Goldman raise from 1125 to 1200

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

sorry, private FB group.Post a link then. Otherwise it might sound like you are making things up

StealthP3D

Well-Known Member

Since this was his drive, probably the classical car within range of keys.

If the car keys are dumped in a bowl right inside the door to the house and not covered with Al-foil then the range of the keys likely leeds to the car staying unlocked. Not specific to Tesla but the same for all cars with keyless entry.

The Model 3 comes with two Key Cards which have a range of under 2 inches or 5 cm maximum. If you configure your phone to work as your primary key, it still locks within about 10 seconds after you park and exit the vehicle, even if you stay within 5 or 10 feet of the car. There are optional key fobs available although most owners don't bother with them.

I suspect he doesn't have "lock on park" turned on or he uses his key cards to drive it and doesn't lock it when arriving home. Alternatively, the entire article is satire just to get clicks.

insaneoctane

Well-Known Member

Maybe....but it also seems like a finite number of GM buyers thinking of buying an Equinox (or whatever) will not...as they wait for these announced "coming soon" amazing versions of what they were going to buy....What she is doing, and many other companies have been doing for years is a tried and true strategy in the consumer marketplace. I don't know the name but the strategy is to give those that are considering a Tesla right now the belief that if they just wait a while longer they can get a real car from a real car company. As well as many people want a car just like their old reliable equinox. Or they always wanted a hummer or Blazer and what she has done is to get many people to delay buying a tesla until her and her company actually have an offering of some sort. These announcements cost very little and they are "advertising."

People are not honest.

bkp_duke

Well-Known Member

GM . . . what a crock of *sugar*

Elon might not be richest person in the world:

www.bloomberg.com

www.bloomberg.com

In a region known for dizzying wealth, Zhao, 44, fits right in: His net worth is $96 billion, according to the Bloomberg Billionaires Index. It’s the first time Bloomberg has estimated his fortune, which exceeds Asia’s richest person, Mukesh Ambani, and rivals tech titans including Mark Zuckerberg and Google founders Larry Page and Sergey Brin.

Zhao’s fortune could be significantly larger, as the wealth estimate doesn’t take into account his personal crypto holdings, which include Bitcoin and his firm’s own token. The so-called Binance Coin surged roughly 1,300% last year.

…

Late last year, Binance was seeking to raise money from sovereign wealth funds, and its U.S. affiliate was also pursuing investors with the goal of an initial public offering. In November, the Wall Street Journal reported that former executives estimated the company could be worth as much as $300 billion.

That would make Zhao even richer than Elon Musk, currently the world’s wealthiest person, and No. 2 Jeff Bezos, whom Zhao said he admires.

Just a short primer on the state of Binance. Here is Vitalik Buterin talking a little about it:

