I do not think this software screw up will have much effect on the stock price, but I was surprised at how poorly Tesla handled the situation. It’s not a big deal to me to release some buggy software and rollback, but the lack of communication with the beta testers was irritating especially when so many were new. Then the confusion about which version was being rolled back to was strange. I don’t know if they even are still trying to roll things back or not as I’m still on 10.3 and have no pending updates.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Some folks in the options thread have speculated that TSLA will plateau or drop hard from here. Reasons include: all-time high, pullback after runup, happened many times this year.

I don't think so. Tesla is changing fast, and so is market sentiment. For the first time in history...

I'm not selling any covered calls now, not even those judged "safe" by folks looking at TSLA's past behavior. Things have changed. History is being made.

You may have heard the aphorism: "Past performance does not guarantee it will continue." The same is true of past underperformance.

I don't think so. Tesla is changing fast, and so is market sentiment. For the first time in history...

- Tesla just raised prices on ALL their cars (nonperformance versions) because backlogs are out of control.

- Plaid shocked the industry, and is still getting press and ecstatic word-of-mouth.

- Production capacity is on track to DOUBLE very soon.

- Battery supply is on track to 10X soon.

- Tesla recently increased sales by double digits while ALL automajors lost sales by double digits.

- FSD Beta, despite today's temporary setback, is expanding to thousands of testers.

- S&P's rating upgrade reportedly expands the number of institutions that can buy TSLA.

- Market manipulators recently lost control, including paying on the GIGANTIC call wall at $900 last Friday.

- Analyst upgrades are pouring in.

- Even the two-faced mercenary Jonas upgraded bigly, maybe because his employer and their clients "who matter" are positioned for more runup.

I'm not selling any covered calls now, not even those judged "safe" by folks looking at TSLA's past behavior. Things have changed. History is being made.

You may have heard the aphorism: "Past performance does not guarantee it will continue." The same is true of past underperformance.

