deshkart

Member

Approx 40k production in China for April. My guess is 220k+ deliveries for this quarter. What do numbers look like?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

For context, I expect:"the actual earnings growth in dollars, not the percentage, will be huge and drastically cut the P/E multiple down with each earnings report"

I dont disagree - that is the reason I said the PE multiple won't stay at the multi hundreds level and that Tesla will grow into the current valuation at a PE multiple somewhere between 50-100x in 2022.

And I wasn't implying he's trading or suggesting others take steps based on his view. I was trying to clarify what "his" buy point would be.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WXX5BIF5EJIGVON22KKE3M3AUM.jpg)

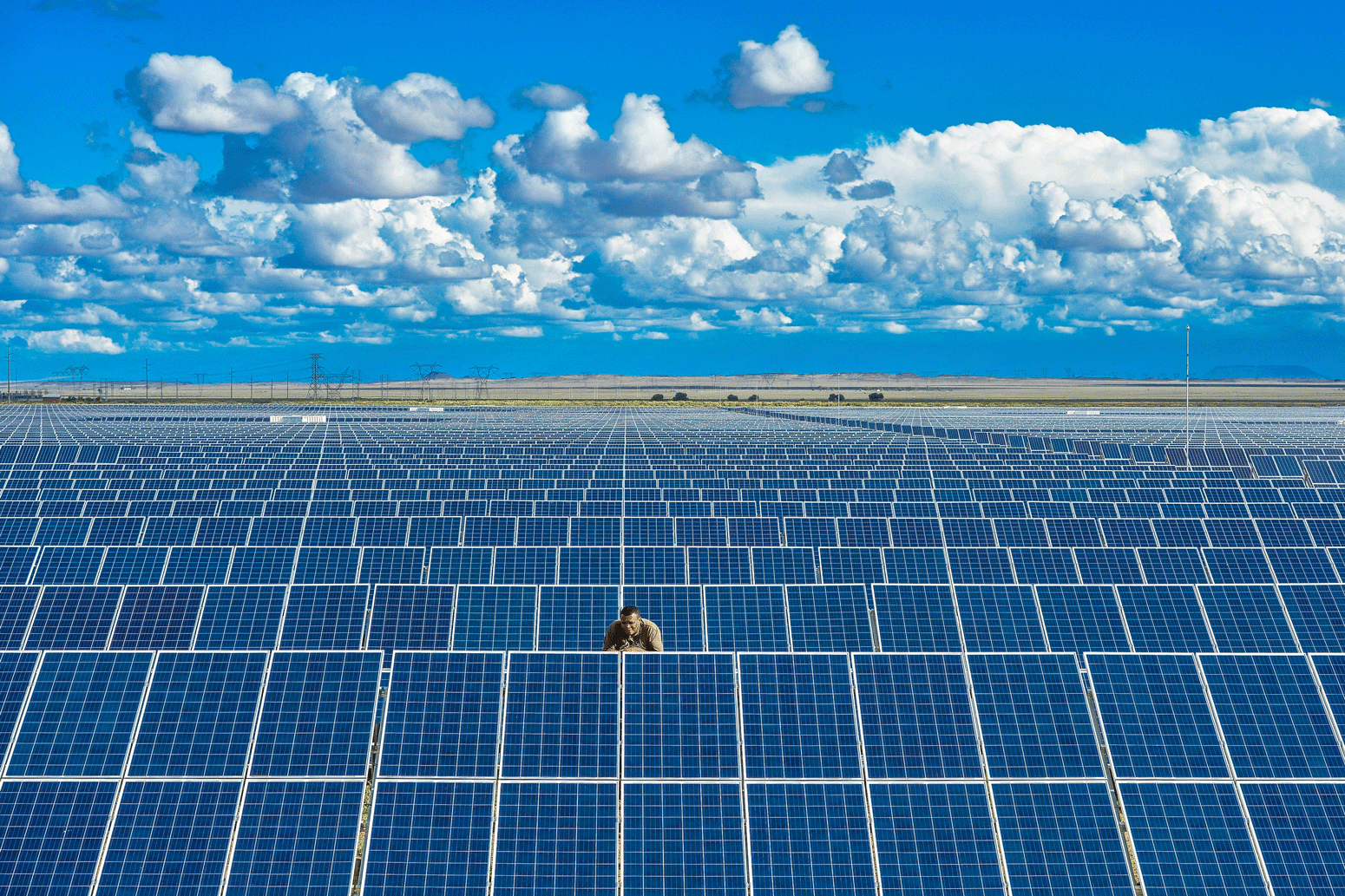

U.S. electric car maker Tesla Inc has halted plans to buy land to expand its Shanghai plant and make it a global export hub, people familiar with the matter said, due to uncertainty created by U.S.-China tensions./cloudfront-us-east-2.images.arcpublishing.com/reuters/WXX5BIF5EJIGVON22KKE3M3AUM.jpg)

EXCLUSIVE Tesla puts brake on Shanghai land buy as U.S.-China tensions weigh - sources

U.S. electric car maker Tesla Inc (TSLA.O) has halted plans to buy land to expand its Shanghai plant and make it a global export hub, people familiar with the matter said, due to uncertainty created by U.S.-China tensions.www.reuters.com

"Tesla had earlier considered expanding exports of its China-made entry-level Model 3 to more markets, including the United States, sources told Reuters, a plan that had not previously been reported."

January is a long way away. Not saying the stock will rise between now and then, but there's plenty of time for that to happen, and a LOT of good catalysts from Tesla to held it alongI must admit, like others this has been severely painful to experience. I was on the wrong side of leverage when the drop began in late January. I am now severely stressed out by some Jan 22 700calls that I bought on margin back in November. Just a few weeks ago 700 by January would have seemed safe...now I am not so sure...

Shanghai producing at a 40k monthly rate? That's slightly higher than the 450k annual production mentioned in the Q1 investor deck. We're well on track for the million units this year if both Fremont and Shanghai are producing at ~500k 3/Y each, with S/X to pick up the spare.Kelvin Yang link to China April sales (I don’t seem to be able to translate).

The underlying part is thisPortfolio margin, I assume? I'm on Reg T through IBKR and have received no such message (the account is 100% TSLA).

Err, what happened that there are 25 pages of posts since yesterday afternoon?

I'm in a similar position where IB will be significantly reducing my initial margin requirements (equivalent to if the stock proce dropped to around $165). With IB the impact is complicated by the opaque way they calculate margin. Their Risk Navigator can be used to simulate the change against an individual portfolio, (which I haven't done yet but will do). For me I'm expecting to have my account locked out from withdrawing any cash or doing anything else that could increase margin requirements.

Absolutely this negatively affects Tsla. He is forcing people who don't believe in meme coins into owning it indirectly as shareholders.Elon tweeted a poll asking if Tesla should accept dogecoin as payment. 75% said yes out of 1.5M votes. 140K likes in 2 hours. If they accept, I hope this will not negatively affect $TSLA.

Portfolio margin, I assume? I'm on Reg T through IBKR and have received no such message (the account is 100% TSLA).