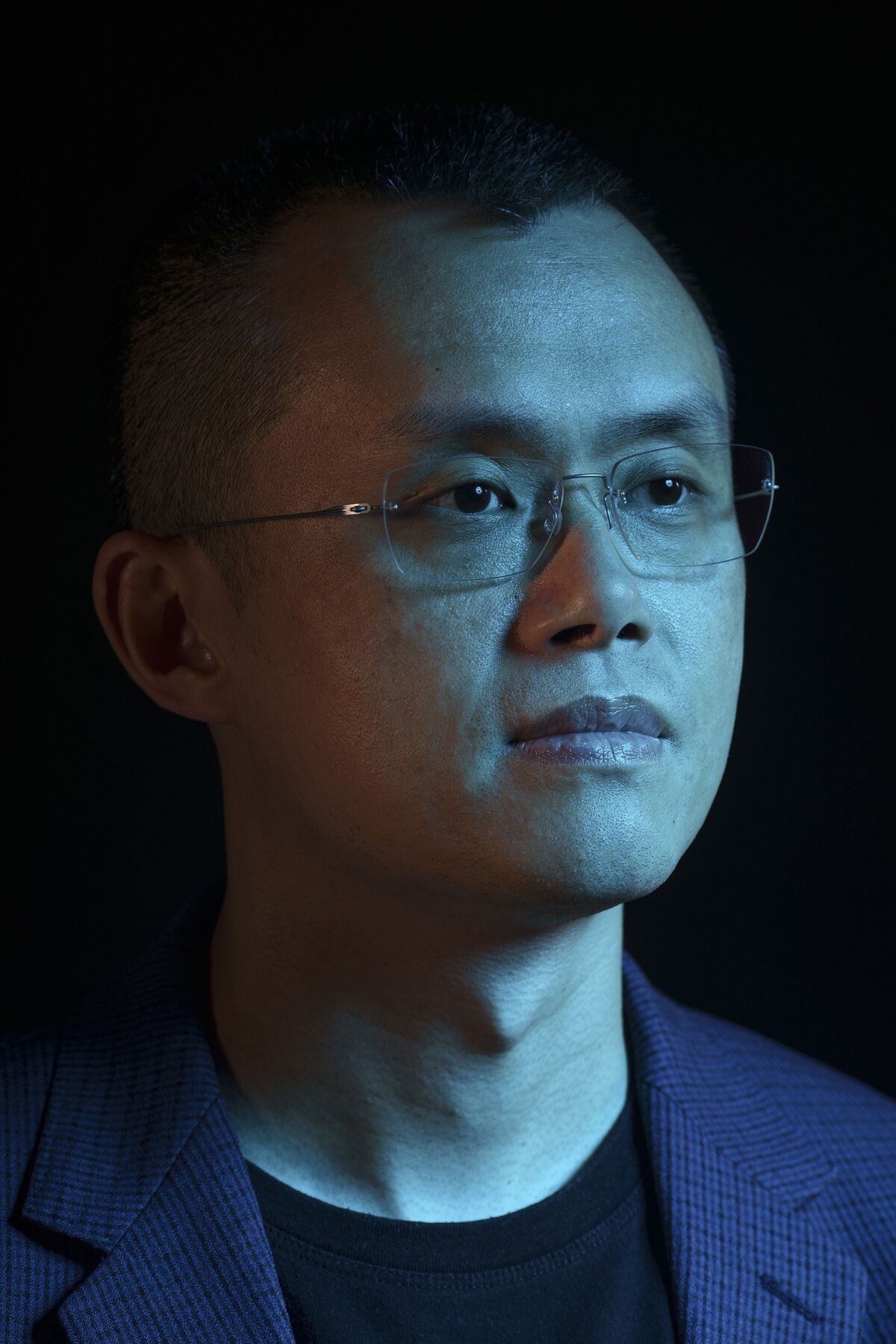

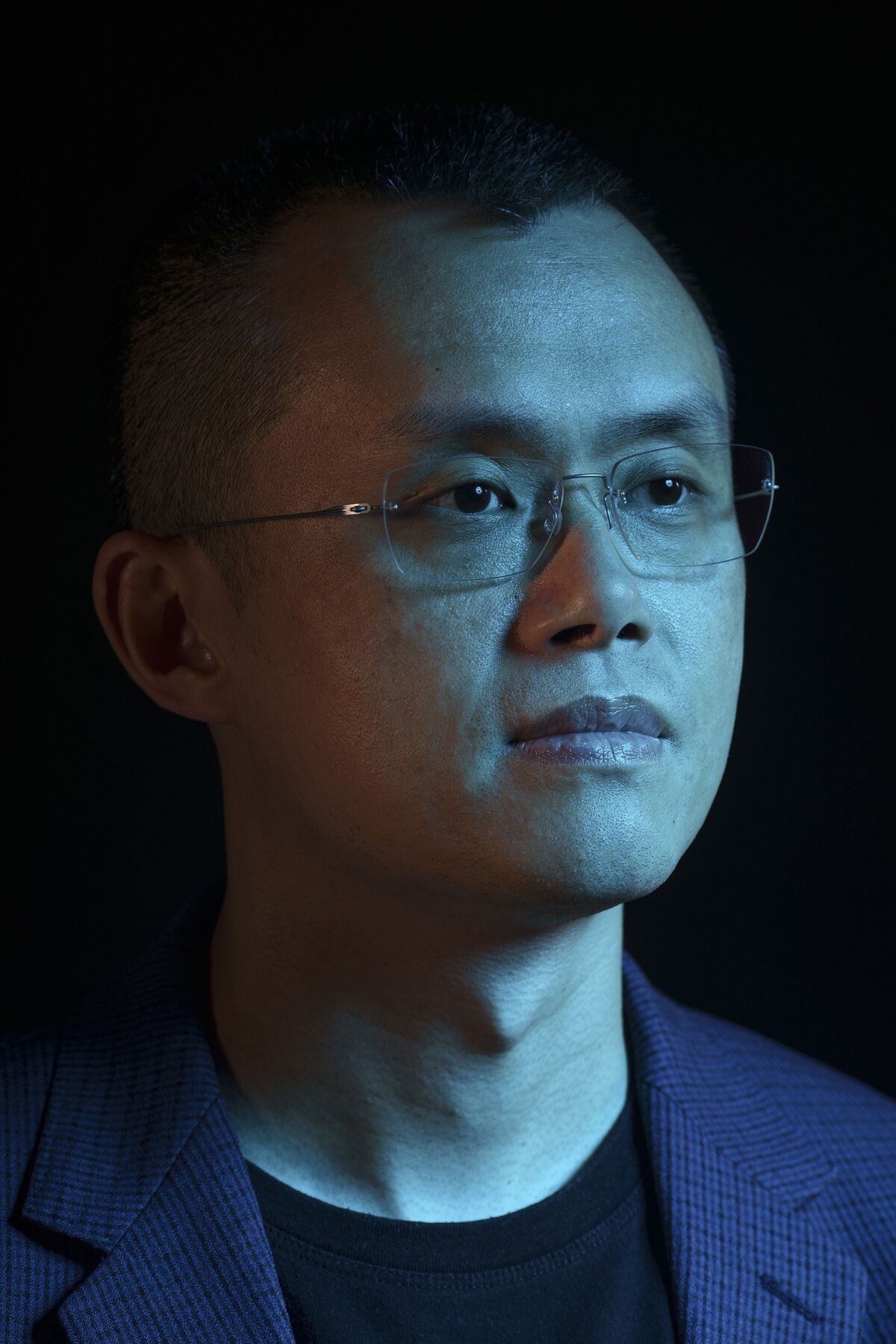

World’s Biggest Crypto Fortune Began With a Friendly Poker Game

With $96 billion, Binance CEO Changpeng Zhao is closing in on tech titans including Facebook’s Mark Zuckerberg and Google’s Larry Page and Sergey Brin.

In a region known for dizzying wealth, Zhao, 44, fits right in: His net worth is $96 billion, according to the Bloomberg Billionaires Index. It’s the first time Bloomberg has estimated his fortune, which exceeds Asia’s richest person, Mukesh Ambani, and rivals tech titans including Mark Zuckerberg and Google founders Larry Page and Sergey Brin.

Zhao’s fortune could be significantly larger, as the wealth estimate doesn’t take into account his personal crypto holdings, which include Bitcoin and his firm’s own token. The so-called Binance Coin surged roughly 1,300% last year.

…

Late last year, Binance was seeking to raise money from sovereign wealth funds, and its U.S. affiliate was also pursuing investors with the goal of an initial public offering. In November, the Wall Street Journal reported that former executives estimated the company could be worth as much as $300 billion.

That would make Zhao even richer than Elon Musk, currently the world’s wealthiest person, and No. 2 Jeff Bezos, whom Zhao said he admires.

Just a short primer on the state of Binance. Here is Vitalik Buterin talking a little about it:

RobDickinson

Active Member

Theres a lot of people actually richer than Elon, its just they either fly under the radar or down have as public a calculable number attached to their wealth.