Robertj

Member

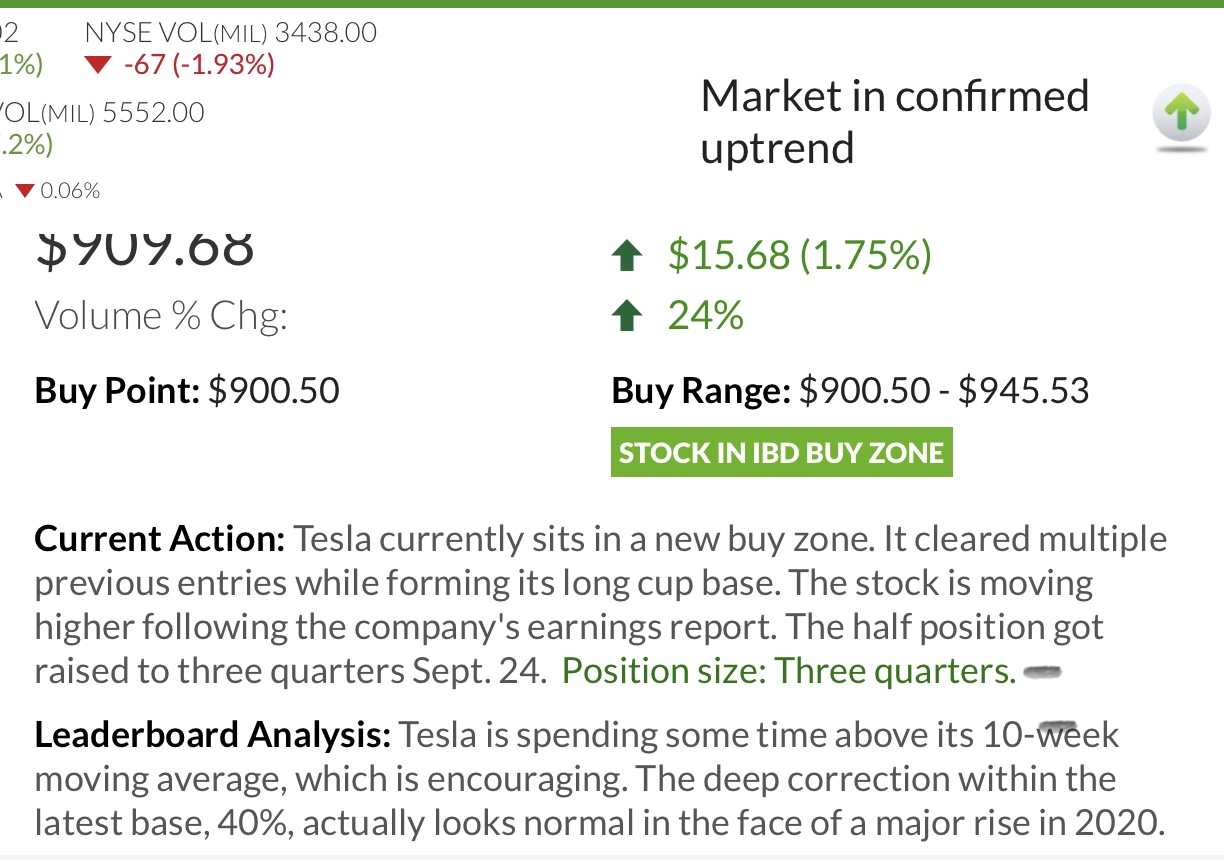

Some people just think Tesla has entered a buy zone IBD/ Leaderboard

UnknownSoldier

Unknown Member

If you have a million already and buy a million of Tesla, what's wrong with being called a Teslanaire?I don't get why there is even debate on the definition.

You have no TSLA position today. You by a million worth tomorrow and you are a Teslanaire?

Has to come from gains ONLY.

Or are you saying KoGuan Leo isn't a legit Teslabillionaire because he bought several billions worth of TSLA?

I just read it - it is BS and ridiculously selective. I have a digital subscription to WAPO - I haven't found its coverage of Tesla to be anywhere close to accurate, but I do value it for other articles, so unlike Fred's pub, I won't be turning it off. I may choose to put a comment in tomorrow - though it will probably just be swallowed up by posters who appear to have little to no knowledge of the feature, the company, or much else.This is just a screen shot because I dont want to give this dufus Siddiqui any clicksView attachment 725313

As @Ohmster noted, this may result in a buying opportunity tomorrow, but then the dust will settle and reality will continue to demonstrate the strength of Tesla's business.

Didn't see this posted yet - Parts and service, the coming EV disruption that nobody's talking about. The topic has been covered before, but the article has some good facts in it. Here are a few examples:

- Making, selling and servicing vehicles employ an estimated 4.7 million people in the U.S., according to the Bureau of Labor Statistics. Some of the jobs won’t go away, of course — there will still be a need for dealerships and tire shops. [I deleted the link to the dealerships, because they don't list Tesla as a manufacturer, lol]

- The shift will reduce demand for oil nearly by 4.7 million barrels a day by 2040 in the U.S. alone, according to projections by BloombergNEF. That’s about 26% of U.S. consumption, roughly equivalent to the amount that Germany and Brazil combined consumed daily in 2020. Less gasoline being sold also means the need for ethanol, which is blended into motor fuels and consumes a third of the U.S. corn crop, will also fall.

Not sure if re-post, Morgan Stanley raises Tesla PT to $1200.

#LFG

What a horrible weekend of posting, I expect much better from you people starting tomorrow.

Boasting about money all weekend, now topped of with political trolling. Shameful!

Looks like I didn't miss much.

Last edited:

RobStark

Well-Known Member

I do not think this software screw up will have much effect on the stock price, but I was surprised at how poorly Tesla handled the situation. It’s not a big deal to me to release some buggy software and rollback, but the lack of communication with the beta testers was irritating especially when so many were new. Then the confusion about which version was being rolled back to was strange. I don’t know if they even are still trying to roll things back or not as I’m still on 10.3 and have no pending updates.

This might result in another letter from NHTSA, and it’s harder to make the argument that the rollback wasn’t a “recall” by their standard.

Tes La Ferrari

Active Member

Tesla Model Y Occupants Walk Away After Their Car Rolls Over 3 Times in Horrific Accident

Tesla cars have an excellent reputation for being the safest on the road. Tesla Model Y protected its occupants from a terrible accident in which it rolled over three times.

TL; DR: 3 occupants not only survive, but walk away after being rear ended by a sleeping driver at 90+ mph which led to rolling their Model Y 3 times.

“Dashcam footage partially captures the terribleness of the accident, as the car can be clearly seen rolling over, continuing to hit the road surface. We can only imagine what horror Gilbert and his wife experienced. It should also be kept in mind that the bodies of the occupants of the car have experienced an incredibly strong physical impact, which could cause irreparable harm to their health and life. However, thanks to the design of Model Y, they were not seriously injured and were able to walk away.”

Gratitude for the oppportunity to invest in a company that is saving lives of it’s customers and non-customer citizens of the planet alike.

Last edited:

This has got to be popular with dealers.

