Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Joe F

Disruption is hard.

Amazon ($AMZN) just announced a 20 for 1 stock split.

Tesla next?

Tesla next?

StarFoxisDown!

Well-Known Member

I'm sure I'm get flack here haha but Tesla could do the same and it would be in a stronger financial position than Amazon after the 10 billion is spent over the course of the year.Amazon ($AMZN) just announced a 20 for 1 stock split.

Tesla next?

Artful Dodger

"Neko no me"

I’m surprised the usual doomsayers haven’t caught onto the 250% price hike of nickel, which may increase battery costs in a typical EV by about $1,000. Of course, Tesla is the one EV manufacturer best positioned to ride out a nickel price hike since they have probably locked in long term pricing. And they have LFP batteries. And they have the most efficient EVs.

Only one quarter of the world's nickle sales go through commodities exchanges. Even then, rampant speculation lead the London Metal Exchange to halt trading of nickle futures, and further took the extreme step of retroactively canceling contracts made during the runup:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JPWD2EJP5ZOWXOOCWBQP2MCQTY.jpg)

LME forced to halt nickel trading, cancel deals, after prices top $100,000

The London Metal Exchange (LME) was forced to halt nickel trading and cancel trades after prices doubled on Tuesday to more than $100,000 per tonne in a surge sources blamed on short covering by one of the world's top producers.

Tesla of course has long-term nickle contracts with mining partners in at least 3 different regions. It's another case of shortzes probing Tesla for weaknesses, and instead stubbing their d|(kz.

Cheers!

BrownOuttaSpec

Active Member

Might want to add the source link since there is a lot of other cool info in the article as well: A Decade of Elon Musk’s Tweets, Visualized

Update your post and I will delete mine so we can keep this thread a little cleaned up.

MartinAustin

Active Member

CNBC's two-faced-ness over the AMZN stock split is disgusting.

They are talking with glowing affection for the AMZN stock split, and even described the TSLA stock split as a good move, with hindsight.

As we recall, at the time of the TSLA stock split, they were indignant and constantly pointing out that it adds nothing to the value of the company. [which is technically correct] Brought people like Tim Higgins on to talk about the stock split.

Today, they are refraining from all that negativity with AMZN. Examples

"this will help retail investors"

"goodness me, they added $90 billion in market cap in 10 minutes."

"I wish they had done this months ago"

"is this now a candidate for DOW inclusion?"

They are talking with glowing affection for the AMZN stock split, and even described the TSLA stock split as a good move, with hindsight.

As we recall, at the time of the TSLA stock split, they were indignant and constantly pointing out that it adds nothing to the value of the company. [which is technically correct] Brought people like Tim Higgins on to talk about the stock split.

Today, they are refraining from all that negativity with AMZN. Examples

"this will help retail investors"

"goodness me, they added $90 billion in market cap in 10 minutes."

"I wish they had done this months ago"

"is this now a candidate for DOW inclusion?"

I specifically remember Gordo saying the exact words "A stock split does nothing for a company.......essentially you are taking 4 slices of pizza and making it 8......"CNBC's two-faced-ness over the AMZN stock split is disgusting.

They are talking with glowing affection for the AMZN stock split, and even described the TSLA stock split as a good move, with hindsight.

As we recall, at the time of the TSLA stock split, they were indignant and constantly pointing out that it adds nothing to the value of the company. [which is technically correct] Brought people like Tim Higgins on to talk about the stock split.

Today, they are refraining from all that negativity with AMZN. Examples

"this will help retail investors"

"goodness me, they added $90 billion in market cap in 10 minutes."

"I wish they had done this months ago"

"is this now a candidate for DOW inclusion?"

Thekiwi

Active Member

Big stock price increase happened to google stock when it announced its split as well. It quickly faded back to where it was in the ensuing days (and this was before Ukraine). The only impact on investors of a stock split is really it makes it easier for people to play options contracts (for better or worse). Wouldn't be surprised to see the total dollar volume of option contracts on both amazon & google increase substantially post stock splits.CNBC's two-faced-ness over the AMZN stock split is disgusting.

They are talking with glowing affection for the AMZN stock split, and even described the TSLA stock split as a good move, with hindsight.

As we recall, at the time of the TSLA stock split, they were indignant and constantly pointing out that it adds nothing to the value of the company. [which is technically correct] Brought people like Tim Higgins on to talk about the stock split.

Today, they are refraining from all that negativity with AMZN. Examples

"this will help retail investors"

"goodness me, they added $90 billion in market cap in 10 minutes."

"I wish they had done this months ago"

"is this now a candidate for DOW inclusion?"

I think equating Tesla stock split to the rise in share price does a disservice to Tesla. The reason the stock price increased dramatically since 2020 is because it is performing fantastically and it wasn't until then that a lot more market participants started realising it - the stock split just happened to happen in the middle of that positive surge.

StarFoxisDown!

Well-Known Member

I think it's incorrect to not include the dynamics of naked shorting and the impacts of Tesla's stock split around that.Big stock price increase happened to google stock when it announced its split as well. It quickly faded back to where it was in the ensuing days (and this was before Ukraine). The only impact on investors of a stock split is really it makes it easier for people to play options contracts (for better or worse). Wouldn't be surprised to see the total dollar volume of option contracts on both amazon & google increase substantially post stock splits.

