Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The problem is that some people are overly sensitive, have no sense of humor, and are constantly offended by everyone else that has a different opinion. It seems that the same people that are so offended by Elon's attempt at a funny meme have no problem constantly comparing and accusing members of the opposite political party in the US of being members of the horrible historic German party that shall not be mentioned. The hypocrisy is hilarious and something we are very used to when we lean more conservative.I have followed investor thread occasionally since 2014 and it has always been very harsh to everyone who isn’t 100% pro TSLA and Musk. People say that they don’t want echo chamber but in practice they want. Sure, some critics are trolling but not all.

Confirmation bias is harmful, yet people seek it, because insecurity is uncomfortable.

P.S. - For the record, I do not believe that a group of truckers should be allowed to block access and important trade between two countries. It is basically a form of terrorism, and the Canadian government had a responsibility to end it ASAP by what ever means necessary. So I don't agree with Elon's tweet at all, but understood the "humor" behind it.

Last edited:

A

AndreP

Guest

By another definition, investors are:Nonsense.

By definition, investors are:

Buying shares of stock purely on the rumor of potential sale is trading stock on that information with the hope of profiting on the deal.

Anyone buying shares in that windows for the purposes of investment have quite clearly not been harmed.

Now there certainly could have been harm if they decided to sell just after the SEV action, but that was their decision. A decision any investor should be making in light of the definition above, not a single SEC action.

any person or other entity (such as a firm or mutual fund) who commits capital with the expectation of receiving financial returns.

Committing capital with the expectation of a financial return could mean any number of things. I can't find how exactly the SEC defines an "investor", but I doubt the securities regulator defines it in the words you posted.

I'm not going to rehash the argument around whether some shareholders could have been harmed or not after the Mod already shut this down.

insaneoctane

Well-Known Member

If the SP wasn't so depressed we wouldn't be picking scabs....

dgodfrey

Member

But the issue you keep going to is "false claims".The SEC is there to protect everyone who is participating in the securities market, not just people that buy and hold.

People who bought during the run-up based on false claims of going private at a big premium on the current price would be harmed by the false claims, that's who the SEC is looking to protect here. If you bought at $379 and could have bought at $319, you should be going after compensation as well.

- Where is your evidence that Elon made a false claim?

- What did Elon say that caused the stock to drop?

- Is there some other catalyst that may have caused the stock to drop like e.g. the SEC

- If so, the SEC should be on the hook for making stupid people whole.

This is just how America feels obligated to compensate stupid people.

Step into a pothole while texting and sprain your ankle, here's your check.

Hit yourself in the head with a boomerang, here's your check.

Trip over a sprinkler head while stealing packages, here's your check.

I have a model 3 in a deep red part of a deep red state working in a deep red industry. I was terrified of how having a Tesla would be received. However, a recent comment from a coworker was "I'm starting to like that Elon Musk more".Yes, we can all bring the heat down a bit on how we discuss the most recent events.

With cold, clear eyes, looking over the arc of recent history, may I present what our often admired colleague's, Karen Rei's , perspective is.

View attachment 771237

We have to remember that most fossil fuels for transportation are being burned in rural areas. Replacing a Prius in Santa Barbara is great, but replacing a Ford F250 with a powerstroke diesel being driven 100 miles a day makes a much bigger difference in terms of CO2. (For context, in my work truck, I burn 10-15 gallons daily).

Green energy can't just be for the greeenies.

TheTalkingMule

Distributed Energy Enthusiast

My definition of "investor" was from the Oxford English dictionary, yours was from the "investing website" Investopedia. Investopedia of course being under the same umbrella as The Home Shopping Network and led by the former M&A VP at Credit Suisse.Committing capital with the expectation of a financial return could mean any number of things. I can't find how exactly the SEC defines an "investor", but I doubt the securities regulator defines it in the words you posted.

The only other interaction I've had with you here was discussing the merits of short term "investments" in once massive coal companies for short term gain. I think we have differing ideas around the definition of investment.

This whole SEC action was utter nonsense, and I was a bit annoyed Elon settled it for just this reason. It let the SEC off the hook after they clearly overstepped. Would liked to have seen a more definitive retraction.

