Oh I dunno. Reuter's Biggest B-- ?Who is RBB?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZeApelido

Active Member

I am no match for the NYTimes media lemmings. There's too many.

Apparently all that Tesla FUD in 2018-2019 was "good journalism".

Lord help us all.

Apparently all that Tesla FUD in 2018-2019 was "good journalism".

Lord help us all.

Last edited:

StarFoxisDown!

Well-Known Member

I do think the market is fearing a number worse than 7.3%. So as long as it doesn’t come in worse than that, I don’t think the market sells offLooking around other stocks with high or no PE and I don't see much of a risk off. Arkk and BTC are the best indicators for risk on/off sentiment and right now it's looking we are risk on. So I have this feeling that the CPI number tomorrow will be well received no matter what it is.

If it comes in under 7% though, it will be quite interesting to watch. The entire maker sell off was predicated on out of control inflation. If the inflation number comes in softer than expected, it means inflation is/was in fact just transitory and already on the downslope

Crowded Mind

Member

Because people can't handle the truth.

More seriously, I think Elon looked at the probable way it would play out and decided it wasn't the right time yet. Not because the Vegas cars couldn't be made safe enough running in autonomous mode, but he wants to release FSD in a manner that is most beneficial to its wide rollout. Sometimes it's better to catch people by surprise. You may think people (in general) are well aware of the state of FSD but that's only true in the relatively very small circles that follow FSD development. To your average person, FSD is "Elon's Dream" that won't be ready for a decade, if ever.

When you are planning to blow millions of people's minds, you need to do it on your terms and your timeline. Not like an experiment that is pushing the limits every step of the way. FSD will come to Vegas tunnels when the time is right. From an economic perspective, the number of human drivers in the Vegas test loop is too inconsequential to be a real consideration. It's all about creating the proper narrative at the proper time.

For those commenting on Tesla not using FSD in The Boring Company tunnels, they are restricted from doing so. They can’t even use Autopilot.

Clark County has required TBC to disable all driver assist technology - source below. Here’s TBC’s president arguing to allow the use of even basic Autopilot features to Clark County’s director of building and fire protection (Jerry Stueve):

“These are not ‘autonomous’ nor ‘self-driving’ vehicles,” continued Davis. “The use of Tesla Autopilot and active safety features adds additional layers of safety while operating the vehicle, however the use of the features still requires a fully attentive driver who is ready to take over the wheel at any moment.”

Here’s a portion of the continued conversation:

In June, Stueve told Davis: “As stated early in the project, the approval of autonomous operation will require extensive scrutiny, testing and validation. This process could take a significant amount of time.”

In reply, Davis wrote: “I want to make sure that it is clear that we are not asking for autonomous or self-driving features/operations.”

Source: TechCrunch

This is the last I’ve heard on the matter, but everything at CES in January was still manually controlled, and it’s definitely not because Elon Musk wants it that way.

Last edited:

Maybe a bit OT, but could be macro related.

Kevin is ending his YouTube channel after being bashed day in and day out because he sold out his portfolio.

One thing he does not mention clearly and I believe is what’s really going on, is he was harvesting loses, and minimizing profits, while moving his assets into a tax free vehicle he is creating. Anyone who considers follow suit need to put that into consideration if you are paying taxes for your gains.

I've seen this gem about Meet Kevin:

thesmokingman

Active Member

Call me crazy, but last time I checked, investing has direct relation to valuation and information about what is affecting said valuation......because ya know, things like that are important for investors. And seeing how this thread is named Investors Roundtable.....

Doesn't matter your timeframe, if you're investing in TSLA it's important to know relation to the overall market and especially in the cases where TSLA's valuations and trading starts to detach from what is happening in the overall market.

If you want a thread where the talk is just about company news/updates, then there should be a thread specifically for that.

I wholeheartedly agree that valuation is important. My investment decisions are always based on Tesla's valuation.

However, I said SP, which is related to market cap. If you mean market cap instead of valuation, that has little to do with valuation, other than being somewhere within +/-50% of valuation on a fair day. Like today, there was no news at 10:30 am PT that would make Tesla worth 2.5% less than the hour before.

FWIW, I don't consider day traders investors either. They may buy Tesla, but they aren't investors from my perspective.

Accidentally I became a daytrader the other day! Bought at the early morning dip, 920, and sold a little later at 940. Netted ten bucks for that single share, not bad eh? Net of cost, that is. Not making it a habit.I wholeheartedly agree that valuation is important. My investment decisions are always based on Tesla's valuation.

However, I said SP, which is related to market cap. If you mean market cap instead of valuation, that has little to do with valuation, other than being somewhere within +/-50% of valuation on a fair day. Like today, there was no news at 10:30 am PT that would make Tesla worth 2.5% less than the hour before.

FWIW, I don't consider day traders investors either. They may buy Tesla, but they aren't investors from my perspective.

Wow, they could have sold at least 25, 000 Xs since they stopped.

that’s about 2.5 billion dollars and about 250 million profit.

Well we ran out of ways to say "I bought shares and I'm never selling them". It got a little boring.

I could use $948 this afternoon or at the open and I think we'll get it. Have few "investments" I need to roll out to after 1Q earnings.

Twitter is before the bell tomorrow and obviously CPI. I thing today's 2% NASDAQ pop is frontrunning the inevitable "rotation back to big tech" that will commence after CPI is announced.

