Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Only a Californian could take ‘when it rains, it pours’ as a positive.Ending slightly higher in extended trading to $1,029.57 . I bet it’s even higher by the morning bell. This feels like capitulation.

Looking forward to watching the ticker tomorrow. When it rains, it pours.

UnknownSoldier

Unknown Member

Ladies and Gentlemen,

It has been a pleasure making a sugarload of money with you.

May tomorrow be even brighter and more beautiful than today was.

I have some whiskey from my Tesla decanter in me and I'm slightly buzzed right now. Please do not change your estimation of the sincerity of the above statement because of this.

It has been a pleasure making a sugarload of money with you.

May tomorrow be even brighter and more beautiful than today was.

I have some whiskey from my Tesla decanter in me and I'm slightly buzzed right now. Please do not change your estimation of the sincerity of the above statement because of this.

There was a glitch in the matrix and I received a message from the future. Year unknown. Hold!

Sorry I've been withholding this from you all for some time.

View attachment 725813

But but... ...I see red... :/

engle

Member

Thanks for correcting me @Tim S that's right I forgot during Monday's excitement! So another split may occur sooner rather than later if $TSLA continues on its positive trajectory. Baring awful macros, as Austin and Berlin ramp up, I think it will split again by 2022 Q2.The SP was in the 1300s (pre-split) when the split was announced on August 11th last year. It was around $2200 (pre-split) when the split took effect August 31st.

Just realized SP is getting close to my spouse-approved Roadster II price target, too! (see below)

Model S M.D.

Ludicrous Radiologist

I came up with a new game. Every time Dan Ives says “Green Tidal Wave”, we drink a shot of Tesla Tequila

Congratulations and thanks to those posting ‘the wider the base, the bigger the pop’ type of comments on here over the last few months.

You certainly gave me the confidence to HODL and accrue, and as a consequence my retirement date and plans are now entirely mine to determine, and all done by investing ethically, in a company and a man motivated to save humanity in the face of the strongest opposition imaginable.

You certainly gave me the confidence to HODL and accrue, and as a consequence my retirement date and plans are now entirely mine to determine, and all done by investing ethically, in a company and a man motivated to save humanity in the face of the strongest opposition imaginable.

Off Shore

Off Topic Member

Damn! I love it when someone on the Internet writes something I agree with.We've been talking all day as if this leg up is 50% rooted in the Hertz deal. I'd say it's 5% at best.

To me there was no way this long awaited squeeze was gonna get put off til 4Q earnings. The profits were speaking too loud.

What we saw today was from:

15% - unfathomable 1Q deliveries

10% - great 1Q earnings report

15% - very good 2Q deliveries

15% - great 2Q earnings report

5% - very good 3Q deliveries

15% - absurd 3Q margins and ZEV-free profits

15% - looming 4Q profits & rational PE

5% - Wall Street laziness

5% - Hertz surprise

MM's pushed aallllllll this stuff down since April and coiled the spring just like before. And it released.

Hell, we're barely now beating SP500 & QQQ YTD. Here's hoping the bloodbath continues. If we think about how much MM's had to push this down for 6 months, it very well could continue right up beyond the new $1200 target.

Wicket

Member

You need to work on your sarcasm.

No one buys Teslas anymore. The waitlist is too long.

My Leaps actually saw a 0.5% increase in IV today. Color me shocked. It has generally been straight down on IV during this run but I suppose 12% daily moves can overpower the trend. I'd book profits on these if we got just half way back to the IV of 3 months ago.

Tes La Ferrari

Active Member

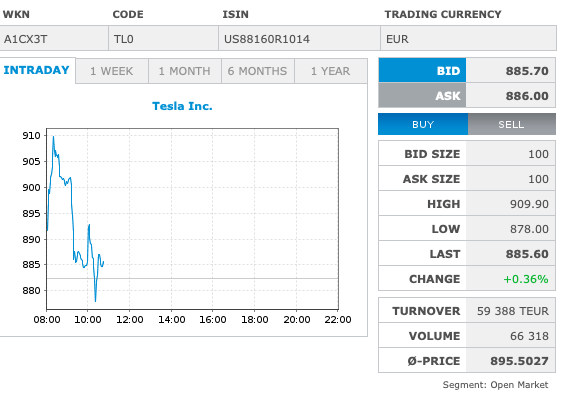

Germany is at $1044.93. Something to consider for those that might be placing limit orders for tomorrow am, or if you have a bunch of limit orders that you might want to recheck if you haven’t looked at them in a while.