Service on EVs is already hitting dealer bottom lines. Now they get hit with a hit to their margins as well. What a great time to be an auto dealership! (No sympathy from me)

I had to do a double-take because initially I thought this was a random troll, given the quality of the reply.

It turns out she’s Head of Communications, Marketing, & Public Affairs at Waymo

Thank god, Tesla doesn’t have a PR department (Gary can go … sell his shares) and this confirms that Tesla is on the right path to FSD.

It turns out she’s Head of Communications, Marketing, & Public Affairs at Waymo

Thank god, Tesla doesn’t have a PR department (Gary can go … sell his shares) and this confirms that Tesla is on the right path to FSD.

I can hardly wait till trading starts Monday morning so all the Teslanaire-designation posts move (I hope) to their own special thread.

What a horrible weekend of posting, I expect much better from you people starting tomorrow.

Boasting about money all weekend, now topped of with political trolling. Shameful!

May I also remind everyone that this is a public forum. Who knows what nefarious lurkers may try to figure out who some of these Teslanaires are. Furthermore, if you brag about being a Teslanaire today and the stock 10x's again in another few years and you then brag about having never sold any shares, or that you make more in your options account than your buy & hold account, well it doesn't take a genius to do that kind of math...

I feel like fearing some lurker finding out your true identity is a waste of time on this forum. There are so many youtubers who show their face, uses their real name, tell you where they live, and shows off their house. Those seems to be simple targets vs trying to decipher screen names.May I also remind everyone that this is a public forum. Who knows what nefarious lurkers may try to figure out who some of these Teslanaires are. Furthermore, if you brag about being a Teslanaire today and the stock 10x's again in another few years and you then brag about having never sold any shares, or that you make more in your options account than your buy & hold account, well it doesn't take a genius to do that kind of math...

As someone who closely follows both this thread as well as the options thread, I feel the need to post some correction here. None of us are expecting a hard drop and we all completely agree with everything you have posted as the reasons for long term growth and gains in TSLA stock. I have myself been a HODLer since 2014 - and all in TSLA since 2019, with no intention of selling or taking profits anytime soon.Some folks in the options thread have speculated that TSLA will plateau or drop hard from here. Reasons include: all-time high, pullback after runup, happened many times this year.

I don't think so. Tesla is changing fast, and so is market sentiment. For the first time in history...

Years ago I posted that a long decline in TSLA turned around when Jonas switched overnight from hilariously negative to positive on Tesla. That's when I jumped into buying again, and was not disappointed.

- Tesla just raised prices on ALL their cars (nonperformance versions) because backlogs are out of control.

- Plaid shocked the industry, and is still getting press and ecstatic word-of-mouth.

- Production capacity is on track to DOUBLE very soon.

- Battery supply is on track to 10X soon.

- Tesla recently increased sales by double digits while ALL automajors lost sales by double digits.

- FSD Beta, despite today's temporary setback, is expanding to thousands of testers.

- S&P's rating upgrade reportedly expands the number of institutions that can buy TSLA.

- Market manipulators recently lost control, including paying on the GIGANTIC call wall at $900 last Friday.

- Analyst upgrades are pouring in.

- Even the two-faced mercenary Jonas upgraded bigly, maybe because his employer and their clients "who matter" are positioned for more runup.

I'm not selling any covered calls now, not even those judged "safe" by folks looking at TSLA's past behavior. Things have changed. History is being made.

You may have heard the aphorism: "Past performance does not guarantee it will continue." The same is true of past underperformance.

While we have no doubts about long term prospects of TSLA - the very short term is not always that clear. Most of us on the options thread are trading weekly options - so the question is: will TSLA be higher or lower by Friday 10/29/2021? With almost 20% appreciation in the stock over the last few months, it is more likely than not that there will be some consolidation in SP. If you pay attention and read the posts, you will find that most of us are not willing to bet anything below a SP of $1000 for next Friday. Most of us are doing Bull Put Spreads - which as the name suggests are bullish in nature. We are mostly betting that the stock will remain above the put option strike prices we are betting on. In other words, even with expectation of consolidation, we are by and large bullish on the stock.

The only reason I am responding to this post is that to me it appeared critical of the other thread, suggesting that we are expecting sudden drop in SP. Even during the massive run-up of the SP from Oct 2019 to Feb 2020 there were weeks of consolidation and even SP drop. We are simply learning to take advantage of some of these while staying bullish for long term.

Tes La Ferrari

Active Member

788.4 in Germany = $918.66 US

Is that a Frankfurt stock price in your pocket, or are you just happy to see me?

Is that a Frankfurt stock price in your pocket, or are you just happy to see me?