I think equating Tesla stock split to the rise in share price does a disservice to Tesla. The reason the stock price increased dramatically since 2020 is because it is performing fantastically and it wasn't until then that a lot more market participants started realising it - the stock split just happened to happen in the middle of that positive surge.

Tesla's stock split confirmed what a lot of us thought was going on......in that there was a ton of naked shorting going on and not just recent/short term naked shorting. I'm talking naked shorting over months/years.

Would a stock split have the same impact today as it did 2 years ago? No. But I think if you think there's not still long term naked shorting going on with TSLA, you're being naive

woodisgood

Optimustic Pessimist

I specifically remember Gordo saying the exact words "A stock split does nothing for a company.......essentially you are taking 4 slices of pizza and making it 8......"

Forget Gordo, many here were saying the same thing. Good times…

MartinAustin

Active Member

The comments about Porsche, VW and others who are grinding production to a halt due to the Ukraine issue, just make me consider Tesla's market share for 2022 (of the overall auto market). In 2023 we will be even more shocked at how much Tesla has grown, as they are not reducing production, they're increasing production all the while. It's gonna be a big shock to the industry. The other guys shrank, Tesla grew.

Artful Dodger

"Neko no me"

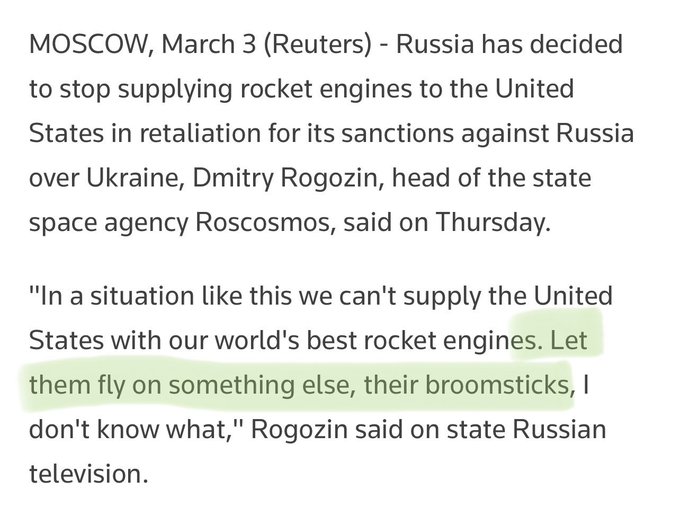

Elon Musk on Twitter: "@SpaceXAmerican Broomstick

https://t.co/r2hJvFQosS" / Twitter

USA! USA!

Elon has added 1.2M followers on Twitter in the past 6 days (now at 76.2M). That's the thing about having a Rock Star CEO. The free PR is amazing!

Cheers!

"Time to let the American broomstick fly, and hear the sound of freedom. LD is go for launch."

Falcon 9 - American broomstick | SpaceX on Youtube (11:02)

USA! USA!

Cheers to the

Artful Dodger

"Neko no me"

Of course they're up! Now they won't be losing money on every EV they don't build. /SBest Example is VW. Up 13.5% currently on news that they cannot produce the Porsche Taycan and halted everything else on the MEB-Platform

Oh, you can bet that European Automakers will use this crisis as an excuse why they can't build EVs, and therefore the carbon pricing scheme should be suspended for the duration.Specific to this situation I'm confident that VW is making money once carbon and other compliance is factored in.

That's why the Big 3 German automakers are up ~10% today.

Cherries!

Artful Dodger

"Neko no me"

FINRA reported today the lowest proportion of TSLA short-selling since 2022-01-24 (two days before Q4 Earnings).

Artful Dodger

"Neko no me"

PPI is next week, March 15.

U.S. Economic Calendar - MarketWatch

U.S. economic calendar consensus forecasts from MarketWatch.

| THURSDAY, MARCH 10 | ||

| 8:30 am | Initial jobless claims | |

| 8:30 am | Continuing jobless claims | |

| 8:30 am | Consumer price index | |

| 8:30 am | Core CPI | |

| 8:30 am | CPI (year-over-year | |

| 8:30 am | Core CPI (year-over-year) |

Artful Dodger

"Neko no me"

Can we please settle the Max Pain debate with science?

Well, no, we can't. That's because we don't know the extent to which Market Makers have hedged their positions at any strike price, or at what level of loss they are willing to step in. It's further made difficult because we don't have realtime data for Open Interest (always at least 1 day stale), and we NEVER get final Open Interest data for the actual day of contract expiry (can't model w/o data).

Then, even if you could, MMs are only 1 of at least 6 different groups playing tug-of-war with the SP.

TL;dr. No we can't settle this debate, and the rules are written by the owners of this casino.

HODL.

Artful Dodger

"Neko no me"

The current expectation I see listed on yahoo finance is EPS of $2.24 Non GAAP.

This is of course, ridiculous considering Tesla will post at least a EPS of $2.84

This is BAU for the financial press and analyst cabal. They keep estimates low on purpose during the quarter to provide better entry prices for the customers, then jack up those estimate in the last 3 days before earnings. Buy the rumor, sell the news. Rince, repeat. It's how they roll.

Unless you're Gordo and you have $TSLA EPS at $3.00/shareThis is BAU for the financial press and analyst cabal. They keep estimates low on purpose during the quarter to provide better entry prices for the customers, then jack up those estimate in the last 3 days before earnings. Buy the rumor, sell the news. Rince, repeat. It's how they roll.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K