I use TA as a piece of mind. If Tesla fills the gap tomorrow then I wouldn't be surprised. I'll be more surprised if we don't fill the gap and ends the day super positive, but that's a good surprise to have. I think people should never trade on TA because it's gambling, but use it perhaps for a favorable entry point to long a stock, or favorable full exit out of a stock.A family friend stock broker, technical analysts guru, committed suicide because he lost someone's piggybank, the third time it happened. Literally spent hundreds of hours with him and other TA. Don't bet all your piggybank is my cautionary advice to anyone looking at TA

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

So they just make up rules as they go along, so they don’t have to do what they should be doing.And for people who wants to know when S&P or Moody will upgrade Tesla to investment grade, this guy is predicting the summer. The reason is that he goes through what these rating companies have said that will change their rating to the up or downside. Basically these rating agencies are waiting for Giga Berlin/Texas to be in production while needing Tesla to show a positive EBITA margin of a percentage of their choosing. They see these two factories ramping as a near term risk to margins and would upgrade once they have clarity on the matter(or downgrade).

Well it's what they set up for Tesla. And they are not hard metrics. One of the company just needed Tesla to show Ebita margin of 4% while Texas/Berlin are in production.So they just make up rules as they go along, so they don’t have to do what they should be doing.

Guess poor production hell execution from Tesla's existence till 2018 was a risk that great execution from giga Shanghai didn't fully cancel out.

Money does not go anywhere, for the most part. The value in terms of dollars just evaporates.Where all that money running away from NFLX and PTON going to go? In the company with the greatest earning grow of all time?

We need a super duper funny for this one.And for people who wants to know when S&P or Moody will upgrade Tesla to investment grade, this guy is predicting the summer. The reason is that he goes through what these rating companies have said that will change their rating to the up or downside. Basically these rating agencies are waiting for Giga Berlin/Texas to be in production while needing Tesla to show a positive EBITA margin of a percentage of their choosing. They see these two factories ramping as a near term risk to margins and would upgrade once they have clarity on the matter(or downgrade).

I for one hope they never give Tesla an upgrade.

They are worthless pay to play trash and I hope all their toilets back up and overflow filling there houses with the crap they spew.

When a company prints money the way Tesla is and will...who needs them....in my best Yoda.."irrelevant they are"

Last edited:

The "high bay" and the "stamping addition" at Austin have set ups that do look suspiciously like the SDI plant. They have gantry cranes and very high clearance, for instance. Also, both areas have column footings buried a couple of storeys down and the floor has not yet been concreted. This could allow for more foundation work to be similar to SDI.There was some talk about Tesla re-processing steel from SDI to improve the purity level.

Joe Tegtmeyer mentioned that one part of the Austin plant looks a bit like part of the SDI facility, so maybe Tesla is doing some processing of material for the Cybertruck body, allowing them to use a greater range of suppliers? I know this is unlikely, but I would not 100% rule it out.

When Elon gives the product roadmap, it is almost certain give provide a timeline for Cybertruck and the semi. IMO we can trust any new timeline is reasonably accurate.

We don't have many details about these two areas so that's why Joe's imagination is wandering. And even if it isn't a steel plant, it could be steel-related. My favorite speculation is that these areas are to work steel at cryogenic temperatures for Cybertruck. Or perhaps Tesla has some other steel voodoo in store for us.

All that said, much of the rest of Austin (stamping, casting, plastics) also has gantry cranes and high clearance, so it's no real clear indication that the high bay and stamping addition are steel-related. One or both could be logistics-related. Austin has a mysterious lack of loading docks, after all.

tivoboy

Active Member

Tomorrow could be the 2nd of these two expected days, could be the AM for sure or ~ 12:00 EST.. lock and load. In many areas of the NSDQ we’re almost there. Generals have fallen, nobody will be spared, its ALMOST time to pickup the pieces.Today, 1/14/22 is officially ONE of the 1-2 “oh s..t” days I expected to come.. next week we’ll probably see the other. Some things are getting very interesting but I’m still going to be waiting till the whites of their eyes are covered in vomit before taking some positions. I’ve spent the day taking OFF the CC‘s I wrote on QQQ and many other NASDAQ holdings for pennies.. There is some good premium for 1/21 and 1/28 for what ppl think is going to be a bounce so I wanted to free up the underlyings to be able to write again. , but as I said I think there is one more day of puking to come. Question is, when.

ZeApelido

Active Member

Maybe because they know how you really drive??

Maybe Tesla Insurance will train an extra neural net to distinguish between reckless driving and 'spirited' but safe driving?

Or will it be one hand giveth (600 - 1000 hp) while the other taketh away ( 2 or 3X for driving a kick a** EV)?

