Doubt that TSLA would showing relative strength to its PM here if China sales were 11Κ.This is so bizarre I can find source after source stating the numbers are clear - 25k China sales, 14k export.

Vincent needs to stop tweeting. He’s confusing everyone and the actual data seems pretty damn easy to understand. His tweets are actually costing real money here

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

henchman24

Active Member

ex

The actual China sales number that Vincent is now saying equally make no sense. 11k sales.....Less sales than in Jan by 4K when Tesla hardly sold any Y and the 3 was still ramping. That would disastrous results. Still no clue why Vincent is changing his numbers drastically lower but he really should stop tweeting until he confirms because there’s a massive discrepancy between his two takes on the data.

I think the 25k makes more sense than 40k. Prior to March, the highest producing months was just under 24k. March was an unexpected blowout of over 35k... combine an end of the quarter push with the rumored shutdown of the Y line in April (~6k for two weeks) would put this number more around 31-32k. That would line right up with March considering the drop in the first month of every new quarter. Seems to me that Shanghai is just operating like Fremont now where a large part of the first month's production gets exported hurting the first month of the quarter sales, and that is the time for maintenance. Then a major ramp in the 2nd and 3rd months. I'd expect ~35k for May and ~40k for June with this.

If by chance it is 40k, then we are not looking at ~220k in Q2... more like 240+k.

asburgers

Sell order in at $8008.5

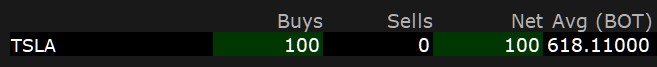

100 more chairs this morning in honor of Chad. Chad balls.

They unloaded with both barrels this AM. I think China news sinking in. We may be positive on the day.

None of my wish orders filled . Too aggressive.

. Too aggressive.

But I will be all right. Just in case anyone was wondering, I have a lot of TSLA .

.

Kudos to all of you and Artful Dodger seems to have called the PM low again. Bounced below and around the 200 DMA for a bit and then lift off.

None of my wish orders filled

But I will be all right. Just in case anyone was wondering, I have a lot of TSLA

Kudos to all of you and Artful Dodger seems to have called the PM low again. Bounced below and around the 200 DMA for a bit and then lift off.

Criscmt

Member

That these guys blatantly spread misinformation with such wording ("company announced") even when Tesla doesn't have PR Department shows the level of their brazenness. No, not stupidity, because I find it hard to believe they are too stupid to have worded as such by mistake.

StarFoxisDown!

Well-Known Member

I think the 25k makes more sense than 40k. Prior to March, the highest producing months was just under 24k. March was an unexpected blowout of over 35k... combine an end of the quarter push with the rumored shutdown of the Y line in April (~6k for two weeks) would put this number more around 31-32k. That would line right up with March considering the drop in the first month of every new quarter. Seems to me that Shanghai is just operating like Fremont now where a large part of the first month's production gets exported hurting the first month of the quarter sales, and that is the time for maintenance. Then a major ramp in the 2nd and 3rd months. I'd expect ~35k for May and ~40k for June with this.

This is demonstrably false.

Yes China is following the Fremont model. But production should not be flat or down for the first month of the quarter compared to the previous quarter. March wasn’t an unexpected blowout lol...it was production expansion. What a bizarre thing to say. Just because people didn’t think they could do that production number doesn’t make it somehow not repeatedable.

I think you’re misunderstanding the Fremont model. Sales will dip from the 3rd month to the first month of the new quarter, but production should stay at the same production level as much or higher. In this case since they’re still ramping both the 3 and Y, a 4K increase in production is very logical

ByeByeJohnny

Active Member

25k + 14k are great numbers.

Don't say I didn't call this one though. Made several posts the last week that the higher than previously export would be used as FUD.

Didn't expect Tesla positive people on twitter to play along though.

Don't say I didn't call this one though. Made several posts the last week that the higher than previously export would be used as FUD.

Didn't expect Tesla positive people on twitter to play along though.

Phobi

Member

Kudos to all that got in below $600 or buying shares in general today

Artful Dodger

"Neko no me"

OT: (Movie quotes)

Captain Marko Ramius: "How did you know our reactor incident was false?"

Jack Ryan: "That was a guess, but it seemed logical."

... once again, we play our dangerous game with the AmericanNavy Hedgy. :O

Cheers!

Captain Marko Ramius: "How did you know our reactor incident was false?"

Jack Ryan: "That was a guess, but it seemed logical."

... once again, we play our dangerous game with the American

Cheers!

Last edited:

Someone was asking just yesterday about the China deliveries... as if they knew this story was coming?

Maybe fishing for a lack of info, so as to spin it?

IDK. Got me asking anyway.

Maybe fishing for a lack of info, so as to spin it?

IDK. Got me asking anyway.

thx1139

Active Member

Disagree Model Y just started ramping in January with 1,641 units, then 4,630 units in February, then 10,151 units in March. That is why March was so large. Assuming March number for Model Y was simply cut in half for Model Y shutdown for 1/2 the month then the Model 3 production was level with March the numbers would be 25K Model 3 and 5K Model Y. That assumes not additional ramp up for either Model 3 or Model Y (for 2 weeks).I think the 25k makes more sense than 40k. Prior to March, the highest producing months was just under 24k. March was an unexpected blowout of over 35k... combine an end of the quarter push with the rumored shutdown of the Y line in April (~6k for two weeks) would put this number more around 31-32k. That would line right up with March considering the drop in the first month of every new quarter. Seems to me that Shanghai is just operating like Fremont now where a large part of the first month's production gets exported hurting the first month of the quarter sales, and that is the time for maintenance. Then a major ramp in the 2nd and 3rd months. I'd expect ~35k for May and ~40k for June with this.

