Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Thanks @mrmage . Those are valid issues, so it's my ignorance showing as I don't trade options and don't know what to ask. I have the one question about if you trade options, (so far 40% of us), that's all. If you could give me other question(s), I can add them (it's a problem changing existing questions as it messes up our 101 responses so far). Or we can do a follow-up poll on option trading.

So far only 10% have more than 10,000 shares, so I don't think we're giving up much reporting not having higher brackets - do you?

I've always been most interested in the top end of any demographic. Something to aspire to. But I agree that adding something now would mess up the data.

One question I'd add is what the estimated annual roi is against total TSLA investment.

thesmokingman

Active Member

It's amazing the degree at which Mary bold faced lies. The interviewer just confirmed you have 9.x% market share in the US to Tesla's 63%...

There must be other strings attached to the German subsidy.

dhanson865

Well-Known Member

(On-topic weekend diversion)

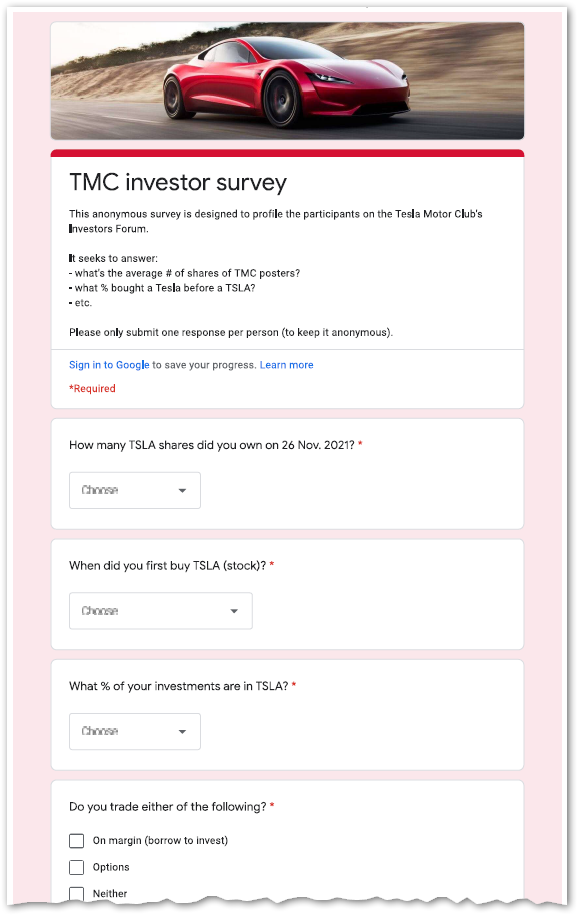

Oftentimes in this thread, people coyly suggest how many shares they own, or at least how many they recently purchased ("Just picked up 50 more chairs on the dip!!"). Others give opinions evidently based on years of investing experience. I'm always curious about the experience behind all the opinions, and I'm guessing you are too. And - let's be honest - I want to know where my TSLA investments fit in compared to those of others on the forum! Well, guess no more.

..... TMC investor survey

This 10 multiple-choice question survey is in Google Forms because we need several questions to effectively profile the community. It's anonymous so I don't believe there's any way for someone to maliciously connect your response with your personal finances - in other words, you're not putting your investments at risk (anyone correct me if I'm wrong). Summary results are visible after completing.

Please fill in - thank you!

that asset question is a little silly on the 75%/76%+ divider. I have well less than a million in non TSLA assets, so all it takes is to have more than $3.x million (under $4 million) in TSLA to have over 76% there.

I'm not there yet, but I could see that happening in a few years.

Anyone in flyover country in the US or anyone in another country where the cost of living is low could easily be in that top bucket and still have a house, multiple cars, and such.

Last edited:

View attachment 737780

There must be other strings attached to the German subsidy.

Yep. Tesla doesn't need subsidies or loans anymore because they've become a money printing machine, so why restrict themselves with terms and red tape?

RobDickinson

Active Member

There must be other strings attached to the German subsidy.

There are, they want the plant to be the first kicking out and using 4680s etc, but due to delays Austin etc will be so rather than hold up use elsewhere (which has its own costs) Tesla has chosen not to go with this subsidy

StealthP3D

Well-Known Member

My 2 cents about Tesla's refusal of the huge subsidy (being my gut-feeling):

This subsidy is to accelerate the wide-spread use of batteries.

