You did hear that. Which is a backpedal from the "will be safer than a human this year" that was said on the q4 call in January.I do believe I heard Elon reiterate fleet-wide FSD-Beta this year.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

garrett5688

Member

Recycling is supposedly part of the design lifecycle, so they must have chosen an adhesive that can be dissolved or otherwise eliminated.

Attachments

dhanson865

Well-Known Member

Don't think it's a backpedal because Elon have said wide release when FSD is safer than a human.You did hear that. Which is a backpedal from the "will be safer than a human this year" that was said on the q4 call in January.

thesmokingman

Active Member

You know that is code for CT!About 30% pf the area shown is for "Future Production". Any guess what that's for?

I went tonight, it was awesome, no comparison to Fremont or Giga Nevada. Spoke to an employee who received their Model Y today, 4680 confirmed. Said hi to Franz and Ross Gerber. There was a petting zoo and mechanical bulls everywhere. Gigapress is impressive, as is battery manufacturing. About 50% of the building volume appears open shell for now, easy to imagine Cybertruck and more battery production infilling.

Cybertruck looks great, 2nd prototype has much higher build quality than original. Snuck under the ropes, got up close, cool.

Roadster is still awesome, even though I'm sure this is the same prototype, can't wait to see how it has morphed when we get its new reveal.

Much cleaner message tonight than earnings call in January:

2022 is about scaling production

2023 is about product launches, inc. Cybertruck and Optimus 1.0!

Cybertruck is awesome, wait for it, don't buy anything else between now and then (Ford, Rivian, etc.)

Beyond includes a futuristic robotaxi

Conclusion - They have so many orders for their current lineup, and so confident in nailing its production (overseas shutdowns aside) they are not at all afraid to share future products. Future products only bring people to the brand sooner.

I can't imagine anyone else doing anything like this - from party to products to people.

The fish are jumping into the barrel...

Cybertruck looks great, 2nd prototype has much higher build quality than original. Snuck under the ropes, got up close, cool.

Roadster is still awesome, even though I'm sure this is the same prototype, can't wait to see how it has morphed when we get its new reveal.

Much cleaner message tonight than earnings call in January:

2022 is about scaling production

2023 is about product launches, inc. Cybertruck and Optimus 1.0!

Cybertruck is awesome, wait for it, don't buy anything else between now and then (Ford, Rivian, etc.)

Beyond includes a futuristic robotaxi

Conclusion - They have so many orders for their current lineup, and so confident in nailing its production (overseas shutdowns aside) they are not at all afraid to share future products. Future products only bring people to the brand sooner.

I can't imagine anyone else doing anything like this - from party to products to people.

The fish are jumping into the barrel...

Last edited:

yeafoshizzle

Member

What does that quote mean?... FSD Beta for all customers who purchased fsd or just a wider release still based on score?Don't think it's a backpedal because Elon have said wide release when FSD is safer than a human.

For all who purchased fsdWhat does that quote mean?... FSD Beta for all customers who purchased fsd or just a wider release still based on score?

Accident

Member

I guess that solves the mystery of who got the new MY Standard, and why it’s not available to order. Hopefully, we can place an order soon.

Spoke to an employee who received their Model Y today, 4680 confirmed.

Interesting they overlayed the map/layout rotated 180 degrees..

teslamotorsclub.com

teslamotorsclub.com

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

Yeah I would go nuts too. They know, and acknowledge, that it is Elon Musk, more than anybody else, making America great.

StealthP3D

Well-Known Member

Well to be fair she isn’t wrong on the Shanghai closure part - it has been closed for coming up on two weeks, and with a production rate of 14,000 a week it is going to have a big negative impact on the current quarters productions and delivery number.

Shaghai lockdown is very extreme, it is the first time the army has enforced a lockdown of this scale since Wuhan in early 2020 - there is still likely to be several more weeks of lockdown in Shanghai. Unless Tesla is able to setup onsite living quarters for employees (with permission of authorities) AND tesla suppliers do the same, then I think think we should be expecting a 30-50 thousand shortfall on Q2 numbers at this rate. Would be glad to be wrong on this of course - lets hope I am.

TSLA's valuation as an automaker is not based on next quarter's numbers except to the extent those numbers can inform us of the speed of Tesla's natural ability to grow production over time. Tesla's valuation is more forward looking in that it is largely based on the assumed much larger production in 2025, 2026 and beyond. The COVID shutdown in Shanghai, while unfortunate, was unavoidable by Tesla and does not reflect negatively on Tesla's ability to quickly scale production in the future so it should have a relatively very small impact on valuation.

We have 2 facts that help us with this.Ok TMCers what do 4680 cells in model y do for margins— based on projected full production capacity at giga Texas?

