to help decentralization as optimal. Seems perfectly reasonable. Better spend some USD (virtual paper money from the Feds) there than giving it to the banking establishment, where it ends up in Swiss (or the modern equivalent) accounts, or for yachts, new condos and high rises used less than 20% of the time, etc.

From the comments section of that CleanTechnica article recapping Q1 news, Ed's contribution:

" We got some Musk Stream-of-Conciousness on a range of topics, but my big takeaway that he spent quite a bit of time on how difficult it is to install solar panels on individual homes. Putting a Powerwall between the meter and the power panel is a snap, but the engineering to put panels on no-two-alike roofs is a costly and difficult enterprise. I have taken recently to using the FAKE sell sheet to make the point that the solution is to put a homeowner's investment in panels in the desert. It will be better performing and cheaper. With Powerwalls at the home and controlled by the utility, the system will have best performance and the best reduction in the Duck Curve effect. Something like this needs to happen."

View attachment 657653

Artful Dodger

"Neko no me"

I'm going to go on a limb and predict that tomorrow's closing price will not have a 7 as the first digit

Missed it by that much...

Cheers!

Better than voltswagonOn Tesla solar, energy and VPP, I'd like to share here an idea from Ed who posted this comment on a post Q1 CleanTechnica article.

Tesla may already be working on this, for all I know. If not, not sure where /how this should be taken up - ideally the DOE would put out a contract to private groups for a modernization initiative of the US power grid, much like NASA subcontracted the space program to a competitive field of new private companies. And a Gwynne Shotwell Tesla equivalent could take charge of this project. Now THAT would catapult the SP and advance the mission. They could also hire Joshua Novacheck, who was the author of that study showing the benefits of linking west and eastern grids.

Keep the solar roofs for new housing and adequate roof situations, else go the VPP way - and install local small solar/ wind farms to help decentralization as optimal. Seems perfectly reasonable. Better spend some USD (virtual paper money from the Feds) there than giving it to the banking establishment, where it ends up in Swiss (or the modern equivalent) accounts, or for yachts, new condos and high rises used less than 20% of the time, etc.

From the comments section of that CleanTechnica article recapping Q1 news, Ed's contribution:

" We got some Musk Stream-of-Conciousness on a range of topics, but my big takeaway that he spent quite a bit of time on how difficult it is to install solar panels on individual homes. Putting a Powerwall between the meter and the power panel is a snap, but the engineering to put panels on no-two-alike roofs is a costly and difficult enterprise. I have taken recently to using the FAKE sell sheet to make the point that the solution is to put a homeowner's investment in panels in the desert. It will be better performing and cheaper. With Powerwalls at the home and controlled by the utility, the system will have best performance and the best reduction in the Duck Curve effect. Something like this needs to happen."

View attachment 657653

willow_hiller

Well-Known Member

pretty upsetting. Majority of people aren’t like us, they just read the exact news agencies Gary is talking about at face value. Peeps that believe in the lies they read don’t have an agenda, they simply were misled.

Elon says “I trust the people”; makes no sense to me and he’s definitely thinking long term.

I don't trust people; people are stupid. But I trust Elon, for the most part.

I was thinking Tesla needs to do something about the tsunami of misinformation, but maybe PR isn't the solution. After all, Tesla had a PR team during the Model 3 ramp. Did it stop any of the FUD? Not really. People who want to slander Tesla will continue doing so. And as we've seen from Ford's Mike Levine on Twitter, having your PR team try and attack folks online just comes off as tacky and inauthentic.

transpondster

Member

It's Jan-Feb, Tesla delivers most in March, so we need updated chart to guess if FCA gets enough from TeslaGod, even with Tesla's help FCA/Honda are still near the bottom of the pack. These credits are going to be around a loooong time.

Weird that PSA-Opel show up in a separate pool. I thought I read that the Stellantis merger pulled them into the Tesla pool.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6MMAJA6UBZP6RPW7LKIURKAXXU.jpg)

Tesla says bitcoin investment worth $2.48 billion

Tesla Inc (TSLA.O) said on Wednesday that the fair market value of bitcoin the electric carmaker held as of March 31 was $2.48 billion, suggesting it could stand to make around $1 billion dollars out of the investment were it to cash in the digital currency.

Note 3 – Digital Assets, Net

During the three months ended March 31, 2021, we purchased and received $1.50 billion of bitcoin. During the three months ended March 31, 2021, we recorded $27 million of impairment losses on bitcoin. We also realized gains of $128 million through sales during the three months ended March 31, 2021. Such gains are presented net of impairment losses in Restructuring and other in the consolidated statement of operations. As of March 31, 2021, the carrying value of our bitcoin held was $1.33 billion, which reflects cumulative impairments of $27 million. The fair market value of bitcoin held as of March 31, 2021 was $2.48 billion.

CLK350

Member

Ed made it as a FAKE sell sheet release for effect, he said so and I should have highlighted thisSomething about the press release no and the date is slightly suspicious....

CLK350

Member

This is NOT a small smear campaign - there is a HUGE amount of underlying oil & gas /coal/ cars/ ethical-brain-impaired-wealthy financial support for the FUD campaign. THOSE are the actors to confront. "Win the war, not endless small battles". Sun TzuI don't trust people; people are stupid. But I trust Elon, for the most part.

I was thinking Tesla needs to do something about the tsunami of misinformation, but maybe PR isn't the solution. After all, Tesla had a PR team during the Model 3 ramp. Did it stop any of the FUD? Not really. People who want to slander Tesla will continue doing so. And as we've seen from Ford's Mike Levine on Twitter, having your PR team try and attack folks online just comes off as tacky and inauthentic.

Tesla could also, as another TMC member suggested, appoint as de facto Pravduh spokesperson Raub Maurer of YouTube Tesla Daily - also feeding him early Tesla news

Those who understand what is happening can do something to help, at many levels. Retweeting intelligent posts on Biden's Twitter, shopping wisely/ ethically, voting, donating, educating ... pushing for an amendment requiring voters to submit to a citizenship aptitude test regularly (we do require an aptitude test for driving, not?) ...

Last edited:

Perhaps but why not fix the SEC regs. Much easier I would think.Could the gigsbux bitcoin investment/liquidity test and the idea of share representation via NFT be related? I remember several forum members salivating at the idea of blockchain-backed stock certificates and the implications for protection against naked shorting-selling.

I do have an idea Tesla could try. They could pull FSD leasing money forward by selling the rights to future leasing revenue. This would provide cash flow to stockholders who could buy the right to leasing revenue returns for a particular block of vehicles for a limited time period.

This is similar to factoring debt. Tesla would get a slug of cash up front to finish FSD and investor would get a revenue stream as leasing of FSD accelerated.

This might be linked to shares in such a fashion that would cause problems/expenses for shorts.

Last edited:

Yeah, I thought of that. That’s a good point. It also lists zero supercredits, which indicated they have few ZEVs to count.It's Jan-Feb, Tesla delivers most in March, so we need updated chart to guess if FCA gets enough from Tesla

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K