Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The transition to EVs will accelerate, after this energy blackmail

the total disgust will be enduring.

Energy independence and nuclear deterrence are primary objectives

in assuring survival In the new new normal.

the total disgust will be enduring.

Energy independence and nuclear deterrence are primary objectives

in assuring survival In the new new normal.

TheTalkingMule

Distributed Energy Enthusiast

You don't think it was strange to see metals and mining down 1.5% today?Even more bizarre is the chart you posted shows XME up 4.93% in the past 5 days.

It's now reversed by more than 3% in the last 35 mins.

Artful Dodger

"Neko no me"

You don't think it was strange to see metals and mining down 1.5% today?

It's now reversed by more than 3% in the last 35 mins.

I typically don't watch metals futures since I have zero intention of betting on them. I'm comfortable in the knowledge that Tesla has secured both it's short- and long-term requirements with production contracts.

IMO, the nickel spike yesterday was futures speculators trying to create a panick (same as they do every day). I ignored it.

Cheers!

What do we know about:

- Tesla hedging activities for commodity inputs, esp. for batteries, to protect against price spikes related to inflation/Ukraine?

- Roughly how much do those inputs cost per car?

Agreed, when I buy I select a sale date, got really piggy this time. (I always buy more Tesla shares with any option gains, now on to Jan 24 leaps)If sold on 1/3/22, yeah, probably 30x. Well if it makes you feel better, we all would be better Investors if we could see the future.

SQ example drop looks like it was raining knives. That was ARKs favorite for a while, OUCH!I think you need to start looking at charts. Look at 5 year charts for SQ or SHOP for good examples of falling knives. When you see charts that look like that, keep your hands in your pockets.

I certainly hope TSLA's at bottom and just bouncing around. But I don't see any clarity since 1200.

Remember 1,200 in Q4? What caused that to happen? Let's do that again!

It’s still there, kooky or not.That tweet seems to have disappeared...

I thought it sounded kind of kooky.