A

AndreP

Guest

The only definition of "investor" that really matters here is the SEC's. I tried to find that but couldn't, but I doubt it matches the words you posted.My definition of "investor" was from the Oxford English dictionary, yours was from the "investing website" Investopedia. Investopedia of course being under the same umbrella as The Home Shopping Network and led by the former M&A VP at Credit Suisse.

The only other interaction I've had with you here was discussing the merits of short term "investments" in once massive coal companies for short term gain. I think we have differing ideas around the definition of investment.

This whole SEC action was utter nonsense, and I was a bit annoyed Elon settled it for just this reason. It let the SEC off the hook after they clearly overstepped.

My comments on coal companies were around the idea that they were uninvestible. At the time of our discussion, the ticker BTU was up like 500% from its pandemic lows -- it's now up 1,700% from the pandemic lows.

I don't own the stock and never will, I've been sitting on all of my holdings for over 2 years. I was just trying to offer a different perspective and play a bit of devil's advocate.

To the folks concerned that Elon's politics are offending potential customers and therefore harming the mission:

Of course you are right. Christ returning with a cure for cancer would offend someone somewhere. But let's consider: Is the harm serious or insignificant?

1) Tesla's products are sold out for months or years. Demand is so high that all new-product releases have been postponed so Tesla can TRY to meet current demand.

2) Tesla's technological lead is huge and growing. So-called competitors simply cannot keep up with the speed and creativity of Tesla innovation in products and manufacturing.

3) Tesla sells products by word-of-mouth. The amount of word-of-mouth is rising exponentially because production is nearly doubling annually. More Tesla cars on the roads, at rental lots, in Las Vegas tunnels, etc. are doing what Super Bowl ads have no hope of matching.

4) The long-expected (not promised) release of FSD from beta will be a Transportation Singularity that wipes out most competitors nearly overnight. If you think Tesla's demand is high now, you ain't seen nothin yet.

In short, Tesla's products are so good that only a fool would avoid them because of an Elon tweet. Sure, plenty of fools exist, but not enough to slow down this company. Tesla doesn't need them, so we investors don't either.

Of course you are right. Christ returning with a cure for cancer would offend someone somewhere. But let's consider: Is the harm serious or insignificant?

1) Tesla's products are sold out for months or years. Demand is so high that all new-product releases have been postponed so Tesla can TRY to meet current demand.

2) Tesla's technological lead is huge and growing. So-called competitors simply cannot keep up with the speed and creativity of Tesla innovation in products and manufacturing.

3) Tesla sells products by word-of-mouth. The amount of word-of-mouth is rising exponentially because production is nearly doubling annually. More Tesla cars on the roads, at rental lots, in Las Vegas tunnels, etc. are doing what Super Bowl ads have no hope of matching.

4) The long-expected (not promised) release of FSD from beta will be a Transportation Singularity that wipes out most competitors nearly overnight. If you think Tesla's demand is high now, you ain't seen nothin yet.

In short, Tesla's products are so good that only a fool would avoid them because of an Elon tweet. Sure, plenty of fools exist, but not enough to slow down this company. Tesla doesn't need them, so we investors don't either.

Yeh, I only had an 11.4x gain on my 8/7/2018 purchase at $377.03 and a 12.1x gain on my 8/14/2018 purchase at $353.01.I don't think that short-sellers would be compensated in this scheme, pretty certain it would be limited to people who bought during the chaotic price movements and before clarification of the claims resulted in a big drop in the stock price.

The distribution would be extremely complex though regardless, it would be onerous just to prove that you bought during this run-up and missed out on more gains or lost money if you sold when the stock price declined.

Good luck reducing this "loss" to math!

The Accountant

Active Member

Most On Wall Street Can't Comprehend What Tesla Has Managed To Pull Off

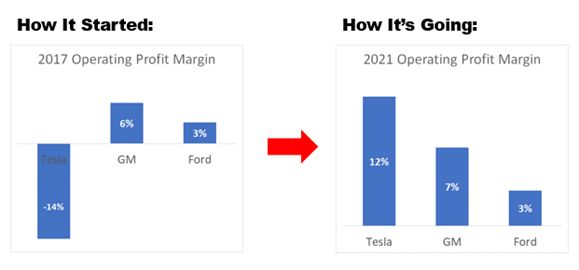

I posted these graphs several weeks ago demonstrating Tesla's impressive 5 year Operating Margin % Growth.

