S

Sofie

Guest

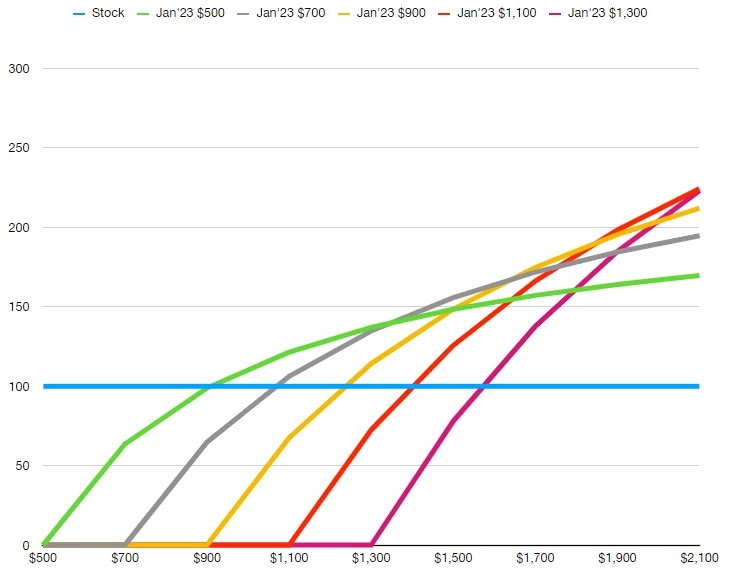

They can also run out of money too…? (Or is that not a thingView attachment 727323

I am sure the MM's will be out for blood come Monday...then again...they can only do so much to hold down the coiled spring....Let the games begin

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

They can also run out of money too…? (Or is that not a thingView attachment 727323

I am sure the MM's will be out for blood come Monday...then again...they can only do so much to hold down the coiled spring....Let the games begin

Really?It’s always good to have someone saying the opposite of us to average down our expectations. I like reading bearish people and hear their irrational arguments.

driveteslacanada.ca

driveteslacanada.ca

lol... $20,000+ stock price? C'mon.

Dave had this Option guy predicting pushdown today, was he for real?

The less attention an investor pays to market theories and predictions by market insiders supposedly 'in the know', the better! These people are just a distraction and are never consistently right. The market will continue to behave in a manner that is unpredictable. Often someone will have a moment of clarity or a flash of insight that allows them to see a good strategy but, for every one that is correct there are two that are wrong and there's no way to tell who is right at any given moment. It's best to avoid exposing one's self to such pronouncements and follow your own path.

In that case, I will buy it at $250.

Do you really think the price is just going to keep going up without any large dips? I still think 99% of people don't 'get' Tesla and are just in it for the short-term gains. They will leave when they made a good profit.

Almost?Guys and girls. This is crazy. In May TSLA SP was $563. We have almost doubled since then.

Model Y = world domination!Model 3 = world domination?

I just saw that over 50% of Tesla registrations in Cali are Model Y this quarter.Model Y = world domination!

TSLA is up 17.19% this week, but I got a friend rubbing his LCID 48.72% gain on my face

Speaking of potential stock split. It’s still impossible without some kind of shareholder meeting/voting right?

People here and there talk about it like it could happen almost out of the blue.

Edit: Afik a 1:1.9 split is possible…

The less attention an investor pays to market theories and predictions by market insiders supposedly 'in the know', the better! These people are just a distraction and are never consistently right. The market will continue to behave in a manner that is unpredictable. Often someone will have a moment of clarity or a flash of insight that allows them to see a good strategy but, for every one that is correct there are two that are wrong and there's no way to tell who is right at any given moment. It's best to avoid exposing one's self to such pronouncements and follow your own path.