Rip at supply issues with Rivian. It took Tesla workers about 2 hrs to make as many Rivians in a quarter and a half. Maybe Tesla can ship them a hour worth of parts so they can hit 1200 by year end.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I'm surprised there has been zero discussion of margins!

My rough guess is Tesla price increases have been passed 100% to the consumer.

I bet demand was inelastic so therefore, I bet previous margin levels were maintained.

It would be madness though if that actually grew.

My rough guess is Tesla price increases have been passed 100% to the consumer.

I bet demand was inelastic so therefore, I bet previous margin levels were maintained.

It would be madness though if that actually grew.

LiveLong&Profit

Member

Re. Shanghai:Amazing. 1.2 Million run rate annual without new factories

Above run rate is without the new battery factory just now being erected (see WUWA video a few post back).

Also without the around 3-4 times larger area where the parking lot/staging area for transport currently is.

This is scheduled to become yet another factory building soon.

(I guess they will move the parking/staging to the place just adjacent where all the earth piles are located)

My ARK vs Tesla holdings are minuscule but still annoying to take the L for no good reason.

HOOD, TDOC, all that shat is still going to be cheap in Feb after Tesla Q4 P/D.

I bought her strategy for the first 5 sells, but not the subsequent 20.

Re. Shanghai:

Above run rate is without the new battery factory just now being erected (see WUWA video a few post back).

Also without the around 3-4 times larger area where the parking lot/staging area for transport currently is.

This is scheduled to become yet another factory building soon.

(I guess they will move the parking/staging to the place just adjacent where all the earth piles are located)

I still remember the early videos of Shanghai when it was a wet muddy field. And that was just three years ago!

What was the P/S numbers for 2021?

In July here was my estimates post:

Here's a little weekend napkin math for your consumption. I set three scenarios for vehicle production and came up with some estimates of possible share prices by year end using a price/sales multiple.

Bear Case: simply assumes zero production growth through Q4

Base Case: carries through Q2 to Q1 production growth of 14% through Q4

Bull Case: assumes 15% growth in Q3 and 30% growth in Q4. Banks on rapid S/X re-ramp and additional model Y line in Shanghai

View attachment 680941

Total vehicles produced

Bear Case: 798k

Base Case: 888k

Bull Case: 930k

View attachment 680942

Big assumption to arrive at revenue numbers is 57,220 rev multiplier. I used Q1 total revenue (10.3b) divided by vehicle production (180k). Quick and dirty.

Total revenue

Bear Case: $45B

Base Case: $50B

Bull Case: $53B

View attachment 680946

I used a price/sales range of 18, 20, and 30. About 18 p/s ratio was the low point we hit in April. I like a p/s ratio of 20 for Tesla long term. Lastly a p/s ratio of 30 was about the peak we hit at the beginning of the year.

Estimated end of year share price range

Bear Case: $853-$1422

Base Case: $950-$1583

Bull Case: $995-$1659

Lastly below is the corresponding market cap estimates

View attachment 680953

*Best taken with a grain of salt

Base case I expected 88k produced with 267k produced in q4. Baseline for year end share price was $1,055

Edit: the price to sales ratio ranged from about 18 to 30 in 2021

The Accountant

Active Member

I still remember the early videos of Shanghai when it was a wet muddy field. And that was just three years ago!

Krugerrand

Meow

I still remember the Potemkin Village remarks. It annoys my sense of fairness that people can spout off at the mouth, but never seem to feel any shame and rarely have consequences of any merit for such venomous intentioned words.I still remember the early videos of Shanghai when it was a wet muddy field. And that was just three years ago!

BrownOuttaSpec

Active Member

What a tease! @The Accountant I see this alert and I am trying to refresh as fast as possible....

....to only get a picture of a muddy field

....to only get a picture of a muddy field

LightngMcQueen

Aspirationally Rational

Did you put Sell Limit order on them or waiting what will happen ?My YOLO Jan 7th 1500 calls are going to explode.

Thank you again, Elon and team.

I bought Jan 7 $1100 Calls for $22 on Friday, I had $42 Sell limit on them, which I just updated to 84.20

JRP3

Hyperactive Member

I still remember the early videos of Shanghai when it was a wet muddy field

No sell limit....that is why they are YOLO's.Did you put Sell Limit order on them or waiting what will happen ?

I bought Jan 7 $1100 Calls for $22 on Friday, I had $42 Sell limit on them, which I just updated to 84.20

Let them ride....wild week ahead for sure.

But TBH my YOLO options track record is.....um...spotty at best.

StarFoxisDown!

Well-Known Member

That was the quickest recession in history according to Elon

Sudre

Active Member

Monday first thing news on CNBS , "NTSHA recalls all Tesla S & X because the puddle light on the door handle can burn out leading to a serious safety issue when the person steps on unseen ice What will Tesla do about all the 3 & Y which do not have lights to illuminate the entrees?.".Something something market-movers mid-monday-morning dip

Stock tanks 10%.

lafrisbee

Active Member

HEY! I can do that kind of posting...stay inside your lines! get to work.