As I delved into the GM and Ford 10Ks, I realized that the Tesla story was much more impressive than my graphs had conveyed.

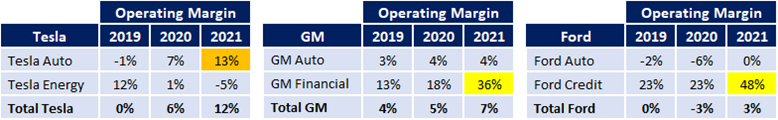

GM & Ford's Operating Margin gains have come mainly from their financing arms (see boxes in yellow).

When you isolate the Auto Operating Margins, GM's margins over the past 3 years have been flat in the 3%-4% range while Ford has not made money on its auto business.

Meanwhile, Tesla OpInc Margin in 2021 was 13% for Auto. The number is likely higher than 13% as I did not allocate any SG&A costs to Energy.

Note: The Services revenues and costs are included in Auto.

Some additional facts & thoughts to compliment these findings:

I posted these graphs several weeks ago demonstrating Tesla's impressive 5 year Operating Margin % Growth.

As I delved into the GM and Ford 10Ks, I realized that the Tesla story was much more impressive than my graphs had conveyed.

GM & Ford's Operating Margin gains have come mainly from their financing arms (see boxes in yellow).

When you isolate the Auto Operating Margins, GM's margins over the past 3 years have been flat in the 3%-4% range while Ford has not made money on its auto business.

Meanwhile, Tesla OpInc Margin in 2021 was 13% for Auto. The number is likely higher than 13% as I did not allocate any SG&A costs to Energy.

Note: The Services revenues and costs are included in Auto.

Some additional facts & thoughts to compliment these findings:

- Tesla achieved the 13% margin in 2021 with slightly under 1m deliveries while GM delivered 6m and Ford 4m.

- Having higher OpInc margins with fewer deliveries indicates that Tesla's business is less complex, more streamlined with a lean operating structure.

- The 13% for Tesla in 2021 was for the full year. Tesla achieved Auto Operating Margins of 16.5% in both Q3 and Q4. I expect to see at least 18% for Tesla in 2022.

- These operating margins help to understand the decision to focus on Model 3/Y for 2022 and delay the Semi and CT . . .don't screw up the money printing machine !!

- Model 3 & Y 2021 price increases surfacing in 2022 with continued cost reductions will further improve margins despite the Berlin/Austin ramps.

- GM/Ford and other OEMs will see increasing Operating Margin pressures as they pivot from ICE to EV and when their Financing Margins come back down.

- When supply issues subside, I expect Tesla Energy to return to Operating Income profitability . . .I expect it to be this year.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

The Tesla Economist (I think) did a video on how "Automotive Revenues" include selling parts, artificially inflating comparative figures with Tesla. Views? Any way to break them apart (can't remember if video covered or even estimated).Most On Wall Street Can't Comprehend What Tesla Has Managed To Pull Off

I posted these graphs several weeks ago demonstrating Tesla's impressive 5 year Operating Margin % Growth.

View attachment 771290

As I delved into the GM and Ford 10Ks, I realized that the Tesla story was much more impressive than my graphs had conveyed.

GM & Ford's Operating Margin gains have come mainly from their financing arms (see boxes in yellow).

When you isolate the Auto Operating Margins, GM's margins over the past 3 years have been flat in the 3%-4% range while Ford has not made money on its auto business.

View attachment 771291

Meanwhile, Tesla OpInc margins in 2021 were 13% for Auto. The number is likely higher than 13% as I did not allocate any SG&A costs to Energy.

Note: The Services revenues and costs are included in Auto.

Some additional facts & thoughts to compliment these findings:

- Tesla achieved the 13% margin in 2021 with slightly under 1m deliveries while GM delivered 6m and Ford 4m.

- Having higher OpInc margins with fewer deliveries indicates that Tesla's business is less complex, more streamlined with a lean operating structure.

- The 13% for Tesla in 2021 was for the full year. Tesla achieved Auto Operating Margins of 16.5% in both Q3 and Q4. I expect to see at least 18% for Tesla in 2022.

- These operating margins help to understand the decision to focus on Model 3/Y for 2022 and delay the Semi and CT . . .don't screw up the money printing machine !!

- Model 3 & Y 2021 price increases surfacing in 2022 with continued cost reductions will further improve margins despite the Berlin/Austin ramps.