Cybertruck is theoretically going to use cold rolled stainless for high strength. This may mean they buy normal coils, then cut and roll to strengthen on site (followed by all the other forming operations). Otherwise, the difficult to bend material needs to be shipped in as sheets/ blanks.The "high bay" and the "stamping addition" at Austin have set ups that do look suspiciously like the SDI plant. They have gantry cranes and very high clearance, for instance. Also, both areas have column footings buried a couple of storeys down and the floor has not yet been concreted. This could allow for more foundation work to be similar to SDI.

We don't have many details about these two areas so that's why Joe's imagination is wandering. And even if it isn't a steel plant, it could be steel-related. My favorite speculation is that these areas are to work steel at cryogenic temperatures for Cybertruck. Or perhaps Tesla has some other steel voodoo in store for us.

All that said, much of the rest of Austin (stamping, casting, plastics) also has gantry cranes and high clearance, so it's no real clear indication that the high bay and stamping addition are steel-related. One or both could be logistics-related. Austin has a mysterious lack of loading docks, after all.

@Krugerrand , how wrong am I?

TheTalkingMule

Distributed Energy Enthusiast

We're a couple bucks from a 10% QQQ correction over about two weeks. Letting things bottom out on this options Friday sets up for a potentially massive TSLA move up after earnings.

I'll be converting 20% of my shares to LEAPs and call spreads in the morning. Wild wild times.

Loosely my plan is to lever up before earnings and hope to cash out these LEAPs/spreads by Feb/Mar with a SP around 1200+. Will then start selling weekly covered calls pretty aggressively at 1250+ until I get assigned for half my shares.

From there I'll hodl 50% of shares and sell BPS in my IRA on the cash from the other half.

Pretty soon it'll be time to start buying 2024 puts on the oil major's! TSLA to ATH before April would be quite helpful.

I'll be converting 20% of my shares to LEAPs and call spreads in the morning. Wild wild times.

Loosely my plan is to lever up before earnings and hope to cash out these LEAPs/spreads by Feb/Mar with a SP around 1200+. Will then start selling weekly covered calls pretty aggressively at 1250+ until I get assigned for half my shares.

From there I'll hodl 50% of shares and sell BPS in my IRA on the cash from the other half.

Pretty soon it'll be time to start buying 2024 puts on the oil major's! TSLA to ATH before April would be quite helpful.

insaneoctane

Well-Known Member

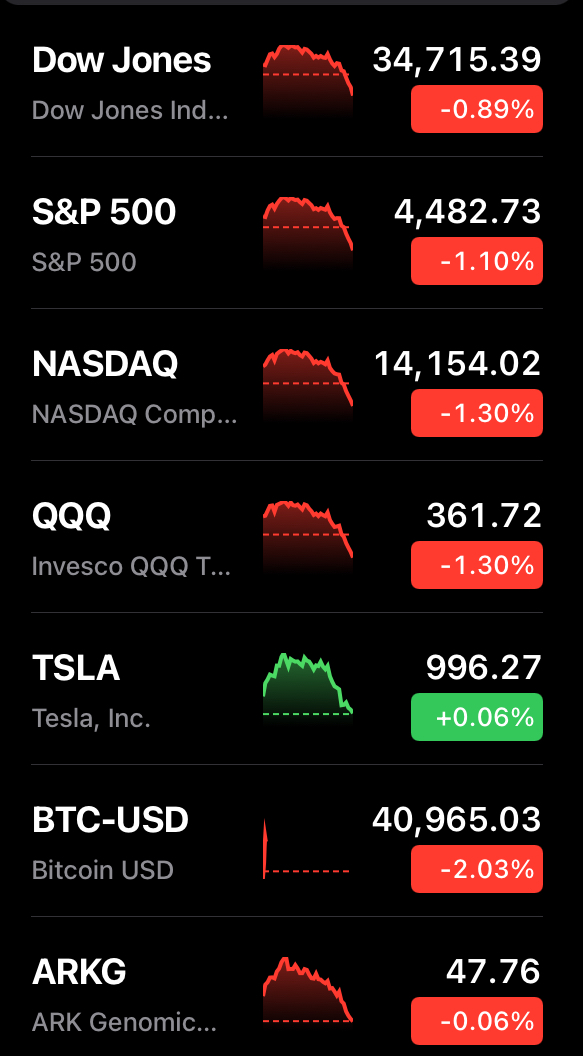

Not TA, but rather an observation. Doesn't my as-configured apple stock feed imply some relative strength today?

