This method works with small independent dealers. However, the really powerful dealerships span states and car manufacturers (of course they have multiple sub-dealerships to give the appearance of competition). These dealerships would not be hurt much if they just stopped selling X brand, but it would cripple the manufacturer.But I also think that GM, Ford &c can play a little more hardball with their dealers: "We cannot by law tell you what price to charge, but if you do not sell X% of your total sales # (not $ number) as EVs then we will diminish the # of ICEs you get allotted", or some such.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

-

- Tags

- elon is an ass

TLDR: He didn’t quite say that. Overall he made a number of very bullish statements on forward margins, but without overcommitting.I thought on the Q3 call, Zach said margins would go down in upcoming quarters due to ramp up costs of Model S/X refresh, and Austin/Berlin ramp ups. (even though long-term profitability is obviously on an upward trend)

Additionally, we have made good progress on the in-house battery manufacturing program. And we're excited to have expanded the full self-driving beta program to more customers. Financially, our auto gross margins reached 30.5% on a GAAP basis and just under 29%, excluding regulatory credits, which was our strongest yet. This benefit primarily comes from higher volumes, particularly out of the Shanghai factory, increased mix of the Model Y as we -- and we have made good progress increasing Model S volumes. [my comment: and now we have an extra 68k unit volume to spread factory costs across]

The Model S has now returned to positive gross margin and we expect this to increase with higher production and the ramp of Model X. As was the case in Q2, there were some net benefit from pricing actions. [my takeaway: S/X will be margin accretive in Q4]

The launch of Austin and Berlin will have ramp inefficiencies there for some period of time until we get those factories up and running. And so that's likely to put some downward pressure on our margins as those factories ramp. Our goals are to ramp those as quickly as possible. [my comment: won’t impact Q4]

We are seeing costs increase on the commodity side. We're getting feedback from our suppliers as we're seeing ourselves the impact of labor shortage. And then logistics and expedite costs just continue to be a part of our story here and it's uncertain how that will unfold. It's our hope that these things stabilize. Exactly when that happens is difficult to predict. And we have been adjusting pricing in line with those changes in cost. And so, we'll see how that unfolds over the course of the next year. So, it's difficult on gross margin to say where that will go for those reasons. [my takeaway: doing their best to neutralize input cost increases via pricing or alternative sourcing]

And we have to overcome cost increases that are outside of our control. So whether that's resourcing components or redesigning components or finding ways to be more efficient in manufacturing. We have no choice but to continue on that path and be even more aggressive in the light of the macroeconomics here. [my takeaway: again neutralizing increases or continuing to reduce input costs]

The benefits here, which is different in the ramp of these factories compared to other factories, is if you think about the percentage of our total cost structure in any given quarter that is associated with new ramps, we have the Fremont factory that's running -- generating stable and growing margins there. The same is also true in Shanghai. I expect we'll see some amount of headwind on margin from these ramps. It's just entirely dependent on how quickly we're able to ramp, and what uncertainties come up during the process. [my takeaway: even when Austin and Berlin start ramping, they won’t have anywhere near the downward pressure on margins that Shanghai ramp did]

And I think the net of all of this is hopefully that we continue to make progress on operating margin over the next 4 of 5 quarters. As we think forward, the business up until this point is kind of largely been a hardware automotive business with a little bit of software on top of that. As full self-driving matures, as take rates increase, if we are to raise pricing on that, there's considerable upside both on gross margins and operating margin as that comes to light, as the business starts to become more of a mix of a hardware-based Company and a software-based Company. [my comment: the end game, turning on more software margins per vehicle, not only increases gross margin per future vehicle sold, but increases net margins directly through existing fleet]

J

jbcarioca

Guest

That is easy. Profits would decline and sales would be unchanged.Just image if Tesla advertised!

MartinAustin

Active Member

Dealers make the majority of their income from servicing existing ICE fleet. If they just stop selling X brand, the implication is that they would cease to receive parts for servicing X brand and would have to stop that too... which I can't see being compellingThis method works with small independent dealers. However, the really powerful dealerships span states and car manufacturers (of course they have multiple sub-dealerships to give the appearance of competition). These dealerships would not be hurt much if they just stopped selling X brand, but it would cripple the manufacturer.