While certainly not a guarantee of what the SP will do tomorrow, i find it to be a useful tool in the toolkit.

While certainly not a guarantee of what the SP will do tomorrow, i find it to be a useful tool in the toolkit.

1052 usd. It's out of control again!Germany is at $1044.93. Something to consider for those that might be placing limit orders for tomorrow am.

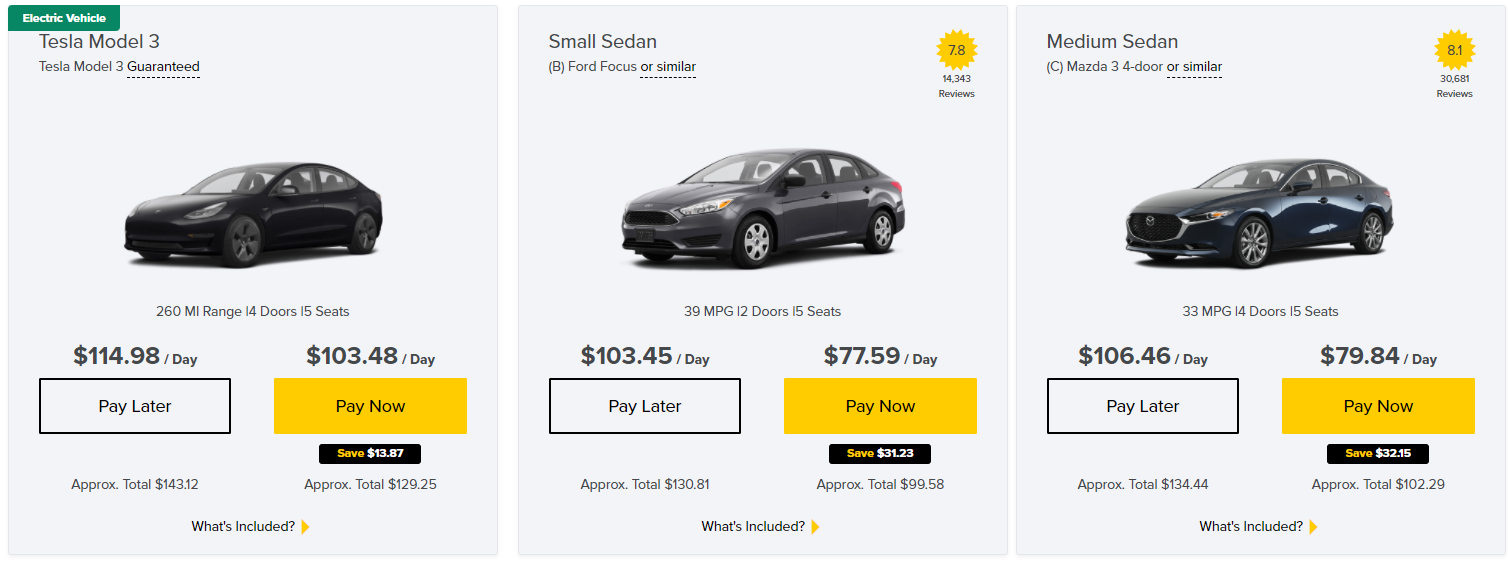

It depends on whether you know how to drive a car.So this begs a question for me, and I’m going to embarrass myself here because you are all car people.

I am not a car person. I don’t care about cars, just need to get from Point A to Point B. I don’t own a Tesla yet, but once I secure my retirement Tesla will be my next car. I’ve often thought that I will have to ask one of you Bay Area Tesla enthusiasts to help me figure out my Model 3 when the time comes.