Pretty crazy how we have to correct FUD from within the forums itself!As someone who closely follows both this thread as well as the options thread, I feel the need to post some correction here. None of us are expecting a hard drop and we all completely agree with everything you have posted as the reasons for long term growth and gains in TSLA stock. I have myself been a HODLer since 2014 - and all in TSLA since 2019, with no intention of selling or taking profits anytime soon.

While we have no doubts about long term prospects of TSLA - the very short term is not always that clear. Most of us on the options thread are trading weekly options - so the question is: will TSLA be higher or lower by Friday 10/29/2021? With almost 20% appreciation in the stock over the last few months, it is more likely than not that there will be some consolidation in SP. If you pay attention and read the posts, you will find that most of us are not willing to bet anything below a SP of $1000 for next Friday. Most of us are doing Bull Put Spreads - which as the name suggests are bullish in nature. We are mostly betting that the stock will remain above the put option strike prices we are betting on. In other words, even with expectation of consolidation, we are by and large bullish on the stock.

The only reason I am responding to this post is that to me it appeared critical of the other thread, suggesting that we are expecting sudden drop in SP. Even during the massive run-up of the SP from Oct 2019 to Feb 2020 there were weeks of consolidation and even SP drop. We are simply learning to take advantage of some of these while staying bullish for long term.

J

jbcarioca

Guest

Those are possibilities. Among the other possibilities are the beneficial impact of increasing factory scalability and efficiency through front and rear Model Y castings and structural battery pack plus paint shop advances. These do have significant implementation complexity, so may end out with nearly immediate benefit and may cause short term production weaknesses.You could be right but I looked at Shanghai's ramp and it really had no impact on margins.

We saw a very slight dip in Q1 2020 when Shanghai came on board (just a 0.3% dip on the Model 3 margin) but much of that had to do with reduced production in Fremont (104k in Q4 vs 86k in Q1 as Covid shutdown Fremont in mid-March).

However, in using Shanghai as a proxy, I may be overlooking the fact that Labor & Overhead costs will be higher in Berlin/Austin than we had in Shanghai and we are dealing with 2 inefficient ramping sites instead of one.

Zach did make some comments on margins as there are "unknown unknowns", but I sense they are putting pieces in place to produce increasing margins (Model X ramp and US price increases).

Further there are indications that Grūneheide may be having recruiting problems.

Only actual ramping results will resolve the questions. Given these issues and global supply chain difficulties I tend towards assuming a lower 2022 growth rate than continuing the recent history of spectacular growth. There is a gigantic tailwind for 2023. 2022 could have spectacular results also, but that does depend on some fortuitous events.

And those YouTubers should be careful as well. There are posters on this board that use their real name as their user id, post the city they live in, what they do for a living, where they went to college, how old they are, who their brokerage account is with, and how much TSLA they hold. That’s a pretty good start for someone who wants to compromise your account. It gets even worse if these folks are active on social media.I feel like fearing some lurker finding out your true identity is a waste of time on this forum. There are so many youtubers who show their face, uses their real name, tell you where they live, and shows off their house. Those seems to be simple targets vs trying to decipher screen names.

S&P's rating upgrade??Some folks in the options thread have speculated that TSLA will plateau or drop hard from here. Reasons include: all-time high, pullback after runup, happened many times this year.

I don't think so. Tesla is changing fast, and so is market sentiment. For the first time in history...

Years ago I posted that a long decline in TSLA turned around when Jonas switched overnight from hilariously negative to positive on Tesla. That's when I jumped into buying again, and was not disappointed.

- Tesla just raised prices on ALL their cars (nonperformance versions) because backlogs are out of control.

- Plaid shocked the industry, and is still getting press and ecstatic word-of-mouth.

- Production capacity is on track to DOUBLE very soon.

- Battery supply is on track to 10X soon.

- Tesla recently increased sales by double digits while ALL automajors lost sales by double digits.

- FSD Beta, despite today's temporary setback, is expanding to thousands of testers.

- S&P's rating upgrade reportedly expands the number of institutions that can buy TSLA.

- Market manipulators recently lost control, including paying on the GIGANTIC call wall at $900 last Friday.

- Analyst upgrades are pouring in.

- Even the two-faced mercenary Jonas upgraded bigly, maybe because his employer and their clients "who matter" are positioned for more runup.

I'm not selling any covered calls now, not even those judged "safe" by folks looking at TSLA's past behavior. Things have changed. History is being made.

You may have heard the aphorism: "Past performance does not guarantee it will continue." The same is true of past underperformance.

EDIT- AH! Thank you, @PeterJA ! BB Credit rating.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K