I agree that legacy manufacturers, who are stuck with profit-guzzling dealerships, should turn up the heat on them. Trouble is... they are also joined at the hip in state legislatures. Same set of donors influencing policy. (sorry getting too OT but it's Sunday)

J

jbcarioca

Guest

Just fro the record, we are now in the Gross Margin territory generally associated with the AAPL's of the world.Q4 represented a 28% increase in unit values QoQ. That from the SAME asset base and factory costs as prior quarter. Q3 saw gross auto margins of 30.5%. I would not be shocked to see a mid 30s gross margin print this quarter. All that to say, you’re being very conservative

And let’s not forget our trust deferred tax asset. This is about to get VERY interesting.

MartinAustin

Active Member

"CORRECTION: This article has been updated to show that Tesla makes Model 3 and Model Y vehicles at its factory in Shanghai and in Fremont, California, but only produces the Model X and Y in Fremont."Lora's article is up on CNBC

Tesla delivered 936,172 electric vehicles in 2021, with the fourth-quarter setting a new record

We apologise again for the fault in the

correction. Those responsible for sacking

the people who have just been sacked,

have been sacked.

correction. Those responsible for sacking

the people who have just been sacked,

have been sacked.

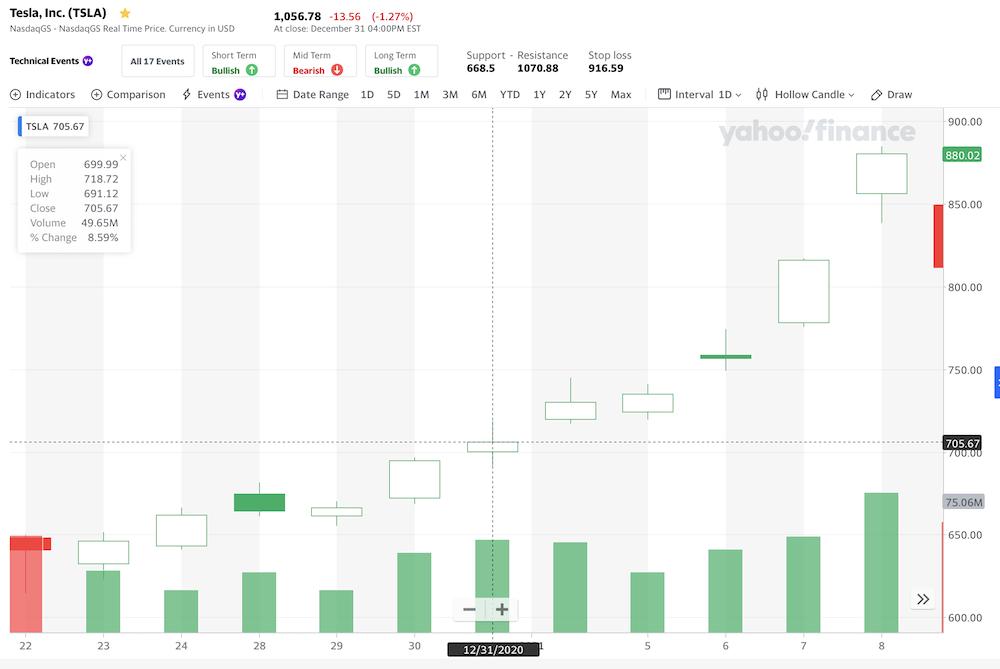

On Jan 2 '21, Tesla announced Q4 '20 deliveries increased from 139K to 181K, up 30% QOQ. One week later, TSLA was up 25%, from 706 to 880.

On Jan 2 '22, Tesla announced Q4 '21 deliveries increased from 241K to 309K, up 27% QOQ. A similar 20-25% increase would push TSLA to 1267-1320. Hmmmm.

On Jan 2 '22, Tesla announced Q4 '21 deliveries increased from 241K to 309K, up 27% QOQ. A similar 20-25% increase would push TSLA to 1267-1320. Hmmmm.

When corrections make the situation worse."CORRECTION: This article has been updated to show that Tesla makes Model 3 and Model Y vehicles at its factory in Shanghai and in Fremont, California, but only produces the Model X and Y in Fremont."