Very likely there are conditions connected to the subsidy that any progress in battery-technology within a certain period must become freely available for other parties.

Also very likely those conditions were still under development in the past.

Now that they have become official, they are not acceptable for Tesla, which is far ahead of other companies in battery-technology.

The only possible and correct decision by Tesla.

My initial thought was that the subsidies came with strings attached and they wouldn't necessarily be limited to sharing. The attached conditions could be onerous in other ways.

2

22522

Guest

Any obligation that distorts the natural order of time is onerous. Tesla is the only company that appears to value time more than linearity (code word for schedules so padded that any and everyone can meet them).View attachment 737780

There must be other strings attached to the German subsidy.

StealthP3D

Well-Known Member

My opinion is that some of the competition is starting to finally deliver decent EVs with the Mach-E as the closest in terms of price / value vs. the Model 3/Y. I think this is the benchmark as this is the highest volume segment and the one Tesla is currently focused on.

Don't make the mistake of using MSRP to determine how close a competitor is to matching the value offered by Tesla. MSRP is set based on how much the manufacturer thinks the market will bear, not how much it costs to produce. Tesla has great margins on the Model Y and thus a lot of flexibility in lowering the price if it's necessary to in order to compete effectively as higher production volumes are reached while the sense I get is that would just cost the competitors to lose more money on each sale. Notice I said "if it's necessary" to lower prices. Because with the amount of superiority the Model Y has over the Mach-e, and the long waiting list for the Model Y, it's not a given that higher volumes would require price cutting.

Also, I've read that the Mach-e MSRP barely leaves anything for the dealerships which is why most of them are marking them up above MSRP and letting them sit on their lots until a profitable sucker comes by. Try to buy a limited production Mach-e for MSRP. Dealers are hanging onto what they have to try to make more profit.

Buckminster

Well-Known Member

For those looking for an Omicron summary:

Omicron: everything you need to know about new Covid variant

No further discussion here pls.

Omicron: everything you need to know about new Covid variant

No further discussion here pls.

Last edited:

thesmokingman

Active Member

Ofc there are, there's nothing free in life or business.There must be other strings attached to the German subsidy.

Actually, the U.S. Government’s Investment in Tesla Was a Disaster, and Cost Taxpayers at Least $1 Billion

In 2009, as the financial crisis raged and General Motors and Chrysler plunged toward bankruptcy, Tesla Motors faced a seemingly impossible task:...

Wicket

Member

There are, they want the plant to be the first kicking out and using 4680s etc, but due to delays Austin etc will be so rather than hold up use elsewhere (which has its own costs) Tesla has chosen not to go with this subsidy

This is correct. There is a FT article that discusses it. Berlin battery factory had to be the first source of 4680s for production globally. Tesla likely did the math and decided delayed production would bring the value of the subsidy down sufficiently that it was not worth it.

The Slate article above did teach me one thing. I was unaware that paying back the earlier loan avoided an option conversion which certainly does bring to question Musk's predicating that purely on good civic mindedness. The swapout of a hypothetical opportunity cost for a higher loan rate with the simplification of 'cost taxpayers over 1B$' is also misleading clickbait.

I do think Musk is being evasive and perhaps misleading overall, and my respect for him is downgraded a smidge, but I don't have a problem with any of Tesla's choices.

Last edited:

jkirkwood001

Active Member

Elon says the "subsidy" had unfavorable terms. Nothing to do with not qualifying.

1.5m/yr is 125k vehicles/month - compared to c.53k GigaShanghai vehicles sold in October this year. Does that seem reasonable when the next phase of construction hasn't started yet?

The DoE loan included the stock option clause to encourage early repayment, not as a means to generate profits. That Slate article is informative, but the authors attitude toward Tesla is nauseating.

“The loan program wasn’t intended to generate profit; the goal of the program is to provide affordable financing so that America’s entrepreneurs and innovators can build a strong, thriving and growing clean energy industry in the United States,” says a department spokeswoman.

“The loan program wasn’t intended to generate profit; the goal of the program is to provide affordable financing so that America’s entrepreneurs and innovators can build a strong, thriving and growing clean energy industry in the United States,” says a department spokeswoman.

2

22522

Guest

This is correct. There is a FT article that discusses it. Berlin battery factory had to be the first source of 4680s for production globally. Tesla likely did the math and decided delayed production would bring the value of the subsidy down sufficiently that it was not worth it.