Gigapress

Trying to be less wrong

The actual contract doesn't have strict timelines on FSD in the Vegas Loop.Wasn’t boring contractually forced to deliver autonomous evs end of 21? do we know if the cars during ces use fsd at least for some parts?

Las Vegas Convention Center and Visitor Authority board meeting minutes from last year indicated that there was supposed to be FSD going in the tunnels by 31 Dec 2021. I have not found any verifiable information about why it's not in use yet. Maybe FSD Beta isn't good enough yet to work in the stations. Alternatively I heard a rumor that LVCVA wanted to wait until after CES 2022 in case it doesn't go smoothly.

Tesla robotaxi service, if it ever happens, will no doubt happen first in the Vegas Loop.

Gigapress

Trying to be less wrong

To the extent that they care about public perception and the politics of mass transit, it matters greatly that they get FSD going soon. A massive contingent of train and bus advocates believe that the Vegas Loop is a joke or a scam. Having paid drivers of cars that hold 3 passengers is bad for public perception, even though it's actually an impressive system even in its current iteration if you look at the actual cost and performance numbers. Still, we were promised autonomous operation and 7 months later it hasn't arrived.Purely driven by humans so far. As far as I know they don't have any forcing factor to turn on Autopilot in the tunnels other than the labor cost of the drivers.

The Boring Co vision really only will be fully disruptive with autonomy. Likewise, Tesla can't make cars fast enough to fulfill their mission fast enough. They need EV robotaxis to convince the majority of drivers to abandon their functional ICEVs earlier than planned and ride EV instead. The value proposition of a robotaxi ride is directly related the local Boring Co Loop capacity, because of the chance to skip traffic at 60+ mph (100 kph) underground.

StealthP3D

Well-Known Member

With GM now showing Hummer, Silverado, Blazer, Equinox, and ???...all "coming in 1 or 2 years", wouldn’t they run into Osborning their own ICE sales for years with these announcements? Doesn't make any sense to me Barra....

I'm confident GM's strategy is that they know they will not be making more EV's than they have batteries, but they need to be able to get people into showrooms and onto car lots where the dealership will do what's in their best interest and convince them an ICE is still their best bet. GM's announced EV's are a way to keep GM from looking behind the times. Eventually, as they are able to make more EV's at a profit, they will position their ICE vehicles as "premium" and charge more than ever for the few they can sell to people who still look at EV's as a questionable choice.

The question is whether GM will be able to get enough funding to carry them through the most difficult part that is coming up soon. By having a large "fleet" of announced EV's, they will still look attractive to investors. However, I think the strategy will fail if Tesla continues improving their products and the value they are able to offer because people might come to the conclusion that GM's EV's are junk. The Silverado EV sure looks like junk to my eye, based mainly on cutaway drawings of its construction that GM released. It's not easy to make a traditional truck that has been converted to an EV drivetrain look good when the new yardstick will likely be the Tesla Cybertruck.

To my eye, it looks like GM is flailing in a big way. We will see.

Thinking more about the 1/21 call walls (captured in this thread) which are most likely a higher fraction of LEAPs that were bought as far back as Jan 2020.

Imagine buying $1000 LEAP contracts in Jan 2020 for expiry on Jan 21 22 and holding them until now.

I wonder how much those would have cost back then? Stock was trading around ~$70 (split adjusted) so more like $350 and the stock tripled as of now. So right now, you can buy at Jan19 24 LEAP strike $2475 for $130 each.

I wonder how much those will be worth? Currently $13k/contract. I'm going to get one Monday, just to see and will revisit this post Jan19 24 if I can HODL

Imagine buying $1000 LEAP contracts in Jan 2020 for expiry on Jan 21 22 and holding them until now.

I wonder how much those would have cost back then? Stock was trading around ~$70 (split adjusted) so more like $350 and the stock tripled as of now. So right now, you can buy at Jan19 24 LEAP strike $2475 for $130 each.