- GM/Ford and other OEMs will see increasing Operating Margin pressures as they pivot from ICE to EV and when their Financing Margins come back down.

- When supply issues subside, I expect Tesla Energy to return to Operating Income profitability . . .I expect it to be this year.

The Accountant

Active Member

I'll see if I can find that video.The Tesla Economist (I think) did a video on how "Automotive Revenues" include selling parts, artificially inflating comparative figures with Tesla. Views? Any way to break them apart (can't remember if video covered or even estimated).

I believe:

. .when an OEM sells parts to a Dealership, the OEM records the sale in revenues.

. .when Tesla sells parts to customers, Tesla records the sale in revenues.

. . the difference is that Tesla likely makes more margin on their parts as they don't have to share the mark-up with a dealer.

paging @jbcarioca

April 1, 2013 was IIRC when Elon tweeted something hopeful about not going negative, for the first time. That signalled to me I should invest, STAT. I did. Was not a joke, as such.Also first day Q2.

I have not gone far enough back to be congratulated for consistency, but just deleted some two dozen posts that were completely irrelevant to the topic of this thread and polite conversation; posts that also were in direct contravention to Moderators’ instructions.

UkNorthampton

TSLA - 12+ startups in 1

And legacy OEM has maybe 20 times this years sales of cars as used cars driving around, getting into crashes and breaking down. Less miles on older cars maybe, so multiple is VERY arguable, but as Teslas sales are going up and legacy are going down, used-car part sales must be a higher % of total revenues than Tesla. Also, few Teslas are out of warranty.I'll see if I can find that video.

I believe:

. .when an OEM sells parts to a Dealership, the OEM records the sale in revenues.

. .when Tesla sells parts to customers, Tesla records the sale in revenues.

. . the difference is that Tesla likely makes more margin on their parts as they don't have to share the mark-up with a dealer.

paging @jbcarioca

Edit: If GM & Ford stopped selling cars today, Automotive Revenue would take many years to hit zero.

Coolio2000

Member

Like it or not, Elon gets a lot of love on Fox News. I don't think we have anything to worry about Tesla being embraced by red states.I have a model 3 in a deep red part of a deep red state working in a deep red industry. I was terrified of how having a Tesla would be received. However, a recent comment from a coworker was "I'm starting to like that Elon Musk more".

We have to remember that most fossil fuels for transportation are being burned in rural areas. Replacing a Prius in Santa Barbara is great, but replacing a Ford F250 with a powerstroke diesel being driven 100 miles a day makes a much bigger difference in terms of CO2. (For context, in my work truck, I burn 10-15 gallons daily).

Green energy can't just be for the greeenies.

Very sorry, seriously, but I just cannot see what you mean.Well keeping in mind this would be about the SEC harming the harmed investors more than they were harmed by the tweet(s), and I'm not sure how we rationalize that. This isn't about the SEC harming or not harming all Tesla investors.

So the alternative here is someone being entitled to nothing additional after buying the stock at ~$379.57 following Elon's $420 tweet and before it dropped down to ~$319.44 when the claim was abandoned. I think reasonable people here would be perturbed if they were caught in this circumstance, a $60 price difference at that time could extrapolate to a massive $$$ impact for someone who bought a lot of shares in that window.

This isn't about just holding the stock through that window, this is about buying shares at an inflated price after false claims were made and then before the stock corrected by like 16%. People caught in this situation would receive nothing for compensation if not for the SEC's action here, so I don't think there would be an argument for the SEC harming these people more than the tweet(s).

If we talk about all Tesla investors, people buying into the stock with a cost basis of $379 would presumably be beneficial to everyone else rather than those same people buying in at $319.

Considering that all trades have two sides, the harm inflicted on the harmed investors would come from people benefitting by selling to them at $379 rather than $319.

Perhaps because of not having paid sufficient attention to the current debate. And it has been a long time since the fines.

Could you please add some clarification?

To my reading, SEC was supposed to use the 40M from fines to "reimburse" "hurting 'investors'" but has to date failed to do so and is being sued as well as the ruling Judge getting annoyed.

Also to my simple mind, it seems that SEC is failing its job as well as being in contempt of Court for it.

It's a given I may have missed a lot of important context here. So, please fill the gaps?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K