So if I, or someone like me, rents a Tesla from Hertz, are we going to be able to drive it without instruction??

Gigapress

Trying to be less wrong

My 2022 prediction:

1.7 million deliveries

33% auto gross margin

$20 billion EBIT

>> Today's price would only be 50x earnings in 2022.

2030: 20 million vehicles at $10k gross profit. $200 billion auto gross profit.

Plus energy.

Then FSD lottery ticket scenario bumping up per vehicle profit 10-20x.

Then more lottery ticket scenarios: Dojo as a service, TeslaBot, HVAC/smarthome services, and more.

IMO we are looking at minimum 10x gain from here with an outside shot of 100-1,000x conceivable, simply because there are plausible outcomes where they cumulatively earn $100Tril-$1Quad over the next 50 years. That's $2-20Trillion profit per year, which is entirely reasonable if FSD etc. hits the full bull case. For what it's worth, in binge watching the Joe Justice videos a couple weeks ago I heard him say 100-1000x from a video released this year. That gives me more evidence that I'm likely not overlooking anything major. My intuition is screaming "No!" but the math tells me otherwise.

Today's $1T valuation is crazy low. The market still does not comprehend the sheer magnitude of what we're witnessing. I believe, literally, that there's a non-negligible chance that we have in this forum some future billionaires for those with 10k shares or more.

1.7 million deliveries

33% auto gross margin

$20 billion EBIT

>> Today's price would only be 50x earnings in 2022.

2030: 20 million vehicles at $10k gross profit. $200 billion auto gross profit.

Plus energy.

Then FSD lottery ticket scenario bumping up per vehicle profit 10-20x.

Then more lottery ticket scenarios: Dojo as a service, TeslaBot, HVAC/smarthome services, and more.

IMO we are looking at minimum 10x gain from here with an outside shot of 100-1,000x conceivable, simply because there are plausible outcomes where they cumulatively earn $100Tril-$1Quad over the next 50 years. That's $2-20Trillion profit per year, which is entirely reasonable if FSD etc. hits the full bull case. For what it's worth, in binge watching the Joe Justice videos a couple weeks ago I heard him say 100-1000x from a video released this year. That gives me more evidence that I'm likely not overlooking anything major. My intuition is screaming "No!" but the math tells me otherwise.

Today's $1T valuation is crazy low. The market still does not comprehend the sheer magnitude of what we're witnessing. I believe, literally, that there's a non-negligible chance that we have in this forum some future billionaires for those with 10k shares or more.

Last edited:

He is limited by his contract to a maximum amount of borrowing against his Tesla shares. IIRC it was 25 billion maybe, which is more than enough for his 10 billion dollar tax bill but that's a big loan for anyone.

Musk's Expiring Tesla Stock Options Put Elon in Perverse Tax Dilemma

Elon Musk's expiring Tesla stock options have put him in a perverse tax dilemma. This tricky situation is forcing him to either take on debt or sell shares.

This article states that the Tesla Board of Directors have rules that limit borrowing to 25% of the shares pledged as collateral.

RobStark

Well-Known Member

RobStark

Well-Known Member

Who has 100k spare EVs to sell another rental car company? Nobody.

VW China had 500k spare ID.4 to sell this year.

Can probably deliver 80k ID.4 through 2021.

FS_FRA

Member

Frankfurt right now....that's $1,027 with an early high of $1,057....keep on pushing

Congrats to all the longs! This I promised at 1000, 1200 and Tesla tequila is getting uncorked.

2

22522

Guest

Err... No, it doesn't.It depends on whether you know how to drive a car.

At least not in a little while.

[I have to test whatever information I hear, to see if it is true for all time, before accepting it as good to build on. Kind of like buying lumber at Home Depot. It may look true when you buy it, but a week later it is so warped it cannot reliably support weight.

Your answer helped me a lot. As it was my unvoiced answer, also. By voicing it, you gave me something to do a true for all time truth test on. Thank you. Echo chambers are not always a bad thing!]

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K