I wonder how much those will be worth? Currently $13k/contract. I'm going to get one Monday, just to see and will revisit this post Jan19 24 if I can HODL

StealthP3D

Well-Known Member

Thinking more about the 1/21 call walls (captured in this thread) which are most likely a higher fraction of LEAPs that were bought as far back as Jan 2020.

Imagine buying $1000 LEAP contracts in Jan 2020 for expiry on Jan 21 22 and holding them until now.

I wonder how much those would have cost back then? Stock was trading around ~$70 (split adjusted) so more like $350 and the stock tripled as of now. So right now, you can buy at Jan19 24 LEAP strike $2475 for $130 each.

I wonder how much those will be worth? Currently $13k/contract. I'm going to get one Monday, just to see and will revisit this post Jan19 24 if I can HODL

$1000 Tesla leaps were not available in Jan. 2020. If they were available, they probably would have been under a dollar. That was pre-split so they would have been sold as $5000 strike leaps.

RobDickinson

Active Member

Has anyone managed to calculate GM's share of the EV market in Q4 yet?

Or do we not have fractions that small?

Or do we not have fractions that small?

-17.5% from all time highs

Every major analysts upgrading their SP targets.

Blowout earnings on the way.

When will they realize Tesla will be the least impacted company by raising rates from the fed?

It is time for a rally motherlovers!

Every major analysts upgrading their SP targets.

Blowout earnings on the way.

When will they realize Tesla will be the least impacted company by raising rates from the fed?

It is time for a rally motherlovers!

Yep, that's why I said "imagine"$1000 Tesla leaps were not available in Jan. 2020. If they were available, they probably would have been under a dollar. That was pre-split so they would have been sold as $5000 strike leaps.

RobDickinson

Active Member

Competition news.

Seems ford sold 2,349 Mach-e in December for a total of 27,120 sales in 2021 for USA.

63,683 production for the year (assuming most of the rest sold into Europe).

Ford came second in the USA for EV sales...

Seems ford sold 2,349 Mach-e in December for a total of 27,120 sales in 2021 for USA.

63,683 production for the year (assuming most of the rest sold into Europe).

Ford came second in the USA for EV sales...

strago13

Member

I actually just charged here 2 days ago on my way to Florida, you can still pump gas at the pumps. This place is in the boon docks.

Yahoo Finance max date range chart shows the $1000 first date as 8/30/2020, right at the split. First trade was for $80.43 post-split price. Looks like they took off the $5000 history.$1000 Tesla leaps were not available in Jan. 2020. If they were available, they probably would have been under a dollar. That was pre-split so they would have been sold as $5000 strike leaps.

Best price for the $1000 was on 9/19/2021 when low of day was $8.48.

During the entire 8/15/2021 to 10/10/2021 period the $1000 calls were in the $8.48 to $21 range. That is when 30IV% were mostly at 0% and when I bought my Jan 2023 $1000 LEAPS for $69 (which I've sold for >120% gain that I could have gotten 320% if I just waited a few more days)

For reference, current IV30% Rank is 81%. Link

Last edited:

Bought 3 of the 1240 strikes for avg of just under $11k each. If memory serves i bought two at $15k each and bought the third for about $2k as tsla continued to drop after jan. Now $248 split adjusted. Currently up about 3500%. Hodl.Thinking more about the 1/21 call walls (captured in this thread) which are most likely a higher fraction of LEAPs that were bought as far back as Jan 2020.

Imagine buying $1000 LEAP contracts in Jan 2020 for expiry on Jan 21 22 and holding them until now.

I wonder how much those would have cost back then? Stock was trading around ~$70 (split adjusted) so more like $350 and the stock tripled as of now. So right now, you can buy at Jan19 24 LEAP strike $2475 for $130 each.

I wonder how much those will be worth? Currently $13k/contract. I'm going to get one Monday, just to see and will revisit this post Jan19 24 if I can HODL

Been slowly buying Jan 2024 spreads for 2300/2475. Max profit is about 10x return on those.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K