The Slate article above did teach me one thing. I was unaware that paying back the earlier loan avoided an option conversion which certainly does bring to question Musk's predicating that purely on good civic mindedness. The swapout of a hypothetical opportunity cost for a higher loan rate with the simplification of 'cost taxpayers over 1B$' is also misleading clickbait.

I do think Musk is being evasive and perhaps misleading overall, and my respect for him is downgraded a smidge, but I don't have a problem with any of Tesla's choices.

Elon’s decisions integrate information from a lot of life experiences, “seriously”.

There was real investment in applying for and supporting the German subsidy effort.

There was a distortion in application of effort that had a cost. Tesla is cutting their losses and doing the right thing for the mission.

I doubt this article will ever be mentioned if ROI is perceived as risky. Critics will not understand. Seriously.

India tells public to shun Musk-backed Starlink until it gets licence

Starlink Internet Services, a division of billionaire Elon Musk's SpaceX aerospace company, as it does not have a licence to operate in the country. A government statement issued late on Friday said Starlink had been told to comply with regulations and refrain from "booking/rendering the...

Wicket

Member

Elon’s decisions integrate information from a lot of life experiences, “seriously”.

There was real investment in applying for and supporting the German subsidy effort.

There was a distortion in application of effort that had a cost. Tesla is cutting their losses and doing the right thing for the mission.

I doubt this article will ever be mentioned if ROI is perceived as risky. Critics will not understand. Seriously.

India tells public to shun Musk-backed Starlink until it gets licence

Starlink Internet Services, a division of billionaire Elon Musk's SpaceX aerospace company, as it does not have a licence to operate in the country. A government statement issued late on Friday said Starlink had been told to comply with regulations and refrain from "booking/rendering the...www.yahoo.com

I would note he has spoken not so much about the EV subsidy in general which by any reasonable accounting of how much it will accelerate supply is an extraordinarily inefficient use of public funding, but in their favor. Elon is a cunning libertarian mind that is oriented to the long future. As such he is utilitarian as well. He will however play with the myths and lesser gods and direct the vox populi.

LiveLong&Profit

Member

Not sure what the current Tesla Austin factory building is rated at.And Berlin is significantly bigger and Texas is… I think 3x the size of Shanghai??

With their existing footprint, without cutting ground on another factory, Tesla likely has enough space to scale up to ~6 million cars/ year.

Including battery production for much of that.

Not sure even Tesla knows for sure at this point, since for example Cybertruck production has not started.

Does that take up more or less volumetric area than traditional production?

Also, even though the Texas area is big, the factory building is 4 levels in some places. That tells you something about the value of co-location and also Teslas ambition: Why build 4 stories/levels when they have that much land? They are just that ambitious!

I expect another huge factory building to start at the Austin site, before long. Why not? They have the demand, and the money. And while good engineers are always a scarce ressource, buildings are a known quantity: Add land, materials and time, then you get capacity.

Tesla has done a lot of work on building factories. They have their own group of factory building specialists, who are responsible for planning and constructing Teslas factories worldwide. A lot of accumulated learning there to be sure.

And they are very agile: You can actually see that when you watch the GF videos - a lot of changes.

From a traditional perspective it looks stupid: They do cement-foundations for some pillars, then ~2 weeks after, that cement is broken up, then add another couple of weeks and the pillars are back, but now moved 3-4 meters compared to original placement.

So why didn't they just plan ahead? I imagine that new plans were agreed between production and the building team, so they just adjusted the building in near real time.

Another Austin example: The stamping hall didn't have windows, just concrete walls. Then a couple of weeks ago the relevant wall segments were partially removed, and now windows are in place. Tesla decided that windows should be there, and so now they are.

Tesla is not afraid of moving quickly and making mistakes. In fact, to not move quickly is perhaps the worst mistake.

The factories are continually updated for whatever Tesla decides to optimize for. And if the most important thing is higher capacity, then they optimize for that.

Then lastly, the X-factor: Bots.

Consider that even with Teslas extreme level of real-time coordination between manufactoring and building planning and execution, moving atoms takes a while. Even with Teslas speed, factories take years to build and fully ramp. (And if bureacracy is added, even longer)

So even Shanghai and Texas, from buying the land to fully ramped: around 5 years.

How much progress can Tesla achieve manufacturing bots in 5 years? How much will using bots in factories add to production capacity, worldwide?

We don't know but long-term, using bots will make production capacity trend upwards without needing more factories.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K