Xd85

Member

anyone notice the CNBC AH volume is >68M. if accurate what does it mean? (wild AH volume also shows for other techie names)

tivoboy

Active Member

All due respect TTM, but I think we’re over 10% at this point, certainly if one moves back into either late DEC or JAN start or top tick I GUESS if I go back a fortnight to 1/6/22 we’re almost at 10%.… my target has always been a. 13% correction for this phase and I think we’re going to tap that and probably a teeny tiny bit of extension on the Q’a.. just for good measure, flush out the weak hands so to speak. Question will be, is it s a FALSE bottom. I think for the 2022 cycle, buys in premium tech either tomorrow or in the final week of JAn will be solid positions by Q4’22/Q1’23We're a couple bucks from a 10% QQQ correction over about two weeks. Letting things bottom out on this options Friday sets up for a potentially massive TSLA move up after earnings.

I'll be converting 20% of my shares to LEAPs and call spreads in the morning. Wild wild times.

Loosely my plan is to lever up before earnings and hope to cash out these LEAPs/spreads by Feb/Mar with a SP around 1200+. Will then start selling weekly covered calls pretty aggressively at 1250+ until I get assigned for half my shares.

From there I'll hodl 50% of shares and sell BPS in my IRA on the cash from the other half.

Pretty soon it'll be time to start buying 2024 puts on the oil major's! TSLA to ATH before April would be quite helpful.

Last edited:

MC3OZ

Active Member

Yes, I also noted the lack of loading docks.The "high bay" and the "stamping addition" at Austin have set ups that do look suspiciously like the SDI plant. They have gantry cranes and very high clearance, for instance. Also, both areas have column footings buried a couple of storeys down and the floor has not yet been concreted. This could allow for more foundation work to be similar to SDI.

We don't have many details about these two areas so that's why Joe's imagination is wandering. And even if it isn't a steel plant, it could be steel-related. My favorite speculation is that these areas are to work steel at cryogenic temperatures for Cybertruck. Or perhaps Tesla has some other steel voodoo in store for us.

All that said, much of the rest of Austin (stamping, casting, plastics) also has gantry cranes and high clearance, so it's no real clear indication that the high bay and stamping addition are steel-related. One or both could be logistics-related. Austin has a mysterious lack of loading docks, after all.

One thing to consider is the economics, both Tesla and SpaceX need at lot of specialised cold-rolled Stainless Steel, even with a bulk supply contact, that might be expensive, especially if a highly-specialised formula, or process is needed.

Cybertruck needs to hit the production cost target price, and there is a lot of Stainless Steel in each body.

Hypothetically what might be needed are electric-arc furnaces, some sort of mixing facility, then the facility to do the cold-rolling. Perhaps the denial from SDI may have been cleverly worded, they seem to deny Stainless Steel shipments, but didn't necessarily rule out supplying Tesla with steel or other metals.

I'm speculating on a long shot here, it isn't that likely, but one way or another, Tesla needs to get a lot of Stainless Steel at a good price.

Bond yield tanking actually a good sign for possible rebound next week. Indicative of true fear. Sell everything and buy bonds.Bears I guess did their job on the Nasdaq, no need to go massive on shorting bond. Bond yield is tanking for whatever reason. Where were you on Tuesday?

2daMoon

Mostly Harmless

Yes, I also noted the lack of loading docks.

One thing to consider is the economics, both Tesla and SpaceX need at lot of specialised cold-rolled Stainless Steel, even with a bulk supply contact, that might be expensive, especially if a highly-specialised formula, or process is needed.

Cybertruck needs to hit the production cost target price, and there is a lot of Stainless Steel in each body.

Hypothetically what might be needed are electric-arc furnaces, some sort of mixing facility, then the facility to do the cold-rolling. Perhaps the denial from SDI may have been cleverly worded, they seem to deny Stainless Steel shipments, but didn't necessarily rule out supplying Tesla with steel or other metals.

I'm speculating on a long shot here, it isn't that likely, but one way or another, Tesla needs to get a lot of Stainless Steel at a good price.

It is both Tesla and SpaceX who will use the metal, as the Cybertruck shares the same skin as Starship. Granted, once in production Cybertruck may dwarf the supply SpaceX needs. Still, I expect whoever supplies one with "30X" SS will supply the other as well. HIgher volume might get even bettererer pricing.

Yeah, feels like this is all BS build on technicals, and why Tivoboy is so sure about his predictions. It's like they are already setting up for a pop next week or maybe later tomorrow as QQQ bounces off the 200MA. This is the best MM can take the shares down before they pay out all them leaps expiring.Bond yield tanking actually a good sign for possible rebound next week. Indicative of true fear. Sell everything and buy bonds.

Knightshade

Well-Known Member

It is both Tesla and SpaceX who will use the metal, as the Cybertruck shares the same skin as Starship.

Do we know that actually is still true?

At the time Elon said that Starship was using 301 stainless..... but mid 2020 SpaceX said it was moving to a 304L alloy- never saw anything saying CT would follow (or if it even makes sense to do so... 301 is cheaper, 304 handles higher temps better- so seems like 301 for making lots of CTs and 304 for things near dozens of rockets makes more sense?).

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K