If by chance it is 40k, then we are not looking at ~220k in Q2... more like 240+k.

The Accountant

Active Member

The China State-Affiliated Media is reporting 25k sold in China AND 14k exported.

Of course, the wording from the Global Times could be incorrect. Hopefully we will get some clarity from other sources.

Of course, the wording from the Global Times could be incorrect. Hopefully we will get some clarity from other sources.

henchman24

Active Member

This is demonstrably false.

Yes China is following the Fremont model. But production should not be flat or down for the first month of the quarter compared to the previous quarter. March wasn’t an unexpected blowout lol...it was production expansion. What a bizarre thing to say. Just because people didn’t think they could do that production number doesn’t make it somehow not repeatedable.

I think you’re misunderstanding the Fremont model. Sales will dip from the 3rd month to the first month of the new quarter, but production should stay at the same production level as much or higher. In this case since they’re still Rampling both the 3 and Y, a 4K increase in production is very logical

Fremont is more mature, and we don't have the month over month numbers there like we do in China. So you're making an assumption they don't fall. We do know that sales in the US are very light in the first month of a quarter and pick up greatly at the end. We know now that Shanghai is exporting, that the first month of a quarter sales within the country are lighter than the later months. That's all we know. From that I would say that Shanghai is operating like Fremont now.

China production fell from Dec 2020 to Jan 2021 by about 8k. This March-April would be about a 9600 drop from March, 6k of which would be on Y line shutdown. We are not talking about an 8k decrease like Dec-Jan and if the Y line wasn't shutdown people would be praising the ~31-32k in the first month of a quarter.

The first FUD actually came from Gary Black who was questioning the first tweets from Vincent and Sawyer. Just read the article yourselves... 【月度分析】2021年4月份全国乘用车市场分析Jesus we can’t even get Tess bulls to get information right. The data straight out of China was 25k sold in China, 14k exported. For a total of 39k production. I have no clue why Vincent is changing his numbers and saying the report is confusing

Open it in a browser that translates; it’s quite clear to me that Tesla in fact hit close to 40k production in April. CPCA always reports the numbers separately. For all the reasons already listed. Sales don’t count exports, because exports are not yet sold. The data sources also come from two different agencies (China customs and exports versus China domestic car registrations).

Seems like people are fishing for bad news to try to explain market movements, when reality is we’re still in tax season sell off, continued institutional rotation, yield rates are still keeping new money at bay, and we are on the tail end of a bear cycle (listen to @Artful Dodger).

LiveLong&Profit

Member

A tale of two TSLA's

It was the best of times, it was the worst of times, it was the age of TMC, it was the age of traditional media, it was the epoch of diamond hands, it was the epoch of paper hands, it was the season of Elon, it was the season of Wall Street, it was the spring of truth, it was the winter of FUD.

It was the best of times, it was the worst of times, it was the age of TMC, it was the age of traditional media, it was the epoch of diamond hands, it was the epoch of paper hands, it was the season of Elon, it was the season of Wall Street, it was the spring of truth, it was the winter of FUD.

henchman24

Active Member

If the Y was taken down for 2 weeks and knocked 6k off... We are back to the 4k in Feb. That would still take a drop off of 3 production for the 25k in total. It would still be more production than any month except March and Dec for the 3.Disagree Model Y just started ramping in January with 1,641 units, then 4,630 units in February, then 10,151 units in March. That is why March was so large. Assuming March number for Model Y was simply cut in half for Model Y shutdown for 1/2 the month then the Model 3 production was level with March the numbers would be 25K Model 3 and 5K Model Y. That assumes not additional ramp up for either Model 3 or Model Y (for 2 weeks).

I really hope it is 40k, and I'm completely wrong here. The 25k just makes more sense if the Y line was down for 2 weeks... that would be 2/3 of the drop right there.

thx1139

Active Member

What is source for this? I see 23K sales in China with no exports in December. I see 15K sales in China in January. January doesnt count the exports to other markets. December had no exports to other markets.China production fell from Dec 2020 to Jan 2021 by about 8k. This March-April would be about a 9600 drop from March, 6k of which would be on Y line shutdown. We are not talking about an 8k decrease like Dec-Jan and if the Y line wasn't shutdown people would be praising the ~31-32k in the first month of a quarter.

The first FUD actually came from Gary Black who was questioning the first tweets from Vincent and Sawyer. Just read the article yourselves... 【月度分析】2021年4月份全国乘用车市场分析

Open it in a browser that translates; it’s quite clear to me that Tesla in fact hit close to 40k production in April. CPCA always reports the numbers separately. For all the reasons already listed. Sales don’t count exports, because exports are not yet sold. The data sources also come from two different agencies (China customs and exports versus China domestic car registrations).

Seems like people are fishing for bad news to try to explain market movements, when reality is we’re still in tax season sell off, continued institutional rotation, yield rates are still keeping new money at bay, and we are on the tail end of a bear cycle (listen to @Artful Dodger).

Gary brings some interesting insights, but he spends way too much time trying to attribute swings in the TSLA price to various events.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K