JRP3

Hyperactive Member

Likely lidar sensors for testing. Tesla has been using them for a while.Strange sensors on top with mirrored glass on the outside and definitely different software running in the car.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Likely lidar sensors for testing. Tesla has been using them for a while.Strange sensors on top with mirrored glass on the outside and definitely different software running in the car.

Tesla has been using this setup since at least 2016.View attachment 757859

Had an interesting experience a week ago in Atlanta. I had seen maybe 2 months ago some model Ys driving around with the California MFG plates of 63277, but I finally got to see one up close and at a stop light. Strange sensors on top with mirrored glass on the outside and definitely different software running in the car.

I was on my bike so I knocked on the window and signaled for him to roll it down.

"Hi! I was wondering what those sensors were on top of your-"

"They're keeping you safe! We're out here trying to keep you safe. This is to keep you safe."

"Ah ok but I noticed your car is running really different software from a normal Tes-"

"Oh sorry! Highly confidential and I can't talk about it! Have a nice night!"

electrek.co

electrek.co

We regularly test our own technologies against other sensors to calibrate our camera, sonar and radar system.

He thinks you're just a concerned citizen.

"Oh sh*t, you're one of those TSLA investors!"

Why would they need to send them from CA to Atlanta for testing???View attachment 757859

Had an interesting experience a week ago in Atlanta. I had seen maybe 2 months ago some model Ys driving around with the California MFG plates of 63277, but I finally got to see one up close and at a stop light. Strange sensors on top with mirrored glass on the outside and definitely different software running in the car.

I was on my bike so I knocked on the window and signaled for him to roll it down.

"Hi! I was wondering what those sensors were on top of your-"

"They're keeping you safe! We're out here trying to keep you safe. This is to keep you safe."

"Ah ok but I noticed your car is running really different software from a normal Tes-"

"Oh sorry! Highly confidential and I can't talk about it! Have a nice night!"

Really going out on a limb there, forecasting what will happen ONE YEAR AGO?Well, most won’t like it but we’ll see 9XX again and possibly 8XX by 1/31/21. Global macro and global geo-political are creating a bunch of near term uncertainty that isn’t going to spare really anyone or anything - other than GOLD (have you seen GOLD lately, it’s quite the tell and the reverse move in the 10-yr) There is a lot of fed auctions between now and then, and funding date for the last round is 1/31/21. For TSLA, many have noted that outside of truly upside earnings and production projections, most expectations are built in and price movement after P/D. and even earnings has tended to be DOWN in the post earnings window vs. further upside. So, I’m keeping the powder dry but reserve the right to start to add - but I haven’t done it yet.

Today, towards the close I DID take off half my QQQ puts from December, but will hold the remainder for the next two weeks most likely (feb expiry). Same with S&P puts at 4375 which I continue to hold. I’ll let all other calls written back in December for 1/21 and 1/28 just expire worthless. Like the 1200 TSLA 1/21 I wrote when I sold 4/5 of the position at 1210. If I hadn’t sold the calls then I’d be flat on the last tranche.

Starting to add RIVN to my ‘getting close’ stack we’re back at my entry price point on my monitor list, but I think we’ll see sub $60 there if we get another overall market push, at that point I’ll be a buyer.

As I said last week, things are getting pretty darn attractive for longer term positions, but we’re not there YET IMHO.

Anyone have TSLA Volume data for today - Options or Stocks?

Nothing on Max Pain site (flat line), and nothing on my chart at TD Amer (doesn't even show the volume graph below the chart).

Curt, no apologies required, holding TSLA is a means to an end to make your life and the lives of others better, not a life sentence. Congratulations on your new home! Curious though, where will you place the proceeds from the sale of your old home once sold? I hear TSLA is on sale.Sorry, but I sold about 7% of my TSLA position today to pay cash for my newly built home which closed today. I traded the shares this morning for a price around $1033. My current home of 5.5 years was put up for sale yesterday afternoon, resulting in six showings today, including one bid above my offering price so far. So, for now I own two homes paid for by TSLA. That may not be for long.

As a bonus* the armor does'nt get bogged down in mud quite as much. Winter storms are harsh right now for the troops en route on landing ships to Crimea. Anchored up in the middle of Kattegat.Yeah, Putin is also a naughty boy. If I was Putin, I would do it when the weather freezes so the Europeans need me the most

Oooh compound tib fibs. What you get in tesla when the other guy gets much worse

I just opened a HSA this year and since it’s new and small balance and I can’t do spreads, I’m wheeling AMC. I know, stupid timing right. So I sold my puts and they got assigned. This morning I just sold calls against the shares because of the pop. Well now I’m considering buying them back to maybe resell again.

My question is, since they are covered calls, can I run into good faith violations for day trading them in a non margin account? I know I can have run into that issue with cash secured puts. Not sure how that works with covered calls though.