Nothing wrong with boring!

FWIW, information like CPI and postulations about when the market will rotate back to tech is interesting. If peeps can't help obsessing about SP, including material information or tips adds relevancy to the post.

Artful Dodger

"Neko no me"

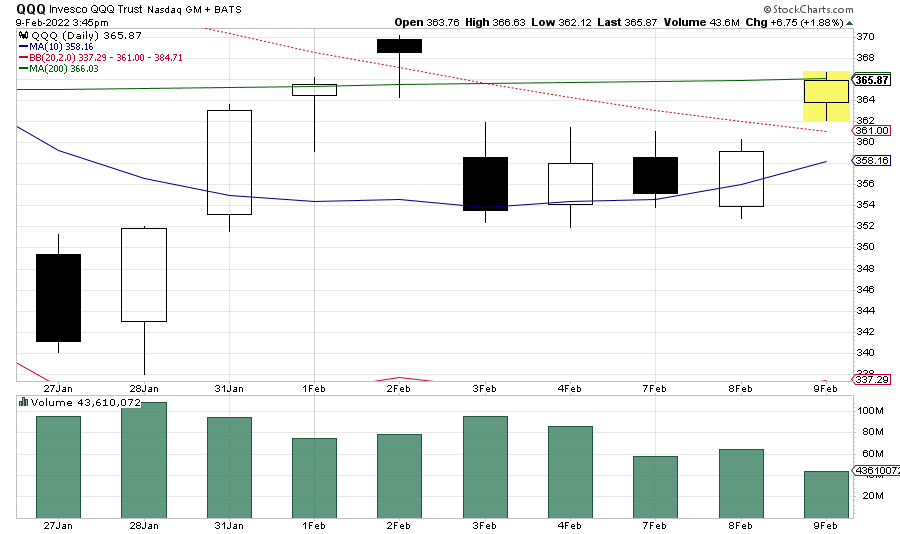

Macros: the 'QQQ' (which is a NASDAQ-100 indexed ETF) marched right up to its 200 day Moving Average, and is double-parked there: (pending CPI news no doubt)

TSLA (+1.15%) is underperforming the QQQ slightly as of 3:45 pm, but has shaken off several knee-capping attempts throughout the day.

Cheers to the Longs!

TSLA (+1.15%) is underperforming the QQQ slightly as of 3:45 pm, but has shaken off several knee-capping attempts throughout the day.

Cheers to the Longs!

StarFoxisDown!

Well-Known Member

Uh "underperforming slightly?". TSLA has a beta of 2. QQQ is up 2%. TSLA should be up 4%. TSLA is massively underperforming.Macros: the 'QQQ' (which is a NASDAQ-100 indexed ETF) marched right up to its 200 day Moving Average, and is double-parked there: (pending CPI news no doubt)

View attachment 767009

TSLA (+1.15%) is underperforming the QQQ slightly as of 3:45 pm, but has shaken off several knee-capping attempts throughout the day.

Cheers to the Longs!

And we all know why. I personally hope that the CPI number comes in under 7% to cause a shock rally. At least then MM's will have spend some actual $'s to hold TSLA to max pain.

-=buzz=-

Member

Tesla isn't perfect and mistakes do happen, but I love how this company is not afraid to admit their mistakes publicly. It's one of the reasons why I'm a happy HODL'er of TSLA.

Now start from 2003 and look at the percentage changes.

My technical analysis tells me to expect a rally if tomorrow's CPI number prints at 4.2069

Not Advise.

after weeks of fear mongering, surprised that tomorrows CPI is not causing any market hesitation ...

. rock bottom, so MM didn't want to go lower - should CPI be bad?

.they already know/project Jan CPI is gonna come lower ... some articles few weeks back mentioned it was trending lower (until payroll info came out last week)

VIX down 6% + today (so PUTS getting unwound)

10 YR down ~ 2%

other factors -- great earnings so far. Russia/Ukraine chillin...(let's hope)

TheTalkingMule

Distributed Energy Enthusiast

TSLA is closing at $969 this week and $1029 next. You know how I know? I just finished rolling all my put spreads out to May. You're welcome.Uh "underperforming slightly?". TSLA has a beta of 2. QQQ is up 2%. TSLA should be up 4%. TSLA is massively underperforming.

And we all know why. I personally hope that the CPI number comes in under 7% to cause a shock rally. At least then MM's will have spend some actual $'s to hold TSLA to max pain.

I truly think anything remotely OK on the CPI kicks this orchestrated "rotation back to tech" into high gear. Today was a preamble and it'll top out after Nvidia earnings next week. These clowns just needed to rattle retail to get the big tech shares they wanted all along. I have a few less, but am now more levered.

Not mentioned in the business news or on here at all are the continued plummeting covid case counts. And now peaked daily deaths. WTI is headed back down and the job market's tight. So long as the Fed keeps it's cool, we should rip.

ZeApelido

Active Member

Hope it is simple enough to maintain

Artful Dodger

"Neko no me"

Wow, they could have sold at least 25, 000 Xs since they stopped.

that’s about 2.5 billion dollars and about 250 million profit.

Yeah, not with semi-conductor shortages. They'd have sold fewer 3/Ys if they chose to build more Xs. Elon is being mellow/dramatic.

For that matter, why don't they build LFP Models X? It'd be an awesome arpt taxi... yeah, its about 'opportunity cost' and limited engineering resources.

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K