I remember Gordo saying he can't have a position in $TSLA because he was a sell side analyst.....did he just out himself again???You got a disagree because you threw the cat under the bus and I will not stand for that.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I swear there's a large fund out there that's "opposite Gordo ETF". The minute Gordon talks about him having a short position the stock skyrockets.I remember Gordo saying he can't have a position in $TSLA because he was a sell side analyst.....did he just out himself again???

No matter how much fun it is to bash Trevor Milton in this thread, posting on Nikola will have to continue in All discussion of Nikola Motors

oshooda

New Member

A further catalyst for the share price could be an adjustment of the Moody rating.

Redeeming 1.8B Bond 2025 should also have a positive issue.

FACTORS THAT COULD LEAD TO AN UPGRADE OR DOWNGRADE OF THE RATINGS

Tesla's ratings could be upgraded if the company remains on a trajectory to sustain automotive EBITA margins above 4% during 2021 as it brings European production facilities on line. This margin would have to be sustained in the face increased BEV competition, particularly in China and expanding AFV offering in Europe. Maintaining a strong liquidity profile to fund its capacity expansion and production ramp up will also be critical to an upgrade.

Redeeming 1.8B Bond 2025 should also have a positive issue.

2025 Notes

On July 16, 2021, we issued a notice of redemption to the holders of the 2025 Notes informing the holders that we will redeem the notes in full in August 2021 at a redemption price equal to 102.65% of outstanding principal amount, plus accrued and unpaid interest, if any.

I remember Gordo saying he can't have a position in $TSLA because he was a sell side analyst.....did he just out himself again???

When even the host was like “ hmmm, Gordon…alright

Like really, it seems that even pro Tesla YouTubers are only using him for clicks now, just like CNBS!

Don't let the b@stards get us down! As if there were anything we could do about it...

TheTalkingMule

Distributed Energy Enthusiast

Looks like Tesla Energy just switched residential solar to 425W panels. Their new array sizes are:

4.25 kW

8.5 kW

12.75 kW

17 kW

I guess these are the larger utility format panel? Anyone know if you can even squeeze 425W on a standard residential size panel?

4.25 kW

8.5 kW

12.75 kW

17 kW

I guess these are the larger utility format panel? Anyone know if you can even squeeze 425W on a standard residential size panel?

2daMoon

Mostly Harmless

Just wanted to let you know how your pain is shared on this piddling TSLA day at the market.2% gain……..I’m more of a 5-10% guy…..

If it doesn't close with at least a 5% gain today I should just sell it all, right?

/s

ThisStockGood

Still cruising my Model S 70 2015

They can’t. It’s a larger panel.Looks like Tesla Energy just switched residential solar to 425W panels. Their new array sizes are:

4.25 kW

8.5 kW

12.75 kW

17 kW

I guess these are the larger utility format panel? Anyone know if you can even squeeze 425W on a standard residential size panel?

I lied about signing off and..i just had to share:

Guess who?? Would not be a CNBS day without mentioning Tesla in a negative manner while stock is up 4.6%

Guess who?? Would not be a CNBS day without mentioning Tesla in a negative manner while stock is up 4.6%

Artful Dodger

"Neko no me"

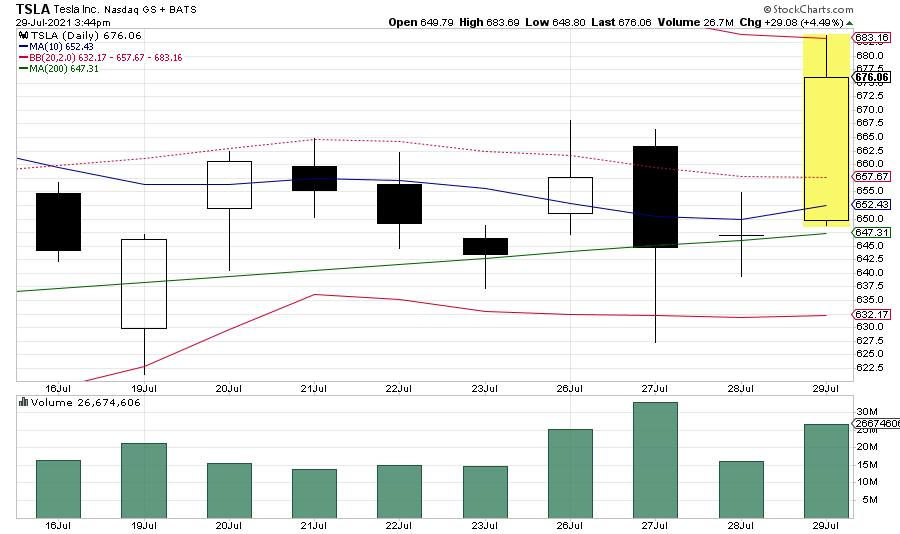

TSLA climbed to the Upper-BB then bounced off today: (15:44 EDT chart)

Let's see how Max-Pain changes when the new number is released tomorrow morning at about 7:00 am EDT.

Cheers!

Let's see how Max-Pain changes when the new number is released tomorrow morning at about 7:00 am EDT.

Cheers!

LN1_Casey

Draco dormiens nunquam titillandus

I swear there's a large fund out there that's "opposite Gordo ETF". The minute Gordon talks about him having a short position the stock skyrockets.

His track record is pretty terrible, and very obvious to everyone who digs even to just the first page of a google search page. I wouldn't be surprised if there is a lot of investors--personal investors, small hedge funds, etc.--who have all independently came to the same concision to do the opposite of what he is saying. With enough of them, it adds up.

Thanks all! Could have been worse! You can put your couch cushions back now...

StarFoxisDown!

Well-Known Member

The closing volume is kinda making me think tomorrow's trading action is going to be quite interesting. The last 10 mins of trading were especially strong.

In fact the 2nd half of the day trading has been interesting. Thought for sure when the macro's started going lower that MM's would use that opportunity to push the stock lower to try and avoid paying out all those 680 Calls tomorrow. But whoever was buying was having none of that.

In fact the 2nd half of the day trading has been interesting. Thought for sure when the macro's started going lower that MM's would use that opportunity to push the stock lower to try and avoid paying out all those 680 Calls tomorrow. But whoever was buying was having none of that.

Marc_K_inNJ

Member

Doing the opposite, is a good investment strategy. I sometimes want to implement that, and do the opposite of what I plan to do...His track record is pretty terrible, and very obvious to everyone who digs even to just the first page of a google search page. I wouldn't be surprised if there is a lot of investors--personal investors, small hedge funds, etc.--who have all independently came to the same concision to do the opposite of what he is saying. With enough of them, it adds up.

there isn't. But some company has internally an "opposite david einhorn"-fund .. iirc.I swear there's a large fund out there that's "opposite Gordo ETF". The minute Gordon talks about him having a short position the stock skyrockets.

Salty much????I lied about signing off and..i just had to share:

View attachment 689631

Guess who?? Would not be a CNBS day without mentioning Tesla in a negative manner while stock is up 4.6%

They are probably a 72-cell, so much longer, around 80" like the Q Cell 420's would be my guess. The width is probably still about 40", they just add 2 more rows of cells down below and add to the length.Looks like Tesla Energy just switched residential solar to 425W panels. Their new array sizes are:

4.25 kW

8.5 kW

12.75 kW

17 kW

I guess these are the larger utility format panel? Anyone know if you can even squeeze 425W on a standard residential size panel?

Speaking of Nikola, does anyone know what the state of their lawsuit against Tesla is? You know the one where they claim that Tesla has stolen their truck design for the semi. It's been very long since I've heard or seen anything about it.

Accident

Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K