You woke up?Ok, what just happened?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

That is true...You woke up?

What's happening is legacy OEM's are 'claiming' they are putting all this $ into EV production, development to appease the gov't and investors...but in reality...they are just buying time to sell as many ICE vehicles as they can. When Tesla is fully ramped...it will accelerate their bankruptcy.Market is too stupid to realize there's no room for F and GM to grow. The more money they "invest" in EV, the worse their 10-K is going to look. There's no upsides in growth or gross margin in store for them. Only downhill from here.

ZachF

Active Member

Market is too stupid to realize there's no room for F and GM to grow. The more money they "invest" in EV, the worse their 10-K is going to look. There's no upsides in growth or gross margin in store for them. Only downhill from here.

True.

A lot of investors don't realize that the traditional auto OEMs are going to be (forced into) spending huge amounts of capital to essentially take market share from their own products...

Gotta prop their stock up to raise more capital. GM doesn't have $30B to spend.What's happening is legacy OEM's are 'claiming' they are putting all this $ into EV production, development to appease the gov't and investors...but in reality...they are just buying time to sell as many ICE vehicles as they can. When Tesla is fully ramped...it will accelerate their bankruptcy.

Noone has made the "General Failure" pun? .. i am disappointed ..You mean "General Mexico"

Not sure if you all follow Dr. know it all… But he’s a pretty sharp cookie. Multiple PhD‘s. Including physics and mathematics.

According to the math that he lays out in this video; FSD will be solved within the year. Couldn’t time stamp it; but if you start at 8:00 min mark you’ll get the nuts and bolts of it.

So…, two weeks is coming up quick!

According to the math that he lays out in this video; FSD will be solved within the year. Couldn’t time stamp it; but if you start at 8:00 min mark you’ll get the nuts and bolts of it.

So…, two weeks is coming up quick!

Knightshade

Well-Known Member

Market is too stupid to realize there's no room for F and GM to grow. The more money they "invest" in EV, the worse their 10-K is going to look. There's no upsides in growth or gross margin in store for them. Only downhill from here.

This isn't necessarily true though.

Some legacy companies won't survive the transition- others will.

At least some of the ones that do are likely to end up with more market share than they had before the transition.

Teslas #s have them with roughly 20% of new car sales in 2030. SOMEBODY needs to sell the other 80%.

It's possible say GM actually does a great job building battery plants and grows significantly at the expense of say Ford who spent years "thinking about" battery plants.

It's possible Ford building much more interesting EVs than GM somehow finds a way to get batteries and grows significantly at the expense of GM.

(or sub in VW for GM and I dunno Mercedes or BMW for Ford up there- or whatever combo you want).

So it's entirely possible some legacy will see significant growth and upside long term from the transition. It'll just be by taking share from OTHER legacy companies.

The trick is guessing WHICH ones are on which side of that. Just buying TSLA instead avoids that concern.

To use that phone comparison everyone likes- Apple obviously has been a great investment for folks during the transition from dumb to smart phones, but that doesn't mean nobody found a reason to own Samsung stock in that time.....but OTOH some folks still owned Nokia way too long

They have!Ford excites the consumers with MachE and F150 Lightning. GM not so with Bolt and low volume Hummer EV. GM needs to step up their game.

GM has got major ownership stakes in Nikola and fraudstown motors. What could possibly go wrong? Hub motors and gravity driven class A trucks bro…that’s clearly the way forward!

Last edited:

Artful Dodger

"Neko no me"

Does anyone feel like $TSLA is just artificially being held down and can break out at any time? Asking for a friend.......

$600 is likely the preferred SP for Options Market Makers this week. A Friday Close at that price kills a huge number of bets in both Calls and Puts at that strike price. Alternatively, if the SP moves in either direction away from their preferred SP, it costs them in increased payouts. Here's the OI from this morning: (note the row highlighted in yellow)

With over 1.4M options contracts open for this week's "triple witching Friday", the dawgs will likely have their day.

Cheers!

Thank you. I just opened a few 595/597.5/602.5/605 IC for $2.16. Max gain $216, max loss $34.$600 is likely the preferred SP for Options Market Makers this week. A Friday Close at that price kills a huge number of bets in both Calls and Puts at that strike price. Alternatively, if the SP moves in either direction away from their preferred SP, it costs them in increased payouts. Here's the OI from this morning: (note the row highlighted in yellow)

View attachment 673992

With over 1.4M options contracts open for this week's "triple witching Friday", the dawgs will likely have their day.

Cheers!

Looks backwards. Interventions per mile increasing and miles per intervention decreasing? What am I missing?Not sure if you all follow Dr. know it all… But he’s a pretty sharp cookie. Multiple PhD‘s. Including physics and mathematics.

According to the math that he lays out in this video; FSD will be solved within the year. Couldn’t time stamp it; but if you start at 8:00 min mark you’ll get the nuts and bolts of it.

So…, two weeks is coming up quick!

FSD reasoning didn't start till halfway through.

Their investment in EV is more like this.What's happening is legacy OEM's are 'claiming' they are putting all this $ into EV production, development to appease the gov't and investors...but in reality...they are just buying time to sell as many ICE vehicles as they can. When Tesla is fully ramped...it will accelerate their bankruptcy.

From: C*O

To: HR

Body: please give me a list of all people whose job description has “electric” in it.

From: HR

To: C*O

Body: Here is the list, this includes everyone, including interior lighting, turn signal engineering, and HQ building electrician etc.