LiveLong&Profit

Member

OK - got it.Dealers can sell cars for any price they wish- they're under no obligation to respect the MSRP, and they aren't owned by the car maker.

So they can do crap like add a big markup to EVs because they'd rather sell you an ICE you'll keep bringing back for profitable service, regardless of it the MFG would like to ramp up their EV transition or not.

Tesla in contrast is selling cars directly to customers (well, except in the handful of states that's not legally allowed still...like Texas- where you technically "buy" it out of state then they can ship your already bought car into that state), without a worthless middle-man adding cost but no value, and insuring anybody ordering the same moment as anyone else sees the same MFG pricing.

But still - what is to stop Ford or other car companies from simply raise the price of the cars the sell to the dealers?

I mean, they can clearly see that the demand is there in spades when people are willing to pay huge mark-ups.

I understand that the dealers are making hay - the are profit-driven after all.

What I don't get is why traditional auto is not just raising their prices for EVs.

If they did, the dealers could still do a mark-up, but a smaller one. Legacy auto companies like Ford would then make more money - and thus have more money for all the investments they need for scaling EV production.

Webeevdrivers

Active Member

What’s the general consensus on Germany going into production. Re, political barriers etc.I voted 1.6-1.7 million in the poll. I don't think I'm overly optimistic. I just can't believe Berlin and Austin will ramp slowly, they are following Shanghai lead and one thing for sure, Tesla fully utilize their learning curve.

ZachF

Active Member

IMHO, we could be looking at $19b in revenue and $3b in profit for Q4.

Tesla lies. They said 50% growth YoY going forward. Buncha liars!

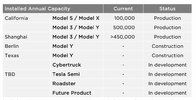

In all seriousness though, they are now at 1.2M annual run rate. Shanghai has target production of 1M units (don’t know by when). Fremont runs at 600K? Then add in Berlin and Austin, which could each make 150K conservatively this year. So, I mean we are looking at a low end estimate of 1.5M units, but could be upwards of 2M assuming no supply chain issues.

my mid-road 2022 estimate = 1.7m

fremont - 600k

shanghai - 800k^

brandenburg - 150k*

austin -150k*

*shanghai did about 150k it’s first year

^shanghai potentially 900k in 2022

———-

fremont already has 600k capacity (from q3 deck):

…but the s&x only did <25k in 2021. that will obv change. and from the q3 call, zach mentioned fremont did 430 in trailing 12 months, and they target to increase that 50%, or 645k.

fremont and shaghai expansion…

from q3 transcript:

Tesla (TSLA) Q3 2021 Earnings Call Transcript | The Motley Fool

TSLA earnings call for the period ending September 30, 2021.

Martin Viecha

Thank you very much. The next question from a retail shareholder is, what is Tesla's goal for vehicle production capacity for the four current factories, Fremont, Shanghai, Austin, and Berlin, by 2024?

Zach Kirkhorn -- Chief Financial Officer

Yeah. Thanks, Martin. You know, our goal as a company here is to grow on an average pace of 50% per year. And so you can extrapolate that out.

You know, there may be some periods of time in which we're well ahead of that. There could be some periods of time, despite best efforts, where we're slightly lower than that. But that remains the long-term goal of the company. In Fremont, you know, we're continuing to push the boundaries of what's possible there.

Over the last 12 months, we've done about 430,000 cars of production. And based upon everything that we know in the factory, where the bottlenecks are, what the potential is, we're targeting to increase that another 50%. I think that will be a difficult goal but that's the goal that the internal team has, and they're going to continue to push on that. As we look toward Shanghai, we're continuing to push the boundaries there and we continue to ramp production there as well, so most recently the ramp-up of the Model Y, which was our biggest contributor of volume in Q3.

We'll continue to ramp that factory. And, you know, our plans there with time are to keep growing the capacity in that factory. Austin and Berlin are interesting factories because our first iterations of capacity there are on Model Y, but we've intentionally set these factories in locations in which they have a quite significant amount of land and ability to expand. And so we'll take Model Y at these factories.

You know, we're trying to get to 5,000 cars a week as soon as we can. And then we'll continue to push beyond that, potentially even getting to 10,000 cars per week at those factories. And then we'll add Cybertruck here in Austin and continue to grow from there. So, you know, our goal is to get to millions of cars per year over the next couple of years and then ultimately, in the long term, be able to achieve 20 million cars per year.

We're going to grow as quickly as is feasibly possible with an eye toward a 50% annual growth rate.

———-

to your follow up question, tesla did 936,172 deliveries 2021

stephensons chart for historical sales:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K