At battery day Tesla told us 4680 cells would reduce battery costs by 56%. Not all of this cost advantage would necessarily be realized at once, but quite a bit should come out of this change. Musk has since said the process actually turned out better than they expected in terms of cost per kWh (forgive me I’ll have to chase down a source for this second bit later). Batteries are currently 20-30% of the total vehicle cost. So this is potentially a huge benefit to margins.

It’s likely there is some amount of inflation at play here, but Tesla’s price increases have more than outpaced inflation.

This car produced on this assembly line was designed to churn out cash. It is likely going to lead to a pretty significant increase in margins.

Artful Dodger

"Neko no me"

WHAT, no surprises?

I think Elon's statement that there will be a 'dedicated Robotaxi that wlll look very different' counts as a big surprise.

Except for those of us that watched "Westworld":

2nd surprise? You'll likely have to wait for "Master Plan Pt3". But nobody is expecting 10m units per year of this "Model 1" Robotaxi.

Cheers!

Phil Seastrand

Member

What I find interesting is that all the press I can find online concerning the event completely misses the features of the factory -- 4680, building many of the sub-components on site, etc., basically all the stuff from the tour. They only focus on the few tidbits from his presentation -- and that is mostly limited to the few "announcements" about cybertruck, FSD, etc., and always with a nod and a wink about his dates being too aggressive.

Are they not seeing the forest for the trees (or only the forest and not the trees)? The coverage just seems so myopic...

Are they not seeing the forest for the trees (or only the forest and not the trees)? The coverage just seems so myopic...

Artful Dodger

"Neko no me"

I do believe I heard Elon reiterate fleet-wide FSD-Beta this year.

Wide-release of FSD beta for N. America this year.

jeewee3000

Active Member

We've been over this. Safer than a human does not equal 'full level 5 self-driving complete'. In fact safer than a human is a low bar for safety, since road accidents are still responsible for 1.3 million annual deaths and 50 million injuries anually all over the world.You did hear that. Which is a backpedal from the "will be safer than a human this year" that was said on the q4 call in January.

If you want to check deaths in your country (latest data from 2018), this wiki-page can give you an idea.

Elon said, as Dodger mentioned upstream, FSD beta should get a wide-release for North America this year.

FSD beta will stay in beta until it's at least 2x safer than a human.

Therefore, Elon is not backpedaling on anything.

(Note: I'm not saying Elons timelines will hold, just that he didn't backpedal as you state).

JusRelax

Active Member

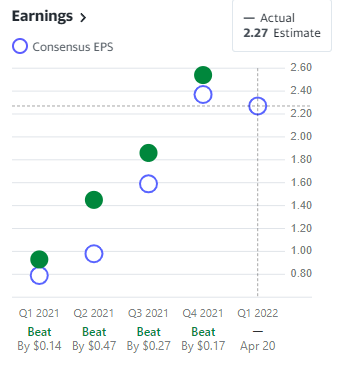

Yahoo Finance's earnings estimate for TSLA for Q1 has started making it's climb upwards, currently at $2.27 (before P&D, it was at $2.24):

I went tonight, it was awesome, no comparison to Fremont or Giga Nevada. Spoke to an employee who received their Model Y today, 4680 confirmed. Said hi to Franz and Ross Gerber. There was a petting zoo and mechanical bulls everywhere. Gigapress is impressive, as is battery manufacturing. About 50% of the building volume appears open shell for now, easy to imagine Cybertruck and more battery production infilling.

Cybertruck looks great, 2nd prototype has much higher build quality than original. Snuck under the ropes, got up close, cool.

Roadster is still awesome, even though I'm sure this is the same prototype, can't wait to see how it has morphed when we get its new reveal.

Much cleaner message tonight than earnings call in January:

2022 is about scaling production

2023 is about product launches, inc. Cybertruck and Optimus 1.0!

Cybertruck is awesome, wait for it, don't buy anything else between now and then (Ford, Rivian, etc.)

Beyond includes a futuristic robotaxi

Conclusion - They have so many orders for their current lineup, and so confident in nailing its production (overseas shutdowns aside) they are not at all afraid to share future products. Future products only bring people to the brand sooner.

I can't imagine anyone else doing anything like this - from party to products to people.

The fish are jumping into the barrel...

View attachment 791229View attachment 791230View attachment 791231View attachment 791232View attachment 791238View attachment 791239View attachment 791240

There are four wheels!

Thekiwi

Active Member

100% agree. Totally agree that long term expectations should be the basis on what Tesla gets valued upon. Which is why I think it is silly when the stock or investors get excited/disappointed about short term results and the stock price reaction to them.TSLA's valuation as an automaker is not based on next quarter's numbers except to the extent those numbers can inform us of the speed of Tesla's natural ability to grow production over time. Tesla's valuation is more forward looking in that it is largely based on the assumed much larger production in 2025, 2026 and beyond. The COVID shutdown in Shanghai, while unfortunate, was unavoidable by Tesla and does not reflect negatively on Tesla's ability to quickly scale production in the future so it should have a relatively very small impact on valuation.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K