Any insight would be great thanks.

I'm confused... yes, the SP was ~$720 - $900.40 (ATH at the time) back then...Well, most won’t like it but we’ll see 9XX again and possibly 8XX by 1/31/21. Global macro and global geo-political are creating a bunch of near term uncertainty that isn’t going to spare really anyone or anything - other than GOLD (have you seen GOLD lately, it’s quite the tell and the reverse move in the 10-yr) There is a lot of fed auctions between now and then, and funding date for the last round is 1/31/21. For TSLA, many have noted that outside of truly upside earnings and production projections, most expectations are built in and price movement after P/D. and even earnings has tended to be DOWN in the post earnings window vs. further upside. So, I’m keeping the powder dry but reserve the right to start to add - but I haven’t done it yet.

Today, towards the close I DID take off half my QQQ puts from December, but will hold the remainder for the next two weeks most likely (feb expiry). Same with S&P puts at 4375 which I continue to hold. I’ll let all other calls written back in December for 1/21 and 1/28 just expire worthless. Like the 1200 TSLA 1/21 I wrote when I sold 4/5 of the position at 1210. If I hadn’t sold the calls then I’d be flat on the last tranche.

Starting to add RIVN to my ‘getting close’ stack we’re back at my entry price point on my monitor list, but I think we’ll see sub $60 there if we get another overall market push, at that point I’ll be a buyer.

As I said last week, things are getting pretty darn attractive for longer term positions, but we’re not there YET IMHO.

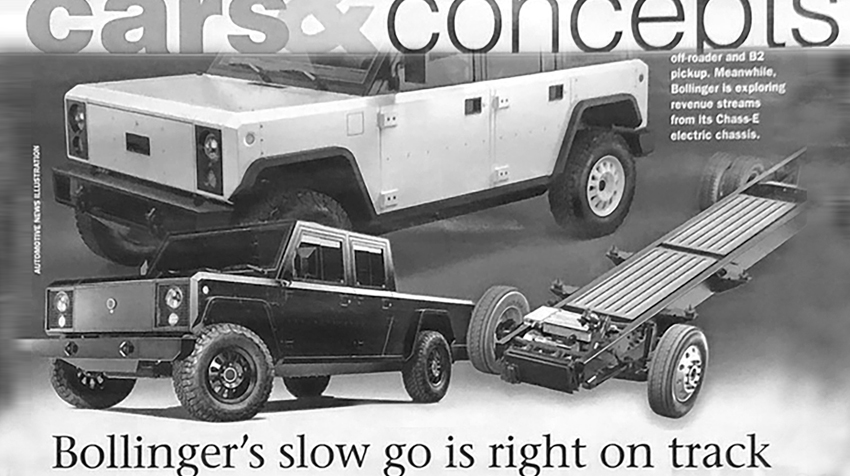

Relevant topic Bollinger Pivots Away From ConsumerIn other news, just how hard is it to make an EV? It is not so easy after all.

An EV Startup Hit a Bump In the Road. It Could Be a Warning Sign for the Sector.

Bollinger Motors just announced last Friday that they are not proceeding with their EV pickup truck B2 and their EV SUV B1 and will refund all the deposits they received from potential purchasers. They will instead concentrate on commercial trucks, although they do not even have a prototype for a semi or van.

Bollinger Motors went from this near finished product:

View attachment 757872 View attachment 757873

to this:

View attachment 757871

Bollinger Motors is a privately owned company. I was expecting big things from Bollinger, and liked their boxy, utilitarian design (similar to Mercedes Benz G Class). I thought they had a great offering, however now obvious that they don’t have what it takes to make their EVs at scale at a profit. Prototypes are easy. Manufacturing EVs is hard. The other legacy autos and EV startups are finding this out the hard way.

The above link also describe the slippery slope for Canoo, Rivian, Lordstown and other EV startups.

Well it tested the upper Boll and now it's doing it again. Haven't looked at QQQ for a while and it is nice to see something a bit less volatile than TSLA now and again.I’m hopeful but I wouldn’t call this a rally just yet. This is exact setup from last 4 days

I’ll consider it a rally if QQQ hits 376

Sorry, but I sold about 7% of my TSLA position today to pay cash for my newly built home which closed today. I traded the shares this morning for a price around $1033.

Wait... so this was you?Friday is the big annual LEAP options expiration day. The hedge funds and market makers may want to keep TSLA channeled around $1000 until then. Many other stocks could be similarly constrained.

Sorry, but I sold about 7% of my TSLA position today to pay cash for my newly built home which closed today. I traded the shares this morning for a price around $1033. My current home of 5.5 years was put up for sale yesterday afternoon, resulting in six showings today, including one bid above my offering price so far. So, for now I own two homes paid for by TSLA. That may not be for long.

Probably better for the BEV comp thread...Relevant topic Bollinger Pivots Away From Consumer