We apologise again for the fault in the

correction. Those responsible for sacking

the people who have just been sacked,

have been sacked.

If you are capacity constrained as they are now, marketing/advertising just eats into the bottom line.Just image if Tesla advertised!

Stop it! I'm already overexcited enough!On Jan 2 '21, Tesla announced Q4 '20 deliveries increased from 139K to 181K, up 30% QOQ. One week later, TSLA was up 25%, from 706 to 880.

View attachment 751282

On Jan 2 '22, Tesla announced Q4 '21 deliveries increased from 241K to 309K, up 27% QOQ. A similar 20-25% increase would push TSLA to 1267-1320. Hmmmm.

torifile

Member

And, sure as the sun rises in the East, someone will say “a hardware manufacturer can’t maintain these margins”.Just fro the record, we are now in the Gross Margin territory generally associated with the AAPL's of the world.

Apple has proved them wrong for years. I suspect Tesla will do the same. I got on the AAPL train in 2001.

I’ve made a few bad trades in the intervening years and didn’t invest as heavily as I should have in AAPL. I’m not going to make the same mistake with TSLA. I believe it’s a twice in a generation company.

Every pullback, I’m going in strong. I’ve already convinced my in-laws to both buy a Tesla and invest in the stock.

Gigapress

Trying to be less wrong

1) As solar and wind become an increasing share of the overall electric grid, the marginal utility of additional battery capacity also increases.I mean yeah batteries are the constraint, and with two new gigafactories coming online, i don't see how they won't continue to be the constraint. As long as shoving them in cars is a more profitable return per watt than using them as storage, Energy will never be 50% of revenue.

2) Lithium iron phosphate batteries will be scaling soon. More suitable for stationary storage than for long-distance EVs for early adopters of the 2012-2021 era who strongly preferred longer range because they were paying luxury prices and facing lower supercharger density than we have today.

3) The projections of more batteries going into energy than cars is a long term prediction for like 2035-2040. Motor vehicle transport consumes about 1/3 of the energy used by human civilization. The other 2/3rds is for buildings, manufacturing, home appliances, etc. That's why the rest will need about twice as many batteries. Eventually, maybe around 2030, we'll hit a saturation point for EVs while grid storage demand is still growing exponentially.

Jan/Feb ‘21 was a strange bubbly time in the market though.On Jan 2 '21, Tesla announced Q4 '20 deliveries increased from 139K to 181K, up 30% QOQ. One week later, TSLA was up 25%, from 706 to 880.

View attachment 751282

On Jan 2 '22, Tesla announced Q4 '21 deliveries increased from 241K to 309K, up 27% QOQ. A similar 20-25% increase would push TSLA to 1267-1320. Hmmmm.

jkirkwood001

Active Member

... inspire AND enable them.Looking at these production and delivery numbers there is only one thing on my mind.

It's not the profit.

It's how utterly amazing it is that Elon has been able to inspire this many people inside Tesla to produce results like this.

I don't know about you, but I've worked in companies with 3 employees, 30 employees, 6,000 employees, and 250,000 employees (Canadian government contracts) and many in between (besides employment, I've had contracts with about 30 international companies over the years). In ALL of them, there are so many impediments to individual innovation and efficiency improvement (e.g. dept. territorialism, meetings, bad strategy, pride, greed, etc.) it is amazing that Tesla keeps outperforming as a whole.

I'm so impressed by Tesla's corporate culture and focus on collective performance. Well done, and many thanks from us investors!

DragonWatch

Small FootPrint

Forward Observing

Snowballs Chance in . . . . .

Back in 2010+/- a little know company said, “I think I can.”

Bottom line, it is as though the legacy automakers have been trying to push their large snowballs up the Matterhorn. Meanwhile, Elon has already reached the top. And is rolling his snowball downhill towards them.

Happy New Year!

Snowballs Chance in . . . . .

Back in 2010+/- a little know company said, “I think I can.”

Bottom line, it is as though the legacy automakers have been trying to push their large snowballs up the Matterhorn. Meanwhile, Elon has already reached the top. And is rolling his snowball downhill towards them.