Fwd: CFO

Body: See attachment for a list of people, please change their cost centers to our EV initiative.

My focus today is on the FOMC meeting. Will investors shrug off reassurances from the Fed with regard to tapering, preferring to see inflation settling down with their own eyes? Also, will there be an outsized reaction to even a hint of accelerated winding down of easy money policy in the 2-3 year time frame, which we may get?

uujjj2

Member

Maybe, maybe not.Market is too stupid to realize there's no room for F and GM to grow. The more money they "invest" in EV, the worse their 10-K is going to look. There's no upsides in growth or gross margin in store for them. Only downhill from here.

There's what, ~15 major auto OEMs making ICE vehicles today. Say 5 of them survive the EV transition. And maybe 3 to 4 of the new EV-only automakers make it to major status (obviously Tesla being one of them). There's an opportunity for some growth even for a traditional automaker. If they survive.

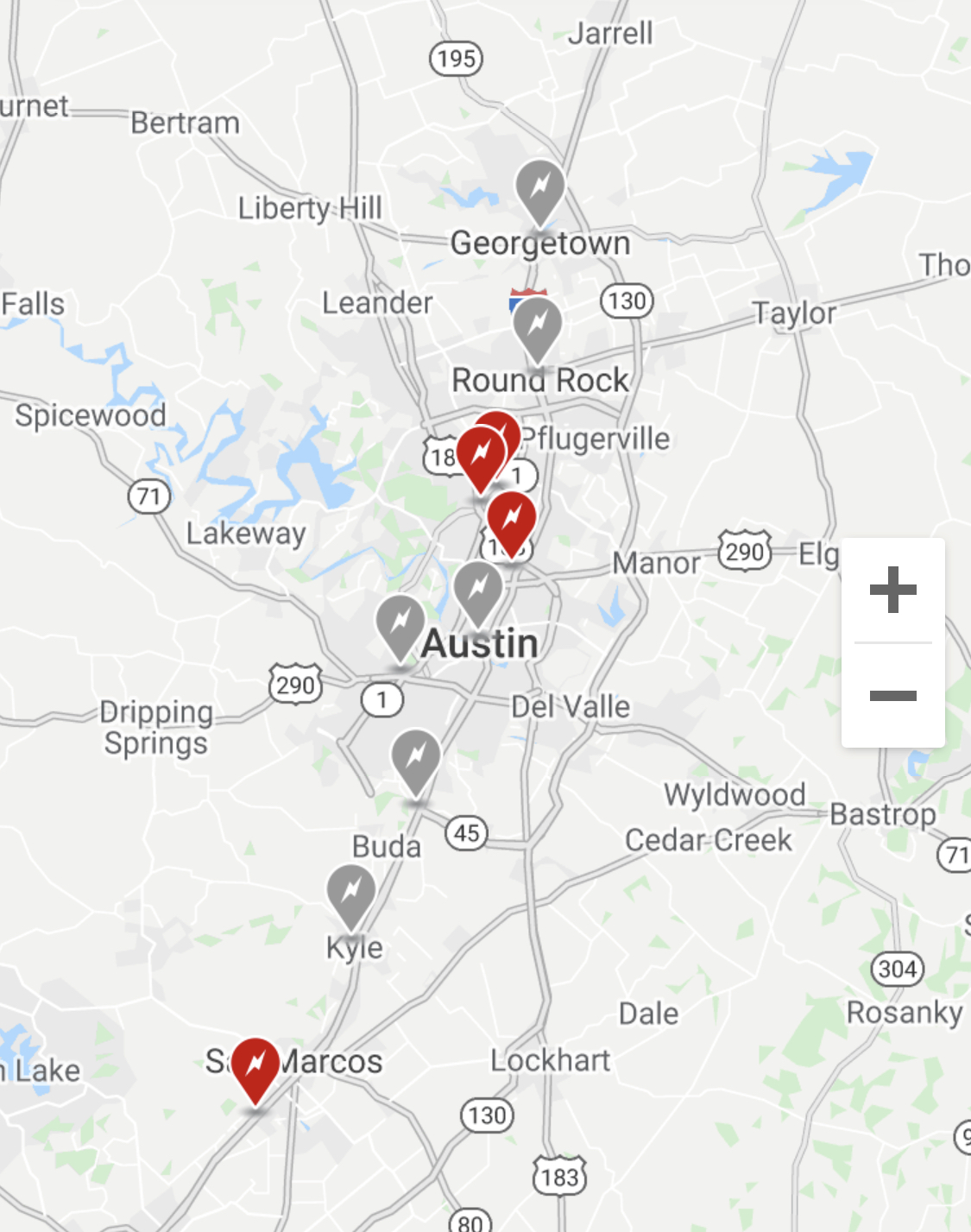

Just noticed. A whole slew of Superchargers planned/under construction near Austin.

Gotta get ready for the mass CT production coming soon!Just noticed. A whole slew of Superchargers planned/under construction near Austin.

View attachment 673997

Seems my CyberDeck is not the only trend in construction - Congrats on being an early adopter of all things Cyber!Yup! Here, I am guilty as charged...

Never owned a truck, never had any intention of buying a truck prior to CT, but when I looked at the combination of price and features and looked at my aging 2014 Model S (prior to Autopilot-1 hardware), I realized I am much better off "upgrading" to a CT rather than a new Model S or X.

And now I am even building a house to match the design of the CT

View attachment 673827

(To think early home builders knew this with their roof truss designs... was right under their noses all along.)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K