insaneoctane

Well-Known Member

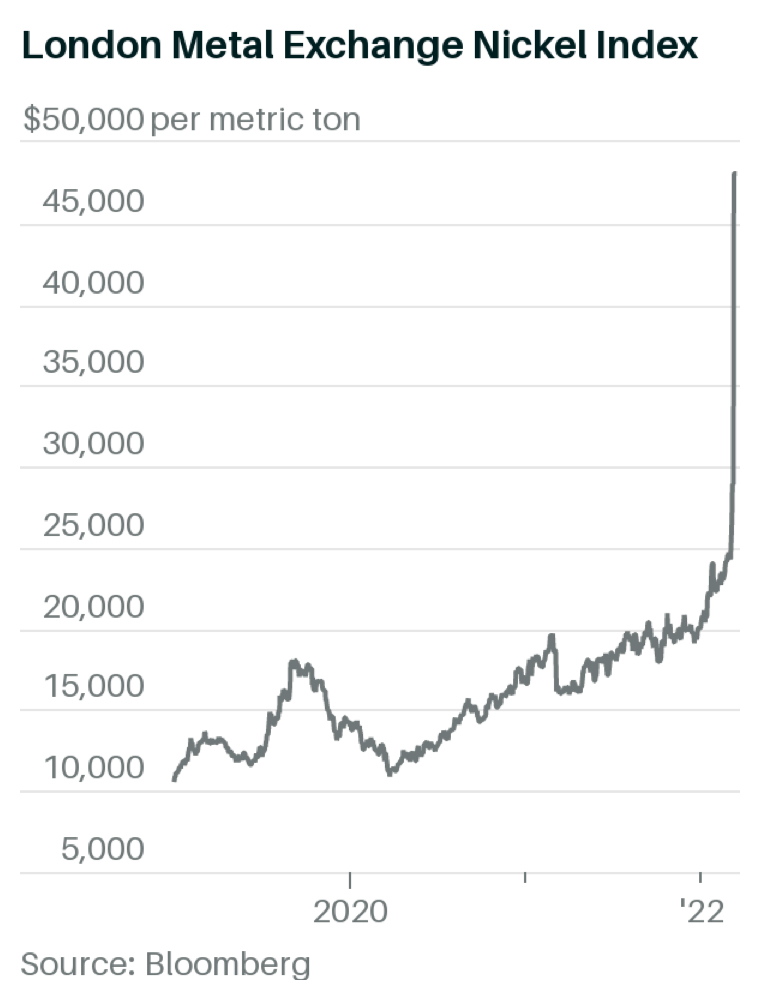

I've been following some of the nickel headlines, but this image gave perspective to them...

Even if Tesla has secured pricing, at what point do those contracts become uncertain because it's more economical to violate the contract than honor it? Extreme times.... extreme measures.

Even if Tesla has secured pricing, at what point do those contracts become uncertain because it's more economical to violate the contract than honor it? Extreme times.... extreme measures.

Tesla's all have heat pumps.... spread the word

There's a difference between speculating trading/short squeeze vs companies that actually buys the products.I've been following some of the nickel headlines, but this image gave perspective to them...

View attachment 778341

Even if Tesla has secured pricing, at what point do those contracts become uncertain because it's more economical to violate the contract than honor it? Extreme times.... extreme measures.

Tesla can announce they are going to use Iron only tomorrow and we will see nickel price drop to the floor overnight.

StarFoxisDown!

Well-Known Member

Yup, no company is going to buy any nickel at that super inflated price because it's an artificially high price due to derivatives/short squeeze. That's why trading got halted on it.There's a difference between speculating trading/short squeeze vs companies that actually buys the products.

Tesla can announce they are going to use Iron only tomorrow and we will see nickel price drop to the floor overnight.

Besides, just because a company wants out of a contract doesn't mean they have any ability to just because they want to sell at the new higher price. That's the entire point of the contract. Also, most contracts that don't even have a set price have a 10% move cap built into it.

So in other words, this move in nickel doesn't mean anything. It might to anyone that hadn't secured supply in the past 1-2 years (cough Ford) but Tesla thought ahead in all these aspects.

An article from Clean Technica offers very good take on Russia invading Ukraine with high relevance to Tesla and Elon.

I do agree with a lot that's been said there. Recommended to broaden horizons for those who are interested.

Article - CleanTechnica

I do agree with a lot that's been said there. Recommended to broaden horizons for those who are interested.

Article - CleanTechnica

Artful Dodger

"Neko no me"

What do we know about:

- Tesla hedging activities for commodity inputs, esp. for batteries, to protect against price spikes related to inflation/Ukraine?

- Roughly how much do those inputs cost per car?

I've don't recall Tesla ever purchasing hedges for commodities (only hedges for convertible bond issues). Telsa perfers to deal directly with the resource owner, and to secure long-term supply through contracts. Typical contract is 5 years supply.

Lol, Tesla will be buying nickle from SpaceX before too long (asteroid mining contracts).

Cheers!

thesmokingman

Active Member

That's kind of a click baity, blaming Musk in a way for the war. It's kind of bizzaro.An article from Clean Technica offers very good take on Russia invading Ukraine with high relevance to Tesla and Elon.

I do agree with a lot that's been said there. Recommended to broaden horizons for those who are interested.

Article - CleanTechnica

larmor

Active Member

I wonder what company is providing a total solution for energy and transportation isolated from oil and gas? (hint its not F and no Mary Barra its not GM)Banning Russia energy is a go

Interesting, Biden flying to Texas?

thesmokingman

Active Member

Germany looks to be super happy about getting the Berlin Factory up in 2 years.

Earlier in this article, they talk about how they are going to shut down nuclear this December as per plan. I am speechless.

Earlier in this article, they talk about how they are going to shut down nuclear this December as per plan. I am speechless.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K