Happy New Year!

TheTalkingMule

Distributed Energy Enthusiast

Wow. Haven't been paying much attention since Thursday and I poke my head in to find 87% growth. Lol!

For all those new to following TSLA on the daily:

1) Yes, this is earthshatteringly impressive.

2) The share price may very will just sit there for a few days or weeks.

Strong potential for bumping the leveraging thoughts in the "shares -> LEAPs" thread. The financial implications of these deliveries makes it all but impossible for the market to sit on their hands, but I'll be ready if they do.

For all those new to following TSLA on the daily:

1) Yes, this is earthshatteringly impressive.

2) The share price may very will just sit there for a few days or weeks.

Strong potential for bumping the leveraging thoughts in the "shares -> LEAPs" thread. The financial implications of these deliveries makes it all but impossible for the market to sit on their hands, but I'll be ready if they do.

ZachF

Active Member

1) As solar and wind become an increasing share of the overall electric grid, the marginal utility of additional battery capacity also increases.

2) Lithium iron phosphate batteries will be scaling soon. More suitable for stationary storage than for long-distance EVs for early adopters of the 2012-2021 era who strongly preferred longer range because they were paying luxury prices and facing lower supercharger density than we have today.

3) The projections of more batteries going into energy than cars is a long term prediction for like 2035-2040. Motor vehicle transport consumes about 1/3 of the energy used by human civilization. The other 2/3rds is for buildings, manufacturing, home appliances, etc. That's why the rest will need about twice as many batteries. Eventually, maybe around 2030, we'll hit a saturation point for EVs while grid storage demand is still growing exponentially.

Transportation is closer to 25%, and that’s with the horrendous inefficiency of small ICE. Road transport is about 2/3rds of that. Switching to EV would drop primary energy consumption of road transport by more than half if we used the same fuel ratio we use for power plants now. That would drop road transport from about 18% of primary energy now to about 10% after.

Grid will need less storage though maybe about a days’ worth, while a 350 mile range is roughly equal to a week or more of average driving, so you end up needing similar batteries for grid storage.

EDIT: here is an energy flow map. Look at how much energy goes right out the tailpipe or radiator of a small ICE. Most people have no idea how comically inefficient car engines are. Even you you just used oil-powered combined cycle power plants to charge the EVs you’d cut US oil consumption by about HALF!!!

Last edited:

jkirkwood001

Active Member

Wait a minute. When you and I bought ARKK, we bought into them selling TSLA whenever it passed 10%, so no foul. But I'm really disappointed that all their other picks are collectively doing so badly!! Last month, I sold half my small ARKK investment at a loss and bought more TSLAView attachment 751153

My ARK vs Tesla holdings are minuscule but still annoying to take the L for no good reason.

HOOD, TDOC, all that shat is still going to be cheap in Feb after Tesla Q4 P/D.

I bought her strategy for the first 5 sells, but not the subsequent 20.

I agree. I am beginning to think Elon is a better talent recruiter than engineer. The team he has assembled has managed a spectacular accomplishment.... inspire AND enable them.

I don't know about you, but I've worked in companies with 3 employees, 30 employees, 6,000 employees, and 250,000 employees (Canadian government contracts) and many in between (besides employment, I've had contracts with about 30 international companies over the years). In ALL of them, there are so many impediments to individual innovation and efficiency improvement (e.g. dept. territorialism, meetings, bad strategy, pride, greed, etc.) it is amazing that Tesla keeps outperforming as a whole.

I'm so impressed by Tesla's corporate culture and focus on collective performance. Well done, and many thanks from us investors!

Managing 87% growth in production during Covid, supply chain constraints, no rebate incentives (US), no advertising and while simultaneously building 2 new factories on different continents. Amazing!

Cal1

Member

I sold all of our ARK at a loss and bought more TSLA! Held it for more than a year. Never cared to really understand why it when down. Looking forward to getting all of it back and more this year.Wait a minute. When you and I bought ARKK, we bought into them selling TSLA whenever it passed 10%, so no foul. But I'm really disappointed that all their other picks are collectively doing so badly!! Last month, I sold half my small ARKK investment at a loss and bought more TSLA

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K